Street Lightning Market

Street Lightning Market Size, Share & Trends Analysis Report by Light Source (LEDs, Fluorescent Lights, HID Lamps), by Wattage Type (Less than 50W, Between 50W and 150W, and More than 150W), and by End-User (Highways, Street and Roadways, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Street lightning market is anticipated to grow at a significant CAGR of 6.4% during the forecast period. The demand for use of smart street lighting for energy conservation and high efficiency is boosting the market. Energy efficient technologies and design can cut street lighting costs dramatically often by 25-60%, these savings can eliminate or reduce the need for new power generating plants and provide the capital for alternative energy solutions for populations in remote areas. According to World Bank data the global population continues to grow at 1.1% per year and people are migrating to urban areas, so smarter land and resource use is becoming a significant area of research which fuels the use of smart street lightning across the globe. Information collection through innovative technologies such as Smart Street Lighting are important sources of data and insights for Smart Cities to improve asset management and energy conservation which is growing the demand for smart street lighting across the globe. Smart street lighting is a cost-effective solution which compromises of advance wireless communication techniques, low cost LED lights and additional sensors which controls the intensity of light. This new system provides cost and energy savings over the conventional lightning. The smart street lights can control remotely the output of individual streetlights, detect faults, monitor energy performance and, when coupled with sensors, even facilitate real time alerts for city-wide problems like traffic flow, parking spaces, electrical outages, and possible accidents and others. On the other hand, the traditional lights consume high power, have a shorter lifetime, and high replacement cost, majorly hindering the street lighting market. These factors are creating demand for street lights in the forecast period as smart street lighting uses a management system which enables streetlight luminaires that are connected to be remotely controlled and monitored through a centralised online application which conserves energy and is more efficient.

Segmental Outlook

The global street lightning market is segmented based on the light source, wattage type, and end-user. Based on light source, the market is segmented into LEDs, fluorescent lights, and HID lamps. Based on wattage type, the market is sub-segmented into less than 50W , between 50W and 150W, and more than 150W . Based on end-user the market is segmented into highways, street and roadways, and others. The above mentioned segments can be customized as per the requirements. Based on end-user the street & roadways segment is anticipated to grow at the fastest rate during the forecast period. The main reason for the growth of the street and roadways segment is due to rapid urbanization and expansion of cities across the globe. The urban areas grows larger which requires new technical solutions for the urban infrastructures to be more energy efficient. One such important system is street lighting system. More street lighting is needed to satisfy the extended networks of roads and walkways, and many street lights are outdated which is needed to be replaced. According to UNCTAD, By 2020, the share of urban population increased to 56.2%. It is generally higher in the developed cities which was around 79.2% in 2020 than in the developing world which was 51.6%. In least developed countries the people living in urban areas are in the minority 34.6%. This shows the increasing urbanization which increases the number of streets and roadways in the urban areas, which further creates the demand for street lightning in that particular area. So this will boost the market during the forecast period.

Regional Outlooks

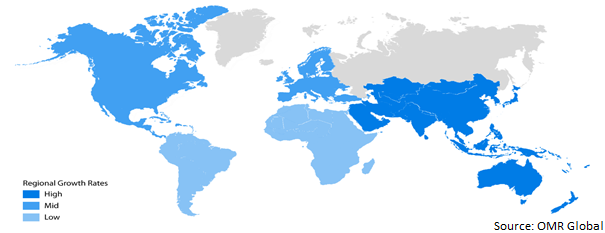

The global street lightning market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America is anticipated to grow at the fastest rate during the forecast period, owing to the rapid development of infrastructure such as smart cities, the US is leading to the development of intelligent infrastructures with smart lighting such as LEDs for energy-efficient lighting systems, which is fueling the market growth. According to The White House, in August 2021 the President and the bipartisan group announced agreement on the details of a once-in-a-generation investment in infrastructure. The legislation includes around $550 billion in new federal investment in America’s roads and bridges, water infrastructure, and more. The bipartisan Infrastructure Investment and Jobs Act will invest $110 billion of new funds for roads, and major projects, and reauthorize the surface transportation program for the next five years building on bipartisan surface transportation reauthorization bills passed out of committee earlier this year. This investment will repair and rebuild roads and bridges with a focus on climate change mitigation, resilience, equity, and safety for all users, including cyclists and pedestrians. The bill includes a total of $40 billion of new funding for bridge repair, replacement, and rehabilitation, which is a dedicated bridge investment since the construction of the interstate highway system.

Global Street Lightning Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold the Considerable Share in the Global Street Lightning Market during the Forecast Period.

The Asia-Pacific region is expected to hold the considerable share in the global street lightning market during the forecast period. The Asia-Pacific street lighting market is growing due to the high manufacturing and distribution of LED-based lighting systems and the presence of major exporters of energy-efficient light solutions. Further, several governments in the Asia-Pacific region have implemented energy-saving policies, which include the promotion of LED bulbs over the traditional incandescent bulbs. According to Governmnet of India, Ministry of Power, in 2020 the Government of India’s zero subsidy Unnat Jyoti by affordable LEDs for all (UJALA) and LED Street Lighting National Programme (SLNP), marked its fifth anniversary. SLNP is the world’s largest streetlight replacement programme and UJALA is the world’s largest domestic lighting project. Under the SLNP programme, over 1.03 crore smart LED streetlights have been installed till date, enabling an estimated energy savings of 6.97 billion kWh per year with an avoided peak demand of 1,161 MW and an estimated greenhouse gas (GHG) emission reduction of 4.80 million t CO2 annually. LED streetlights have been installed in various states across the country. Through the UJALA initiative, over 36.13 crore LED bulbs have been distributed across India. This has resulted in estimated energy savings of 46.92 billion kWh per year, avoided peak demand of 9,394 MW, and an estimated GHG emission reduction of 38 million t CO2 annually. Further, Energy Efficiency Services Limited (EESL) has an ambitious plan in this portfolio for next 4-5 years where it intends to bring investment by 2024 by covering entire rural India. It is expected that more than 30 million LED streetlights would be retrofitted/installed by EESL.

Market Players Outlook

The major companies serving the global street lightning market include Acuity Brands, Inc., Cree, Inc., General Electric Company , Koninklijke Philips N.V., OSRAM Licht AG and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance in January 2021 OSRAM Licht AG, launched new LED driver for intelligent and flexible lighting systems. It provides various energy-saving features. Further, in June 2019, Acuity Brands, Inc. acquired WhiteOptics, L.L.C. manufacturer of advanced optical components used to reflect, diffuse and control light for LED lighting used in commercial and institutional applications.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global street lightning market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Acuity Brands, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cree, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. General Electric Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Koninklijke Philips N.V.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. OSRAM Licht AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Street lightning by Light Source

4.1.1. LEDs

4.1.2. Fluorescent Lights

4.1.3. HID Lamps

4.2. Global Street lightning by Wattage Type

4.2.1. Less than 50W

4.2.2. Between 50W and 150W

4.2.3. More than 150W

4.3. Global Street lightning by End-User

4.3.1. Highways

4.3.2. Street and Roadways

4.3.3. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Dimonoff Inc.

6.2. Eaton Corp Plc

6.3. Hubbell Incorporated

6.4. K-LITE

6.5. Legrand

6.6. Panasonic holding Corp.

6.7. Schneider Electric

6.8. Signify Holding

6.9. Toshiba Lighting & Technology Corp.

1. GLOBAL STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY LIGHT SOURCE, 2021-2028 ($ MILLION)

2. GLOBAL LEDS FOR STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL FLUORESCENT LIGHTS FOR STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL HID LAMPS FOR STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY WATTAGE TYPE, 2021-2028 ($ MILLION)

6. GLOBAL STREET LIGHTNING BY LESS THAN 50W MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL STREET LIGHTNING BY BETWEEN 50W AND 150W MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL 6 STREET LIGHTNING BY MORE THAN 150W MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

10. GLOBAL STREET LIGHTNING FOR HIGHWAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL STREET LIGHTNING FOR STREET AND ROADWAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL 0 STREET LIGHTNING FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. NORTH AMERICAN STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY LIGHT SOURCE, 2021-2028 ($ MILLION)

16. NORTH AMERICAN STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY WATTAGE SOURCE, 2021-2028 ($ MILLION)

17. NORTH AMERICAN STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

18. EUROPEAN STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. EUROPEAN STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY LIGHT SOURCE, 2021-2028 ($ MILLION)

20. EUROPEAN STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY WATTAGE TYPE, 2021-2028 ($ MILLION)

21. EUROPEAN STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY LIGHT SOURCE, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY WATTAGE TYPE, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

26. REST OF THE WORLD STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. REST OF THE WORLD STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY LIGHT SOURCE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY WATTAGE TYPE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD STREET LIGHTNING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL STREET LIGHTNING MARKET SHARE BY LIGHT SOURCE, 2021 VS 2028 (%)

2. GLOBAL LEDS FOR STREET LIGHTNING MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL FLUORESCENT LIGHTS FOR STREET LIGHTNING MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL HID LAMPS FOR STREET LIGHTNING MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL STREET LIGHTNING MARKET SHARE BY WATTAGE TYPE, 2021 VS 2028 (%)

6. GLOBAL STREET LIGHTNING BY LESS THAN 50W MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL STREET LIGHTNING BY BETWEEN 50W AND 150W MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL STREET LIGHTNING BY MORE THAN 150W MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL STREET LIGHTNING MARKET SHARE BY END-USER, 2021 VS 2028 (%)

10. GLOBAL STREET LIGHTNING FOR HIGHWAYS MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL STREET LIGHTNING FOR STREET AND ROADWAYS MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL STREET LIGHTNING FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL STREET LIGHTNING MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. US STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

15. CANADA STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

16. UK STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

17. FRANCE STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

18. GERMANY STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

19. ITALY STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

20. SPAIN STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

21. REST OF EUROPE STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

22. INDIA STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

23. CHINA STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

24. JAPAN STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

25. SOUTH KOREA STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF ASIA-PACIFIC STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD STREET LIGHTNING MARKET SIZE, 2021-2028 ($ MILLION)