Social Trading Market

Global Social Trading Market Size, Share & Trends Analysis Report by Type (Single Trade, Copy Trade, Mirror Trade), By End-User (Individual, Enterprise) Forecast Period 2021-2027

The global social trading market is anticipated to grow at a significant CAGR of 15.6% during the forecast period (2021-2027). Social trading is a form of investing that allows investors to observe the trading behaviour of their peers and expert traders. The primary objective is to follow their investment strategies using copy trading or mirror trading. This form of trading requires no or little knowledge of financial market; hence it is offering lucrative opportunities for those individuals and enterprises that are planning to enter into trading business. Additionally, quick access to reliable trading information, quick grasping of the trading market, and higher reach to trading community of investors are some of the others benefits of social trading that are promoting its adoption. The high inclination of traders towards increased transparency and open information is a key trend in the social trading market.

The increasing popularity of digital assets such as bitcoin and Litecoin is likely to drive the growth of the social trading market. For instance, in May 2021, Israel-based social trading platform eToro and New York-based based cryptocurrency exchange Gemini had announced Dogecoin listing. Dogecoin is the fourth-largest cryptocurrency as per CoinMarketCap. The significant surge in its trading is supporting the higher demand for the social trading platforms. However, trading in financial market is subject to market risk; therefore, blindly following influencer’s investment pattern can lead to huge losses. Hence, failure of these platforms in some cases is likely to hinder the growth of social trading market across the globe.

Segmental Outlook

The report on global social trading market covers segments including type, and end-user. Based on type, the market is segmented into single trade, copy trade, and mirror trade. Based on end-user, the market is segmented into individual, and enterprise. Based on end-user, individual trade is anticipated to exhibit considerable CAGR during the forecast period.

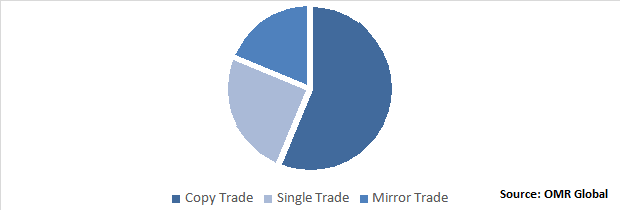

Global Social Trading Market Share by Type, 2020 (%)

Copy Trade held the significant share in the Market

Based on type, copy trade held considerable market share in 2020. The ability of copy trade to follow and duplicate successful and profitable traders that have proven track records and battle-tested trading strategies, is a key advantage of copy trade which is promoting higher adoption of this trading type.

Regional Outlooks

The global social trading market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. Europe held considerable share in the social trading market in 2020. Europe is having first mover advantage in the field of social trading. The significant presence of major vendors of social trading platforms such as eToro AUS Capital Pty Ltd., Eva Trade Ltd., Instant Trading Ltd. (BVI), iSYSTEM AG, and Kinfo AB, among others across the region is a key factor contributing to the considerable share of the regional market. Additionally, higher penetration of cryptocurrency, strong regulated financial market, and increased volume online trade across the region is further contributing towards the high share of the regional market.

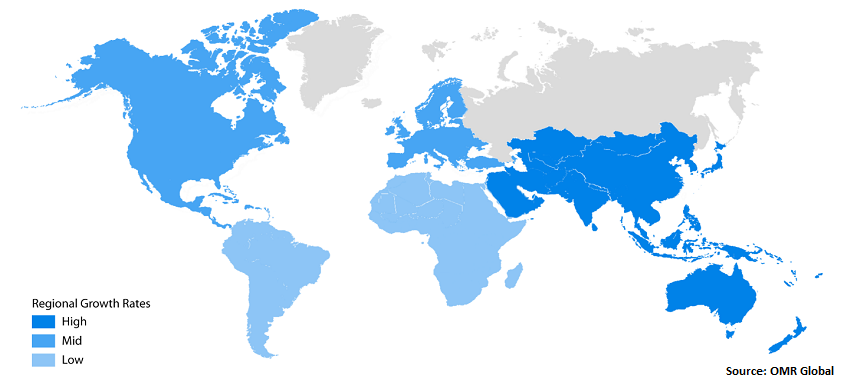

Global Social Trading Market Growth, by Region 2021-2027

Asia-Pacific is projected to have considerable share in the global social trading market

Asia-Pacific is anticipated to exhibit considerable growth in the global social trading market. The increasing penetration of cryptocurrency, rising digitization, and rising confidence of individuals in the online trading platforms are the key factors that are promoting social trading platform providers to exhibit their interest in the Asia-Pacific region. Hence, the growing awareness among population related to benefits of social trading along with the easy availability of these platforms in Asia-Pacific is a key factor driving the growth of the regional market.

Market Players Outlook

The key players that are contributing significantly to the growth of the global social trading market include eToro AUS Capital Pty Ltd., Eva Trade Ltd., Instant Trading Ltd. (BVI), iSYSTEM AG, MetaQuotes Ltd. (MQL5 Trading Signals), PrimeXBT Trading Services LLC, and Zulu Trade,among others. These players are adopting different growth strategies such as investment in technological advancement, mergers and acquisition, partnership, and collaboration, among others to expand their footprints in the global marketplace. Additionally, many project startups of social trading platform are raising funding for the development of this technology. For instance, in April 2021, Enso Finance, a project aimed at creating a dedicated social trading platform on the Ethereum network, has raised $5.0 million. VC firm Polychain Capital and the Dfinity Beacon Fund are the major funders for the project. Additionally, the funding round involved participation from companies such as Multicoin Capital, P2P Capital, and Spartan Group, as well as angel investors from Synthetix, Messari, Aave and others.

Recent Development

- In May 2021, Darwinex, a UK-based social trading broker and asset manager has elaborated that its clients can now trade any stocks listed on NASDAQ, NYSE, AMEX, ARCA, CHX, IEX, EDGE, BYX, BATS, LTSE, MEMX and even PINK market centers. The stocks trading support will be added across existing Trader Workstation (TWS) platforms of the company, along with TWS-supported third-party platforms, such as NinjaTrader and MultiChart. With this extension, the company intends to expand its geographical reach across the globe.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global social trading market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Social Trading Industry

• Recovery Scenario of Global Social Trading Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Social Trading Market, By Type

5.1.1. Single Trade

5.1.2. Copy Trade

5.1.3. Mirror Trade

5.2. Global Social Trading Market, By End User

5.2.1. Individual

5.2.2. Enterprise

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. COLLECTIVE2 LLC

7.2. ETORO AUS CAPITAL PTY LTD.

7.3. EVA TRADE LTD.

7.4. FOREXTIME LTD.

7.5. FXPRO GROUP LTD.

7.6. INSTANT TRADING LTD. (BVI)

7.7. INTERACTIVE BROKERS LTD.

7.8. ISYSTEM AG

7.9. KINFO AB

7.10. LITEFOREX INVESTMENTS LTD.

7.11. METAQUOTES LTD. (MQL5 TRADING SIGNALS)

7.12. MYFXBOOK LTD.

7.13. NAGA GLOBAL LTD.

7.14. PLUS500 LTD.

7.15. PRIMEXBT TRADING SERVICES LLC

7.16. TRADENCY

7.17. TRADESLIDE TRADING TECH LTD. (DARWINEX)

7.18. ZULU TRADE?

1. GLOBAL SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL SINGLE TRADE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL COPY TRADE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL MIRROR TRADE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY END USER , 2020-2027 ($ MILLION)

6. GLOBAL INDIVIDUAL SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL ENTERPRISE SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

9. NORTH AMERICAN SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

10. NORTH AMERICAN SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

11. NORTH AMERICAN SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY NON-TYPE, 2020-2027 ($ MILLION)

12. NORTH AMERICAN SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

13. EUROPEAN SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. EUROPEAN SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

15. EUROPEAN SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY NON-TYPE, 2020-2027 ($ MILLION)

16. EUROPEAN SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

17. ASIA-PACIFIC SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY NON-TYPE, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

21. REST OF THE WORLD SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. REST OF THE WORLD SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

23. REST OF THE WORLD SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY NON-TYPE, 2020-2027 ($ MILLION)

24. REST OF THE WORLD SOCIAL TRADING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. GLOBAL SOCIAL TRADING MARKET SHARE BY TYPE, 2020 VS 2027 (%)

2. GLOBAL SOCIAL TRADING MARKET SHARE BY END USER, 2020 VS 2027 (%)

3. GLOBAL SOCIAL TRADING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

4. GLOBAL SINGLE TRADE MARKET SHARE BY REGION, 2020 VS 2027 (%)

5. GLOBAL COPY TRADE MARKET SHARE BY REGION, 2020 VS 2027 (%)

6. GLOBAL MIRROR TRADE MARKET SHARE BY REGION, 2020 VS 2027 (%)

7. GLOBAL INDIVIDUAL SOCIAL TRADING IN HOSPITALS & CLINICS MARKET SHARE BY REGION, 2020 VS 2027 (%)

8. GLOBAL ENTERPRISE SOCIAL TRADING MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. US SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

10. CANADA SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

11. UK SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

12. FRANCE SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

13. GERMANY SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

14. ITALY SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

15. SPAIN SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

16. REST OF EUROPE SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

17. INDIA SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

18. CHINA SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

19. JAPAN SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

20. SOUTH KOREA SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

21. REST OF ASIA-PACIFIC SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF THE WORLD SOCIAL TRADING MARKET SIZE, 2020-2027 ($ MILLION)