Software-Defined Data Center Market

Software-Defined Data Center Market Size, Share & Trends Analysis Report by Type (Software-Defined Network, Software-Defined Storage, and Software-Defined Compute), and by Industry (BFSI, Telecom & IT, Healthcare, Retail, and Others (Media & Entertainment, Logistics)) Forecast Period (2024-2031)

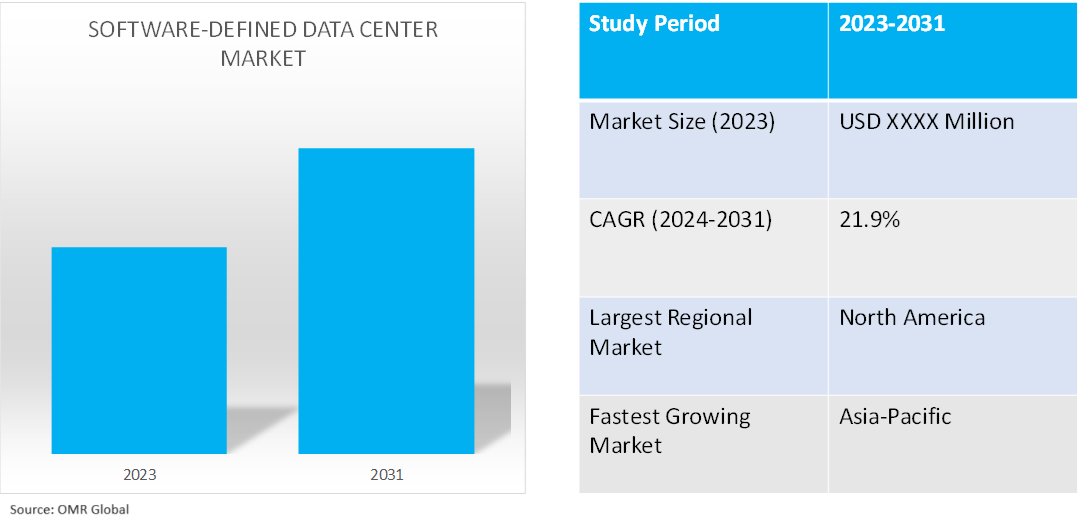

Software-defined data center market is anticipated to grow at a CAGR of 21.9% during the forecast period (2024-2031). Software-defined data centers are virtualized data center infrastructures comprising networking, storage, and computing, which are collectively offered as a service. The global market growth is driven by the rapid adoption of cloud computing, the modernization of data centers, a growing demand for automation and orchestration, and advancements in technologies such as artificial intelligence (AI), machine learning (ML), and containerization. Furthermore, the market is expected to be influenced by the integration of edge computing, AI-driven business operations, and the growing efforts for security enhancement and regulatory compliance.

Market Dynamics

Increasing Adoption of Cloud Computing

One of the pivotal factors driving the demand for software-defined data centers is the growing adoption of cloud computing services and solutions. The rapid adoption of cloud computing services, both public and private, has fueled the demand for SDDC owing to the complementary features of the solutions that provide the required infrastructure that supports cloud services. Additionally, it enables seamless integration between on-premises data centers and cloud resources, facilitating hybrid cloud deployments and ensuring consistent management across distributed IT environments. For instance, the Federal Deposit Insurance Corporation (FDIC) has expedited its transition to the cloud following the issuance of Executive Order 14028, Improving the Nation’s Cybersecurity (2021), by the White House. This executive order mandated that each agency head update their existing plans to prioritize the adoption and utilization of cloud technology and submit a detailed report to OMB outlining their plan. Subsequently, the FDIC has been phasing out its on-premises infrastructure and modernizing its IT portfolio through cloud migration. As of March 2023, the FDIC had 252 operational systems, with 95 of them being cloud-based (38%), and was utilizing 7 major cloud platforms. The FDIC operates within a multi-cloud environment, obtaining services from various cloud service providers offering infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS).

Growing Demand for Automation & Orchestration

The software-defined data center market is expected to benefit from the growing demand for solutions or services offering automation and orchestration capabilities. Automation and orchestration capabilities are integral to SDDC, which enables IT teams to automate routine tasks, streamline operations, and improve overall efficiency. Further, organizations are increasingly integrating solutions that offer robust automation frameworks, helping to maintain consistency, reduce human errors, and accelerate time-to-market for new services. The trend is expected to continue as organizations seek to simplify management and enhance agility, benefiting the SDDC market. For instance, in April 2023, DXC Technology, a prominent global technology services provider, unveiled the DXC Secure Network Fabric. This cutting-edge data center solution, tailored for the hybrid cloud environment, is the result of a collaboration between DXC Technology, Hewlett-Packard Enterprise, and AMD. The DXC Secure Network Fabric offers a scalable software-defined data center solution that streamlines, updates, automates, and fortifies the data center network while keeping costs down.

Segmental Outlook

- Based on type, the market is segmented into software-defined network, software-defined storage, and software-defined compute.

- Based on industry, the market is segmented into BFSI, telecom & IT, healthcare, retail, and others (media & entertainment, logistics).

Software Defined Networking is the Most Sorted Type

Software-defined networking (SDN) is the most popular type in the SDDC market owing to its ability to centralize and automate network management, optimize resource allocation, and improve scalability and operational efficiency. Further, the market growth drivers for the segment include AI advancements in network automation, rising needs for adaptable network architectures to aid digital transformation, and the expanding requirements of edge computing for resilient network infrastructures. For instance, in June 2022, Tech Mahindra, a prominent supplier of digital transformation, consulting, and business re-engineering services and solutions, unveiled the introduction of Synergy Lounges, created in partnership with IBM and Red Hat, the foremost provider of open-source solutions worldwide. The inaugural Synergy Lounge was inaugurated in Bengaluru, with a concentration on edge, 5G, and software-defined networking solutions, to expedite the hybrid cloud progression of enterprises on a global scale.

IT & Telecom is the Prominent Software-Defined Data Center Industry

IT and telecom are the leading industries for software-defined data centers (SDDCs) owing to their ability to provide scalable and agile infrastructure for IT and telecom operations. Further, the segmental growth is driven by increasing digitalization efforts, demand for efficient cloud integration, advancements in automation technologies, and the need to support expanding IoT and edge computing applications. For instance, in February 2024, VMware Inc., now under Broadcom's ownership, launched new enhancements within its Software-Defined Edge (SDE) portfolio. This includes advancements in 5G, software-defined wide area network (SD-WAN), secure access service edge (SASE), and edge computing. These developments are designed to support telecom operators in monetizing their networks and introducing new revenue-generating services.

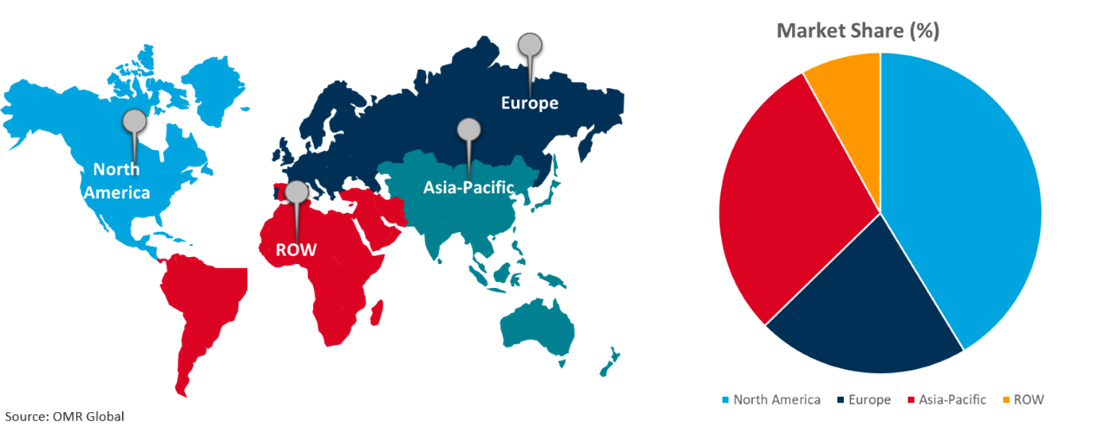

Regional Outlook

The global software-defined data center market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America is Estimated to Dominate the Global Software-Defined Data Center Market

North America is projected to dominate the software-defined data center market in the future, attributed to the strong IT infrastructure of the region, rapid adoption and integration of cloud-based solutions across sectors, regulatory requirements to modernize current data center capabilities, and the presence of major solution providers such as Oracle, Cisco, Microsoft, and Amazon Web Services. For instance, in March 2023, a bipartisan group of senators reintroduced a bill aimed at enhancing the security of federal data centers, both physically and digitally. The Federal Data Center Enhancement Act, introduced by Sens. Jacky Rosen, D-Nev., Gary Peters, D-Mich., and John Cornyn, R-Texas, would mandate the Office of Management and Budget to collaborate with federal agencies in establishing minimum cybersecurity, resiliency, availability, and sustainability standards for new federal data centers. These standards would cover cyber intrusions, data center availability, mission-critical uptime, and resilience against physical attacks, wildfires, and other natural disasters.

Global Software-Defined Data Center Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing in the Global Software-Defined Data Center Market

- The Asia-Pacific region is experiencing an increase in the adoption of digital technologies and initiatives across industries, which is expected to drive demand for agile and scalable data center solutions such as SDDCs.

- The countries in the Asia-Pacific, such as India, China, and Southeast Asian nations, are witnessing rapid economic growth, leading to increased investments in IT infrastructure, including SDDCs.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global software-defined data center market include Cisco Systems Inc., Hewlett Packard Enterprise Co., IBM Corp., Microsoft Corp., and Oracle Corp. among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in October 2023, NetApp, a global software company focused on cloud and data, officially declared the extension of its partnership contract with Ducati Corse for the seasons spanning from 2023 to 2025. In addition, NetApp has been appointed as the Official Data Infrastructure Partner of the team. A notable outcome of this collaboration is the introduction of a cutting-edge virtual data management and insights solution designed for race analytics and research and development, which leverages NetApp ONTAP, NetApp SnapMirror, and NetApp FlexCache.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global software-defined data center market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cisco Systems, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hewlett Packard Enterprise Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IBM Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Microsoft Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Oracle Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Software-Defined Data Center Market by Type

4.1.1. Software-Defined Network

4.1.2. Software-Defined Storage

4.1.3. Software-Defined Compute

4.2. Global Software-Defined Data Center Market by Industry

4.2.1. BFSI

4.2.2. Telecom & IT

4.2.3. Healthcare

4.2.4. Retail

4.2.5. Others (Media & Entertainment, Logistics)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Arista Networks, Inc.

6.2. Cloud Software Group,

6.3. Commvault Systems, Inc.

6.4. DataCore Software Corp.

6.5. Dell Inc.

6.6. Equinix, Inc.

6.7. Fujitsu Ltd.

6.8. Honeywell International Inc.

6.9. Intel Corp.

6.10. Kyndryl Inc.

6.11. NEC Enterprise Solutions

6.12. NetApp, Inc.

6.13. Nutanix, Inc.

6.14. SUSE Group

6.15. Telefonaktiebolaget LM Ericsson

1. Global Software-Defined Data Center Market Research and Analysis by Type, 2023-2031 ($ Million)

2. Global Software-Defined Network Market Research and Analysis by Region, 2023-2031 ($ Million)

3. Global Software-Defined Storage Market Research and Analysis by Region, 2023-2031 ($ Million)

4. Global Software-Defined Compute Market Research and Analysis by Region, 2023-2031 ($ Million)

5. Global Software-Defined Data Center Market Research and Analysis by Industry, 2023-2031 ($ Million)

6. Global Software-Defined Data Center for BFSI Market Research and Analysis by Region, 2023-2031 ($ Million)

7. Global Software-Defined Data Center for Telecom & IT Market Research and Analysis by Region, 2023-2031 ($ Million)

8. Global Software-Defined Data Center for Healthcare Market Research and Analysis by Region, 2023-2031 ($ Million)

9. Global Software-Defined Data Center for Retail Market Research and Analysis by Region, 2023-2031 ($ Million)

10. Global Software-Defined Data Center for Other Industry Market Research and Analysis by Region, 2023-2031 ($ Million)

11. Global Software-Defined Data Center Market Research and Analysis by Region, 2023-2031 ($ Million)

12. North American Software-Defined Data Center Market Research and Analysis by Country, 2023-2031 ($ Million)

13. North American Software-Defined Data Center Market Research and Analysis by Type, 2023-2031 ($ Million)

14. North American Software-Defined Data Center Market Research and Analysis by Industry, 2023-2031 ($ Million)

15. European Software-Defined Data Center Market Research and Analysis by Country, 2023-2031 ($ Million)

16. European Software-Defined Data Center Market Research and Analysis by Type, 2023-2031 ($ Million)

17. European Software-Defined Data Center Market Research and Analysis by Industry, 2023-2031 ($ Million)

18. Asia-Pacific Software-Defined Data Center Market Research and Analysis by Country, 2023-2031 ($ Million)

19. Asia-Pacific Software-Defined Data Center Market Research and Analysis by Type, 2023-2031 ($ Million)

20. Asia-Pacific Software-Defined Data Center Market Research and Analysis by Industry, 2023-2031 ($ Million)

21. Rest of The World Software-Defined Data Center Market Research and Analysis by Region, 2023-2031 ($ Million)

22. Rest of The World Software-Defined Data Center Market Research and Analysis by Type, 2023-2031 ($ Million)

23. Rest of The World Software-Defined Data Center Market Research and Analysis by Industry, 2023-2031 ($ Million)

1. Global Software-Defined Data Center Market Share by Type, 2023 Vs 2031 (%)

2. Global Software-Defined Network Market Share by Region, 2023 Vs 2031 (%)

3. Global Software-Defined Storage Market Share by Region, 2023 Vs 2031 (%)

4. Global Software-Defined Compute Market Share by Region, 2023 Vs 2031 (%)

5. Global Software-Defined Data Center Market Share by Industry, 2023 Vs 2031 (%)

6. Global Software-Defined Data Center for BFSI Market Share by Region, 2023 Vs 2031 (%)

7. Global Software-Defined Data Center for Telecom & IT Market Share by Region, 2023 Vs 2031 (%)

8. Global Software-Defined Data Center for Retail Market Share by Region, 2023 Vs 2031 (%)

9. Global Software-Defined Data Center for Other Industry Market Share by Region, 2023 Vs 2031 (%)

10. Global Software-Defined Data Center for Market Share by Region, 2023 Vs 2031 (%)

11. Global Software-Defined Data Center Market Share by Region, 2023 Vs 2031 (%)

12. US Software-Defined Data Center Market Size, 2023-2031 ($ Million)

13. Canada Software-Defined Data Center Market Size, 2023-2031 ($ Million)

14. UK Software-Defined Data Center Market Size, 2023-2031 ($ Million)

15. France Software-Defined Data Center Market Size, 2023-2031 ($ Million)

16. Germany Software-Defined Data Center Market Size, 2023-2031 ($ Million)

17. Italy Software-Defined Data Center Market Size, 2023-2031 ($ Million)

18. Spain Software-Defined Data Center Market Size, 2023-2031 ($ Million)

19. Rest of Europe Software-Defined Data Center Market Size, 2023-2031 ($ Million)

20. India Software-Defined Data Center Market Size, 2023-2031 ($ Million)

21. China Software-Defined Data Center Market Size, 2023-2031 ($ Million)

22. Japan Software-Defined Data Center Market Size, 2023-2031 ($ Million)

23. South Korea Software-Defined Data Center Market Size, 2023-2031 ($ Million)

24. Rest of Asia-Pacific Software-Defined Data Center Market Size, 2023-2031 ($ Million)

25. Latin America Software-Defined Data Center Market Size, 2023-2031 ($ Million)

26. Middle East And Africa Software-Defined Data Center Market Size, 2023-2031 ($ Million)