Soy Protein for Animal Feed Market

Soy Protein for Animal Feed Market Size, Share & Trends Analysis Report Market by Protein Type (Concentrated Soy Protein, Isolated Soy Protein, and Others), and by Application (Aqua Feed, Poultry Feed, Pig Feed, and Others) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Soy protein for animal feed market is anticipated to grow at a considerable CAGR of 4.3% during the forecast period. Soy protein is a renowned ingredient in animal feed, as it is a high-quality source of protein that can improve the growth and development of livestock. The use of soy protein in animal feed is used to increase the overall protein content of the feed, which can lead to improved weight gain, feed efficiency, and overall animal health. The major factors contributing to the growth of the soy protein for animal feed market include the increasing livestock population and rising demand for meat and dairy products.

A significant rise in livestock population has been reported across emerging countries. For instance, as per the National Dairy Development Board, in India, the total livestock population increased from 512.1 million in 2012 to 535.8 million in 2019. Increasing dairy farming is the major factor in the increasing focus on livestock farming in the country. This leads to the increasing demand for soy protein for animal feed which is which is highly nutritious for different livestock.

In April 2023, China's agriculture ministry issued a three-year action plan to reduce soymeal use in animal feed as it tries to reduce its heavy reliance on soybean imports. The new plan proposes soymeal ratios in animal feed should be reduced to less than 13.0% by 2025, from 14.5% in 2022. Such restrictions in major economies such as China may hamper the growth of the global soy protein for animal feed market.

Segmental Outlook

The global soy protein for animal feed market is segmented based on protein type and application. Based on protein type, the market is segmented into concentrated soy protein, isolated soy protein, other products. Based on application, the market is segmented into aqua feed, poultry feed, pig feed, and other application.

Poultry to Exhibit Considerable Growth Based on Application

The poultry segment is expected to be the fastest growing segment during the forecast period. The continuously rising demand for poultry meat and eggs has driven the demand for more poultry farms. The soy protein feed increases the nutritional value of the feed given to the poultry. Therefore, the growing poultry demand is making significant impact on the growth of this market segment. Poultry-based products are used for animal nutrition to improve the quality of feed and the quality of food along with improving the animals' performance and health. Further, poultry animals are usually bred in captivity and are likely to develop deficiencies. These poultry-based products ensure that the livestock doesn't develop any deficiencies and grow to their maximum potential.

Regional outlook

The global soy protein for animal feed market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). North America held considerable share in the global soy protein for animal feed market.

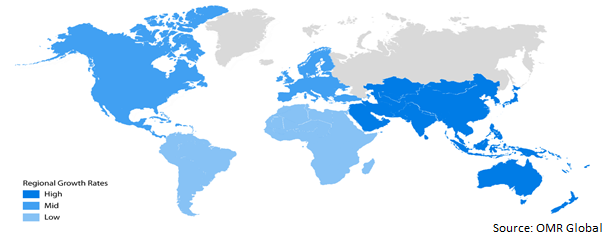

Global Soy Protein for Animal Feed Market Growth, by Region 2023-2030

Asia-Pacific Held Considerable Share in the Global Soy Protein for Animal Feed Market

The Asia-Pacific held considerable share in the global market. The presence of a large livestock population and their growth rate in the region is propelling the growth of the market. For instance, according to the National Dairy Development Board, the number of livestock in India has increased to 535.8 million in 2021 from 485 million in 2003. Moreover, according to the Department of Animal Husbandry & Dairying, the total Commercial Poultry in the country is 534.74 million in 2019, an increase of 4.5%. However, the shortage of feed and fodder, loss of traditional cattle breeds, inadequate infrastructure, and contribution to global warming are some of the concerns facing the livestock sector.

Market Players Outlook

The major companies serving the global soy protein for animal feed market include Archer Daniels Midland Co., Cargill Inc., Wilmar International Ltd., Kerry Global, and DHN International among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, and new product launches, to stay competitive in the market. For instance, in March 2023, Unibio International PLC has signed an agreement with the Saudi Industrial Investment Group (“SIIG”) to invest approximately $70 million (GBP 59 million) in Unibio. The proceeds will be deployed to enable Unibio’s vision of feeding the world’s growing population in a sustainable way. Unibio will use the funds to roll-out new global production capacity, grow operating capabilities, and accelerate innovation and commercialization.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global soy protein for animal feed market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Afton Chemical Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Innospec Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. The Lubrizol Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Soy Protein for Animal Feed Market by Protein Type

4.1.1. Concentrated Soy Protein

4.1.2. Isolated Soy Protein

4.1.3. Other Products

4.2. Global Soy Protein for Animal Feed Market by Application

4.2.1. Aqua Feed

4.2.2. Poultry Feed

4.2.3. Pig Feed

4.2.4. Other Application

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Archer-Daniels-Midland Co.

6.2. Burcon NutraScience Corp.

6.3. Caramuru Alimentos

6.4. Cargill Inc.

6.5. CJ Selecta

6.6. DHN International

6.7. Fujian Changde Protein Science and Technology

6.8. Hamlet Protein

6.9. Kerry group

6.10. Meca Group

6.11. Nordic Soya

6.12. Now Foods

6.13. Nutraferma

6.14. Shandong Zhongyang BiotechnologyA

6.15. Sonic Biochem Extraction Pvt. Ltd.

6.16. Wilmar International Ltd.

1. GLOBAL SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY PROTEIN TYPE, 2022-2030 ($ MILLION)

2. GLOBAL CONCENTRATED SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL ISOLATED SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL OTHER TYPE SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

6. GLOBAL SOY PROTEIN FOR AQUA FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL SOY PROTEIN FOR POULTRY FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL SOY PROTEIN FOR PIG FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL SOY PROTEIN FOR OTHER ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. NORTH AMERICAN SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. NORTH AMERICAN SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY PROTEIN TYPE, 2022-2030 ($ MILLION)

13. NORTH AMERICAN SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

14. EUROPEAN SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. EUROPEAN SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY PROTEIN TYPE, 2022-2030 ($ MILLION)

16. EUROPEAN SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY PROTEIN TYPE, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

20. REST OF THE WORLD SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. REST OF THE WORLD SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY PROTEIN TYPE, 2022-2030 ($ MILLION)

22. REST OF THE WORLD SOY PROTEIN FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL SOY PROTEIN FOR ANIMAL FEED MARKET SHARE BY PROTEIN TYPE, 2022 VS 2030 (%)

2. GLOBAL CONCENTRATED SOY PROTEIN FOR ANIMAL FEED MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL ISOLATED SOY PROTEIN FOR ANIMAL FEED MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL OTHER TYPE SOY PROTEIN FOR ANIMAL FEED MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL SOY PROTEIN FOR ANIMAL FEED MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

6. GLOBAL SOY PROTEIN FOR AQUA FEED MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL SOY PROTEIN FOR POULTRY FEED MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL SOY PROTEIN FOR PIG FEED MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL SOY PROTEIN FOR ANIMAL FEED FOR OTHER ANIMAL FEED MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL SOY PROTEIN FOR ANIMAL FEED MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. US SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

12. CANADA SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

13. UK SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

14. FRANCE SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

15. GERMANY SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

16. ITALY SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

17. SPAIN SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

18. REST OF EUROPE SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

19. INDIA SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

20. CHINA SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

21. JAPAN SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

22. SOUTH KOREA SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF ASIA-PACIFIC SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF THE WORLD SOY PROTEIN FOR ANIMAL FEED MARKET SIZE, 2022-2030 ($ MILLION)