Smoking Cessation and Nicotine De-Addiction Market

Smoking Cessation and Nicotine De-Addiction Market Size, Share & Trends Analysis Report by Types (Nicotine Replacement Therapy (NRT), Drug Therapy, and E-Cigarettes), and by Distribution Channel (Hospitals Pharmacies, Drug Stores, Retail Stores, and Online Stores) Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Smoking cessation and nicotine de-addiction market is anticipated to grow at a CAGR of 15.2 % during the forecast period. The smoking cessation and nicotine de-addiction market has witnessed significant growth due to health disadvantages of smoking such as lung cancer, cardiac diseases, and other respiratory problems, initiatives supported by governments to raise awareness about the harmful effects of smoking through the use of informational brochures, warning labels, dissuasive imagery on cigarette packages, television advertisements, and newspapers.

Segmental Outlook

The global smoking cessation and nicotine de-addiction market is segmented based on the type, and distribution channel. Based on the type, the market is sub-segmented into NTR, drug therapy, e-cigarettes. Based on distribution channel, the market is sub-segmented into hospitals pharmacies, drug stores, retail stores and online stores. Among the distribution channel, the hospitals pharmacies sub-segment is anticipated to hold a considerable share of the market due to good assurance of product standards and consumer trust. In most countries, sales of nicotine gum and other nicotine replacement products are restricted to pharmacy shops.

NTR Sub-Segment is Anticipated to Hold a Prominent Share in the Global Smoking cessation and nicotine de-addiction Market

Among the types, NTR sub-segment is anticipated to hold a prominent share of the market due to its ease of use, its increased accessibility, and its effectiveness in reducing the nicotine craving in smokers. NTR gives individual nicotine in the form of gum, patches, sprays, inhalers, or lozenges but not the other harmful chemicals in tobacco. NRT can help relieve some of the physical withdrawal symptoms so that you can focus on the psychological (emotional) aspects of quitting. According to WHO tobacco epidemic the greatest hazards to global public health, killing more than 8 million people annually. Around 1.3 million of those fatalities are caused by non-smokers being exposed to secondhand smoke, whereas more than 7 million are caused by direct tobacco use. NRT products have been effective in helping people quit smoking and are widely used among smokers struggling to quit. Between 2017 and 2020 over-the-counter NTR sales totaled about $1 billion annually. In 2020, lozenges accounted for 33.3 per cent ($322 million), gum accounted for 52.7% ($511 million) and patches accounted for 14.1% ($137 million) of over-the-counter nicotine replacement therapy sales. Drug stores were accounting for the largest percentage of total over-the-counter nicotine replacement therapy sales (42.9%).

Regional Outlook

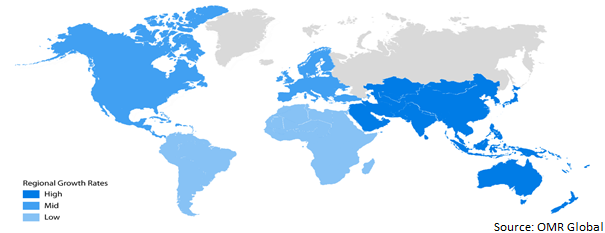

The global smoking cessation and nicotine de-addiction market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, the Europe regional market is expected to grow considerably over the forecast period. Nicotine-containing OTC smoking cessation products are the most preferred nicotine replacement therapy (NRT) products in the countries such as UK. The market in Europe is being driven by increased public awareness of the advantages of quitting smoking and a rise in the number of smoking cessations programmes.

Global Smoking Cessation and Nicotine De-Addiction Market Growth, by Region 2023-2030

North America is Expected to Hold a Prominent Share in the Global Smoking cessation and nicotine de-addiction

North America is dominating the smoking cessation and nicotine de-addiction market, due to the developed healthcare infrastructure as well as the growing incomes available for discretionary spending. According to the American Medical Association (AMA), health spending in the US increased by 9.7% in 2020 and reached to $4.1 trillion or $12,530 per capita. Region's strong demand for e-cigarette products also played a major role in increasing smoking cessation and nicotine de-addiction market in North America. E-cigarettes were the second most commonly used tobacco product, with 4.5% (10.9 million) of the US adults reporting use of the product in 2019. It is anticipated that the North American region will expand at a significant rate due to the shifting preferences of consumers towards the utilization of plant-based, nicotine de-addiction-related products in countries.

Market Players Outlook

The major companies serving the global smoking cessation and nicotine de-addiction market include British American Tobacco Plc, Dr. Reddy's Laboratories Ltd., GlaxoSmithKline Plc, Imperial Brands Plc, Japan Tobacco, Inc., JUUL Labs, Inc., Philip Morris International Inc., Niconovum AB, Perrigo Company plc, OncoGenex Pharmaceuticals Inc, NJOY, LLC, InnokinTechnology and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in May 2020, Nicotex, Cipla Health’s smoking cessation brand, collaborated with Karnataka and Goa governments to provide Nicotine Replacement Therapy (NRT) to frontline workers, who are engaged in field work under high vulnerability amidst the COVID-19 outbreak.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smoking cessation and nicotine de-addiction market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Johnson & Johnson Services, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Pfizer, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Cipla Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Smoking Cessation and Nicotine De-addiction Market by Types

4.1.1. Nicotine Replacement Therapy (NRT)

4.1.2. Drug Therapy

4.1.3. E-Cigarettes

4.2. Global Smoking Cessation and Nicotine De-addiction Market by Distribution Channel

4.2.1. Hospitals Pharmacies

4.2.2. Drug Stores

4.2.3. Retail Stores

4.2.4. Online Stores

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. British American Tobacco Plc

6.2. Dr. Reddy's Laboratories Ltd.

6.3. GlaxoSmithKline Plc

6.4. Imperial Brands Plc

6.5. Japan Tobacco, Inc.

6.6. JUUL Labs, Inc.

6.7. Philip Morris International Inc.

6.8. Niconovum AB

6.9. Perrigo Company plc,

6.10. OncoGenex Pharmaceuticals, Inc.

6.11. NJOY, LLC

6.12. Vaping Daily

6.13. InnokinTechnology

6.14. Snowplus

6.15. Ritchy group Ltd.

1. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY TYPES, 2022-2030 ($ MILLION)

2. GLOBAL NTR SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL DRUG THERAPY SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL E-CIGARETTES SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

6. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION BY HOSPITALS PHARMACIES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION BY DRUG STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION BY RETAIL STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION BY ONLINE STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. NORTH AMERICAN SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. NORTH AMERICAN SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

13. NORTH AMERICAN SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

14. EUROPEAN SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. EUROPEAN SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

16. EUROPEAN SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

17. ASIA- PACIFIC SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. ASIA- PACIFIC SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

19. ASIA- PACIFIC SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

20. REST OF THE WORLD SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. REST OF THE WORLD SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

22. REST OF THE WORLD SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

1. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2022 VS 2030 (%)

2. GLOBAL NTR SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

3. GLOBAL DRUG THERAPY SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

4. GLOBAL E-CIGARETTES SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

5. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022 VS 2030 (%)

6. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION BY HOSPITALS PHARMACIES MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

7. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION BY DRUG STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

8. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION BY RETAIL STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

9. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION BY ONLINE STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

10. GLOBAL SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

11. US SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

12. CANADA SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

13. UK SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

14. FRANCE SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

15. GERMANY SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

16. ITALY SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

17. SPAIN SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

18. REST OF EUROPE SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

19. INDIA SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

20. CHINA SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

21. JAPAN SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

22. SOUTH KOREA SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF ASIA-PACIFIC SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF THE WORLD SMOKING CESSATION AND NICOTINE DE-ADDICTION MARKET SIZE, 2022-2030 ($ MILLION)