Still Bottled Water Market

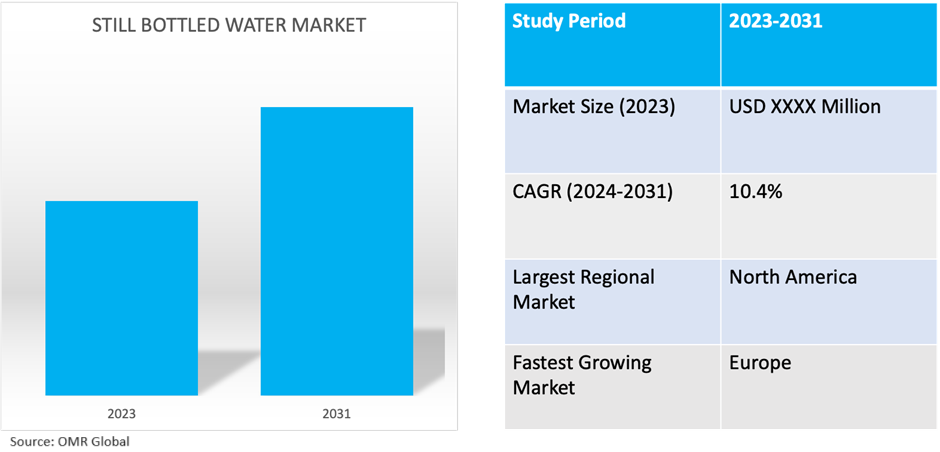

Still Bottled Water Market Size, Share & Trends Analysis Report by Size (Up to 0.5 Liters, 0.5 Liters to 1.0 Liters, 1.0 Liters to 1.5 Liters, and More than 1.5 Liters), by Bottle Type (PET, Glass, and Can), and by Distribution Channel (Off-trade and On-trade), Forecast Period (2024-2031)

Still bottled water market is anticipated to grow at a CAGR of 10.4% during the forecast period (2024-2031). A major factor supporting the market growth is the increasing consumer preference for healthy and convenient hydration options. With rising health consciousness and awareness of the importance of staying hydrated, consumers are shifting towards healthier beverage choices, including still bottled water. Additionally, concerns about water quality and safety have led consumers to choose bottled water as a reliable and convenient source of clean drinking water, especially in regions where tap water quality may be questionable.

Market Dynamics

Consumer Health Focus Driving Growth in the Still Bottled Water Market

Consumer preferences drive the global still bottled water market, with an increasing demand for healthier beverage options. As consumers become more health conscious, they are seeking alternatives to sugary drinks and carbonated beverages, leading to the growing popularity of still bottled water. Its perception as a healthier choice contributes to its steady market growth, as consumers prioritize hydration and wellness in their beverage choices. For instance, in September 2022, Essentia Water revealed the debut of Essentia Plus, a fresh line of electrolyte-infused bottled water tailored to health-conscious consumers seeking an alternative to sugary sports beverages.

Convenience and Portability Fueling Growth in the Still Bottled Water Market

The convenience and portability of still bottled water are key factors driving its market dynamics. Available in various sizes and packaging formats, still bottled water offers consumers a convenient and portable hydration option for on-the-go lifestyles. Its accessibility in supermarkets, convenience stores, and vending machines further enhances its convenience, making it a preferred choice for consumers seeking hydration anytime, anywhere.

Market Segmentation

- Based on size, the market is segmented into up to 0.5 liters, 0.5 liters to 1.0 liters, 1.0 liters to 1.5 liters, and more than 1.5 liters.

- Based on bottle type, the market is segmented into PET, glass, and can.

- Based on the distribution channel, the market is segmented into off-trade and on-trade.

More Than 1.5 Litres is Projected to Emerge as the Largest Segment

The more than 1.5 liters segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing consumer demand for value-sized packaging options. As consumers seek greater convenience and cost-effectiveness, larger-volume bottles offer them a longer-lasting supply of water at a competitive price per unit. This trend is particularly pronounced in regions where consumers prioritize bulk purchases and stockpiling, as well as in settings such as households, offices, and events where larger quantities of water are consumed.

On-Trade Segment to Hold a Considerable Market Share

The on-trade segment commands a notable market share in the global still bottled water market for various reasons such as the increasing preference for healthier beverage options among patrons frequenting bars, restaurants, and other on-premise establishments. Consumers' growing health consciousness favors still bottled water over sugary drinks and carbonated beverages, making it a popular choice in such venues. Moreover, the convenience and portability of still bottled water make it well-suited for on-trade settings, where patrons seek refreshing and hydrating options alongside their meals or beverages.

Regional Outlook

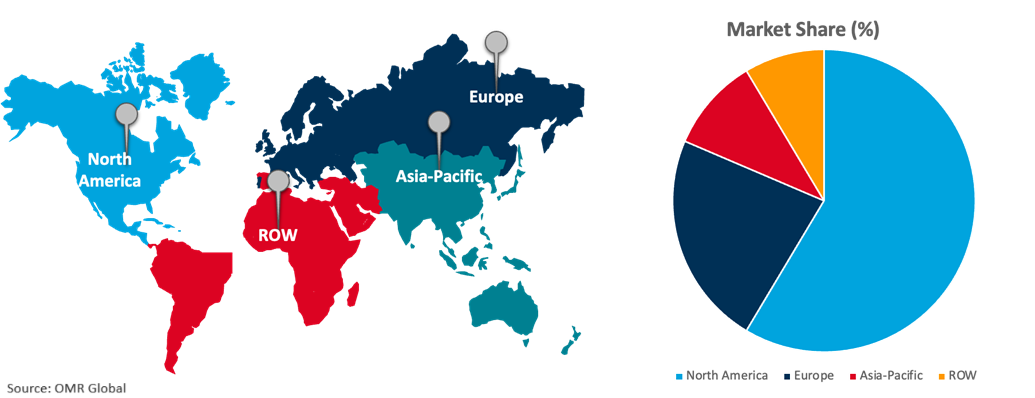

The global still bottled water market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Europe's Rising Demand Driving Growth in the Still Bottled Water Market

Europe emerges as the fastest-growing market in the global still bottled water market due to shifting consumer preferences towards healthier beverage options, coupled with an increasing emphasis on hydration and wellness, driving the demand for still bottled water in the region. Additionally, stringent regulations on sugary drinks and carbonated beverages promote the consumption of healthier alternatives like still bottled water. The convenience and portability of bottled water also contribute to its popularity among European consumers, particularly those leading busy lifestyles, and the growing awareness of environmental sustainability prompts the adoption of eco-friendly packaging solutions, further boosting the demand for still bottled water in Europe.

Global Still Bottled Water Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to a robust awareness of health and wellness trends, favoring healthier beverage options like still bottled water over sugary alternatives. Additionally, the convenience and widespread availability of still bottled water across various retail outlets contribute to its dominance. Well-established brands, renowned for their quality and innovative packaging, further solidify North America's position in the market. Despite environmental concerns, the region's busy lifestyles drive demand for convenient hydration solutions, sustaining the popularity of still bottled water. For instance, in June 2022, Coca-Cola joined forces with The Ocean Cleanup to unveil Clear Ocean, an innovative bottled water brand crafted from 100.0% recycled ocean plastic, underscoring its commitment to environmental sustainability.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global still bottled water market include Bisleri International Pvt. Ltd., Tata Consumer Products Ltd., The Coca-Cola Co., NESTLÉ WATERS MANAGEMENT & TECHNOLOGY, and Danone S.A., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in April 2023, Nestlé forged a partnership with Acreto, an organization dedicated to sustainable packaging solutions, to introduce a novel range of bottled water crafted entirely from plant-based materials.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global still bottled water market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bisleri International Pvt. Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Tata Consumer Products Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. The Coca-Cola Company

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Still Bottled Water Market by Size

4.1.1. Up to 0.5 Liters

4.1.2. 0.5 Liters to 1.0 Liters

4.1.3. 1.0 Liters to 1.5 Liters

4.1.4. More than 1.5 Liters

4.2. Global Still Bottled Water Market by Bottle Type

4.2.1. PET

4.2.2. Glass

4.2.3. Can

4.3. Global Still Bottled Water Market by Distribution Channel

4.3.1. Off-trade

4.3.1.1. Supermarkets & Hypermarkets

4.3.1.2. Convenience Stores

4.3.1.3. Grocery Stores

4.3.2. On-trade

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Aqua Maestro Inc.

6.2. CG Roxane, LLC

6.3. Danone S.A.

6.4. Essentia Water, LLC

6.5. Ferrarelle SpA

6.6. FIJI Water Company LLC

6.7. Gerolsteiner Brunnen GmbH & Co. KG

6.8. Highland Spring Group

6.9. Icelandic Glacial

6.10. Mountain Valley Spring Water

6.11. National Beverage Corp.

6.12. NESTLÉ WATERS MANAGEMENT & TECHNOLOGY

6.13. Nongfu Spring

6.14. Otsuka Pharmaceutical Co. Ltd.

6.15. PepsiCo Inc.

6.16. Primo Water Corp.

6.17. Voss Water

1. GLOBAL STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

2. GLOBAL UP TO 0.5 LITERS STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL 0.5 LITERS TO 1.0 LITERS STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL 1.0 LITERS TO 1.5 LITERS STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL MORE THAN 1.5 LITERS STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY BOTTLE TYPE, 2023-2031 ($ MILLION)

7. GLOBAL PET STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL GLASS STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CAN STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

11. GLOBAL STILL BOTTLED WATER VIA OFF-TRADE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL STILL BOTTLED WATER VIA SUPERMARKETS & HYPERMARKETS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL STILL BOTTLED WATER VIA CONVENIENCE STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL STILL BOTTLED WATER VIA GROCERY STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL STILL BOTTLED WATER VIA ON-TRADE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY BOTTLE TYPE, 2023-2031 ($ MILLION)

20. NORTH AMERICAN STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

21. EUROPEAN STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

23. EUROPEAN STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY BOTTLE TYPE, 2023-2031 ($ MILLION)

24. EUROPEAN STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY BOTTLE TYPE, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

29. REST OF THE WORLD STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY BOTTLE TYPE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD STILL BOTTLED WATER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL STILL BOTTLED WATER MARKET SHARE BY SIZE, 2023 VS 2031 (%)

2. GLOBAL UP TO 0.5 LITERS STILL BOTTLED WATER MARKET SHARE BY REGION, 2023-2031 (%)

3. GLOBAL 0.5 LITERS TO 1.0 LITERS STILL BOTTLED WATER MARKET SHARE BY REGION, 2023-2031 (%)

4. GLOBAL 1.0 LITERS TO 1.5 LITERS STILL BOTTLED WATER MARKET SHARE BY REGION, 2023-2031 (%)

5. GLOBAL MORE THAN 1.5 LITERS STILL BOTTLED WATER MARKET SHARE BY REGION, 2023-2031 (%)

6. GLOBAL STILL BOTTLED WATER MARKET SHARE BY BOTTLE TYPE, 2023 VS 2031 (%)

7. GLOBAL PET STILL BOTTLED WATER MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL GLASS STILL BOTTLED WATER MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CAN STILL BOTTLED WATER MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL STILL BOTTLED WATER MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

11. GLOBAL STILL BOTTLED WATER VIA OFF-TRADE MARKET SHARE BY REGION, 2023-2031 (%)

12. GLOBAL STILL BOTTLED WATER VIA SUPERMARKETS & HYPERMARKETS MARKET SHARE BY REGION, 2023-2031 (%)

13. GLOBAL STILL BOTTLED WATER VIA CONVENIENCE STORES MARKET SHARE BY REGION, 2023-2031 (%)

14. GLOBAL STILL BOTTLED WATER VIA GROCERY STORES MARKET SHARE BY REGION, 2023-2031 (%)

15. GLOBAL STILL BOTTLED WATER VIA ON-TRADE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 (%)

16. GLOBAL STILL BOTTLED WATER MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. US STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

19. UK STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)

31. MIDDLE EAST AND AFRICA STILL BOTTLED WATER MARKET SIZE, 2023-2031 ($ MILLION)