Smoking Accessories Market

Smoking Accessories Market Size, Share & Trends Analysis Report by Type (Waterpipes, Vaporizers, Rolling Paper & Cigarette Tubes, Lighters, Filter & Paper Tip, Bubbler & Bongs and Herb Grinders), and by Distribution Channel (Online and Offline),Forecast Period (2024-2031)

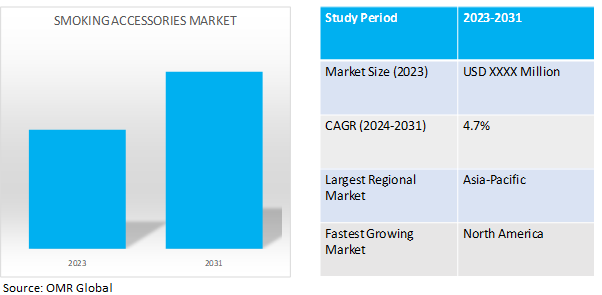

Smoking accessories market is anticipated to grow at a moderate CAGR of 4.7% during the forecast period (2024-2031). Smoking accessories means any cigarette or cigar holder, pipe, mechanical lighter, or other tobacco or smoking-related device or instrument whose sale and/or use is not unlawful or prohibited except as provided in Section 5 of Local Law.

Market Dynamics

Growing Trend for Online Shopping of Smoking Accessories

Smoking accessories manufacturing companies have their own web-based retail stores where users have access to information about product launches, product features, demo, price, and other required information about products. There is an increase in number of consumers shopping online, owing to availability of different product options and price comparison on online shopping sites. This is useful for retailers, owing to zero expenditure on physical outlets. Furthermore, there is a rise in preference for online shopping as consumers can read reviews provided by other consumers, compare various stores & products, and verify product price by different sellers. Thus, rise in adoption of online sales channels drives growth of the smoking accessories market.

Rebranding to Promote Consumption Driving Global Market

The tobacco industry has made well-researched, calculated attempts to redesign and rebrand its products to sustain profitability. It introduced cigarette filters and the so-called “light” and “mild” tobacco products as an alternative to quitting, reducing tobacco users’ perceptions of risk and harm, and undermining effective tobacco control policies. Such misleading marketing continues today, with the industry advocating for the harm reduction approach through new products such as electronic nicotine delivery systems (ENDS) and electronic non-nicotine delivery systems (ENNDS), commonly referred to as ‘e-cigarettes’, and heated tobacco products (HTPs).

Market Segmentation

Our in-depth analysis of the global smoking accessories market includes the following segments by type, product, and technology:

- Based on type, the market is sub-segmented into waterpipes, vaporizers, rolling paper & cigarette tubes, lighters, filter & paper tip, bubbler & bongs and herb grinders.

- Based on distribution channel, the market is bifurcated into online and offline.

Online Segment is Projected to Emerge as the Largest Segment

The online segment is estimated to witness significant growth during the forecast period. Attributable to the proliferation of e-commerce platforms the online sale of smoke accessories has become the most significant market segment the appeal of online sales can be attributed to their convenience extensive product assortment, and discrete purchasing alternatives. The segment is experiencing growth due to the preference of consumers for the convenience of browsing and purchasing smoking accessories from the comfort of their residences. The online channels provide a wide range of products to choose from. In addition, these online channels provide various discounts, offers, and other such facilities due to which they are highly used thus contributing to the growth of the segment.

Vaporizer Sub-segment to Hold a Considerable Market Share

The vaporizer segment led the smoking accessories market for smoking accessories and held a considerable market share. The segment is expected to witness the highest CAGR during the forecast period. The dominance and growth of the segment are attributed to the high adoption and usage of vaporizers as a better alternative to products that produce smoke. They are highly adapted, as they do not produce harmful chemicals including carbon monoxide and tar. A wide range of settings is available in vaporizers along with the availability of a high number of flavors to use which are boosting their adoption thus contributing to the segment growth. Moreover, vaporizers need a one-time investment and can be used for a longer period making them cost-effective resulting in their increasing adoption thus contributing to more revenue generation.

Regional Outlook

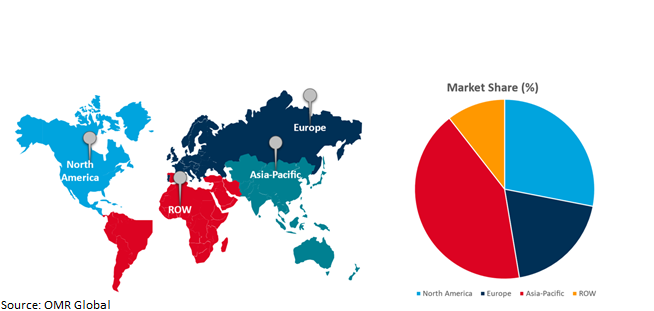

The global smoking accessories market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

The growth of North America i smoking accessories market can be attributed to several factors, including the escalating prevalence of alternative smoking methods, the evolving states of consumers, and the pervasive acceptance of a smoking culture.The sustained growth of the smoking accessories market can be attributed to several factors in the region, including a strong level of disposable income, a well-established market infrastructure, and robust distribution channels.

Global Smoking Accessories Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

The Asia-Pacific region procured the highest revenue share in the market in 2022. Operating players have substantial expansion potential in the Asia-Pacific market.The growth of the regional market is contributed to the increasing number of young population smokers and the increasing use and adoption of smoking accessories as they adopt the habit of smoking to gain a cool appearance. The two main factors propelling expansion are consumers' rising disposable income and acceptance of Western lifestyles.The market participants can debut cutting-edge smoking accessories in Asia-Pacific, offering prospective growth opportunities.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global smoking accessories market British American Tobacco PLC, Bull Brand, Imperial Brands, BBK Tobacco & Foods, LLP, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, i n November 2022, a new cannabis vaporizer from Dr. Dabber, a cannabis technology business located in Las Vegas, has been released. The new portable vaporizer, called the XS Nano eRig, has been made available on the company website for a launch price of $159.9. The new vaporizer is currently the smallest one of its kind on the market.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smoking accessoriesmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. British American Tobacco PLC

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bull Brand

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Imperial Brands

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. BBK Tobacco & Foods, LLP

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Chongz

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Smoking Accessories Market by Type

4.1.1. Waterpipes

4.1.2. Vaporizers

4.1.3. Rolling Paper & Cigarette Tubes

4.1.4. Lighters

4.1.5. Filter & Paper Tip

4.1.6. Bubbler & Bongs

4.1.7. Herb Grinders

4.2. Global Smoking Accessories Market by Distribution Channel

4.2.1. Online

4.2.2. Offline

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. China Tobacco International (HK) Company Ltd.

6.2. Curved Papers, Inc.

6.3. Elements Rolling Papers

6.4. Empire Glassworks

6.5. Hempacco Co., Inc.

6.6. Ispire Technology Inc.

6.7. Jinlin (HK) Smoking Accessories Co. Ltd.

6.8. KT&G Corp.

6.9. Moondust Paper Pvt. Ltd.

6.10. Philip Morris International Inc.

6.11. PT Gudang Garam Tbk

6.12. Republic Technologies International;

6.13. RLX Technology Inc.

6.14. Scandinavian Tobacco Group A/S

6.15. Turning Point Brands, Inc.

6.16. Univac Furncrafts Pvt. Ltd.

1. GLOBAL SMOKING ACCESSORIES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL SMOKING WATERPIPES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SMOKING VAPORIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ROLLING PAPER & CIGARETTE TUBES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SMOKING LIGHTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL FILTER & PAPER TIP FOR SMOKING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BUBBLER & BONGS FOR SMOKING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL HERB GRINDERS FOR SMOKING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SMOKING ACCESSORIES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

10. GLOBAL SMOKING ACCESSORIES ONLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SMOKING ACCESSORIES OFFLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SMOKING ACCESSORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN SMOKING ACCESSORIES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN SMOKING ACCESSORIES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

15. EUROPEAN SMOKING ACCESSORIES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. EUROPEAN SMOKING ACCESSORIES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC SMOKING ACCESSORIES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC SMOKING ACCESSORIES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

19. REST OF THE WORLD SMOKING ACCESSORIES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. REST OF THE WORLD SMOKING ACCESSORIES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL SMOKING ACCESSORIES MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL SMOKING WATERPIPES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SMOKING VAPORIZERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ROLLING PAPER & CIGARETTE TUBES FOR SMOKING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL LIGHTERS FOR SMOKING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL FILTER & PAPER TIP FOR SMOKING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL BUBBLER & BONGS FOR SMOKING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL HERB GRINDERS FOR SMOKING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL SMOKING ACCESSORIES MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

10. GLOBAL SMOKING ACCESSORIES ONLINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SMOKING ACCESSORIES OFFLINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL SMOKING ACCESSORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

15. UK SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA SMOKING ACCESSORIES MARKET SIZE, 2023-2031 ($ MILLION)