Solar Panel Market

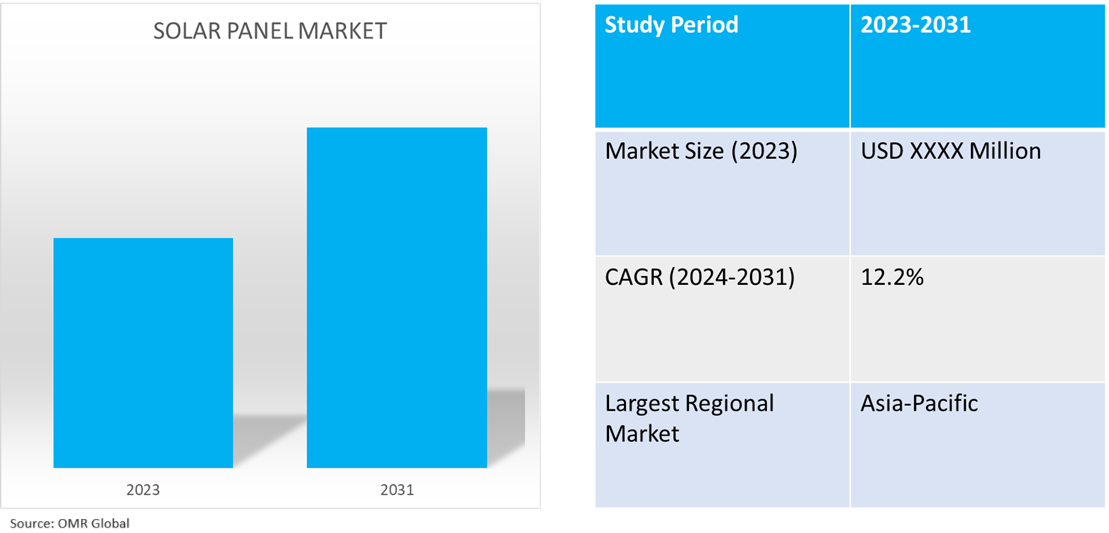

Solar Panel Market Size, Share & Trends Analysis Report By Technology (Mono-Crystalline, Polycrystalline Silicon, Thin-film Solar Panel, and Others), and by End-User (Residential, Commercial, and Industrial) Forecast Period (2024-2031)

Solar panel market is anticipated to grow at a CAGR of 12.2% during the forecast period (2024-2031). Solar panels, commonly referred to as photovoltaic (PV) panels utilize semiconductors often composed of silicon, to directly transform sunlight into electricity. The global market growth is driven by the growing emphasis on energy diversification and security, increasing investment in renewable energy, and decreasing the cost-effectiveness of energy infrastructure, particularly PV cells. The advancements in energy generation and transmission technology through solar panels, the growing adoption of utility-scale solar farms supported by government initiatives, and regulatory requirements in the commercial and industrial sectors for clean electricity sourcing are other contributors to the heightened demand for solar panels.

Market Dynamics

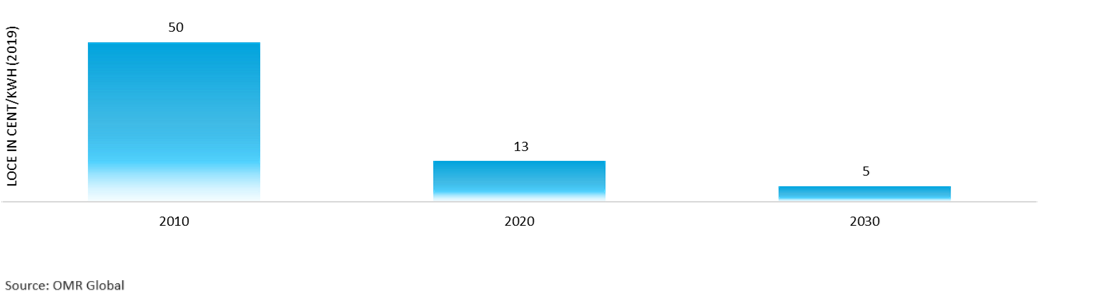

Reduction in Photovoltaic (PV) Cell and Related Infrastructure Cost

The substantial decrease in costs of PV solar cells and related infrastructure had a significant impact on the growing preference for the implementation of solar energy systems in residential, commercial, and industrial settings across different countries. Additionally, national-level organizations are consistently striving to minimize costs to the lowest possible levels, which will contribute to the increasing market demand. For instance, the US Department of Energy Solar Energy Technologies Office (SETO) is dedicated to funding PV research and development projects aimed at reducing the costs of solar-generated electricity through enhanced efficiency and reliability. SETO's PV research initiatives are focused on upholding US leadership in the field, with a proven track record of influence spanning several decades. Notably, around half of the world's solar cell efficiency records, as monitored by the National Renewable Energy Laboratory, have been supported by the DOE, primarily through SETO PV research. SETO's ultimate goal is to achieve a levelized cost of $0.02 per kilowatt-hour (kWh) for utility-scale solar photovoltaics, $0.04 per kWh for commercial PV systems, and $0.05 per kWh for residential rooftop PV systems.

Residential Sector Photovoltaics (PV) Levelized Cost of Energy (LOCE) Progress and Goals (In Dollars)

Source – Department of Energy (DOE), the US

Substantial Push to Promote Solar Energy Deployment by State-Run Organizations

The solar panel industry is experiencing a significant boost from government entities for the installation of solar panels in both the public and private sectors. Several initiatives are part of a unified strategy to promote clean energy generation, diversify energy sources, and decrease carbon footprints. These initiatives are additionally reinforced through financial incentives, regulations, and other forms of support. Further, the comprehensive approach is aimed at promoting solar energy as a feasible and cost-effective means of electricity generation, especially in the residential sector, resulting in increased demand for solar panels. For instance, the National Renewable Energy Laboratory has indicated that the updated Western Solar Plan can significantly boost solar energy projects on around 700,000 acres of public lands over the next 20 years. The solar facilities established on these lands could potentially generate up to 100,000 megawatts of electricity, enough to power millions of homes. The implementation of these projects could prevent as much as 123 million metric tons of CO2 emissions annually by 2045, which is equal to the emissions saved by keeping 32 coal-fired power plants inactive every year.

Segmental Outlook

- Based on technology, the market is segmented into mono-crystalline, polycrystalline silicon, thin-film solar panels, and others (amorphous silicon).

- Based on end-users, the market is segmented into residential, commercial, and industrial.

Mono-crystalline is the Preferred Technology Segment

Monocrystalline solar panels are preferred in solar panel manufacturing owing to their higher efficiency and longer lifespan. The technology demand in the market is driven by its ability to generate more energy per square meter, excellent performance in low-light conditions, and sleek, attractive appearance. Additionally, advancements in manufacturing have resulted in steadily reduced costs, making monocrystalline panels a viable option for both residential and commercial applications.

Residential is the Biggest End-User Segment

The residential sector dominates the end-user consumption of solar panels owing to the low installation and maintenance costs of solar energy systems, substantial support by state-run organizations to deploy solar energy-based electricity systems in residential sectors, the higher feasibility of solar energy electricity generation in remote areas, and the declining cost of solar energy generation infrastructure. For instance, as per the International Energy Association, in the scenario of achieving net zero emissions by 2050, the number of households utilizing solar PV is set to surge from 25 million in 2022 to more than 100 million by 2030. A minimum of 190 GW will be installed each year from 2022 onwards, with this figure on a continuous rise owing to the increased competitiveness of PV and the growing preference for clean energy sources.

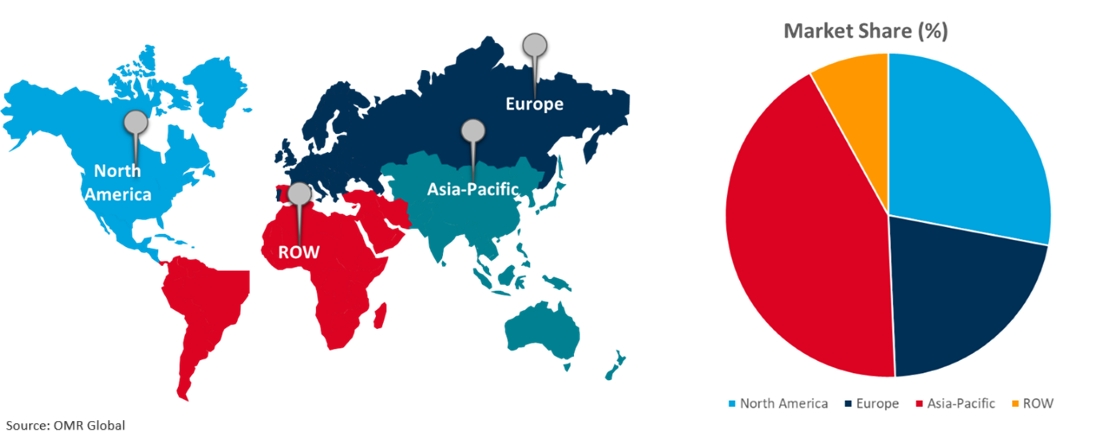

Regional Outlook

The global solar panel market is segmented based on geography including North America (the US, and Canada), Asia-Pacific (India, China, Japan, South Korea, and the Rest of Asia-Pacific), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Solar Panel Market Growth by Region 2024-2031

Asia-Pacific Dominates the Global Solar Panel Market

Asia-Pacific is projected to deliver the highest growth rate in the future, attributed to substantial regional investment in renewable energy, energy diversification measures by regional countries, and constant support by the government to promote solar energy adoption through policies, subsidies, and projects, among others. The abundant availability of solar panel raw materials in the region, and electrification shifts to renewable sources such as solar energy in emerging countries further aiding the regional market growth. For instance, according to IBEF India, India plans to more than double its electricity generation capacity from 399.5 GW in 2022 to approximately 849 GW by 2032. The NEP14 (National Electricity Plan) emphasizes a robust focus on renewable energy, particularly solar power, which is projected to grow from 66.78 GW in 2023 to 366 GW by 2032, constituting half of the total growth. India’s solar capacity is expected to increase at a CAGR of 22.7% through 2023–27 to achieve its initial target of installed capacity of 185.6 GW until 2027, which is further expected to increase to 364.6 GW by 2032, as per NEP14.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global solar panel market include Canadian Solar Inc., LONGi Green Energy Technology Co. Ltd., First Solar, Inc., JinkoSolar Holding Co., Ltd., and Trina Solar Ltd. among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in December 2022, Complete Solaria, Inc., a prominent company in the solar technology, services, and installation sector, and Freedom Acquisition Corp., a publicly traded special purpose acquisition company, revealed several favorable financial advancements related to their planned business merger. Complete Solaria brings together two closely related enterprises in a vertically integrated manufacturing and distribution framework, providing comprehensive residential solar solutions, top-notch customer service, visually attractive and high-performing solar panels, as well as project financing, design, and software solutions.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global solar panel market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Canadian Solar, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. First Solar, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Trina Solar, Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. JinkoSolar Holding Co., Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. LONGi Green Energy Technology Co. Ltd

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Solar Panel Market by Technology

4.1.1. Mono-crystalline

4.1.2. Polycrystalline silicon

4.1.3. Thin-film solar panel

4.1.4. Others (Amorphous Silicon)

4.2. Global Solar Panel Market by End-User

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Adani Group

6.2. ALLPOWERS Industrial International Ltd.

6.3. China Sunergy (Nanjing) Co., Ltd.

6.4. Hanwha Q CELLS Americas Holdings Corp.

6.5. Hanwha Solarone Co. Ltd.

6.6. JA SOLAR Co., Ltd.

6.7. JUWI Group

6.8. KYOCERA Corp.

6.9. Motech Industries Inc.

6.10. Neo Solar Power Corp.

6.11. Renesola Zhejiang Ltd.

6.12. Risen Energy Co., Ltd.

6.13. Sharp Corp.

6.14. SunEdison AG

6.15. SunPower Corp.

6.16. Tata Power Ltd.

6.17. Trina Solar Co., Ltd

6.18. Vikram Solar Ltd.

6.19. Wuxi Suntech Power Co., Ltd.

6.20. Yingli Solar

1. Global Solar Panel Market Research and Analysis by Technology, 2023-2031 ($ Million)

2. Global Mono-crystalline Solar Panel Market Research and Analysis by Region, 2023-2031 ($ Million)

3. Global Polycrystalline Silicon Solar Panel Market Research and Analysis by Region, 2023-2031 ($ Million)

4. Global Thin-film Solar Panel Market Research and Analysis by Region, 2023-2031 ($ Million)

5. Global Other Technology-based Solar Panel Market Research and Analysis by Region, 2023-2031 ($ Million)

6. Global Solar Panel Market Research and Analysis by End-User, 2023-2031 ($ Million)

7. Global Solar Panel for Residential Market Research and Analysis by Region, 2023-2031 ($ Million)

8. Global Solar Panel for Commercial Market Research and Analysis by Region, 2023-2031 ($ Million)

9. Global Solar Panel for Industrial Market Research and Analysis by Region, 2023-2031 ($ Million)

10. Global Solar Panel Market Research and Analysis by Region, 2023-2031 ($ Million)

11. North American Solar Panel Market Research and Analysis by Country, 2023-2031 ($ Million)

12. North American Solar Panel Market Research and Analysis by Technology, 2023-2031 ($ Million)

13. North American Solar Panel Market Research and Analysis by End-User, 2023-2031 ($ Million)

14. European Solar Panel Market Research and Analysis by Country, 2023-2031 ($ Million)

15. European Solar Panel Market Research and Analysis by Technology, 2023-2031 ($ Million)

16. European Solar Panel Market Research and Analysis by End-User, 2023-2031 ($ Million)

17. Asia-Pacific Solar Panel Market Research and Analysis by Country, 2023-2031 ($ Million)

18. Asia-Pacific Solar Panel Market Research and Analysis by Technology, 2023-2031 ($ Million)

19. Asia-Pacific Solar Panel Market Research and Analysis by End-User, 2023-2031 ($ Million)

20. Rest of The World Solar Panel Market Research and Analysis by Region, 2023-2031 ($ Million)

21. Rest of The World Solar Panel Market Research and Analysis by Technology, 2023-2031 ($ Million)

22. Rest of The World Solar Panel Market Research and Analysis by End-User, 2023-2031 ($ Million)

1. Global Solar Panel Market Share by Technology, 2023 Vs 2031 (%)

2. Global Mono-crystalline Solar Panel Market Share by Region, 2023 Vs 2031 (%)

3. Global Polycrystalline Silicon Solar Panel Market Share by Region, 2023 Vs 2031 (%)

4. Global Thin-film Solar Panel Market Share by Region, 2023 Vs 2031 (%)

5. Global Other Technology Based Solar Panel Market Share by Region, 2023 Vs 2031 (%)

6. Global Solar Panel Market Share by End-User, 2023 Vs 2031 (%)

7. Global Solar Panel for Residential Market Share by Region, 2023 Vs 2031 (%)

8. Global Solar Panel for Commercial Market Share by Region, 2023 Vs 2031 (%)

9. Global Solar Panel for Industrial Market Share by Industry, 2023 Vs 2031 (%)

10. Global Solar Panel Market Share by Region, 2023 Vs 2031 (%)

11. US Solar Panel Market Size, 2023-2031 ($ Million)

12. Canada Solar Panel Market Size, 2023-2031 ($ Million)

13. UK Solar Panel Market Size, 2023-2031 ($ Million)

14. France Solar Panel Market Size, 2023-2031 ($ Million)

15. Germany Solar Panel Market Size, 2023-2031 ($ Million)

16. Italy Solar Panel Market Size, 2023-2031 ($ Million)

17. Spain Solar Panel Market Size, 2023-2031 ($ Million)

18. Rest of Europe Solar Panel Market Size, 2023-2031 ($ Million)

19. India Solar Panel Market Size, 2023-2031 ($ Million)

20. China Solar Panel Market Size, 2023-2031 ($ Million)

21. Japan Solar Panel Market Size, 2023-2031 ($ Million)

22. South Korea Solar Panel Market Size, 2023-2031 ($ Million)

23. Rest of Asia-Pacific Solar Panel Market Size, 2023-2031 ($ Million)

24. Latin America Solar Panel Market Size, 2023-2031 ($ Million)

25. Middle East And Africa Solar Panel Market Size, 2023-2031 ($ Million)