Stevia Market

Global Stevia Market Size, Share & Trends Analysis Report by Product Form (Powder, Liquid, and Leaf), By Application (Bakery, Dairy Food Products, Beverages, Dietary Supplements, Confectionery, and Others) Forecast Period 2022-2028 Update Available - Forecast 2025-2035

The global market for stevia market is projected to have a considerable CAGR of around 9.4% during the forecast period. The growing awareness of stevia's health advantages is primarily driving the global stevia market. As stevia is 200-350 times sweeter than sugar and has low-calorie content, it is employed by a number of food and beverage industries. Stevia has its unique taste that enhances the taste of foods in which it is used. Stevia offers several advantages such as sugar preplacement, flavor enhancement, sweetness, reduction in calories, color, and texture. Further, the rising popularity of natural ingredients and antioxidants is also a key growth driver of the global stevia market. The rise in the demand for stevia is also fuelled by an increase in disposable income among individuals, which encourages them to adopt healthier eating habits and replacements. Moreover, the increasing prevalence of diabetes and cardiovascular diseases and surge in the obese population is also majorly responsible for the market growth. However, the high cost involved to employ highly skilled staff and for equipment for the colex process of stevia formulation is a restraint to the growth of the stevia market.

Impact of COVID-19 on Stevia Market

COVID-19 had a positive impact on the stevia market, as Food and beverage products, such as dairy products, bakery products, confectionery, and soft drinks containing food additives, have been kept back, as supermarkets re-allocated stock priorities toward staples and essential supplies during the COVID-19 outbreak. And this has maintained the growth of the food and beverages industry during the COVID-19 pandemic which in turn had boosted the stevia market growth. Nutraceuticals and healthy food and beverage products, on the other hand, have surpassed their market growth due to increasing demand for immunity-boosting and healthy products during the COVID-19 period, which has increased the use of stevia.

Segmental Outlook

The global stevia market is segmented based on product form, and application. Based on the product form, the market is further classified as powder, liquid, and leaf. Further, based on the application the market is classified into the bakery, dairy food products, beverages, dietary supplements, confectionery, and others.

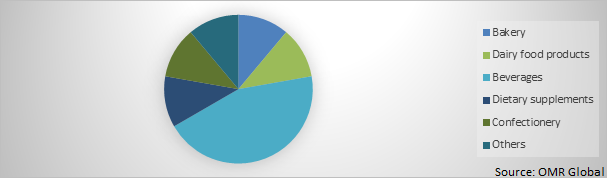

Global Stevia Market Share by Application, 2020(%)

The Beverages Segment is Considered as Dominating Segment in the Global Stevia Market.

Among its applications, beverages are expected to have a major share in the global Stevia market. Stevia holds a prominent place in the sweetener segment due to its numerous benefits, such as a substantial protein ingredient and low-calorie content. As consumers become more aware of the health benefits of stevia, it is being used more widely in the beverage industry. Stevia is a 100% natural, calorie-free sweetener that's 200 times sweeter than sugar and used to treat health issues. Several major players in the beverages sector are introducing products with natural low-calorie sweeteners, particularly stevia. Consumers from developed economies such as the US, UK, Germany, are inclined toward low-sugar fruits and vegetable juices, which is driving the demand for stevia for beverages application. For instance, in 2019, Tampico Beverages launched the zero-sugar juice concentrated drink brand Tampico ZERO in Texas owing to the increasing demand zero calories juices in the US.

Regional Outlook

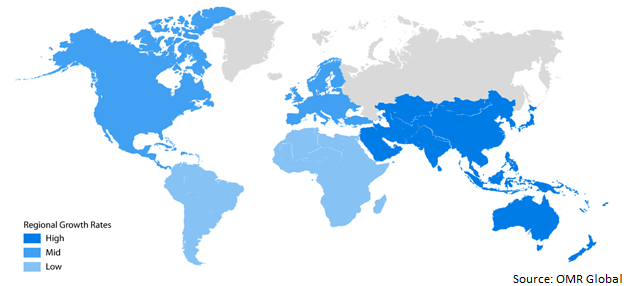

Geographically, the global stevia market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). The Asia Pacific is projected to have a significant CAGR in the Stevia market. In Asia-Pacific, health awareness is growing, the majority of people check a product's label before buying it, and this increased customer awareness has prompted producers to switch to natural sweeteners in place of high-calorie polyols. China, as the world’s production base for stevia sweeteners as stevia sweeteners is more popular among Chinese customers, who are influenced by Chinese traditional medicine and natural products.

Global Stevia Market Growth, by Region 2022-2028

North America to Hold a Considerable Share in the Global Stevia Market

Geographically, North America will dominate the stevia market due to ingredient demand from the beverage sector, which has been growing at a remarkable pace due to the rise in the US diabetic population. As diabetes is still the seventh leading cause of death in the US (according to a 2015 report by the American Diabetes Association), the companies are producing beverages with stevia as a sugar substitute, such as sports drinks. The market in the region is being aided by raising awareness about the ill effects of sugar consumption, greater government regulations, and taxation on sugary beverages. According to a report by WHO, 2016, the tax generated was USD 13 billion from taxation on sugary products, which could be utilized for promoting the health of the population and to create favorable conditions for the companies to enter the stevia market.

Market Players Outlook

The key players in the stevia market contribute significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include GLG Life Tech Corp., Ingredion Inc, Tate & Lyle PLC, The Coca-Cola Co, PepsiCo Inc., Cargill Inc., Evolva Holding S.A. among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In July 2021, Tereos, a leading French-based sweetness solutions supplier, has announced a strategic sourcing agreement for stevia extracts, allowing the company to provide its customers with innovative and reliable stevia-based sweetening solutions around the globe. BY combining Tereos’ solutions with Firmenich’s range of stevia extracts, the French business believes this agreement will further accelerate Tereos’ innovation in sugar reduction.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global stevia market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Application Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Stevia Application

• Recovery Scenario of Global Stevia Application

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.4. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Stevia Market by Product Form

5.1.1. Powder

5.1.2. Liquid

5.1.3. Leaf

5.2. Global Stevia Market by Application

5.2.1. Bakery & Confectionery

5.2.2. Dairy Food Products

5.2.3. Beverages

5.2.4. Dietary Supplements

5.2.5. Others (Convenience foods)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Archer Daniels Midland Company

7.2. Cargill Inc

7.3. Evolva Holding SA

7.4. GLG Life Tech Corporation

7.5. Guilin Layn Natural Ingredients Corp

7.6. Haihang Indsutry Co

7.7. Hyet Sweet BV

7.8. Ingredion Inc

7.9. Koninklijke DSM NV

7.10. Morita Kagakau Kogyo Co. Ltd.

7.11. PepsiCo Inc.

7.12. Purecircle Limited

7.13. PureCircle Ltd

7.14. Pyure Brands LLC

7.15. S&W Seed Company

7.16. Stevia Biotech Pvt Ltd

7.17. Sunwin Stevia International, Inc.

7.18. Tate & Lyle PLC

7.19. Van Wankum Ingredients BV

7.20. Zhucheng Haotian Pharm Co. Ltd

1. GLOBAL STEVIA MARKET RESEARCH AND ANALYSIS BY PRODUCT FORM, 2021-2028 ($ MILLION)

2. GLOBAL POWDER STEVIA MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL LIQUID STEVIA MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL LEAF STEVIA MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL STEVIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

6. GLOBAL STEVIA IN BAKERY & CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL STEVIA IN DAIRY FOOD PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL STEVIA IN BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL STEVIA IN DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL STEVIA IN OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL STEVIA MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN STEVIA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN STEVIA MARKET RESEARCH AND ANALYSIS BY PRODUCT FORM, 2021-2028 ($ MILLION)

14. NORTH AMERICAN STEVIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

15. EUROPEAN STEVIA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. EUROPEAN STEVIA MARKET RESEARCH AND ANALYSIS BY PRODUCT FORM, 2021-2028 ($ MILLION)

17. EUROPEAN STEVIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC STEVIA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC STEVIA MARKET RESEARCH AND ANALYSIS BY PRODUCT FORM, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC STEVIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. REST OF THE WORLD STEVIA MARKET RESEARCH AND ANALYSIS BY PRODUCT FORM, 2021-2028 ($ MILLION)

22. REST OF THE WORLD STEVIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL PROCESS ANALYZER, 2021-2028 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL STEVIA BY SEGMENT, 2021-2028 (% MILLION)

3. RECOVERY OF GLOBAL STEVIA MARKET, 2021-2028 (%)

4. GLOBAL STEVIA MARKET SHARE BY PRODUCT FORM, 2021 VS 2028 (%)

5. GLOBAL STEVIA MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

6. GLOBAL STEVIA MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL POWDER STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

8. GLOBAL LIQUID STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

9. GLOBAL LEAF STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

10. GLOBAL STEVIA IN BAKERY & CONFECTIONERY MARKET SIZE, 2021-2028 ($ MILLION)

11. GLOBAL STEVIA IN DAIRY FOOD PRODUCTS MARKET SIZE, 2021-2028 ($ MILLION)

12. GLOBAL STEVIA IN BEVERAGES MARKET SIZE, 2021-2028 ($ MILLION)

13. GLOBAL STEVIA IN WATER & WASTERWATER MARKET SIZE, 2021-2028 ($ MILLION)

14. GLOBAL STEVIA IN OTHERS APPLICATION MARKET SIZE, 2021-2028 ($ MILLION)

15. US STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

17. UK STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

22. ROE STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

26. ASEAN STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC STEVIA MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD STEVIA MARKET SIZE, 2021-2028 ($ MILLION)