Solid Biomass Feedstock Market

Solid Biomass Feedstock Market Size, Share & Trends Analysis Report by Source (Agriculture Waste, Forest Waste, Animal Waste, and Municipal Waste), by Type (Chips, Pellets, and Briquettes). by Application (Electricity, Heat, Biofuels, and Biomethane), and by End-Users (Residential & Commercial, Industrial and Utilities), Forecast Period (2024-2031)

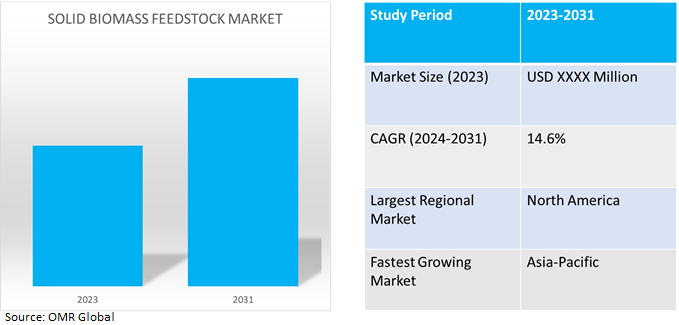

Solid biomass feedstock market is anticipated to grow at a significant CAGR of 14.6% during the forecast period (2024-2031). The growth of the solid biomass feedstock market is attributed to the increasing demand for electricity, heat, biofuels, and biomethane globally. According to the International Energy Agency (IEA), in February 2024, over the next five years biofuel demand is set to expand by 38 billion liters, a nearly 30.0% increase from the last five-year period. Total biofuel demand rises 23.0% to 200 billion liters by 2028.

Market Dynamics

Increasing Utilizing Of Organic Waste as Biomass Feedstock

The use of organic waste to make biomass energy is getting more popular as the demand for renewable energy rises. One form of sustainable energy is biomass energy, which is produced through burning organic materials like wood chips, plant matter, and agricultural waste. According to the National Center for Biotechnology Information, in February 2022, nearly 50.0% of the average composition of global waste, 3 million tons per day, is organic material. This accounts for the main source of greenhouse gases (GHG), and it includes household, food manufacturing, and pre-factory wastes, the rest being paper, plastic, glass, metal, and others. Although several facilities direct their waste toward land spreading, these facilities only represent between 26.0% and 46.0% of the organic waste and most of it is still disposed of in landfills.

Adoption of Advanced Conversion Technologies

Advanced conversion technology for converting biomass into energy, such as thermochemical, biological, physical, and biochemical processes, as well as hybrid and integrated systems technologies. Blends of several technologies, such as thermochemical and biochemical technologies, are also being researched for hybrid or combination systems. All biorefinery processes can produce a specific fuel, though, depending on the type and availability of the feedstock. Therefore, heterogeneous and multiple feedstocks might be treated to provide several supplies in the form of fuel, energy, heat, feedstock, and valuable chemicals if these techniques were combined under the concept of an integrated waste bio-refinery. Systems with hybrid configurations produce the least amount of harmful emissions and the highest possible electrical generation efficiency.

Market Segmentation

Our in-depth analysis of the global solid biomass feedstock market includes the following segments by source, type, application, and end-users.

- Based on source, the market is sub-segmented into agriculture waste, forest waste, animal waste, and municipal waste.

- Based on type, the market is sub-segmented into chips, pellets, and briquettes.

- Based on application, the market is sub-segmented into electricity, heat, biofuels, and biomethane.

- Based on end-users, the market is sub-segmented into residential & commercial, industrial, and utilities.

Agriculture Waste is Projected to Emerge as the Largest Segment

Based on the source, the global solid biomass feedstock market is sub-segmented into agriculture waste, forest waste, animal waste, and municipal waste. Among these agriculture waste sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include the growing demand for agricultural waste owing to its availability in abundance and cost-effectiveness. According to the National Center for Biotechnology Information, in October 2022, currently, bioethanol was produced from various agricultural wastes and crop residues such as sugarcane bagasse, sweet sorghum bagasse, rice straw, barley straw, wheat straw, sorghum straw, corn stover, cassava peels, sugar beet, wood, and other. These materials are nonedible, cost-effective, and readily available at a reasonably low cost. The share of bioethanol in biofuel production has reached about 65.0% owing to improved production methods, the use of locally and readily available feedstocks, and the continuous demand for bioethanol for various applications.

Biomethane Sub-segment to Hold a Considerable Market Share

Based on the application, the global solid biomass feedstock market is sub-segmented into electricity, heat, biofuels, and biomethane. Among these, the biomethane sub-segment is expected to hold a considerable share of the market. The technological advancements in the manufacturing of a portable fabricator for anaerobic digestion for biomethane production precisely depend on the type of feedstock and the production pathway. According to the European Biogas Association (EBA), in July 2022, Biomethane potentials – Anaerobic digestion in 2030 and 2050, a potential of 41.8 bcm is estimated for anaerobic digestion in 2030, of which 38.1 bcm relates to the EU-27. The potential increases to 98 bcm in 2050, an increase of 56 bcm. The top 5 countries in both 2030 and 2050 consistently include France, Germany, Italy, Spain and Poland. Key feedstocks in 2030 are animal manure (32.0%), agricultural residues (24.0%), and sequential cropping (21.0%). This contrasts with 2050 in which sequential cropping dominates (47.0%), with again a significant contribution from manure (19.0%), and agricultural residues (17.0%). Industrial wastewater contributes over 10.0% of the potential in both 2030 and 2050.

Regional Outlook

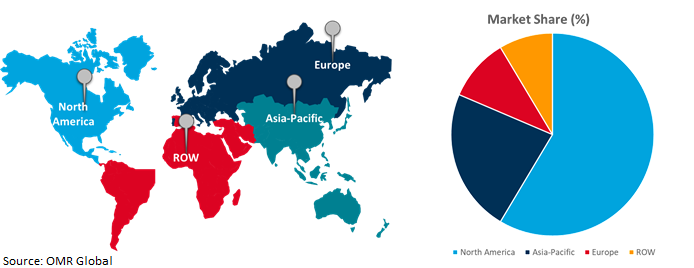

The global solid biomass feedstock market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Solid Biomass Feedstock Adoption in Asia-Pacific

- The regional growth is attributed to the increasing demand for electricity, heat, biofuels, and biomethane in emerging countries like India, China, and Japan driving the growth of the solid biomass feedstock market.

- According to the International Energy Agency (IEA), in February 2024, the government of India has already established a 5.0% biodiesel target by 2030, which would require almost 4.5 billion liters of biodiesel per year. To diversify feedstocks beyond sugar cane, India provides separate pricing for maize-based ethanol and includes ethanol produced from agricultural residues such as cotton stalks, wheat straw, rice straw, bagasse, and bamboo.

Global Solid Biomass Feedstock Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and solid biomass feedstock providers. The growth is attributed to the increasing demand for biofuels across various countries are few of the factors accelerating the growth of solid biomass feedstock in in the region. According to the US Energy Information Administration, in 2022, biomass accounted for 5.0% of US energy consumption, or about 4,930 trillion British thermal units (TBtu) in 2022. The types, amounts, and percentage shares of total biomass energy consumption in 2022 were biofuels-2,419 TBtu-49.0%, Wood and wood waste-1,984 TBtu-43.0%, municipal solid waste, animal manure, and sewage-411 TBtu-8.0%. The industrial sector is the largest consumer of biomass for energy in the US. The amounts-in TBtu and percentage shares of total US biomass energy use by the consuming sector in 2022 were industrial-2,266 TBtu-46.0%, transportation-1,565 TBtu-32.0%, residential-539 TBtu-11.0%, electric power-413 TBtu-8.0% and commercial-147 TBtu-3.0%

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global solid biomass feedstock market include Chevron Corp., Drax Group plc, Enviva Inc., RWE AG, and Siemens AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2023, Nippon Paper Industries Co., Ltd., Sumitomo Corp., and Green Earth Institute Co., Ltd. collaborated to begin trilateral consideration of the first commercial production of cellulosic bioethanol from woody biomass in Japan and its development into bio-chemical products.

Recent Development

- In September 2021, SCA and St1 entered a joint venture to produce and develop liquid biofuels. SCA will supply tall oil to the joint venture and invest approximately SEK 60.0 million ($6.9 million) in the company. The new biorefinery is under construction on the St1 refinery site in Gothenburg and will have a total capacity of 200,000 tons of liquid biofuels. It is designed to optimize the production of renewable HVO diesel and bio-jet fuel and to use tall oil-based feedstock. The biorefinery will also be capable of using a wide range of other feedstocks.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global solid biomass feedstock market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Chevron Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Siemens AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. RWE AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Solid Biomass Feedstock Market by Source

4.1.1. Agriculture Waste

4.1.2. Forest Waste

4.1.3. Animal Waste

4.1.4. Municipal Waste

4.2. Global Solid Biomass Feedstock Market by Type

4.2.1. Chips

4.2.2. Pellets

4.2.3. Briquettes

4.3. Global Solid Biomass Feedstock Market by Application

4.3.1. Electricity

4.3.2. Heat

4.3.3. Biofuels

4.3.4. Biomethane

4.4. Global Solid Biomass Feedstock Market by End-Users

4.4.1. Residential & Commercial

4.4.2. Industrial

4.4.3. Utilities

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Arbaflame AS

6.2. Bioenergy International

6.3. Biomass Secure Power Inc.

6.4. Drax Group plc

6.5. Ecostrat Inc.

6.6. Enerkem Inc.

6.7. Enviva Inc.

6.8. Fram Renewable Fuels, LLC

6.9. Fulcrum BioEnergy

6.10. Georgia Biomass, LLC

6.11. German Pellets GmbH

6.12. Göteborg Energi

6.13. Green Circle Inc.

6.14. Hawkins Wright Ltd.

6.15. Rentech, Inc.

6.16. Stora Enso Oyj

6.17. Targray Technology International Inc.

6.18. Viridis Energy Inc.

1. GLOBAL SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

2. GLOBAL SOLID AGRICULTURE WASTE BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SOLID FOREST WASTE BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SOLID ANIMAL WASTE BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SOLID MUNICIPAL WASTE BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

7. GLOBAL SOLID CHIPS BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL SOLID PELLETS BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SOLID BRIQUETTES BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

11. GLOBAL SOLID BIOMASS FEEDSTOCK FOR ELECTRICITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SOLID BIOMASS FEEDSTOCK FOR HEAT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SOLID BIOMASS FEEDSTOCK FOR BIOFUELS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL SOLID BIOMASS FEEDSTOCK FOR BIOMETHANE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

16. GLOBAL SOLID BIOMASS FEEDSTOCK FOR RESIDENTIAL & COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL SOLID BIOMASS FEEDSTOCK FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL SOLID BIOMASS FEEDSTOCK FOR UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

22. NORTH AMERICAN SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. NORTH AMERICAN SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY Application, 2023-2031 ($ MILLION)

24. NORTH AMERICAN SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

25. EUROPEAN SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. EUROPEAN SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

27. EUROPEAN SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

28. EUROPEAN SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. EUROPEAN SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

35. REST OF THE WORLD SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

36. REST OF THE WORLD SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

37. REST OF THE WORLD SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

38. REST OF THE WORLD SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

39. REST OF THE WORLD SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

40. REST OF THE WORLD SOLID BIOMASS FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL SOLID BIOMASS FEEDSTOCK MARKET SHARE BY SOURCE, 2023 VS 2031 (%)

2. GLOBAL SOLID AGRICULTURE WASTE BIOMASS FEEDSTOCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SOLID FOREST WASTE BIOMASS FEEDSTOCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SOLID ANIMAL WASTE BIOMASS FEEDSTOCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL SOLID MUNICIPAL WASTE BIOMASS FEEDSTOCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL SOLID BIOMASS FEEDSTOCK MARKET SHARE BY TYPE, 2023 VS 2031 (%)

7. GLOBAL SOLID CHIPS BIOMASS FEEDSTOCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL SOLID PELLETS BIOMASS FEEDSTOCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL SOLID BRIQUETTES BIOMASS FEEDSTOCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL SOLID BIOMASS FEEDSTOCK MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

11. GLOBAL SOLID BIOMASS FEEDSTOCK FOR ELECTRICITY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL SOLID BIOMASS FEEDSTOCK FOR HEAT MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL SOLID BIOMASS FEEDSTOCK FOR BIOFUELS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL SOLID BIOMASS FEEDSTOCK FOR BIOMETHANE MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL SOLID BIOMASS FEEDSTOCK MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

16. GLOBAL SOLID BIOMASS FEEDSTOCK FOR RESIDENTIAL & COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL SOLID BIOMASS FEEDSTOCK FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL SOLID BIOMASS FEEDSTOCK FOR UTILITIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. US SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

21. UK SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

22. FRANCE SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

23. GERMANY SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

24. ITALY SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

25. SPAIN SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

27. INDIA SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

28. CHINA SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

29. JAPAN SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)

33. MIDDLE EAST AND AFRICA SOLID BIOMASS FEEDSTOCK MARKET SIZE, 2023-2031 ($ MILLION)