Submarine Battery Market

Submarine Battery Market Size, Share & Trends Analysis Report by Type (Lead-acid batteries, lithium-ion batteries, and others) and by Application (Civil and Military), Forecast Period (2024-2031)

Submarine battery market is anticipated to grow at a moderate CAGR of 4.6% during the forecast period (2024-2031). A submarine battery is a high-capacity, specialized power source that propels the vessel underwater and provides auxiliary power. These batteries are designed for extended submerged use with strict safety and performance requirements.

Market Dynamics

Growing Need for Advanced Submarine Batteries

Naval modernization initiatives worldwide are driving an increased demand for high-performance submarine batteries. Countries are investing in upgrading their submarine fleets with advanced technology and capabilities to enhance maritime security and defense. For instance, in February 2024, under the leadership of Türkiye's President, significant efforts are being made to upgrade submarines, boosting naval strength. STM Savunma Teknolojileri Mühendislik ve Ticaret A.?., a key player in Türkiye's defense sector, is crucial in modernizing Gür-Class and Preveze-Class submarines for the Turkish Navy. These upgrades include important improvements to navigation, machinery, and communication systems, aiming to equip submarines with advanced technologies for better operations in the Blue Homeland. As a part of these programs, modern submarines require reliable and efficient power sources to support their operations. High-performance submarine batteries, featuring advanced energy storage technologies, are essential components to meet the power demands of modern submarines. This growing demand underscores the critical role of submarine batteries in supporting naval modernization efforts and ensuring the operational readiness of submarines in safeguarding maritime interests globally.

Technological Advancements on Submarine Battery Evolution

Technological advancements in battery technology, particularly in lithium-ion and lithium-polymer batteries, are revolutionizing the submarine industry. These batteries provide superior energy density, extended operational lifespan, and enhanced safety features when compared to conventional lead-acid batteries. For instance, in January 2024, Hanwha Aerospace Co. and ITM Semiconductor Co. collaborated to develop lithium-ion batteries specifically for submarines. These batteries are crucial for next-generation submarines, offering shorter recharge times and higher energy density, enabling longer durations underwater. The focus of their partnership is to enhance the stability, size, and weight of the battery packs. The adoption of these advanced battery technologies is driven by their ability to meet the increasing power demands of modern submarines while offering significant improvements in efficiency and performance. As a result, naval forces worldwide are increasingly turning to these innovative battery solutions to enhance the capabilities and operational effectiveness of their submarine fleets.

Market Segmentation

Our in-depth analysis of the global submarine battery market includes the following segments by type and by application:

- Based on type, the market is sub-segmented into lead-acid batteries, lithium-ion batteries, and others.

- Based on application, the market is bifurcated into civil and military.

Lithium-Ion Batteries Power the Dive: Redefining Submarine Endurance

The submarine battery market is experiencing a revolution driven by demand for more powerful underwater vessels. Leading this transformation is the rapid growth of lithium-ion batteries, fueled by advancements in energy storage technology. Lithium-ion batteries offer significantly higher energy density than traditional lead-acid batteries, translating to extended submerged endurance critical for modern naval operations. Beyond energy density, they boast superior efficiency and lighter weight, aligning perfectly with efforts to modernize submarine fleets. For instance, the Indian Navy is shifting to lithium-ion (Li-Ion) batteries to enhance its conventional submarine fleet's performance. Following global trends, the move aims to improve range, reduce charging time, and boost operational efficiency, aligning with evolving naval strategies and technological advancements. As countries prioritize maritime security, the demand for high-performance lithium-ion batteries highlights their vital role in powering the silent sentinels of the seas.

Military Submarines Take the Lead: High-Performance Batteries Fuel Naval Modernization

The military segment of the submarine battery market is currently experiencing a period of explosive growth. This surge is driven by a global focus on naval modernization efforts. As countries prioritize maritime security and defense, they are investing heavily in upgrading their submarine fleets with advanced technology. For instance, in February 2024, The Philippines, amid tensions in the South China Sea, plans to purchase submarines as part of its military modernization. President Ferdinand Marcos Jr approved the move to bolster maritime sovereignty. Potential suppliers include France, Spain, Korea, and Italy. The decision reflects a shift towards external defense strategy. These modern submarines require high-performance batteries to support their demanding operations, with extended submerged endurance being a critical factor. Given the crucial role submarines play in national defense strategies, the military segment is expected to remain the primary driver of growth in the submarine battery market for the foreseeable future.

Regional Outlook

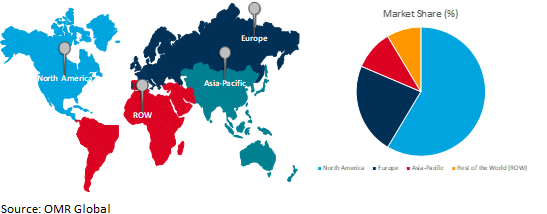

The global submarine battery market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Submarine Battery Market Growth by Region 2024-2031

Asia-Pacific: A Powerhouse in the Submarine Battery Market

The Asia-Pacific region reigns supreme in the submarine battery market, boasting both the largest market size and the fastest growth rate. This dominance is fueled by a multi-pronged approach. Increased investments in submarine production by countries like China and India create a massive demand for batteries. For instance, in July 2023, L&T has partnered with Spain's Navantia for India's Navy P75 (I) submarine project, aiming to deliver six advanced diesel-electric submarines with Air-Independent Propulsion and high Indigenous Content. The agreement supports India's Make in India initiative and strategic autonomy, with Spain offering technology transfer. Navantia will design the submarines based on its S80 class, fostering long-term cooperation in military and green energy sectors. Additionally, nations like Japan and South Korea are developing their manufacturing capabilities, reducing reliance on imports. For instance, in February 2024, South Korea begins construction of its third KSS-III Batch-II submarine, enhancing maritime security with improved combat systems and stealth capabilities, aiming to boost domestic defense production and global competitiveness.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global submarine battery market include enersys, EXIDE INDUSTRIES LTD., GS Yuasa International Ltd, HBL POWER SYSTEMS LIMITED, and Toshiba Infrastructure Systems &Solutions Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2023, EnerSys secured contracts exceeding $20 million for submarine batteries in the US and Europe. In the US, a second consecutive contract with the Navy covers its full valve-regulated lead acid (VRLA) submarine battery requirement. Production will continue in Warrensburg, Missouri. In Europe, contracts for nuclear and diesel-electric submarine batteries will be fulfilled at a new facility in Targovishte, Bulgaria.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global submarine battery market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. EnerSys

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. EXIDE INDUSTRIES LTD.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. GS Yuasa International Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. HBL Power Systems Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Toshiba Infrastructure Systems & Solutions Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Submarine Battery Market by Type

4.1.1. Lead-acid batteries

4.1.2. Lithium-ion batteries

4.1.3. Others (Silver-zinc batteries, Nickel-cadmium batteries)

4.2. Global Submarine Battery Market by Application

4.2.1. Civil

4.2.2. Military

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Altertek Ltd

6.2. Epsilor-Electric Fuel Ltd.

6.3. Ever Exceed Corp.

6.4. Kokam Battery

6.5. Korea Special Battery Co., Ltd.

6.6. Mazagon Dock Ltd.

6.7. PMB Defence

6.8. ZIBO TORCH ENERGY CO., LTD.

1. GLOBAL SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL LEAD-ACID SUBMARINE BATTERY MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL LITHIUM-ION SUBMARINE BATTERYMARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OTHERS SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBALCIVILSUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL MILITARYSUBMARINE BATTERYMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBALSUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. NORTH AMERICAN SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

10. NORTH AMERICAN SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

11. NORTH AMERICAN SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

12. EUROPEAN SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. EUROPEAN SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

14. EUROPEAN SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. ASIA-PACIFIC SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. ASIA- PACIFIC SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. ASIA-PACIFICSUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. REST OF THE WORLD SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. REST OF THE WORLD SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. REST OF THE WORLD SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2023 VS 2031 (%)

2. GLOBALLEAD-ACID SUBMARINE BATTERYMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBALLITHIUM-ION SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL OTHERS SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL SUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL CIVILSUBMARINE BATTERYMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL MILITARYSUBMARINE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL SUBMARINE BATTERYMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. US SUBMARINE BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

10. CANADA SUBMARINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

11. UK SUBMARINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

12. FRANCE SUBMARINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

13. GERMANY SUBMARINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

14. ITALY SUBMARINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

15. SPAIN SUBMARINE BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

16. REST OF EUROPE SUBMARINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

17. INDIA SUBMARINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

18. CHINA SUBMARINE BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

19. JAPAN SUBMARINE BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

20. SOUTH KOREA SUBMARINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF ASIA-PACIFIC SUBMARINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)

22. LATIN AMERICA SUBMARINE BATTERY MARKET SIZE, 2023-2031 ($ MILLION)

23. THE MIDDLE EAST & AFRICA SUBMARINE BATTERYMARKET SIZE, 2023-2031 ($ MILLION)