Starch Derivatives Market

Global Starch Derivatives Market Size, Share & Trends Analysis Report by Source (Corn, Wheat, Cassava, Potato, and Others), By Type (Maltodextrin, Cyclodextrin, Glucose Syrup, Hydrolysates, and Others), By Application (Food & Beverage, Paper Industry, Pharmaceutical Industry, Cosmetics, and Others) Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global starch derivatives market is projected to grow at a significant CAGR during the forecast period. The key factors that drive the market growth include a wide range of applications in which starch is used such as food & beverage, feed, paper industry, pharmaceutical industry, cosmetics, plastic, and others. Rising extensive use of natural ingredients across these industries is encouraging the use of starch derivatives and thereby enhancing the market growth during the forecast period.

Further, the extensive use of starch derivatives in making biodegradable plastics for vehicle manufacturing is also spurring market growth. It is a cost-effective alternative to plastic as it is a lightweight component, which increases the overall efficiency of the vehicle. The conventional plastic is non-degradable and increases the production of carbon dioxide. As a result, the use of bio-plastic or biodegradable plastic is increasing since these are renewable resources and significantly reduces emissions. Furthermore, as bioplastic is easily degradable and creates no or less pollution, the adoption of bioplastics is projected to increase in the near future due to continuous government support for green initiatives. Thus, this is further propelling the market growth during the forecast period.

Segmental Outlook

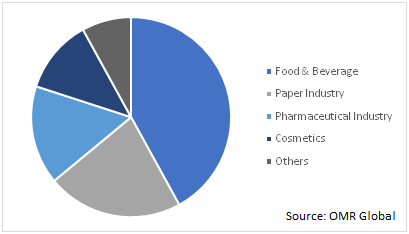

The global starch derivatives market is segmented on the basis of source, type, and application. Based on the source, the market is segmented into corn, wheat, cassava, potato, and others such as rice. Based on the type, the market is segmented into maltodextrin, cyclodextrin, glucose syrup, hydrolysates, and others. Whereas, based on the application, the market is sectioned into food & beverage, paper industry, pharmaceutical industry, cosmetics, and others, including bioethanol and feed.

Global Starch Derivatives Market by Application, 2019 (%)

Pharmaceutical Industry to Register Significant Growth in the Market Growth

Amongst the application segment of the market, the pharmaceutical industry is likely to exhibit a significant growth rate in the market. The segmental growth of the market is attributed to the wide application of starch in the pharmaceutical industry. Several factors affect the digestibility of native starch and, hence, make it suitable for the pharmaceutical application. These include amylopectin, amylose ratio, amylopectin chain length, degree of crystallinity, and intermolecular association in granules. Modification typically affects all these properties, and the choice of modification can lead to customization and flexibility in starch used for the pharmaceutical applications.

Regional Outlook

The global starch derivatives market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. Europe is estimated to expand at a significant rate during the forecast period. The growth of the region is backed by several factors including well-established plastic industry especially in Germany and is gradually moving towards the adoption of bioplastic in the automotive industry. In July 2019, European automaker Porsche has adopted bioplastic to develop certain parts in the new 718 Cayman GT4 Clubsport.

Further, the increasing industrial sector in the emerging economies of the Asia-Pacific, especially in China and India are among the major countries contributing to global market growth. China has the largest plastic manufacturing industry across the globe, owing to which, there is a large consumption of plastics in the country. The increasing plastic pollution has drawn the attention of governmental bodies of the country, regarding the decrease in the consumption of non-biodegradable plastics. This, in turn, is driving the overall starch adoption for manufacturing bioplastics and in turn enhancing the market growth.

Market Players Outlook

Some of the prominent players operating in the global starch derivatives market include Ingredion Inc., Roquette Frères, Tate & Lyle Plc, Cargill Inc., Agrana Group, Emsland Group, Archer Daniels Midland Co., Avebe UA, Grain Processing Corp., and others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global starch derivatives market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global starch derivatives market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Cargill Inc.

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Tate & Lyle PLC

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Ingredion Inc.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Roquette Frères

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Starch Derivatives Market by Source

5.1.1. Corn

5.1.2. Wheat

5.1.3. Cassava

5.1.4. Potato

5.1.5. Other

5.2. Global Starch Derivatives Market by Type

5.2.1. Maltodextrin

5.2.2. Cyclodextrin

5.2.3. Glucose Syrup

5.2.4. Hydrolysates

5.2.5. Others

5.3. Global Starch Derivatives Market by Application

5.3.1. Food & Beverage

5.3.2. Paper Industry

5.3.3. Pharmaceutical Industry

5.3.4. Cosmetics

5.3.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Agrana Group

7.2. Archer Daniels Midland Co.

7.3. Avebe UA

7.4. BENEO GmbH

7.5. Cargill Inc.

7.6. Emsland Group

7.7. Global Bio-chem Technology Group Co. Ltd.

7.8. Grain Processing Corp.

7.9. Ingredion Inc.

7.10. Lasenor Emul S.L.

7.11. Roquette Frères

7.12. SPAC Group

7.13. Stern-Wywiol Gruppe GmbH & Co. KG

7.14. Tate & Lyle Plc

7.15. Tereos S.A

7.16. Tongaat Hulett Ltd.

1. GLOBAL STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

2. GLOBAL CORN STARCH MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL WHEAT STARCH MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL CASSAVA STARCH MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL POTATO STARCH MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER SOURCES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

8. GLOBAL MALTODEXTRIN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL CYCLODEXTRIN MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL GLUCOSE SYRUP MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL HYDROLYSATES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL OTHER STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. GLOBAL STARCH DERIVATIVES FOR FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL STARCH DERIVATIVES FOR PAPER INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL STARCH DERIVATIVES FOR PHARMACEUTICAL INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

17. GLOBAL STARCH DERIVATIVES FOR COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

18. GLOBAL STARCH DERIVATIVES FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

19. GLOBAL STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

20. NORTH AMERICAN STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. NORTH AMERICAN STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

22. NORTH AMERICAN STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

23. NORTH AMERICAN STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

24. EUROPEAN STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

25. EUROPEAN STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

26. EUROPEAN STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

27. EUROPEAN STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

28. ASIA-PACIFIC STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

29. ASIA-PACIFIC STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

30. ASIA-PACIFIC STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

31. ASIA-PACIFIC STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

32. REST OF THE WORLD STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

33. REST OF THE WORLD STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

34. REST OF THE WORLD STARCH DERIVATIVES MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2019-2026 ($ MILLION)

1. GLOBAL STARCH DERIVATIVES MARKET SHARE BY SOURCE, 2019 VS 2026 (%)

2. GLOBAL STARCH DERIVATIVES MARKET SHARE BY TYPE, 2019 VS 2026 (%)

3. GLOBAL STARCH DERIVATIVES MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

4. GLOBAL STARCH DERIVATIVES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

7. UK STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD STARCH DERIVATIVES MARKET SIZE, 2019-2026 ($ MILLION)