Soda ash Market

Soda ash Market Size, Share & Trends Analysis Report by Type (Light Soda Ash, and Dense Soda Ash), Category (Natural Soda Ash, and Synthetic Soda Ash), and Application (Glass, Soaps & Detergents, Metallurgy, Pulp & Paper, Water Treatment, and Other (Textiles, Construction)) Forecast Period (2025-2035)

Industry Overview

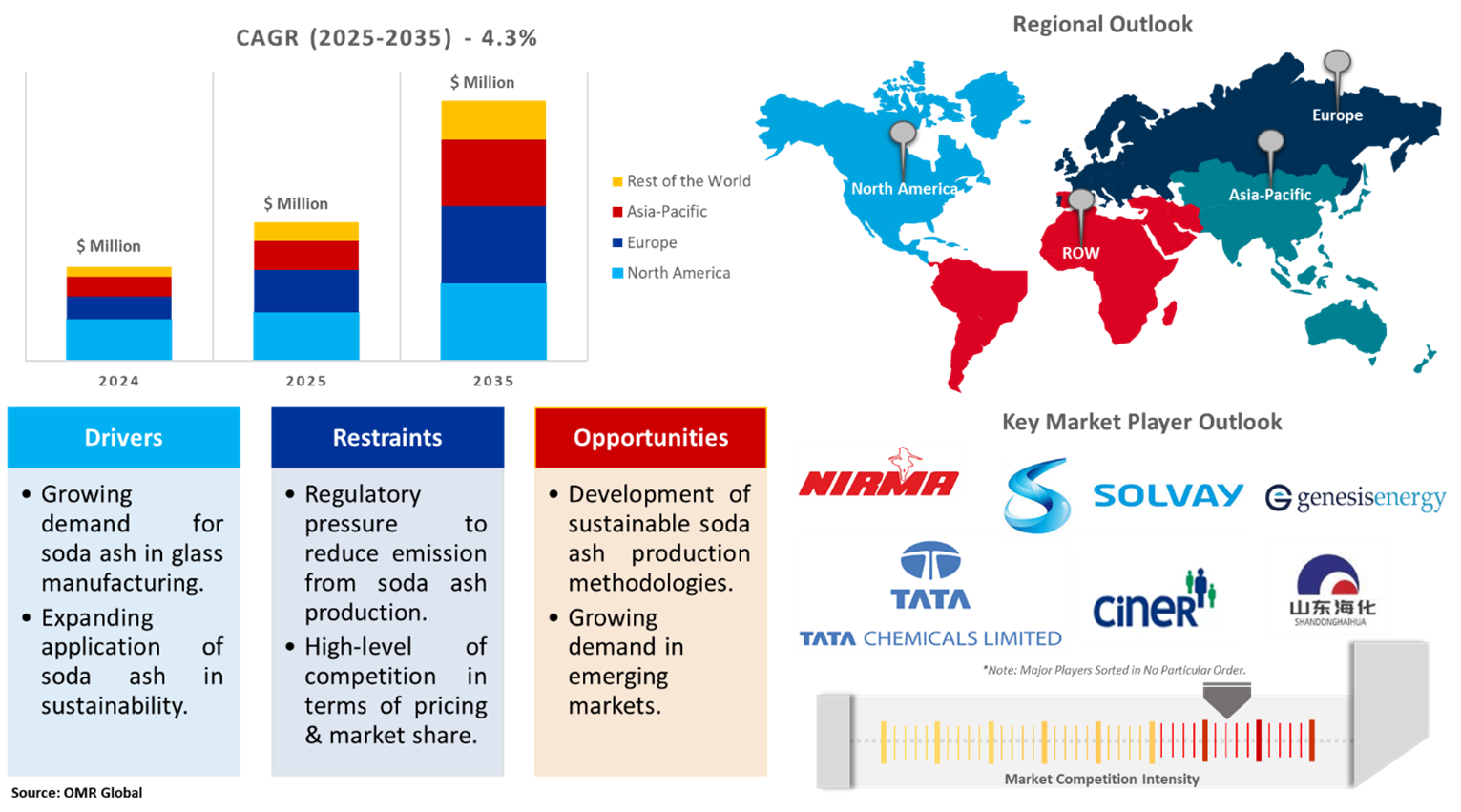

Soda ash market was estimated at $20.4 billion in 2024 and is projected to reach $32.1 billion by 2035, growing at a CAGR of 4.3% during the forecast period (2025-2035). Soda ash market growth is positively influenced by factors such as growing demand for soda ash in glass manufacturing, expanding application in sustainability, and advancements of sustainable production methods for soda ash production. Further, the soda ash industry growth is highly reliant on reducing GHG emissions, and developing sustainable infrastructure for production, as the regulatory frameworks for the manufacturing industry are expected to pose considerable hinderances. For example, in September 2022, Solvay took action towards achieving carbon neutrality by 2050 with an investment in its Dombasle site to test a sustainable soda ash production process. The company invested $42 million in developing proprietary technology, first patented in 2014.

Market Dynamics

Growing Consumption of Soda Ash in Glass Manufacturing

The growing demand for soda ash in glass production is projected to contribute to the growth of the soda ash market. Soda ash is extensively used in the production of different glass types as a flux agent for reducing the melting point of silica sand, which results in optimum energy consumption. Further, the consumption of glass products, including flat glasses, automotive glasses, and container glasses, has consistently increased owing to the growth of the relevant end-user industries such as construction, FMCG packaging, and automotive, making the industry consumption most significant for soda ash market players to grow. For example, according to the US Department of Geological Survey, in 2022, the U.S. produced approximately 11 million tons of natural soda ash valued at $1.4 billion. The industry involves five plants in Wyoming and one plant in California that have a total combined annual production capacity of 13.9 million tons. Of this amount, 48 percent of soda ash consumption is dedicated to use in the production of glass.

Expanding Application of Soda Ash in Sustainability

Soda ash is increasingly finding its application in distinct types of sustainability-focused applications, including water treatment, pollution control, and agriculture. Primarily, soda ash is being used as an acid neutralizer for water & soil and in certain carbon capture systems to capture acidic gases. These applications of soda are likely to increase with expansion in sustainability initiatives and regulations, developing scope for market players to extend their presence in these applications. For instance, in October 2024, the Public Utilities Corporation (PUC), Seychelles, issued a tender for the supply of 105 metric tonnes (MT) of sodium carbonate (soda ash) for use in water treatment. The tender invites both local and international manufacturers and suppliers to submit bids. The required amount will be delivered in three 40ft containers, with delivery expected by March 2025.

Market Segmentation

- Based on the type, the market is segmented into light soda ash and dense soda ash.

- Based on the category, the market is segmented into natural soda ash, and synthetic soda ash.

- Based on the application, the market is segmented into glass, soaps & detergents, metallurgy, pulp & paper, water treatment, and others (textiles, construction).

Dense Soda Ash Segment to Lead the Market with the Largest Share

The dense soda ash type is expected to remain the dominant type owing to its high demand in glass manufacturing and the chemical industry and its comparatively better utility in detergent products based on its chemical composition. Further, dense soda ash is also relatively easier to transport and consume, making it the preferred type in the soda ash market.

Glass: A Key Segment in Market Growth

Glass is expected to remain a very prominent application market for soda ash, attributing to growing demand from diverse glass products, including automotive glasses, packaging glasses, and others; the significant role of soda ash in the glass manufacturing process, aiding production costs; and supplier dependency on the glass segment for business growth.

Regional Outlook

The global soda ash market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America)

Asia-Pacific Region Dominates the Global Soda Ash Market

Asia-Pacific holds a significant share owing to rapid industrialization & urbanization in the regional countries, resulting in the growth of glass, detergent, construction, and other end-user industries; the presence of major soda ash manufacturers, including Tata Chemicals, Nirma, and others; regional dominance in chemical production; and comparatively less regulatory hindrance for soda ash production. Further, the domestic demand for the utilization of soda ash across various end-user industries is likely to help in the further growth of the regional soda ash market. For example, according to the Alkali Manufacturer Association of India, the installed capacity as of 31st March 2024 is 43.96 lakh MTPA, with a production of 35.12 lakh MTPA during the year 2023-24, giving a capacity utilization of 80%. Over the last 10 years, there has been tremendous growth in both installed capacity and production. Imports increased dramatically by 80% to 1,041 KT over the same period.

Market Players Outlook

The major companies operating in the global soda ash market include Ciner Group, Nirma Ltd., ?i?ecam, Solvay Group, and Tata Chemicals Ltd, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In December 2024, the Ministry of Environment, Forest, and Climate Change accorded environmental clearance to GHCL Ltd for its Greenfield Soda Ash project in Kutch, Gujarat. The approval will enable GHCL to proceed with the establishment of a 1.1 MMTPA Soda Ash facility, which will cost ?6,500 crore and is expected to be completed in the next six years.

- In December 2024, Sisecam acquired the shares of Ciner Group in Sisecam Chemicals Resources and Pacific Soda LLC, which boosted the global soda ash production capacity of the company to more than 10 million tons. With this $285.39 million investment in sustainable production, Sisecam will continue to lead the industry.

- In May 2023, Solvay purchased AGC's 20% minority interest in the Solvay Soda Ash Joint Venture (SSAJV) at Green River, WY, further solidifying Solvay's leadership in global trona-based soda ash production.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global soda ash market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Soda Ash Market Sales Analysis –Type | Category |Application ($ Million)

• Soda Ash Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Soda Ash Industry Trends

2.2.2. Market Recommendations

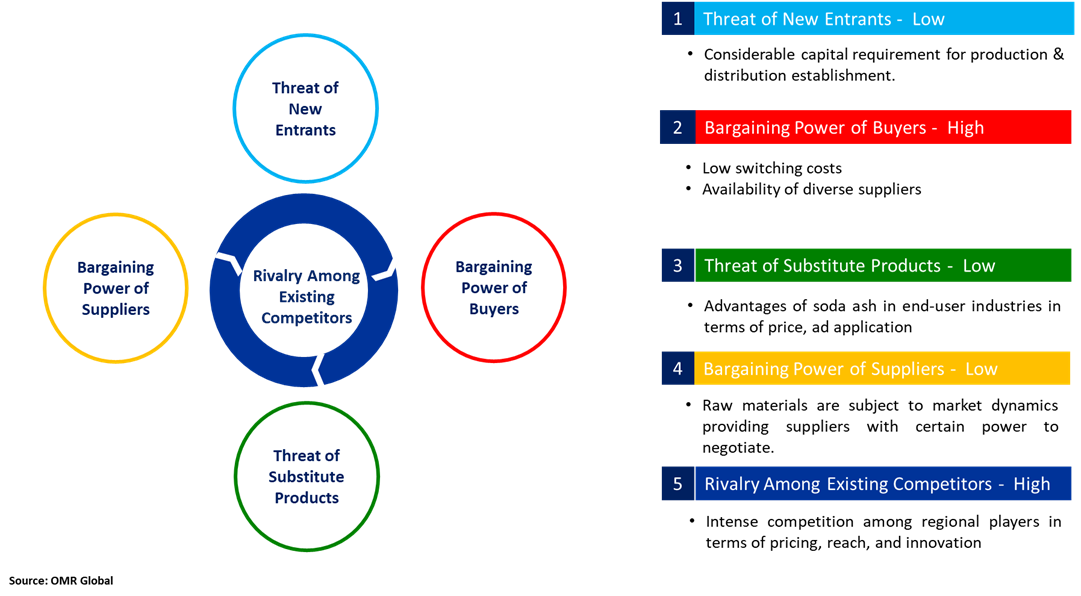

2.3. Porter's Five Forces Analysis for the Soda Ash Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Soda Ash Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Soda Ash Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Soda Ash Market Revenue and Share by Manufacturers

• Soda Ash Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Ciner Group

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. ANSAC (Genesis Energy, L.P.)

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Shandong Haihua Group Co., Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Solvay Group

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Tata Chemicals Ltd.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Soda Ash Market Sales Analysis by Type ($ Million)

5.1. Light Soda Ash

5.2. Dense Soda Ash

6. Global Soda Ash Market Sales Analysis by Category ($ Million)

6.1. Natural Soda Ash

6.2. Synthetic Soda Ash

7. Global Soda Ash Market Sales Analysis by Application ($ Million)

7.1. Glass

7.2. Soaps & Detergents

7.3. Metallurgy

7.4. Pulp & Paper

7.5. Water Treatment

7.6. Other (Textiles, Construction)

8. Regional Analysis

8.1. North American Soda Ash Market Sales Analysis –Type | Category | Application | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Soda Ash Market Sales Analysis –Type | Category |Application| Country ($ Million)

• Macroeconomic Factors for North America

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Soda Ash Market Sales Analysis –Type | Category |Application | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Soda Ash Market Sales Analysis –Type | Category |Application | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. ANSAC (Genesis Energy, L.P.)

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Ciner Group

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Chemical Iran

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. DCW Ltd (Dhrangadhra Chemical Works Ltd)

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Eti Soda Elektrik

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. GHCL Ltd.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Gujarat Alkalies and Chemicals Ltd (GACL)

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Innova Corp. (India)

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Jiangsu Huachang Chemical Co. Ltd.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Kakdiya Chemicals

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Kazan Soda Elektrik

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. NAVNEET CHEMICAL

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Nirma Ltd.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Prakash Chemicals International Pvt. Ltd

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Qemetica Soda Polska S.A.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. ?i?ecam

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Solvay Group

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Shandong Haihua Group Co., Ltd.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Takasugi Pharmaceutical Co., Ltd

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Tata Chemicals Ltd.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Tianjin Bohai Chemical Industry Group Supply and Sales Co., Ltd.

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Tokuyama Corp.

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Vizag Chemicals

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. WE Soda Ltd.

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

9.25. YILDIRIM Group

9.25.1. Quick Facts

9.25.2. Company Overview

9.25.3. Product Portfolio

9.25.4. Business Strategies

1. Global Soda Ash Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Natural Soda Ash Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Synthetic Soda Ash Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Soda Ash Market Research And Analysis By Category, 2024-2035 ($ Million)

5. Global Light Soda Ash Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Dense Soda Ash Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Soda Ash Market Research And Analysis By Application, 2024-2035 ($ Million)

8. Global Soda Ash In Glass Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Soda Ash In Soaps & Detergents Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Soda Ash In Metallurgy Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Soda Ash In Pulp & Paper Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Soda Ash In Water Treatment Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Soda Ash In Other Application Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Soda Ash Market Research And Analysis By Region, 2024-2035 ($ Million)

15. North American Soda Ash Market Research And Analysis By Country, 2024-2035 ($ Million)

16. North American Soda Ash Market Research And Analysis By Type, 2024-2035 ($ Million)

17. North American Soda Ash Market Research And Analysis By Category, 2024-2035 ($ Million)

18. North American Soda Ash Market Research And Analysis By Application, 2024-2035 ($ Million)

19. European Soda Ash Market Research And Analysis By Country, 2024-2035 ($ Million)

20. European Soda Ash Market Research And Analysis By Type, 2024-2035 ($ Million)

21. European Soda Ash Market Research And Analysis By Category, 2024-2035 ($ Million)

22. European Soda Ash Market Research And Analysis By Application, 2024-2035 ($ Million)

23. Asia-Pacific Soda Ash Market Research And Analysis By Country, 2024-2035 ($ Million)

24. Asia-Pacific Soda Ash Market Research And Analysis By Type, 2024-2035 ($ Million)

25. Asia-Pacific Soda Ash Market Research And Analysis By Category, 2024-2035 ($ Million)

26. Asia-Pacific Soda Ash Market Research And Analysis By Application, 2024-2035 ($ Million)

27. Rest Of The World Soda Ash Market Research And Analysis By Region, 2024-2035 ($ Million)

28. Rest Of The World Soda Ash Market Research And Analysis By Type, 2024-2035 ($ Million)

29. Rest Of The World Soda Ash Market Research And Analysis By Category, 2024-2035 ($ Million)

30. Rest Of The World Soda Ash Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Soda Ash Market Share By Type, 2024 Vs 2035 (%)

2. Global Natural Soda Ash Market Share By Region, 2024 Vs 2035 (%)

3. Global Synthetic Soda Ash Market Share By Region, 2024 Vs 2035 (%)

4. Global Soda Ash Market Share By Category, 2024 Vs 2035 (%)

5. Global Light Soda AshMarket Share By Region, 2024 Vs 2035 (%)

6. Global Dense Soda AshMarket Share By Region, 2024 Vs 2035 (%)

7. Global Soda Ash Market Share By Application, 2024 Vs 2035 (%)

8. Global Soda Ash In Glass Market Share By Region, 2024 Vs 2035 (%)

9. Global Soda Ash In Soaps & Detergents Market Share By Region, 2024 Vs 2035 (%)

10. Global Soda Ash In Metallurgy Market Share By Region, 2024 Vs 2035 (%)

11. Global Soda Ash In Pulp & Paper Market Share By Region, 2024 Vs 2035 (%)

12. Global Soda Ash In Water Treatment Market Share By Region, 2024 Vs 2035 (%)

13. Global Soda Ash In Other Application Market Share By Region, 2024 Vs 2035 (%)

14. Global Soda Ash Market Share By Region, 2024 Vs 2035 (%)

15. US Soda Ash Market Size, 2024-2035 ($ Million)

16. Canada Soda Ash Market Size, 2024-2035 ($ Million)

17. UK Soda Ash Market Size, 2024-2035 ($ Million)

18. France Soda Ash Market Size, 2024-2035 ($ Million)

19. Germany Soda Ash Market Size, 2024-2035 ($ Million)

20. Italy Soda Ash Market Size, 2024-2035 ($ Million)

21. Spain Soda Ash Market Size, 2024-2035 ($ Million)

22. Russia Soda Ash Market Size, 2024-2035 ($ Million)

23. Rest Of Europe Soda Ash) Market Size, 2024-2035 ($ Million)

24. India Soda Ash Market Size, 2024-2035 ($ Million)

25. China Soda Ash Market Size, 2024-2035 ($ Million)

26. Japan Soda Ash Market Size, 2024-2035 ($ Million)

27. South Korea Soda Ash Market Size, 2024-2035 ($ Million)

28. Australia & New Zealand Soda Ash Market Size, 2024-2035 ($ Million)

29. ASEAN Countries Soda Ash Market Size, 2024-2035 ($ Million)

30. Rest Of Asia-Pacific Soda Ash Market Size, 2024-2035 ($ Million)

31. Latin America Soda Ash Market Size, 2024-2035 ($ Million)

32. Middle East And Africa Soda Ash Market Size, 2024-2035 ($ Million)