Space Power Electronics Market

Space Power Electronics Market Size, Share & Trends Analysis Report by Device Type (Video Wall, and Standalone), by Application (Satellite, Spacecraft & Launch Vehicle, Rovers, and Space Stations), and by Voltage (Low Voltage, Medium Voltage, and High Voltage). Forecast Period (2024-2031)

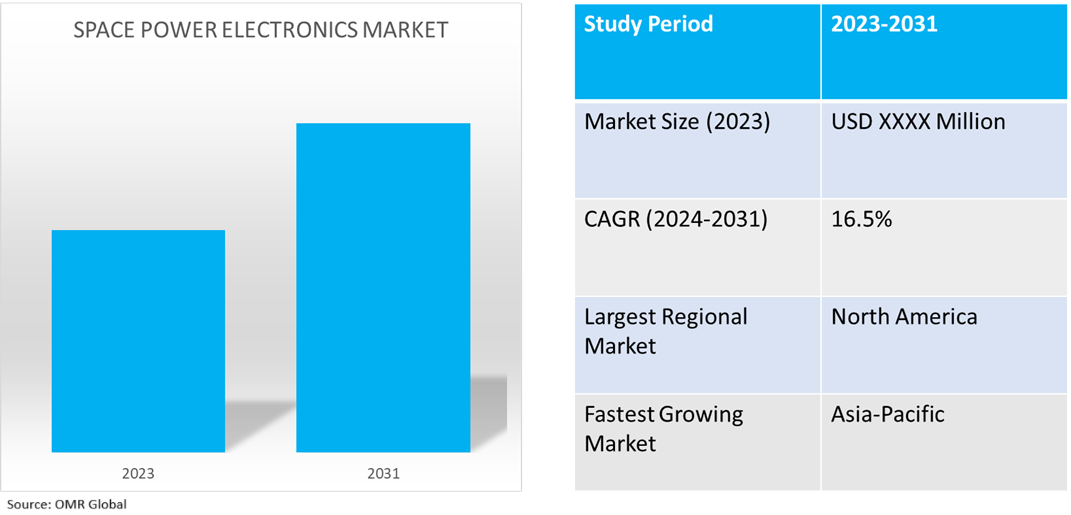

Space power electronics market is projected to grow at a significant CAGR of 16.5% during the forecast period (2024-2031). The expansion of the space power electronics market is supported by pivotal factors such as the rapid growth of the commercial space industry, extension in space exploration initiatives, increasing number of efforts by smaller nations in developing space capabilities, and development of space electronic components supporting future space endeavors. Further, the growing innovations in electronic components through miniaturization & material developments and the shift towards more reliable & advanced systems, such as autonomous power management & energy harvesting systems, are also contributing to the growth of the market.

Market Dynamics

Expansion of the Space Exploration Industry

The expansion of the space exploration industry is constantly adding to the growth of the space power electronics market. This extension is supported by the growth of the commercial space industry, the increasing number of space missions by state-owned organizations for developing reliable space capabilities, and the rising emphasis on deploying more advanced space missions such as deep space missions and human-involved missions, among others. These evolving requirements of the space exploration industry have contributed to the growth & innovation of the space power electronics market, as the missions of this build include advanced electronic solutions such as radiation-hardened power electronics for more reliable & efficient performance and aim to incorporate advanced technological capabilities such as autonomous power management tools & storage systems that utilize compact electrical components, which are collectively projected to strengthen demand & investments in the space power electronics market. For example, The Space Foundation's report for the first quarter of 2024 shows that the global space industry continued to advance in launch and payload activities, despite challenges like U.S. budget constraints and increasing international tensions. The year kicked off strongly, with 41 launches, which included the inaugural flights of new launch vehicles from China, Japan, and the US.

Development of Space-Based Infrastructure

The development of permanent space infrastructure across space involving the establishment of novel space stations, commercial space platforms, & bases on other planets presents an opportunity for space-power electronic manufacturing companies to expand. As the industry for space exploration matures, the next milestone for space agencies is aimed towards the development of space habitats, which is supported by factors such as extension in human colonization, growth of space tourism activities, and In-Situ Resource Utilization (ISRU) in space missions. Further, infrastructural progress & development require strong, reliable & efficient power electronics for life-support systems, scientific instruments, and communications such as radiation-hardened DC/AC converters, and advanced power conditioning units (PCUs), among others. ISRO intends to construct a space station orbiting the Moon by 2024 as part of India's ambitious lunar exploration program. The plan has been divided into three phases: Phase 1 is based on robotic missions and technology development to support future human missions. The Chandrayaan-3 mission that successfully landed on the Moon in 2023 set the stage for the next Chandrayaan-4 mission in 2028, to bring back lunar samples and further explore the Moon. These efforts reflect increasing attention from space agencies on developing space colonization infrastructure that will eventually support the expansion of space power electronics manufacturers.

Market Segmentation

- Based on the device type, the market is segmented into power discrete, power module, and power IC.

- Based on the application, the market is segmented into satellites, spacecraft & launch vehicles, rovers, and space stations.

- Based on the voltage, the market is segmented into low voltage, medium voltage, and high voltage.

Power Module Segment is Projected to Hold the Largest Market Share

Under the device type, the power module leads the segment owing to rising demand for electric propulsion, cost-effectivity & resilient features for large or mega constellation projects, and widespread applications in space systems such as satellites, spacecraft, and launch vehicles. Further, the demand for power modules is promoted by expansion in the space exploration industry and the growing integration of advanced power management systems.

Satellites Segment is Projected to Hold Considerable Market Share

Under the application, the satellite segment is projected to hold considerable market share owing to the increasing number of satellite-based space missions, the growing use of satellites in the commercial space industry for utilities such as telecommunication networks, and rising investments from both sectors (private & government) in satellite technologies, among others. Further, this satellite segment is expected to gain more traction with expansion in satellite-based services, technological advancements, and global connectivity projects.

Regional Outlook

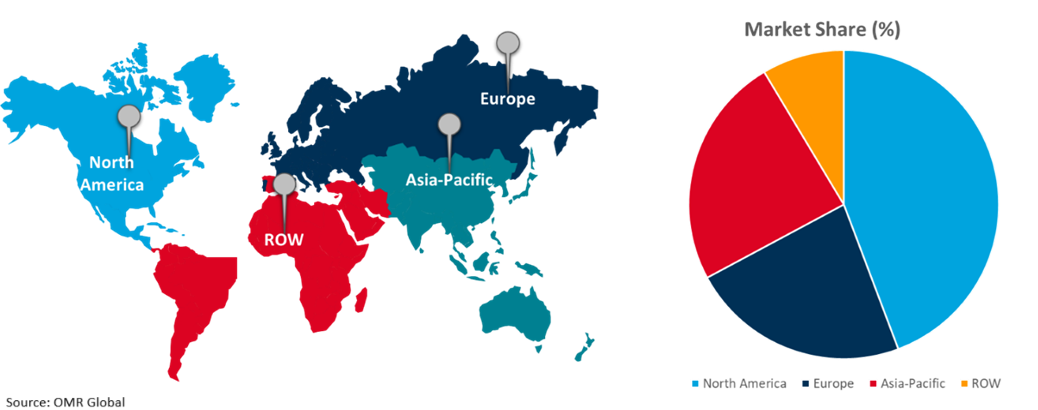

The global space power electronics market is further segmented based on geography including North America (the US, and Canada), Europe (Germany, France, the UK, Italy, Spain, and the Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds the Highest Share in the Global Space Power Electronics Market

The North American region leads in the space power electronics market, because of factors such as an enormously matured space exploration industry and a rapidly expanding commercial space industry with companies such as SpaceX, Blue Origin, and Virgin Galactic; highly invested funds for the development of space infrastructure & electronics components; and advanced capabilities in manufacturing space components. Primarily, the state-owned organizational push for enhancing space exploration capabilities is contributing to the growth of space power electronics. For instance, the Biden-Harris Administration recently released the Fiscal Year 2025 budget, committing billions of dollars to NASA to continue space exploration and scientific discoveries. The budget puts forward significant highlights, such as spending $7.8 billion towards the Artemis lunar program aimed at funding crewed missions to the Moon and $2.4 billion on Earth science initiatives dealing with climate change. The budget also includes space technology development worth $1.2 billion to encourage innovation, and, lastly, $966 million for NASA's aeronautics program on sustainable aviation technologies. Commercial space station development, and opportunities for STEM programs at minority-serving institutions, investments in job creation across the United States through projects related to space.

Global Space Power Electronics Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing Region in the Global Space Power Electronics Market

The Asia-Pacific is the fastest-growing region in the global space power electronics market, supported by increasing investment in space technologies from countries such as China, India, and Japan; increasing regional focus on developing space infrastructure; rising popularity of the region as a commercial space exploration hub; and state-owned push for developing manufacturing capabilities in the space exploration sector. For instance, the Indian Union Cabinet approved a $120 million venture capital fund to support India's space sector under the aegis of IN-SPACe. The fund, to be deployed over five years, has been designed to encourage innovation, and economic growth, and strengthen national space capabilities; it will focus on infusing capital, supporting new startups, and accelerating developments in space technology. Moreover, it aims at retaining space companies in India, increasing competitiveness at a global level, and being a part of the "Atmanirbhar Bharat" initiative. This initiative is estimated to benefit around 40 startups, and it would play an important role in developing India's space economy within the next decade.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order*.

The major companies serving the space power electronics market include Infineon Technologies AG, Semiconductor Applications Industries, LLC (Onsemi), Renesas Electronics Corp., STMicroelectronics NV, and Texas Instruments Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In January 2024, Infineon Technologies introduced the first phase of its new 200-mm silicon carbide power semiconductor plant in Malaysia world's largest of this type. It was hosted by Malaysian leaders and attended by Infineon CEO Jochen Hanebeck. The $2.1 billion investment will produce SiC and GaN semiconductors that will be used for electric vehicles, charging stations, and renewable energy. The first phase will create 900 jobs while total job creation is expected to reach 4,000 as the facility expands.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global space power electronics market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.1.1. Industry Focus on Miniaturization & Compactness

2.2.1.2. Increasing Investments in Developing Space Electronics

2.2.1.3. Growing Integration of Renewable Energy Based Power Systems

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Infineon Technologies AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Renesas Electronics Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Semiconductor Components Industries, LLC

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. STMicroelectronics N.V

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Texas Instruments Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Space Power Electronics Market by Device Type

4.1.1. Power Discrete

4.1.2. Power Module

4.1.3. Power IC

4.2. Global Space Power Electronics Market by Application

4.2.1. Satellite

4.2.2. Spacecraft & Launch Vehicle

4.2.3. Rovers

4.2.4. Space stations

4.3. Global Space Power Electronics Market by Voltage

4.3.1. Low Voltage

4.3.2. Medium Voltage

4.3.3. High Voltage

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Analog Devices, Inc.

6.2. AIRBUS SE

6.3. BAE Systems PLC

6.4. Cobham Ltd.

6.5. CRANE CO.

6.6. HEICO Corp.

6.7. MICROCHIP TECHNOLOGY INC.

6.8. Modular Devices, Inc.

6.9. Monolithic Power Systems, Inc.

6.10. NXP Semiconductors N.V.

6.11. Solid State Devices, Inc.

6.12. SPACE IC GmbH

6.13. Terma Group

6.14. Vicor Corp

6.15. Vishay Intertechnology, Inc.

1. Global Space Power Electronics Market Research And Analysis By Device Type, 2023-2031 ($ Million)

2. Global Power Discrete For Space Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Power Module For Space Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Power IC For Space Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Space Power Electronics Market Research And Analysis By Application, 2023-2031 ($ Million)

6. Global Power Electronics in Satellite Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Power Electronics in Spacecraft & Launch Vehicle Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Power Electronics in Rovers Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Power Electronics in Space Stations Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Space Power Electronics Market Research And Analysis By Voltage, 2023-2031 ($ Million)

11. Global Low Voltage Space Power Electronics Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Medium Voltage Space Power Electronics Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global High Voltage Space Power Electronics Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Space Power Electronics Market Research And Analysis By Region, 2023-2031 ($ Million)

15. North American Space Power Electronics Market Research And Analysis By Country, 2023-2031 ($ Million)

16. North American Space Power Electronics Market Research And Analysis By Device Type, 2023-2031 ($ Million)

17. North American Space Power Electronics Market Research And Analysis By Application, 2023-2031 ($ Million)

18. North American Space Power Electronics Market Research And Analysis By Voltage, 2023-2031 ($ Million)

19. European Space Power Electronics Market Research And Analysis By Country, 2023-2031 ($ Million)

20. European Space Power Electronics Market Research And Analysis By Device Type, 2023-2031 ($ Million)

21. European Space Power Electronics Market Research And Analysis By Application, 2023-2031 ($ Million)

22. European Space Power Electronics Market Research And Analysis By Voltage, 2023-2031 ($ Million)

23. Asia-Pacific Space Power Electronics Market Research And Analysis By Country, 2023-2031 ($ Million)

24. Asia-Pacific Space Power Electronics Market Research And Analysis By Device Type, 2023-2031 ($ Million)

25. Asia-Pacific Space Power Electronics Market Research And Analysis By Application, 2023-2031 ($ Million)

26. Asia-Pacific Space Power Electronics Market Research And Analysis By Voltage, 2023-2031 ($ Million)

27. Rest Of The World Space Power Electronics Market Research And Analysis By Region, 2023-2031 ($ Million)

28. Rest Of The World Space Power Electronics Market Research And Analysis By Device Type, 2023-2031 ($ Million)

29. Rest Of The World Space Power Electronics Market Research And Analysis By Application, 2023-2031 ($ Million)

30. Rest Of The World Space Power Electronics Market Research And Analysis By Voltage, 2023-2031 ($ Million)

1. Global Space Power Electronics Market Research and Analysis By Device Type, 2023 Vs 2031 (%)

2. Global Power Discrete For Space Market Share By Region, 2023 Vs 2031 (%)

3. Global Power Module For Space Market Share By Region, 2023 Vs 2031 (%)

4. Global Power IC For Space Market Share By Region, 2023 Vs 2031 (%)

5. Global Space Power Electronics Market Research and Analysis By Application, 2023 Vs 2031 (%)

6. Global Power Electronics in Satellite Market Share By Region, 2023 Vs 2031 (%)

7. Global Power Electronics in Spacecraft & Launch Vehicle Market Share By Region, 2023 Vs 2031 (%)

8. Global Power Electronics in Rovers Market Share By Region, 2023 Vs 2031 (%)

9. Global Power Electronics in Space Stations Market Share By Region, 2023 Vs 2031 (%)

10. Global Space Power Electronics Market Research and Analysis By Voltage, 2023 Vs 2031 (%)

11. Global Low Voltage Space Power Electronics Market Share By Region, 2023 Vs 2031 (%)

12. Global Medium Voltage Space Power Electronics Market Share By Region, 2023 Vs 2031 (%)

13. Global High Voltage Space Power Electronics Market Share By Region, 2023 Vs 2031 (%)

14. Global Space Power Electronics Market Share By Region, 2023 Vs 2031 (%)

15. US Space Power Electronics Market Size, 2023-2031 ($ Million)

16. Canada Space Power Electronics Market Size, 2023-2031 ($ Million)

17. UK Space Power Electronics Market Size, 2023-2031 ($ Million)

18. France Space Power Electronics Market Size, 2023-2031 ($ Million)

19. Germany Space Power Electronics Market Size, 2023-2031 ($ Million)

20. Italy Space Power Electronics Market Size, 2023-2031 ($ Million)

21. Spain Space Power Electronics Market Size, 2023-2031 ($ Million)

22. Rest Of Europe Space Power Electronics Market Size, 2023-2031 ($ Million)

23. India Space Power Electronics Market Size, 2023-2031 ($ Million)

24. China Space Power Electronics Market Size, 2023-2031 ($ Million)

25. Japan Space Power Electronics Market Size, 2023-2031 ($ Million)

26. South Korea Space Power Electronics Market Size, 2023-2031 ($ Million)

27. Rest Of Asia-Pacific Space Power Electronics Market Size, 2023-2031 ($ Million)

28. Latin America Space Power Electronics Market Size, 2023-2031 ($ Million)

29. Middle East And Africa Space Power Electronics Market Size, 2023-2031 ($ Million)