Soybean Derivatives Market

Global Soybean Derivatives Market Size, Share & Trends Analysis Report by Type (Soy Oil, Soybean, Soy Meal, and Others), and by Application (Feed & Food Industry, BioComposites, Biodiesel, Insulation, and Others) Forecast Period (2022-2028)

The global soybean derivatives market is anticipated to grow at a significant CAGR of 4.9% during the forecast period. The rising demand among people for high protein food is driving the soybean derivatives market. People prefer to include high protein food such as soy milk, soy chunks, soy nuts, and many more in their daily diet owing to its benefits, this is motivating manufacturers to come up with new products made up of soybean derivatives. For instance, in February 2022, Benson Hill, Inc. launched TruVail, a new line of non-GMO plant-based protein ingredients. The TruVail offers high protein soy flour, a less processed equivalent to soy protein concentrate (SPC), and texturized proteins for application in traditional soy protein. In addition, the use of soybean products in animal feeding as it contains a high concentration of essential amino acids is the another prominent factor accelerating the market growth.

Impact of COVID-19 Pandemic on Global Soybean Derivatives Market

During COVID-19 people were shifting toward a healthy lifestyle and to boost immunity due to which the demand for healthy protein items has been increased. This shift towards the healthy diet leads to increase the soybean derivatives market but during COVID-19 all the offline distribution channels were closed and only limited online delivery were in action due to which the product availability was less.

Segmental Outlook

The global soybean derivatives market is segmented based on the type and application. Based on the type, the market is segmented into soy oil, soybean, soy meal, and others. Based on the application, the market is sub-segmented into the feed & food industry, biocomposites, biodiesel, insulation, and others. Among these, the food & feed industry segment is projected to hold a significant share in the market during the forecast period. Increasing awareness and benefits associated with soybean has increased its use in food and feed products manufacturing by the food & feed industry.

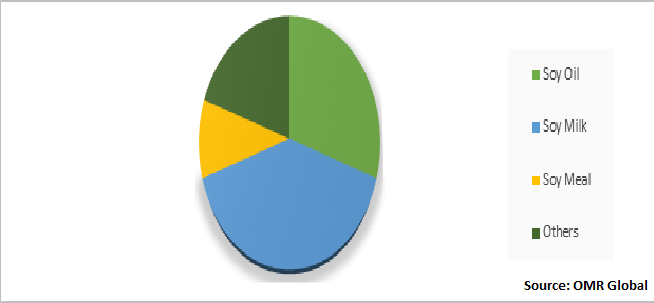

Global Soybean Derivatives Market Share by Type, 2021 (%)

The Soy Oil Segment is Expected to Hold the Major Share in the Global Soybean Derivatives Market

The increasing consumer preference towards processed food and rising health awareness are the two major factor that has increased the demand for soy oils. a. Consumers are switching towards the healthier alternative in food oil which results in increasing the demand of soy oil. The soy oil is beneficial for heart patients as its consists of polyunsaturated fatty acids and Omega-3 fatty acids, which are a heart-healthy type of fat, helps in reducing inflammation, and provides other health benefits such as fetal development, brain function, and boosts immunity. This is expected to drive the segment growth during forecast period.

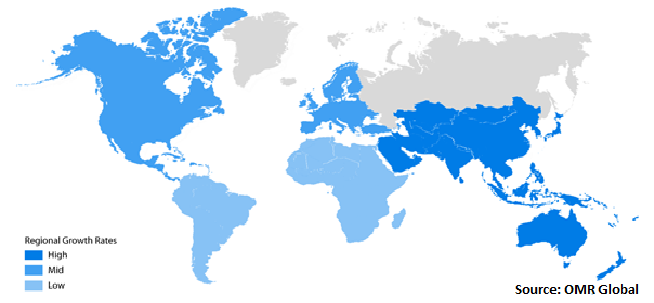

Regional Outlooks

The global soybean derivatives market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). North America showed notable growth in the market in 2021 by accounting largest share. The region is further likely to hold a prominent share during the forecast period. The increasing prevalence of cardiovascular diseases and high cholesterol level due to fast food consumption making consumers to opt for healthy products such as soy products.

Global Soybean Derivatives Market Growth, by Region 2022-2028

The Asia-Pacific Region Emerge as Fastest Growing Region in the Global Soybean Derivatives Market

The Asia-Pacific region is expected to be the fastest-growing in the soybean derivatives market. The increase in domestic consumption of soy food items promotes the growth of the soybean derivates market in the Asia-Pacific region. India and China are the major consumers of soy products. The major players operating in the region’s soybean derivatives market are focusing on new product launches to fulfill the growing market demands. For instance, Asahi launched a plant-based cultured milk drink Calpis, using soy milk instead of regular milk. Additionally, in February 2021, National Commodity & Derivatives Exchange Ltd. (NCDEX) launched the hi-pro soybean meal futures contract. The basis center and additional delivery center for the contract would be Indore and Latur.

Market Players Outlook

The major companies serving the global soybean derivatives market include Ag Processing Inc a cooperative, Archer Daniels Midland Company, International Flavors & Fragrances Inc., Louis Dreyfus Company, Ruchi Soya Industries Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in August 2021, Corteva, Inc. launched of Conkesta E3 soybeans to the Brazilian market. Conkesta E3 soybeans are available to Brazilian farmers.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global soybean derivatives market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global SOYBEAN DERIVATIVES Market

- Recovery Scenario of Global SOYBEAN DERIVATIVES Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Soybean Derivatives Market by Type

4.1.1. Soy Oil

4.1.2. Soybean

4.1.3. Soy Meal

4.1.4. Others

4.2. Global Soybean Derivatives Market by Application

4.2.1. Feed & Food Industry

4.2.2. Bio Composites

4.2.3. Biodiesel

4.2.4. Insulation

4.2.5. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ag Processing Inc a cooperative

6.2. Archer Daniels Midland Company

6.3. Bunge LTD.

6.4. Cargill, Inc.

6.5. CHS Inc.

6.6. Hershey India Pvt. Ltd.

6.7. International Flavors & Fragrances Inc.

6.8. Louis Dreyfus Company

6.9. Noble Group Holdings Ltd.

6.10. Prakash Foods and Feed Mills (P) Ltd.,

6.11. Rollins International Pvt. Ltd. (Purefoods)

6.12. Ruchi Soya Industries Ltd.

6.13. Sanitarium Healthfood Company

6.14. TBOF Foods Pvt. Ltd.

6.15. Istore Direct Trading Pvt. Ltd. (Urban Platter)

6.16. Wilmar International Ltd

1. GLOBAL SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL SOY OIL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL SOYBEAN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL SOY MEAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL OTHERS SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

7. GLOBAL SOYBEAN DERIVATIVES IN FEED & FOOD INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL SOYBEAN DERIVATIVES IN BIO COMPOSITES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL SOYBEAN DERIVATIVES IN BIODIESEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL SOYBEAN DERIVATIVES IN INSULATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL SOYBEAN DERIVATIVES IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

15. NORTH AMERICAN SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. EUROPEAN SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. EUROPEAN SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

18. EUROPEAN SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. REST OF THE WORLD SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. REST OF THE WORLD SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD SOYBEAN DERIVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL SOYBEAN DERIVATIVES MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL SOYBEAN DERIVATIVES MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL SOYBEAN DERIVATIVES MARKET, 2022-2028 (%)

4. GLOBAL SOYBEAN DERIVATIVES MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL SOY OIL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL SOY BEAN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL SOY MEAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL OTHERS SOYBEAN DERIVATIVES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL SOYBEAN DERIVATIVES MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

10. GLOBAL SOYBEAN DERIVATIVES IN FEED & FOOD INDUSTRY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL SOYBEAN DERIVATIVES IN BIO COMPOSITES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL SOYBEAN DERIVATIVES IN BIODIESEL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL SOYBEAN DERIVATIVES IN INSULATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL SOYBEAN DERIVATIVES IN OTHERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL SOYBEAN DERIVATIVES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. US SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

18. UK SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD SOYBEAN DERIVATIVES MARKET SIZE, 2021-2028 ($ MILLION)