Sourcing Software Market

Sourcing Software Market Size, Share & Trends Analysis Report by Type (On-premise and Cloud), by Enterprise Size (Large Enterprises and Small & Medium Enterprises), and by End-User (BFSI, IT and Telecom, Media and Entertainment, Retail and E-Commerce, Healthcare, Government, Education, Travel and Transport) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Sourcing software market is anticipated to grow at a CAGR of 8.2% during the forecast period. Organizations benefit from sourcing software, as it is capable of engaging suppliers in competitive bidding events easily while reducing sourcing expenses and diversifying their supply chains. It also shortens the time it takes to complete the purchase of products and services by several weeks. The sourcing software simplifies the sourcing procedures by strategically acquiring goods and services and leveraging faster online bidding with their chosen suppliers. Automation allows sourcing firms to eliminate manual tasks and, as a result, save money.

The primary factors attributed to the market growth include cloud migration and opting for cloud services, fueled by a rapid shift to remote work, which led organizations to adjust their infrastructure and software to connect workers. Organizations look to scale up resources and include developers with unique skills that resort to software sourcing. For instance, in April 2021, with the launch of its platform-driven e -sourcing solution, cloud-based software company Eka plans to alter legacy-based supply chain operations across a wide range of business activities and industries. Managing supplier operations with outdated systems sometimes necessitates teams spending hours exchanging emails or phone conversations and updating data using spreadsheets, resulting in restricted visibility along with mistakes that pose an additional risk. Eka's E -Sourcing solution is a platform-driven cloud solution that identifies and tackles critical sources of weakness in sourcing operations while improving supply chain robustness.

However, managing hundreds of different categories and lines can be challenging to achieve best value sourcing. Sourcing software makes it easy to find suitable suppliers for business through efficient, easy-to-use, and intuitive sourcing tools. It enables coworkers to collaborate across offices and geographies to evaluate suppliers and award contracts. It increases the potential of supply markets to maximize the value of the user's spending.

Segmental Outlook

The global sourcing software market is segmented based on type, enterprise size, and by end-user. Based on type, the market is bifurcated into on-premises and cloud. By enterprise size, the market is bifurcated into large enterprises and small and medium enterprises. Further, by end-user, the market is sub-segmented into BFSI, IT and Telecom, media and entertainment, retail, healthcare, government, education, travel, and transport. Among enterprise size, the large enterprises sub-segment is expected to account for the dominant share of the market during the forecast period. This can be attributed to increased efficiency and cost savings, enhanced supplier management, and streamlined global sourcing.

Retail Sub-Segment is Anticipated to Hold a Prominent Share of the Global Sourcing Software Market

Sourcing software solutions enable retail businesses to streamline procurement processes, manage supplier relationships, optimize costs, and mitigate risks. As retailers strive to navigate the complexities of global sourcing and supply chain management, sourcing software has become an invaluable tool for driving operational efficiency, ensuring compliance, and maintaining a competitive advantage in an increasingly dynamic retail industry. The digital transformation and increasing online buying in the retail industry supply chain are anticipated to drive the retail sourcing and procurement market. For instance, according to India Brand Equity Foundation, online retail penetration is expected to reach 10.7% by 2024, compared with 4.7% in 2019. Additionally, online shoppers in India are expected to reach 220.0 million by 2025. Further, according to Oberlo, in 2021, the number of digital buyers will be 2.14 billion, making 27.6% of the 7.74 billion people in the world. In other words, more than one out of every four people is an online shopper.

With the rise of internet shopping and significant shifts in consumer buying patterns, different trends are shaping the retail industry. According to Tidio, there are 9.1 million online retailers in the world. With the advent of digital technologies such as artificial intelligence (AI), blockchain, and robotics, there will be increased stock visibility for both vendors and retailers. Blockchain enables retailers to gain customer trust by maintaining sourcing data, and chain-of-custody information, and supporting autonomous transactions.

Regional Outlook

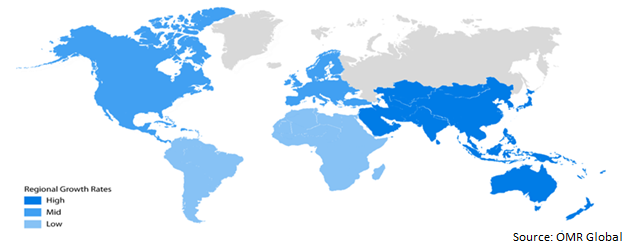

The global sourcing software market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East and Africa, and Latin America). Among these, the North American region is projected to expand at a significant CAGR during the forecast period, due to various factors including cost reduction objectives, complex global supply chains, regulatory compliance needs, technological advancements, and the demand for supplier collaboration and innovation.

Global Sourcing Software Market Growth, by Region 2023-2030

The Asia-Pacific Region is Anticipated to Hold a Significant Share of the Global Sourcing Software Market

The primary factor driving the growth of the sourcing software market in the Asia-Pacific region is the region's strong manufacturing and outsourcing capabilities. For example, China has established itself as the world's manufacturing hub, attracting businesses seeking cost-effective production solutions. As companies increasingly rely on sourcing software to manage complex supply chains, the demand for advanced solutions in the Asia-Pacific region surges. With its extensive manufacturing base, the region offers a large customer pool for sourcing software providers, stimulating market growth. Additionally, with the increase in demand for sourcing software, the market is witnessing several investments in advanced technologies and expansions by prominent industry players. For instance, in September 2022, Procurement management software Procol announced that it had raised $627.0 million in funding. The capital raised will build and enhance solutions for India’s procurement problems through Procol’s procurement software and B2B marketplace.

Market Players Outlook

The major companies serving the global sourcing software market include Aavenir, IBM Corp., Microsoft Corp., and Oracle Corp. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, funding, collaborations, and new product launches to stay competitive in the market. For instance, in January 2022, Absolut chose GEP Software to transform its European source-to-contract process. Absolut, situated in Stockholm, will use GEP Software to enhance its sourcing, contract management, and supplier management across Europe. The firm also announced client projects with grocer Tesco and machinery manufacturer Netzsch. Tesco will utilize GEP Smart to handle its purchase-to-pay (PTP) process in the UK and Ireland, including requisitioning, ordering, supplier ASN, and invoice activities for non-resale products and services.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global sourcing software market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Aavenir (ServiceNow)

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. IBM Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Microsoft Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Oracle Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Sourcing Software Market by Deployment

4.1.1. On-Premises

4.1.2. Cloud

4.2. Global Sourcing Software Market by Enterprise Size

4.2.1. Large Enterprises

4.2.2. Small and Medium Enterprises

4.3. Global Sourcing Software Market by End-User

4.3.1. BFSI

4.3.2. IT and Telecom

4.3.3. Media and Entertainment

4.3.4. Retail

4.3.5. Healthcare

4.3.6. Government

4.3.7. Education

4.3.8. Travel and Transport

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ariba Inc.

6.2. Basware

6.3. Capgemini SE

6.4. Coupa Software Inc.

6.5. GEP

6.6. Ivalua Inc.

6.7. Infor Inc.

6.8. Integration Appliance, Inc.

6.9. JAGGAER, Inc.

6.10. Market Dojo

6.11. WINDDLE

6.12. Workday, Inc.

6.13. Workday, Inc.

6.14. SAP SE

6.15. Zycus Inc.

1. GLOBAL SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2022-2030 ($ MILLION)

2. GLOBAL ON-PREMISE SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL CLOUD-BASED SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2022-2030 ($ MILLION)

5. GLOBAL SOURCING SOFTWARE FOR LARGE ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL SOURCING SOFTWARE FOR SMALL AND MEDIUM ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

8. GLOBAL SOURCING SOFTWARE FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL SOURCING SOFTWARE FOR IT AND TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL SOURCING SOFTWARE FOR MEDIA AND ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL SOURCING SOFTWARE FOR RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL SOURCING SOFTWARE FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL SOURCING SOFTWARE FOR GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL SOURCING SOFTWARE FOR EDUCATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL SOURCING SOFTWARE FOR TRAVEL AND TRANSPORT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. NORTH AMERICAN SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. NORTH AMERICAN SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2022-2030 ($ MILLION)

19. NORTH AMERICAN SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2022-2030 ($ MILLION)

20. NORTH AMERICAN SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

21. EUROPEAN SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. EUROPEAN SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2022-2030 ($ MILLION)

23. EUROPEAN SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2022-2030 ($ MILLION)

24. EUROPEAN SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

26. ASIA-PACIFIC SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2022-2030 ($ MILLION)

28. ASIA-PACIFIC SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

29. REST OF THE WORLD SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

30. REST OF THE WORLD SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2022-2030 ($ MILLION)

31. REST OF THE WORLD SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2022-2030 ($ MILLION)

32. REST OF THE WORLD SOURCING SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL SOURCING SOFTWARE MARKET SHARE BY DEPLOYMENT, 2022 VS 2030 (%)

2. GLOBAL ON-PREMISE SOURCING SOFTWARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL CLOUD-BASED SOURCING SOFTWARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL SOURCING SOFTWARE MARKET SHARE BY ENTERPRISE SIZE, 2022 VS 2030 (%)

5. GLOBAL SOURCING SOFTWARE FOR LARGE ENTERPRISES MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL SOURCING SOFTWARE FOR SMALL AND MEDIUM ENTERPRISES MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL SOURCING SOFTWARE MARKET SHARE BY END-USER, 2022 VS 2030 (%)

8. GLOBAL SOFTWARE FOR BFSI MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL SOURCING SOFTWARE MARKET FOR IT AND TELECOM MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL SOURCING SOFTWARE FOR MEDIA AND ENTERTAINMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL SOURCING SOFTWARE FOR RETAIL MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL SOURCING SOFTWARE FOR HEALTHCARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL SOURCING SOFTWARE FOR GOVERNMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL SOURCING SOFTWARE FOR EDUCATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL SOURCING SOFTWARE FOR TRAVEL AND TRANSPORT MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL SOURCING SOFTWARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. US SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

18. CANADA SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

19. UK SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

20. FRANCE SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

21. GERMANY SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

22. ITALY SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

23. SPAIN SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF EUROPE SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

25. INDIA SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

26. CHINA SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

27. JAPAN SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

28. SOUTH KOREA SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF ASIA-PACIFIC SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)

30. REST OF THE WORLD SOURCING SOFTWARE MARKET SIZE, 2022-2030 ($ MILLION)