Sodium Ion Battery Market

Global Sodium Ion Battery Market Size, Share & Trends Analysis Report by Type (Sodium Sulfur Battery, Sodium Salt Battery, and Sodium Oxygen Battery) and by End-User (Automobile Applications, Residential & Commercial Power Backups, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global sodium-ion battery market is anticipated to grow at a considerable CAGR of 7.9% during the forecast period. The factor that drives the global sodium-ion battery market is the increasing demand for cleaner energy, with rising greenhouse gas emissions around the globe. For instance, in November 2021, The European Space Agency (ESA) and the European Union's Earth-monitoring program Copernicus are working on a constellation of satellites that will track emissions of man-made greenhouse gases and assist to meet climate goals. The constellation, called European CO2 Monitoring and Verification Support Capacity (CO2MVS) on anthropogenic emissions, is being launched by ESA and the European Organisation for the Exploitation of Meteorological Satellites (EUMETSAT).

Impact of COVID-19 Pandemic on Global Sodium-Ion Battery Market

The COVID-19 pandemic had a negative impact on the global sodium-ion battery market as it resulted in the reduction of power demand which directly impacted the energy storage projects across the globe. However, the electric vehicle market showed exponential growth. As per the data of the International Energy Agency (IEA) 2020, electric car sales reached 2,977,058 vehicle units globally which is 40.8% more than the sales of electric cars in 2019.

Segmental Outlook

The global sodium ion battery market is segmented based on the type and end-user. Based on the type, the market is segmented into sodium sulfur battery, sodium salt battery, and sodium oxygen battery. Based on the end-user, the market is sub-segmented into the automobile applications, residential & commercial power backups, and others. The above mentioned segments can be customized as per the requirements. Among these residential & commercial power backups segment is expected to be the fastest-growing during the forecast period due to the technical advancement in residential generators operating on sodium-ion batteries.

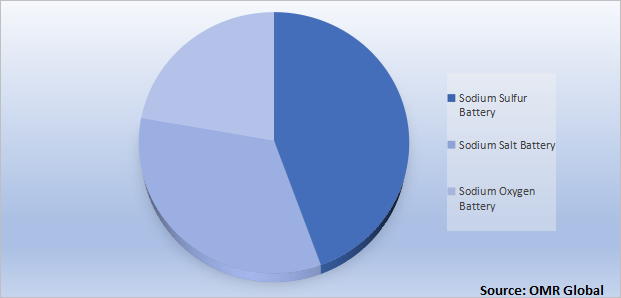

Global Sodium Ion Battery Market Share by Type, 2021 (%)

The sodium-sulfur segment is Expected to Hold the Prominent Share in the Global Sodium-Ion Battery Market

The sodium-sulfur segment is expected to hold a prominent share in the global sodium-ion battery due to an increase in the demand for renewable energy. Various projects are still on the way to getting added to the national grid of many countries, equipped with sodium-sulfur battery systems. For Instance, In October 2021, German chemicals company BASF’s subsidiary BASF New Business (BNB) commissioned the energy storage system consisting of four NAS battery containers integrated into the electricity grid at BASF’s Verbund site in Antwerp, Belgium.

Regional Outlooks

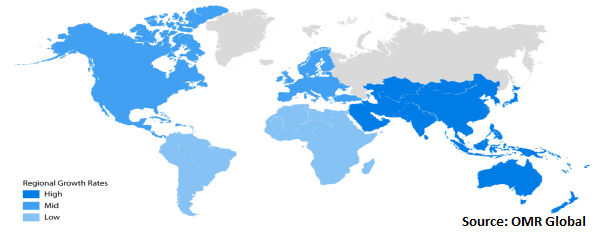

The global sodium ion battery market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for particular region or country level as per the requirement. The Asia-Pacific is expected to be the fastest growing region in the global sodium ion battery market during the forecast period due to rise in demand of the electronic devices and stringent government regulation to control rising environmental pollution in the region especially in India and China.

Global Sodium Ion Battery Market Growth, by Region 2022-2028

The Europe Region is Expected to Hold the Prominent Share in the Global Sodium-Ion Battery Market

The Europe region is expected to hold a prominent share in the global sodium-ion battery market due to an increase in the sales of electric vehicles in this region. According to International Energy Agency (IEA), the largest increase in 2020 occurred in Europe, where registrations more than doubled to 1.4 million (a sales share of 10%) all over the globe. Furthermore, automotive battery production reached 160 GWh in 2020, and in Europe, it had the highest growth (+110%) to reach 52 GWh.

Market Players Outlook

The major companies serving the global Sodium Ion Battery market include Faradion Limited, NGK Insulators Ltd, TIAMAT SAS, HiNa Battery Technology Co. Ltd, General Electric, Altairnano, and Natron Energy Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, In January 2022, Reliance Industries announced that its subsidiary Reliance New Energy Solar Limited had entered an agreement with Faradion (Faradion) and its shareholders to acquire 100% of the equity shares of Faradion through secondary transactions for a total value of GBP 94.42 million. The company also revealed that Reliance will use Faradion’s state-of-the-art technology at its proposed fully integrated energy storage giga-factory as part of the Dhirubhai Ambani Green Energy Giga Complex project at Jamnagar.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global sodium ion battery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Definition

2.2. Analyst Insights & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendation

2.2.3. Conclusion

2.3. Regulations

3. Market Determinants

3.1. Motivators

3.1.1. Increasing Demand for Consumer Electronics and Smart Devices

3.1.2. Natural Abundance of Sodium Metal

3.1.3. Low Cost of Sodium Ion Battery as Compared to Other Batteries

3.1.4. Government Regulations to Control Environmental Pollution

3.2. Restraints

3.2.1. Availability of Alternative Choice in the Market

3.3. Opportunities

3.3.1. Advancement in Technology

3.3.2. Growing Demand for Electric Vehicle Market

4. Market Segmentation

4.1. Global Sodium Ion Battery Market by Type

4.1.1. Sodium-Sulphur Battery

4.1.2. Sodium-Salt Battery

4.1.3. Sodium-Oxygen Battery

4.2. Global Sodium Ion Battery Market by End-User

4.2.1. Automobile Applications

4.2.2. Residential and Commercial Power Backups

4.2.3. Others (Grid-Level Applications and Military and Space Application)

5. Competitive Landscape

5.1. Key Company Analysis

5.2. Key Strategy Analysis

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.1.3. Rest of North America

6.2. Europe

6.2.1. United Kingdom

6.2.2. France

6.2.3. Germany

6.2.4. Italy

6.2.5. Spain

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. India

6.3.2. China

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AES Energy Storage, LLC

7.2. AGM Batteries Ltd.

7.3. Akzo Nobel N.V.

7.4. Altair Nanotechnologies Inc.

7.5. Ambri Inc.

7.6. American Elements

7.7. Aquion Energy Inc.

7.8. BASF SE

7.9. Broadbit Batteries Oy

7.10. BYD Auto Co. Ltd.

7.11. Ceramatec Inc.

7.12. Faradion Ltd.

7.13. General Electric

7.14. Maxpower Inc.

7.15. Mitsui & Co. Ltd.

7.16. Natron Energy, Inc.

7.17. NEI Corp.

7.18. NGK Insulators Ltd.

7.19. Panasonic Corp.

7.20. Samsung Group

7.21. Siemens AG

7.22. Tesla, Inc.

7.23. Umicore N.V.

7.24. Younicos AG

1.GLOBAL SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2.GLOBAL SODIUM-SULFUR BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3.GLOBAL SODIUM-SALT BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.GLOBAL SODIUM-OXYGEN BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5.GLOBAL SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

6.GLOBAL SODIUM ION BATTERY IN AUTOMOBILE APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7.GLOBAL SODIUM ION BATTERY IN RESIDENTIAL & COMMERCIAL POWER BACK UP MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8.GLOBAL SODIUM ION BATTERY IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9.GLOBAL SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

10.NORTH AMERICAN SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11.NORTH AMERICAN SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

12.NORTH AMERICAN SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

13.EUROPEAN SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14.EUROPEAN SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

15.EUROPEAN SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

16.ASIA-PACIFIC SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17.ASIA-PACIFIC SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

18.ASIA-PACIFIC SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

19.REST OF THE WORLD SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20.REST OF THE WORLD SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

21.REST OF THE WORLD SODIUM ION BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON GLOBAL SODIUM ION BATTERY MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL SODIUM ION BATTERY MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF GLOBAL SODIUM ION BATTERY MARKET, 2022-2028 (%)

4.GLOBAL SODIUM ION BATTERY MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5.GLOBAL SODIUM-SULFUR BATTERY MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

6.GLOBAL SODIUM-SALT BATTERY MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

7.GLOBAL SODIUM-OXYGEN BATTERY MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

8.GLOBAL SODIUM ION BATTERY MARKET SHARE BY END-USER, 2021 VS 2028 (%)

9.GLOBAL SODIUM ION BATTERY IN AUTOMOBILE APPLICATIONS MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

10.GLOBAL SODIUM ION BATTERY IN RESIDENTIAL & COMMERCIAL POWER BACK UP MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

11.GLOBAL SODIUM ION BATTERY IN OTHER MARKET REGION BY GEOGRAPHY, 2021 VS 2028 (%)

12.GLOBAL SODIUM ION BATTERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13.US SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

14.CANADA SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

15.UK SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

16.FRANCE SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

17.GERMANY SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

18.ITALY SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

19.SPAIN SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

20.REST OF EUROPE SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

21.INDIA SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

22.CHINA SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

23.JAPAN SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

24.SOUTH KOREA SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

25.REST OF ASIA-PACIFIC SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

26.REST OF THE WORLD SODIUM ION BATTERY MARKET SIZE, 2021-2028 ($ MILLION)