SNP genotyping Market

SNP genotyping Market Size, Share & Trends Analysis Report by Technology (TaqMan SNP Genotyping, Massarray SNP Genotyping, SNP GeneChip Arrays, and Other Techniques), End-User (Pharmacogenomics and Diagnostic Field) Forecast Period (2023-2030) Update Available - Forecast 2025-2031

SNP genotyping market is anticipated to grow at a significant CAGR of 20.5% during the forecast period. The market is mainly driven by increasing R&D projects in genotyping domain, and rising funding in the biotechnology industry. The biopharmaceutical companies are investing heavily in the R&D projects, attributed to advances and discoveries. From genomics to personalized medicines, all the recent advancement has created significant scope in developing unique treatment options for various chronic diseases including Cancer, and other infectious diseases. There are around 8,000 medicines under clinical trials across the globe, owing to the robust investment and funding in R&D projects.

Further, Biotechnology firms have successfully raised a significant amount from IPOs in the last few years. Despite the political disruptions, and increasing drug prices, biotechnology stocks performed reasonably well in recent times. These firms have developed groundbreaking SNP genotyping technologies. However, lack of skilled technicians, especially in developing countries, hampering the market growth, genotyping data analysis and management requires high technical knowhow. Currently, there is a relatively low number of professionals and experts working in this field in developing nations.

Strategic initiatives undertaken by local players are further contributing to the market growth. For instance, in February 2021, VG Acquisition Corp. merged with 23andMe, a US-based genetics and research company actively working with direct-to-consumer genotyping solutions. This merger would provide capital funds for their genetic consumer health business.

Segmental Outlook

The global SNP genotyping market is segmented based on technology and end-user. Based on technology, the market is segmented into TaqMan SNP Genotyping, Massarray SNP Genotyping, SNP GeneChip arrays, and other techniques. Based on end-user, the market is sub-segmented into pharmacogenomics and diagnostic field.

Pharmacogenomics to Exhibit Considerable Growth

The increasing pipeline for personalized medicine and novel drug delivery systems, which extensively exploit SNP in genetic materials for drug development applications is a key factor driving the growth of this market segment. For instance, according to an article published by MDPI, in 2021, the potential of the Estonian personalized medicine initiative was boosted by the Estonian biobank with over 200,000 participants.

Regional Outlooks

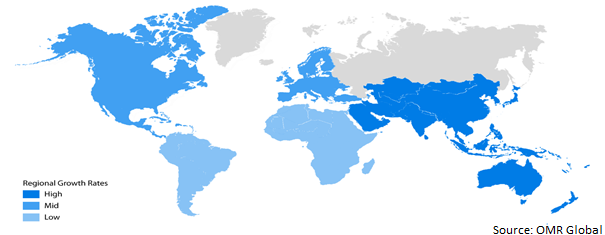

The global SNP genotyping market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, Asia-Pacific is estimated to be the fastest-growing region owing to the rapidly developing healthcare infrastructure and growing disposable incomes in the region. Besides, favourable government policies, rising geriatric population, presence of key market players, and rise in the demand for diagnostic procedures are some of the major factors that contributed towards the fueling of regional market growth.

Global SNP genotyping Market Growth, by Region 2023-2030

The North America Region held Considerable Share in the Global SNP genotyping Market

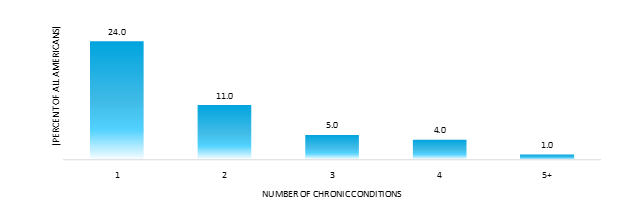

North America held a considerable share in the global SNP genotyping market. In North America, the US held a major market share. The increasing need for personalized medicines, reducing costs of DNA sequencing, rising cases of genetic disorders, and technological advancements are the factors giving rise to SNP genotyping in the North American market. The continuously increasing burden of chronic diseases in the US has further created demand for genotyping tools and services. For instance, as per the American Hospital Association, in 2022 an estimated 133 million Americans – nearly half the population – suffer from at least one chronic illness, such as hypertension, heart disease and arthritis. That figure is 15 million higher than just a decade ago, and by 2030, this number is expected to reach 170 million.

Percent of Americans with Chronic Medical Conditions by Number of Conditions

The SNP genotyping techniques can be used for the early diagnosis and treatment of chronic diseases. Thus, the high burden of chronic diseases is anticipated to boost the regional market growth. Furthermore, the growing funding biotechnology researches across the region is further contributing to the regional market growth. For instance, according to data from the National Institutes of Health (NIH), cancer genomics received increasingly higher funding. Up to $1,116 million in financing was given to it in total in 2021. Canada is the second country after North America in market domination.

Market Players Outlook

The major companies serving the global SNP genotyping market include Thermo Fisher Scientific Inc., Agilent Technologies Inc., Bio-Rad Laboratories Inc., Illumina Inc., Danaher Corp. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

For instance, in January 2023, Thermo Fisher Scientific, Inc. launched its CE-IVD marked TaqPath Seq HIV-1 genotyping kit to broaden its product portfolio and strengthen its market presence in the market.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global SNP genotyping market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Thermo Fisher Scientific Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Agilent Technologies Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Bio-Rad Laboratories Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Illumina Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

4. Market Segmentation

4.1. Global SNP Genotyping Market by Technology

4.1.1. TaqMan SNP Genotyping

4.1.2. Massarray SNP Genotyping

4.1.3. SNP GeneChip Arrays

4.1.4. Other Technology

4.2. Global SNP Genotyping Market by End-User

4.2.1. Pharmacogenomics

4.2.2. Diagnostic Field

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Agilent Technologies, Inc.

6.2. Bio-Rad Laboratories, Inc.

6.3. CRISPR Therapeutics AG

6.4. Danaher Corp.

6.5. Deep Genomics

6.6. Eurofins GSC Lux SARL

6.7. Fluidigm Corp.

6.8. General Electric Co.

6.9. GENEWIZ

6.10. Illumina, Inc.

6.11. Integrated DNA Technologies, Inc.

6.12. Intellia Therapeutics Inc.

6.13. Merck KGaA

6.14. Pacific Biosciences of California, Inc.

6.15. Pathway Genomics Corp.

6.16. PerkinElmer, Inc.

6.17. QIAGEN N.V.

6.18. Quantabio

6.19. Roche Molecular Systems, Inc.

6.20. Thermo Fisher Scientific, Inc.

1. GLOBAL SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY,2022-2030 ($ MILLION)

2. GLOBAL TAQMAN SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL MASSARRAY SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL SNP GENECHIP ARRAYS IN SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL OTHER TECHNOLOGY IN SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

6. GLOBAL SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY END-USER,2022-2030 ($ MILLION)

7. GLOBAL SNP GENOTYPING FOR PHARMACOGENOMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL SNP GENOTYPING FOR DIAGNOSTIC FIELD MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. NORTH AMERICAN SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

11. NORTH AMERICAN SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

12. NORTH AMERICAN SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

13. EUROPEAN SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

14. EUROPEAN SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

15. EUROPEAN SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

19. REST OF THE WORLD SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

20. REST OF THE WORLD SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

21. REST OF THE WORLD SNP GENOTYPING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL SNP GENOTYPING MARKET SHARE BY TECHNOLOGY, 2022 VS 2030(%)

2. GLOBAL TAQMAN SNP GENOTYPING MARKET SHARE BY REGION, 2022 VS 2030(%)

3. GLOBAL MASSARRAY SNP GENOTYPING MARKET SHARE BY REGION, 2022 VS 2030(%)

4. GLOBAL SNP GENECHIP ARRAYS MARKET SHARE BY REGION, 2022 VS 2030(%)

5. GLOBAL OTHER TECHNOLOGY IN SNP GENOTYPING MARKET SHARE BY REGION, 2022 VS 2030(%)

6. GLOBAL SNP GENOTYPING MARKET SHARE BY END-USER, 2022 VS 2030(%)

7. GLOBAL SNP GENOTYPING FOR PHARMACOGENOMICS MARKET SHARE BY REGION, 2022 VS 2030(%)

8. GLOBAL SNP GENOTYPING FOR DIAGNOSTIC FIELD MARKET SHARE BY REGION, 2022 VS 2030(%)

9. GLOBAL SNP GENOTYPING FOR OTHER END-USER MARKET SHARE BY REGION, 2022 VS 2030(%)

10. GLOBAL SNP GENOTYPING MARKET SHARE BY REGION, 2022 VS 2030(%)

11. US SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

12. CANADA SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

13. UK SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

14. FRANCE SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

15. GERMANY SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

16. ITALY SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

17. SPAIN SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

18. REST OF EUROPE SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

19. INDIA SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

20. CHINA SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

21. JAPAN SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

22. SOUTH KOREA SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF ASIA-PACIFIC SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF THE WORLD SNP GENOTYPING MARKET SIZE, 2022-2030 ($ MILLION)