Spray Polyurethane Foam Market

Global Spray Polyurethane Foam Market Size, Share & Trends Analysis Report, By Product (Open-Cell, and Closed-Cell), By Application (Residential, Commercial, and Industrial) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global spray polyurethane foam (SPF) market is estimated to grow at a CAGR of 7% during the forecast period. Polyurethane foam is a chemical product that is widely used in construction applications that require filling, sealing, bonding, and insulation. SPF (SPF), when compared to conventional roofing systems, are lightweight, durable, weather-proof, and requires less maintenance. Owing to their high thermal resistance and acoustic insulation, SPFs are used in various applications such as water pipes, bonding and sealing roofs and walls, and installation of door and window frames, which, in turn, drives the growth of the global spray polyurethane foam market. Moreover, SPFs are also sprayed on roofs and walls to enhance the thermal resistance of buildings. Other factors that motivate the growth of the global spray polyurethane foam industry include the emerging demand for innovative insulation products for buildings coupled with the growing construction activities.

Segmental Outlook

The global SPF market is segmented on the basis of product, application, and regions. On the basis of the product, the market is segmented into open-cell and closed-cell. Based on the basis of application, the market is classified into residential, commercial, and industrial.

Global SPF Market Share by Products, 2018 (%)

- In April 2019, Icynene-Lapolla had launched Lapolla Foam-Lok 750 to address the better energy solution for meeting the building code and energy efficiency requirement of high-performance homes, owing to its core density of 0.75-pound which makes it highly air-permeable.

- In February 2019, Icynene-Lapolla had launched Icynene Open-cell No-Mix insulation. The no-mix is a two-component light-density one-to-one by volume spray. This product launch tends to address the increasing demand for no-mix insulation owing to its utility in new and retrofit home and commercial applications.

- In December 2018, Thermoseal launched Thermoseal 360, ultra-high yield open-cell spray foam insulation and Thermoseal 800, ultra-high R-value open-cell spray foam. The company launched these innovative sprays for getting an edge over other competitors in the highly competitive market of spray polyurethane foams.

- In October 2017, Icynene, Inc. and Lapolla Industries Inc. entered into a merger agreement under which Icynene will acquire all the outstanding shares of Lapolla. Together, the combined company's energy-conserving SPF insulation products will serve a broad range of new commercial, residential, specialty non-construction and remodeling insulation project needs in North America and across the globe.

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global spray polyurethane foam market. Based on the availability of data, information related to products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

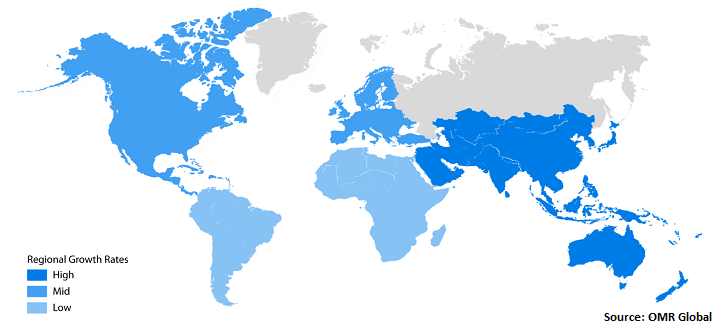

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. The Dow Chemical Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Bayer AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.3.5. Recent Developments

3.3.4. Huntsman International, LLC

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Spray Polyurethane Foam Market by Product

5.1.1. Open-Cell

5.1.2. Closed-Cell

5.2. Global Spray Polyurethane Foam Market by Application

5.2.1. Residential

5.2.2. Commercial

5.2.3. Industrial

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. India

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Accella Polyurethane Systems, LLC

7.2. Armacell Llc

7.3. BASF SE

7.4. Bayer AG

7.5. Certainteed Corp.

7.6. Huntsman International LLC

7.7. Icynene, Inc.

7.8. Johns Manville

7.9. NCFI Polyurethanes (A Division of Barnhardt Manufacturing Co.)

7.10. Polyurethane Foam Systems, Inc.

7.11. Premium Spray Products, Inc.

7.12. Rhino Linings Corp.

7.13. Saint-Gobain Group

7.14. Specialty Products, Inc.

7.15. The Dow Chemical Co.

7.16. Thermoseal Inc.

1. GLOBAL SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL OPEN-CELL SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL CLOSED-CELL SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

5. GLOBAL SPRAY POLYURETHANE FOAM IN RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL SPRAY POLYURETHANE FOAM IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL SPRAY POLYURETHANE FOAM IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

11. NORTH AMERICAN SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

12. EUROPEAN SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. EUROPEAN SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

14. EUROPEAN SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

15. ASIA-PACIFIC SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

18. REST OF THE WORLD SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

19. REST OF THE WORLD SPRAY POLYURETHANE FOAM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL SPRAY POLYURETHANE FOAM MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL SPRAY POLYURETHANE FOAM MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL SPRAY POLYURETHANE FOAM MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)

6. UK SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)

12. CHINA SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)

13. JAPAN SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)

14. INDIA SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD SPRAY POLYURETHANE FOAM MARKET SIZE, 2018-2025 ($ MILLION)