Space Sensors Market

Space Sensors Market Size, Share & Trends Analysis Report by Type (IMU Sensors, GPS Sensors, Star Sensors, Optical Sensors, Synthetic Aperture Radar Sensors, Pressure Sensors, Temperature Sensors, and Others (Vibration Sensors, Gas Sensors)), by Platform (Satellites, Space Station & Testing Probes, Rovers/Spacecraft Landers, and Launch Vehicle), by End-User (Civil, Commercial, and Defense). Forecast Period (2024-2031).

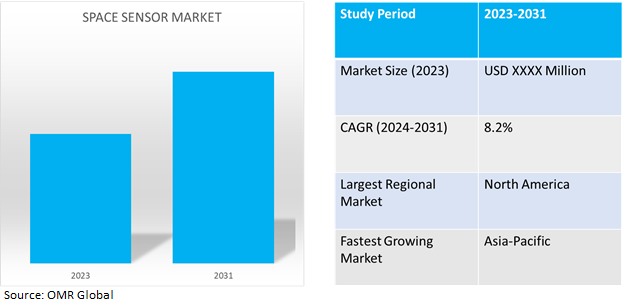

Space sensor market is anticipated to grow at a considerable CAGR of 8.2% during the forecast period (2024-2031). Space sensors market growth is attributed to increasing demand for space sensors in satellite development, expansion in the space exploration market, growing commercial satellite industry, and growing application in defense. The market is highly influenced by investment from state-run organizations for developing and innovating space sensor technology to enhance space and defense capabilities. The major trend in the market includes miniaturization of space sensing technology, demand for remote sensing and observation-based sensing technology, and integration of novel technology such as quantum sensors.

Market Dynamics

Rising Application in Defense

The growing need for space-based assets in defense and security is driving demand for sensors in the marketplace. Space sensors are used to monitor, acquire intelligence, and provide early warning systems. Satellites equipped with high-resolution optical sensors, synthetic aperture radar SARs, or other advanced imaging technologies provide critical intelligence data for monitoring potential threats, assessing military operations, and obtaining strategic information on a timely basis. Also, hypersonic missiles and ballistic missile systems leverage space sensors to work. For instance, in January 2024, the Space Development Agency granted L3Harris, Lockheed Martin, and Sierra Space $2.5 billion for 54 satellites in its new missile warning and missile tracking (MW/MT) and missile defense networks. The MW/MT satellites are designed to detect and track missile launches from orbit using infrared sensors with a large field of view. The missile defense satellites will have a mix of wide and medium-field-of-view infrared sensors to provide high-quality fire control tracks, assisting ground forces to intercept missiles.

Advancements in Space Sensor Technology

The market has recorded several technological advancements and product developments in recent times. Major market participants are working on developing technologically enhanced sensors to withstand space environments while improving sensor reliability and efficiency. Quantum sensors are one such advancement which can detect even minute changes in their surroundings, identify items underwater or underground, and provide navigational information if the GPS is down or unavailable. The European Commission is laying the groundwork for the launch of a quantum space gravimetry pathfinder mission, which will be the first flight demonstration of the instrument's groundbreaking technology to characterize its performance. This will help prepare for a future full-scale Earth observation mission. The CARIOQA-PHA (Phase A) project will develop the initial phase of the Pathfinder space mission. In January 2024, the project partners (CNES, German Aerospace Center (DLR), Airbus Defense & Space, GMV, and FORTH/PRAXI) officially launched the Phase A project. This is a significant milestone in the demonstration mission's efforts to test a quantum sensor capable of sensing accelerations in space using cold atoms.

Segmental Outlook

Our in-depth analysis of the global space sensors market includes the following segments by type, platform, and end-user.

- Based on type, the market is segmented into IMU sensors, GPS sensors, star sensors, optical sensors, synthetic aperture radar sensors, pressure sensors, temperature sensors, and others (vibration sensors, gas sensors)

- Based on the platform, the market is segmented into satellites, space stations & testing probes, rovers/spacecraft landers, and launch vehicles.

- Based on end-users, the market is segmented into civil, commercial, and defense.

Satellites are Projected to Dominate the Market

The satellite segment dominated the market, owing to increased scheduled satellite launches by major public and private satellite operators, the growing small satellite market, and the increasing application of satellites. Further, several state-driven organizations have invested in the development of communication, monitoring, weather forecasting, and navigation satellites, creating demand for sensors. According to the Space Foundation's 2023 Q4 report, global launch activity hit record highs for the third year in a row, with 223 launch attempts and 212 successful launches. Commercial launch activity rose by 50% in 2022. The United States witnessed a 33.0% rise in launch attempts, while China, India, and Japan also saw increased activity, with more than 2,800 satellites sent into orbit, 23.0% more than in 2022.

Defenses is the Biggest End-User

Space sensing was established to accelerate innovation in response to potential threats such as hypersonic weapons, which put our missile warning, tracking, and defense capabilities at risk. Satellites are also often used to support military or security missions such as intelligence, surveillance, and reconnaissance (ISR), which verify compliance with arms control. CACI International Inc. signed a five-year cooperative research and development agreement (CRADA) with the US Army Space and Missile Defense Technical Center (USASMDC-TC) to advance the development of advanced payload technologies, space sensor applications, and resilient positioning, navigation, and timing (PNT).

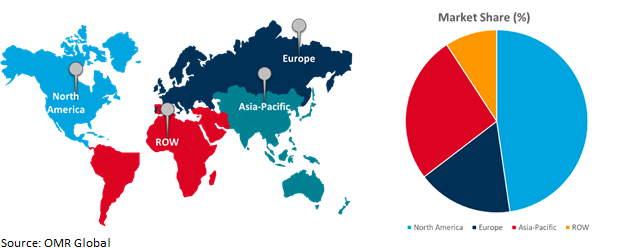

Regional Outlook

Space sensors market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (Middle East & Africa, and Latin America).

North America Holds Highest Share in Global Space Sensors Market

North America holds the highest share of the global space sensor market. The key factors contributing to the growth are increasing the defense budget, investment in novel sensing technology, the presence of major sensor manufacturers, and rising investment in space exploration, and commercial space missions. For instance, in February 2024, NASA selected 11 American firms to develop technology that would enable long-term exploration on the Moon and in space for the benefit of all. The technologies span from lunar surface power systems to equipment for in-space 3D printing, expanding industrial capabilities for a long-term human presence on the Moon via Artemis and other NASA, government, and commercial missions. The projects approved for the agency's sixth tipping point opportunity will be sponsored jointly by NASA and industry partners. The total estimated NASA commitment to the collaborations is $150.0 million. Each company will contribute a minimum percentage of the entire project cost, ranging from 10-25.0%, depending on its size. NASA's Space Technology Mission Directorate (STMD) will award Space Act agreements with milestone-based funding that will run for up to four years.

Global Space Sensors Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing in Space Sensors market

- The Asia-Pacific region is the space-tech outsourcing market for Western countries as they launch and collaborate for low-cost space missions with space agencies such as ISRO.

- Asia-Pacific governments have heavily invested in developing their space capabilities including wireless communication, navigation, space exploration, and earth monitoring alongside allowing private companies to launch commercial projects in space.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global space sensors market include ABB Ltd., TE Connectivity Ltd., Honeywell International Inc., Ametek Inc., and Airbus S.A.S, among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in August 2023, Raytheon, an RTX company, reported that its Geostationary Littoral Imaging and Monitoring Radiometer, or GLIMR, sensor has passed the Critical Design Review and is now in the construction and test phase of the program. NASA selected GLIMR to be its first hyperspectral imager in geostationary orbit. GLIMR will capture and process data from the entire electromagnetic spectrum, including visible light, infrared, and ultraviolet frequencies, to provide a highly detailed picture of physical and biological conditions in coastal seas.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in space sensors market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABB Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Airbus S.A.S

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Ametek Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Honeywell International Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. TE Connectivity Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Space Sensors Market by Type

4.1.1. IMU Sensors

4.1.2. GPS Sensors

4.1.3. Star Sensors

4.1.4. Optical Sensors

4.1.5. Synthetic Aperture Radar Sensors

4.1.6. Pressure Sensors

4.1.7. Temperature Sensors

4.1.8. Others (Vibration Sensors, Gas Sensors)

4.2. Global Space Sensors Market by Platform

4.2.1. Satellites

4.2.2. Space Station & Testing Probes

4.2.3. Rovers/Spacecraft Landers

4.2.4. Launch Vehicle

4.3. Global Space Sensors Market by End-User

4.3.1. Civil

4.3.2. Commercial

4.3.3. Defense

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. InnaLabs Ltd. Analog Devices, Inc.

6.2. Bradford Engineering BV

6.3. CEDRAT TECHNOLOGIES

6.4. InnaLabs Ltd.

6.5. L3Harris Technologies Inc.

6.6. Moog Inc.

6.7. MinebeaMitsumi Inc.

6.8. Safran S.A.

6.9. Sierra Nevada Corp

6.10. STMicroelectronics NV.

6.11. Teledyne Technologies Inc.

6.12. Texas Instruments Inc.

6.13. Raytheon Technologies Corp.

6.14. Renesas Electronics Corp.

6.15. UAG Group

1. GLOBAL SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL IMU SENSORSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL GPS SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL STAR SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OPTICAL SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL SYNTHETIC APERTURE RADAR SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL PRESSURE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL TEMPERATURE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL OTHER SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

11. GLOBAL SPACE SENSORS FOR SATELLITESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBALSPACE SENSORSFOR SPACE STATION & TESTING PROBESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SPACE SENSORS FOR ROVERS/SPACECRAFT LANDERSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL SPACE SENSORS FOR LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. GLOBAL SPACE SENSORS IN CIVIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL SPACE SENSORSIN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL SPACE SENSORSIN DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. NORTH AMERICAN SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

23. NORTH AMERICAN SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. EUROPEAN SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. EUROPEAN SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

26. EUROPEAN SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

27. EUROPEAN SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. ASIA-PACIFICSPACE SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

32. REST OF THE WORLD SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

35. REST OF THE WORLD SPACE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL SPACE SENSORS MARKETSHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL IMU SENSORSMARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL GPS SENSORSMARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL STAR SENSORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL OPTICAL SENSORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL SYNTHETIC APERTURE RADAR SENSORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL PRESSURE SENSORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL TEMPERATURE SENSORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL OTHER SPACE SENSORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL SPACE SENSORS MARKET SHARE BY PLATFORM, 2023 VS 2031 (%)

11. GLOBAL SPACE SENSORSFOR SATELLITESMARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL SPACE SENSORSFOR SPACE STATION & TESTING PROBESMARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL SPACE SENSORS FOR ROVERS/SPACECRAFT LANDERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL SPACE SENSORS FOR LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL SPACE SENSORS MARKET SHARE BY END-USER, 2023 VS 2031 (%)

16. GLOBAL SPACE SENSORS IN CIVIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL SPACE SENSORSIN COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBALSPACE SENSORSIN DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL SPACE SENSORS MARKETSHARE BY REGION, 2023 VS 2031 (%)

20. US SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

21. CANADA SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

22. UK SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

23. FRANCE SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

24. GERMANY SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

25. ITALY SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

26. SPAIN SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF EUROPE SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

28. INDIA SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

29. CHINA SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

30. JAPAN SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

31. SOUTH KOREA SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

32. REST OF ASIA-PACIFIC SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

33. LATIN AMERICA SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)

34. THE MIDDLE EAST AND AFRICA SPACE SENSORS MARKET SIZE, 2023-2031 ($ MILLION)