Solar Panel Recycling Market

Solar Panel Recycling Market Size, Share & Trends Analysis Report by Material (Glass, Plastic, Aluminum, Silicon, and Metals), by Product (Silicon Based PV and Thin Film PV), and by Process (Thermal, Mechanical, Chemical, Combination and Laser), Forecast Period (2024-2031)

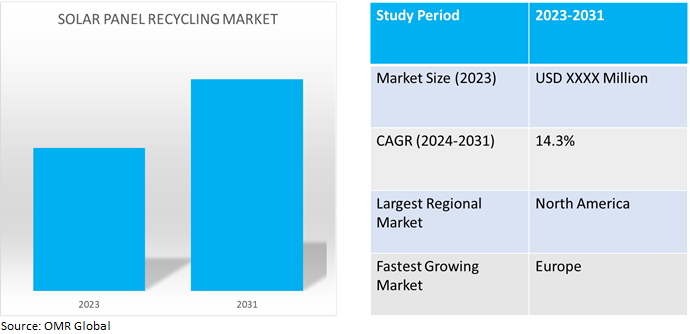

Solar panel recycling market is anticipated to grow at a significant CAGR of 14.3% during the forecast period (2024-2031). The market growth is attributed to the increasing adoption of silicon-based PV solar panels containing silicon solar cells resulting in increased demand for solar panel recyclings globally. According to the American Chemical Society, in May 2022, More than 90.0% of photovoltaic (PV) panels rely on crystalline silicon and have a life span of about 30 years. Forecasts suggest that 8.0 million metric tons of these panels will have reached the end of their working lives by 2030, a tally that is projected to reach 80.0 million tons by 2050.

Market Dynamics

Innovative Approaches to Solar PV Panel Recycling

Innovations in solar PV panel recycling are developing rapidly owing to the demand for sustainability and advances in technology. These inventive procedures, which make use of robotics and automation, make it possible to disassemble panels quickly and effectively, separating and recovering precious materials like silicon wafers, metals, and glass. This method is in line with the circular economy's tenets since it reduces waste and makes it easier to reuse and repurpose components. Moreover, chemical recycling solutions are growing more and more common as a viable method of disassembling solar PV panels into their parts. Valuable components like silicon and silver can be extracted by dissolving encapsulating materials using solvent-based methods and chemical baths.

Collaboration with Recycling Centers and Manufacturers

Collaboration between recycling facilities and manufacturers is essential for efficient recycling and sustainable product design. Partnerships make it easier to share expertise, dispose of waste properly, and create environmentally friendly products. Interacting with manufacturers also encourages creative recycling methods and extended producer responsibility. To create efficient recycling systems and promote eco-friendly designs, cooperation between installers, manufacturers, legislators, and recyclers is essential. Adopting these principles ensures the longevity and environmental integrity of solar energy solutions and helps create a more sustainable, greener planet.

Market Segmentation

Our in-depth analysis of the global solar panel recycling market includes the following segments material, product, and process.

- Based on the material, the market is sub-segmented into glass, plastic, aluminum, silicon, and metals.

- Based on the product, the market is sub-segmented into silicon-based PV and thin film PV.

- Based on the process, the market is sub-segmented into thermal, mechanical, chemical, combination, and laser.

Silicon Based PV is Projected to Hold as the Largest Segment

Based on the product, the global solar panel recycling market is sub-segmented into silicon-based PV and thin film PV. Among these silicon-based PV sub-segment is expected to hold the largest share of the market. The primary factors supporting the growth include increasing scrapped Si-based photovoltaic (PV) panels. The rapid development of the photovoltaic (PV) industry has led to increasing emissions of silicon-based solid (SIBS) waste. According to the Fraunhofer Institute for Solar Energy Systems ISE, in February 2022, around ten thousand tons of silicon in discarded photovoltaic modules end up on the recycling market annually in Germany. This figure rise to several hundred thousand tons per year by 2029. Researchers from the Fraunhofer Center for Silicon Photovoltaics CSP and the Fraunhofer Institute for Solar Energy Systems ISE together with the largest German recycling company for PV modules, Reiling GmbH & Co. KG, have developed a solution, in which the silicon in the discarded modules was recycled on an industrial scale and reused to produce new passivated emitter and rear contact (PERC) solar cells.

Glass Sub-segment to Hold a Considerable Market Share

Based on material, the global solar panel recycling market is sub-segmented into glass, plastic, aluminum, silicon, and metals. Among these, the glass sub-segment is expected to hold a considerable market share. The majority of a solar panel's weight is made up of glass, which accounts for 75.0% of the weight of solar panels and other solar power system components. The glass recycling industry is already well-established. Glass cullet is a raw material for processing, or synthetic silica sand in place of natural sand that is rounded at the corners. A standard panel is composed of several parts, the first of which is an aluminum alloy frame with a layer of tempered glass placed on top. Two sheets of ethylene vinyl acetate (EVA) with the semiconductor (Al) included make up the following layer. The bottom, or the standard white plastic back sheet of solar modules, comes last.

Regional Outlook

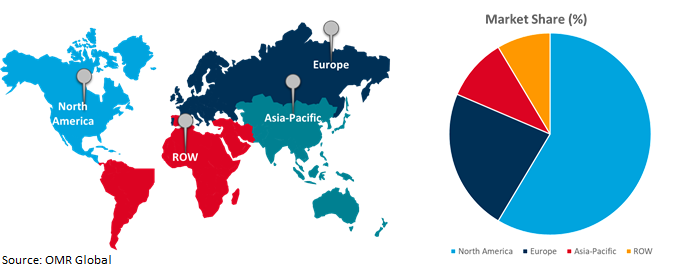

The global solar panel recycling market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Demand for Solar Panel Recyclings in Europe

- The regional growth is attributed to the growing adoption of solar panel recyclings with rising demand for environment-friendly and sustainable practices in the renewable energy sector. According to the European Environment Agency, in April 2024, the Waste Electrical and Electronic Equipment (WEEE) directive includes targets for the recovery and recycling/preparing for reuse of photovoltaic panels, the only green energy technology. Recovering 85.0% of the collected PV panel waste and reusing/recycling 80.0% of it from 2018 onwards. However, 6 of the 12 countries that reported this data met this target in 2021.

- According to the American Chemical Society, in May 2022, in the European Union (EU), legislation requires PV manufacturers to recycle waste panels and recover at least 80.0% of their mass, an effort largely organized through an industry consortium called PV Cycle.

Global Solar Panel Recycling Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent solar panel recycling companies such as Canadian Solar Inc., First Solar, Inc., We Recycle Solar, and solar panel recycling providers in the region. The growth is mainly attributed to the increasing adoption of crystalline-silicon solar technology for recycling solar panels with an aluminum frame, glass, copper wire, polymer layers, back sheet, silicon solar cells, and a plastic junction box. Many of these components can be recycled. Glass composes most of the weight of a solar panel and glass recycling is already a well-established industry. According to the US Environment Protection Agency (EPA), in June 2023, by 2030, the cumulative value of recoverable raw materials from end-of-life panels globally will be about $450.0 million, which is equivalent to the cost of raw materials currently needed to produce about 60.0 million new panels. Diverting solar panels from landfills to recycling saves space in landfills in addition to capturing the value of the raw materials.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global solar panel recycling market include Aurubis AG, Canadian Solar Inc., First Solar, Inc., Sharp Corp., and Veolia Environnement S.A. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in April 2024, Sol Systems and SOLARCYCLE collaborated to recycle solar panels, ensuring greener solar solutions. The collaboration has already successfully executed two work orders on distinct projects, demonstrating Sol Systems’ commitment to addressing the environmental impact of solar panel disposal.

Recent Development

- In February 2024, Collect and Recycle launched the solar panel recycling service. The new recycling service for businesses looking to dispose of solar panels. The team collects bulk quantities of solar panels nationwide, offering businesses an efficient and environmentally sound service to recycle their waste. The solar panel recycling service is designed to support businesses in responsibly managing their end-of-life solar panels in the UK.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global solar panel recycling market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Aurubis AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Canadian Solar Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. First Solar, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Sharp Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Veolia Environnement S.A

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Solar Panel Recycling Market by Material

4.1.1. Glass

4.1.2. Plastic

4.1.3. Aluminum

4.1.4. Silicon

4.1.5. Metals

4.2. Global Solar Panel Recycling Market by Product

4.2.1. Silicon Based PV

4.2.2. Thin Film PV

4.3. Global Solar Panel Recycling Market by Process

4.3.1. Thermal

4.3.2. Mechanical

4.3.3. Chemical

4.3.4. Combination

4.3.5. Laser

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Aerisoul Metal & Energy Corp.

6.2. Cleanlites Recycling

6.3. Creative Energies

6.4. Cyber Computer Recycling & Disposal PTY. LTD

6.5. Eiki Shoji Co., Ltd.

6.6. Elecsome

6.7. Envaris GmbH

6.8. GCL Technology

6.9. INTERCO TRADING, INC.

6.10. PV CYCLE

6.11. Recycle1234

6.12. Reiling GmbH & Co. KG

6.13. Rinovasol Global Services B.V.

6.14. SILCONTEL Ltd.

6.15. Silrec Corp.

6.16. Sinopower Holding (Hong Kong) Co. Ltd.

6.17. Sinovoltaics Group Ltd.

6.18. SOLARCYLE, Inc.

6.19. We Recycle Solar

1. GLOBAL SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

2. GLOBAL SOLAR PANEL GLASS RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SOLAR PANEL PLASTIC RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SOLAR PANEL ALUMINUM RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SOLAR PANEL SILICON RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL SOLAR PANEL METALS RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

8. GLOBAL SILICON BASED PV SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SILICON THIN-FILM PV PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

11. GLOBAL THERMAL SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL MECHANICAL SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CHEMICAL SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL COMBINATION SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL LASER SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

19. NORTH AMERICAN SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. NORTH AMERICAN SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

21. EUROPEAN SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

23. EUROPEAN SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

24. EUROPEAN SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

29. REST OF THE WORLD SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

31. REST OF THE WORLD SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

32. REST OF THE WORLD SOLAR PANEL RECYCLING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

1. GLOBAL SOLAR PANEL RECYCLING MARKET SHARE BY MATERIAL, 2023 VS 2031 (%)

2. GLOBAL SOLAR PANEL GLASS RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SOLAR PANEL PLASTIC RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SOLAR PANEL ALUMINUM RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL SOLAR PANEL SILICON RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL SOLAR PANEL METALS RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL SOLAR PANEL RECYCLING MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

8. GLOBAL SILICON BASED PV SOLAR PANEL RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL SOLID SOLAR PANEL RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL SOLAR PANEL RECYCLING MARKET SHARE BY PROCESS, 2023 VS 2031 (%)

11. GLOBAL THERMAL SOLAR PANEL RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL MECHANICAL SOLAR PANEL RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CHEMICAL SOLAR PANEL RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL COMBINATION SOLAR PANEL RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL LASER SOLAR PANEL RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL SOLAR PANEL RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. US SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

19. UK SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

31. MIDDLE EAST AND AFRICA SOLAR PANEL RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)