Steel Wire Market

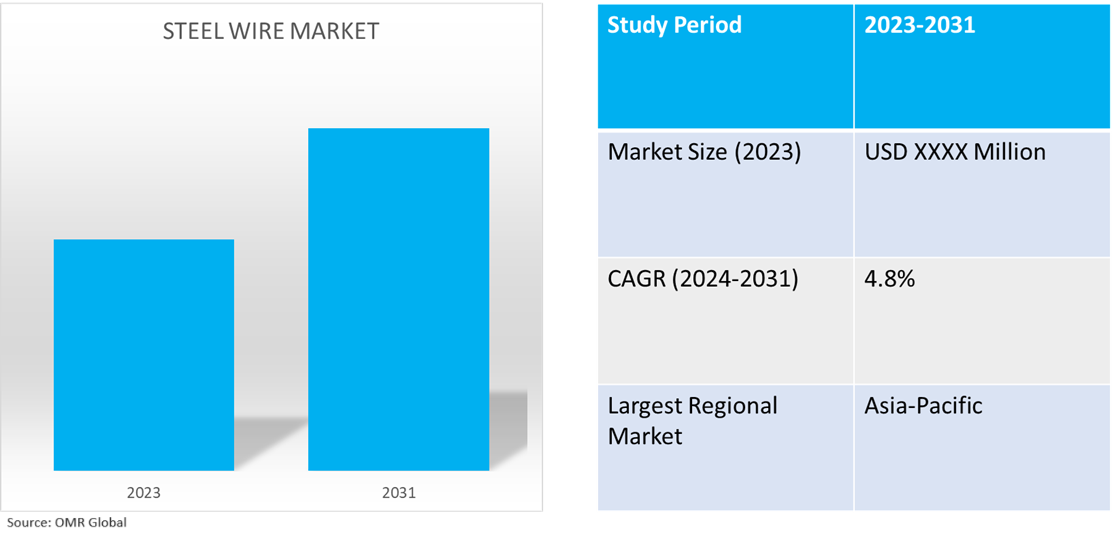

Steel Wire Market Size, Share & Trends Analysis Report by Form (Rope, and Non-Rope), by Type (Alloy Steel, Carbon Steel, and Stainless Steel), and by End-User (Construction, Automotive, Energy, Agriculture, and Industrial) Forecast Period (2024-2031)

Steel wire market is anticipated to grow at a CAGR of 4.8% during the forecast period (2024-2031). Steel wire is a versatile and strong material generated from various steel grades and treated by procedures such as cold drawing, hot rolling, and galvanizing to optimize its qualities. The pivotal factors driving market growth include the expansion of the construction and infrastructure development sectors, rapid industrialization, especially in emerging economies, and the rising application of steel wires in various industries such as telecom and cables, agriculture and fencing, power, and energy, among others.

Market Dynamics

Increasing Consumption of Steel Wires in Construction & Infrastructure Development

Steel wires are widely used in several construction activities, such as fencing and barriers, formwork and scaffolding, suspension cables for bridges, and pre-stressed and post-tensioned concrete, among others, which consistently creates demand for steel wires in the construction & infrastructure industry. Further, the global steel wire market is recording steady demand from the construction and infrastructure industries owing to increasing investment in novel construction in the residential and non-residential sectors, infrastructure expansion in emerging economies, rapid urbanization, and government initiatives, which are consistently developing demand for steel wires in construction and infrastructure projects. For instance, the Q1 2023 Global Construction Monitor results indicate a slight improvement in overall activity during the quarter. Workloads increased across all sectors globally, leading to a rise in the headline Global Construction Activity Index to a four-quarter high. The infrastructure sector continues to show the strongest twelve-month workload expectations compared to other sectors across all world regions. In APAC, the latest infrastructure expectations net balance reading of +64.0% is the highest figure recorded since the series began in 2020. Expectations are also positive in the Americas and MEA regions, although infrastructure growth expectations are slightly lower in Europe.

Growing Application of Steel Wires across Industries

Simultaneously, several other sectors have also extensively consumed steel wires for various purposes such as fiber optic cables in telecommunication, baling wires & fencing in agriculture, drilling rigs, pipelines, and other oil and gas extraction and transportation equipment in the oil & gas industry, springs and fasteners & steel-belted radial tires in the automotive industry, among others. Further, with growing industrial consumption, and increasing demand from end-user industries, the steel wire market is expected to receive constant demand in the future. For instance, in April 2022, ArcelorMittal signed an agreement to purchase an 80.0% stake in Voestalpine's top-tier Hot Briquetted Iron (HBI) plant in Corpus Christi, Texas. The Voestalpine will maintain ownership of the remaining 20.0%. The deal values the Corpus Christi operations at $1.0 billion, with the closing contingent upon standard regulatory approvals.

Segmental Outlook

- Based on form, the market is segmented into rope, and non-rope.

- Based on type, the market is segmented into alloy steel, carbon steel, and stainless steel.

- Based on end-users, the market is segmented into construction, automotive, energy, agriculture, and industrial.

Carbon Steel Wire is the Most Prominent Steel Wire Type

Carbon steel wire is the most consumed steel wire type owing to its cost-effectiveness, high tensile strength, versatility in diverse environments, and ease of manufacturing features. Its application range includes construction, automotive components, household goods, and industrial machinery. The demand for the wire type is expected to be driven by rapid urbanization and industrial growth.

Construction is the Biggest End-User Segment

The construction industry is expected to remain a dominant industry for steel wire end-use owing to rapid urbanization globally. The increasing investments in infrastructure and substantial support from regional governments to promote safe construction and infrastructure is further aiding the growth of the business segments. For instance, as per the World Steel Association, construction is one of the most important steel-using industries, accounting for more than 50.0% of global steel demand.

Regional Outlook

The global steel wire market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Steel Wire Market Growth by Region 2024-2031

Asia-Pacific Holds Significant Share in Global Steel Wire Market

Asia-Pacific holds a significant share of the global market attributed to the ongoing increase in industrial activities in the region. The rising demand for end-user industries, and the prominent position of regional countries such as China, India, and Japan in global steel production are other contributors to the regional market share. For instance, as per the World Steel Short Range Outlook in April 2024, India has emerged as the strongest driver of steel demand growth since 2021, and projections suggest Indian steel demand will continue to charge ahead with 8.0% growth in its steel demand over 2024 and 2025, driven by continued growth in all steel-using sectors and especially by continued strong growth in infrastructure investments. In 2025, steel demand in India is projected to be almost 70 million tons higher than in 2020.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.”

The major companies serving the global steel wire market include ArcelorMittal, HBIS Group, Heico Wire Group, Nippon Steel & Sumitomo Metal Corp., and TATA Steel Ltd., among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global steel wire market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ArcelorMittal

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. HBIS Group

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Heico Wire Group

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Nippon Steel Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. TATA Steel Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Steel Wire Market by Form

4.1.1. Rope

4.1.2. Non-Rope

4.2. Global Steel Wire Market by Type

4.2.1. Alloy Steel

4.2.2. Carbon Steel

4.2.3. Stainless Steel

4.3. Global Steel Wire Market by End-User

4.3.1. Construction

4.3.2. Automotive

4.3.3. Energy

4.3.4. Agriculture

4.3.5. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. China Ansteel Group Corp. Ltd.

6.2. Bridon International Ltd.

6.3. China Baowu Steel Group Corp. Ltd.

6.4. Davis Wire Corp.

6.5. Gerdau S.A.

6.6. Insteel Industries, Inc.

6.7. JFE Steel Corp.

6.8. Jiangsu Shagang Group

6.9. Kobe Steel Ltd.

6.10. Leggett & Platt Inc.

6.11. NV Bekaert SA

6.12. POSCO

6.13. Shougang Shuicheng Iron & Steel (Group) Co., Ltd.

6.14. ThyssenKrupp Steel Europe AG

6.15. Tree Island Industries Ltd.

6.16. Usha Martin Ltd.

1. Global Steel Wire Market Research and Analysis by Form, 2023-2031 ($ Million)

2. Global Rope Steel Wire Market Research and Analysis by Region, 2023-2031 ($ Million)

3. Global Non-Rope Steel Wire Market Research and Analysis by Region, 2023-2031 ($ Million)

4. Global Steel Wire Market Research and Analysis by Type, 2023-2031 ($ Million)

5. Global Alloy Steel Wire Market Research and Analysis by Region, 2023-2031 ($ Million)

6. Global Carbon Steel Wire Market Research and Analysis by Region, 2023-2031 ($ Million)

7. Global Stainless Steel Wire Market Research and Analysis by Region, 2023-2031 ($ Million)

8. Global Steel Wire Market Research and Analysis by End-User, 2023-2031 ($ Million)

9. Global Steel Wire for Construction Market Research and Analysis by Region, 2023-2031 ($ Million)

10. Global Steel Wire for Automotive Market Research and Analysis by Region, 2023-2031 ($ Million)

11. Global Steel Wire for Energy Market Research and Analysis by Region, 2023-2031 ($ Million)

12. Global Steel Wire for Agriculture Market Research and Analysis by Region, 2023-2031 ($ Million)

13. Global Steel Wire for Industrial Market Research and Analysis by Region, 2023-2031 ($ Million)

14. Global Steel Wire Market Research and Analysis by Region, 2023-2031 ($ Million)

15. North American Steel Wire Market Research and Analysis by Country, 2023-2031 ($ Million)

16. North American Steel Wire Market Research and Analysis by Form, 2023-2031 ($ Million)

17. North American Steel Wire Market Research and Analysis by Type, 2023-2031 ($ Million)

18. North American Steel Wire Market Research and Analysis by End-User, 2023-2031 ($ Million)

19. European Steel Wire Market Research and Analysis by Country, 2023-2031 ($ Million)

20. European Steel Wire Market Research and Analysis by Form, 2023-2031 ($ Million)

21. European Steel Wire Market Research and Analysis by Type, 2023-2031 ($ Million)

22. European Steel Wire Market Research and Analysis by End-User, 2023-2031 ($ Million)

23. Asia-Pacific Steel Wire Market Research and Analysis by Country, 2023-2031 ($ Million)

24. Asia-Pacific Steel Wire Market Research and Analysis by Form, 2023-2031 ($ Million)

25. Asia-Pacific Steel Wire Market Research and Analysis by Type, 2023-2031 ($ Million)

26. Asia-Pacific Steel Wire Market Research and Analysis by End-User, 2023-2031 ($ Million)

27. Rest of The World Steel Wire Market Research and Analysis by Region, 2023-2031 ($ Million)

28. Rest of The World Steel Wire Market Research and Analysis by Form, 2023-2031 ($ Million)

29. Rest of The World Steel Wire Market Research and Analysis by Type, 2023-2031 ($ Million)

30. Rest of The World Steel Wire Market Research and Analysis by End-User, 2023-2031 ($ Million)

1. Global Steel Wire Market Share by Form, 2023 Vs 2031 (%)

2. Global Rope Steel Wire Market Share by Region, 2023 Vs 2031 (%)

3. Global Non-Rope Steel Wire Market Share by Region, 2023 Vs 2031 (%)

4. Global Steel Wire Market Share by Type, 2023 Vs 2031 (%)

5. Global Alloy Steel Wire Market Share by Region, 2023 Vs 2031 (%)

6. Global Carbon Steel Wire Market Share by Region, 2023 Vs 2031 (%)

7. Global Stainless Steel Wire Market Share by Region, 2023 Vs 2031 (%)

8. Global Steel Wire Market Share by End-User, 2023 Vs 2031 (%)

9. Global Steel Wire for Construction Market Share by Region, 2023 Vs 2031 (%)

10. Global Steel Wire for Automotive Market Share by Region, 2023 Vs 2031 (%)

11. Global Steel Wire for Energy Market Share by Region, 2023 Vs 2031 (%)

12. Global Steel Wire for Agriculture Market Share by Region, 2023 Vs 2031 (%)

13. Global Steel Wire for Industrial Market Share by Region, 2023 Vs 2031 (%)

14. Global Steel Wire Market Share by Region, 2023 Vs 2031 (%)

15. US Steel Wire Market Size, 2023-2031 ($ Million)

16. Canada Steel Wire Market Size, 2023-2031 ($ Million)

17. UK Steel Wire Market Size, 2023-2031 ($ Million)

18. France Steel Wire Market Size, 2023-2031 ($ Million)

19. Germany Steel Wire Market Size, 2023-2031 ($ Million)

20. Italy Steel Wire Market Size, 2023-2031 ($ Million)

21. Spain Steel Wire Market Size, 2023-2031 ($ Million)

22. Rest of Europe Steel Wire Market Size, 2023-2031 ($ Million)

23. India Steel Wire Market Size, 2023-2031 ($ Million)

24. China Steel Wire Market Size, 2023-2031 ($ Million)

25. Japan Steel Wire Market Size, 2023-2031 ($ Million)

26. South Korea Steel Wire Market Size, 2023-2031 ($ Million)

27. Rest of Asia-Pacific Steel Wire Market Size, 2023-2031 ($ Million)

28. Latin America Steel Wire Market Size, 2023-2031 ($ Million)

29. Middle East And Africa Steel Wire Market Size, 2023-2031 ($ Million)