Sugar Market

Sugar Market Size, Share & Trends Analysis Report by Product Type (White Sugar, Brown Sugar, and Liquid Sugar), by Form (Granulated Sugar, Powdered Sugar, and Syrup Sugar), by Source (Sugarcane and Sugar Beet), and by End-Use (Food & Beverages, Pharmaceuticals, and Personal Care), Forecast Period (2024-2031)

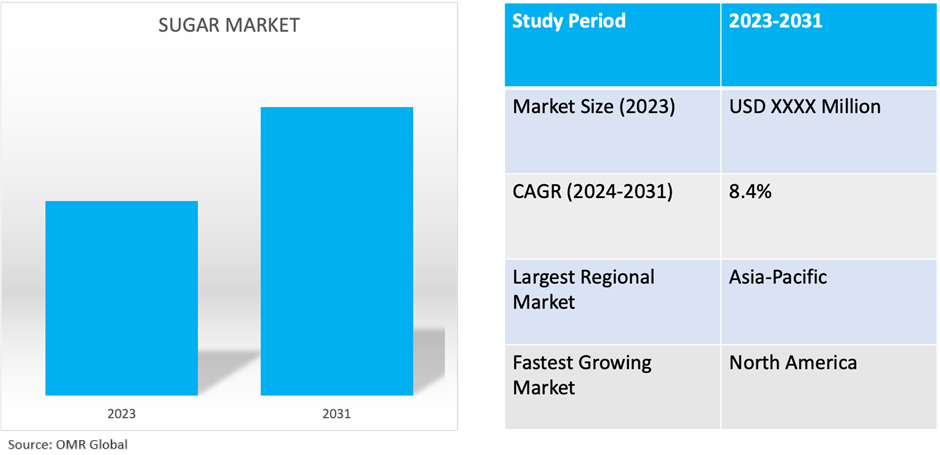

Sugar market is anticipated to grow at a CAGR of 8.4% during the forecast period (2024-2031). Factors such as population growth, rising disposable incomes, and changing consumer lifestyles, especially in emerging economies, are driving the demand for sugar-based products. Moreover, the growing popularity of convenience foods and the expansion of the food processing industry are further boosting the demand for sugar.

Market Dynamics

Balancing Supply and Demand Dynamics in the Global Sugar Market

The global sugar market is influenced by the balance between supply and demand. Factors such as weather conditions, crop yields, and changes in consumer preferences impact sugar production levels. Increasing population and urbanization drive demand for sugar-containing products, while dietary shifts and health concerns influence consumption patterns. Understanding and forecasting supply and demand dynamics are crucial for stakeholders to make informed decisions regarding production, pricing, and market positioning.

Market players are expanding their production capacity to meet the market demand. For instance, in February 2021, integrated ethanol, sugar, and bioenergy major Raízen S.A. announced that it had signed a commercial agreement to incorporate the assets of Biosev S.A., a Brazilian subsidiary of Louis Dreyfus Holding. The deal, which is subject to regulatory approval, includes nine production units strategically located in Brazil – six in the state of São Paulo, two in Mato Grosso do Sul, and one in Minas Gerais – with a total installed sugarcane processing capacity of up to 32.0 million tons.

Navigating Price Volatility in the Sugar Market

Sugar prices are subject to fluctuations due to various factors including changes in production levels, influenced by weather events and agricultural practices, and can affect supply and demand dynamics, leading to price volatility. Currency exchange rates, trade policies, and geopolitical tensions also impact sugar prices. Additionally, speculation in commodity markets and investor sentiment contribute to short-term price fluctuations. Managing price volatility requires effective risk management strategies and market monitoring by industry participants to mitigate potential impacts on profitability and market stability.

Market Segmentation

- Based on product type, the market is segmented into white sugar, brown sugar, and liquid sugar.

- Based on form, the market is segmented into granulated sugar, powdered sugar, and syrup sugar.

- Based on the source, the market is segmented into sugarcane and sugar beet.

- Based on end-use, the market is segmented into food & beverages, pharmaceuticals, and personal care.

Brown Sugar is Projected to Emerge as the Largest Segment

The brown sugar segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing consumer preference for natural and minimally processed food products. Brown sugar is perceived as less refined compared to white sugar, retaining some of the natural molasses content from the sugarcane refining process. This gives brown sugar a distinct flavor and slightly darker color, appealing to consumers seeking a more natural and wholesome sweetening option. Additionally, the growing trend towards healthier eating habits has led to increased awareness of the potential health benefits of brown sugar, as it may contain slightly higher levels of minerals and antioxidants compared to white sugar.

Personal Care Segment to Hold a Considerable Market Share

The personal care segment maintains a significant market share in the global sugar market for several reasons. Sugar serves functional roles in formulations, acting as a bulking agent, sweetener, or stabilizer in personal care products. Its natural origin and renewable nature align with consumer preferences for natural and sustainable ingredients. Sugar contributes to desirable texture and sensory attributes in personal care items, enhancing user experience. With the increasing demand for natural alternatives and customization in formulations, sugar offers versatility and innovation opportunities.

Regional Outlook

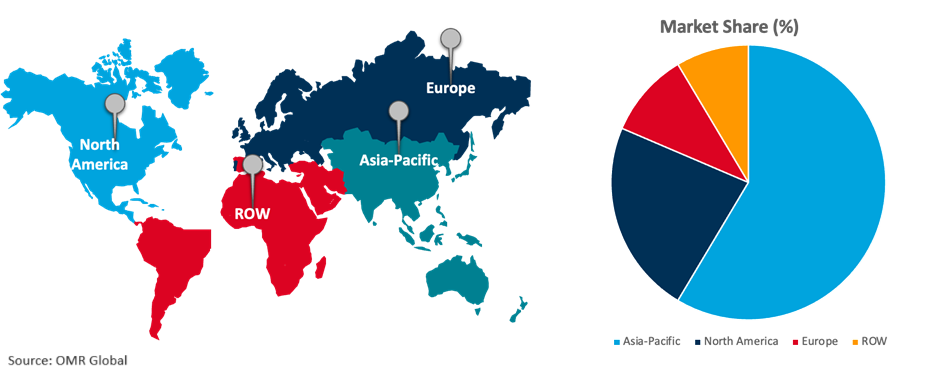

The global sugar market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Driving Forces Behind North America's Surge in the Global Sugar Market

North America is experiencing rapid growth in the global sugar market due to the increasing demand for sugar and sugar-containing products in the food and beverage industry. Consumers' affinity for sweetened beverages, processed foods, and confectionery items fuels the demand for sugar as a primary ingredient. Additionally, North America's growing population and rising disposable incomes contribute to higher consumption levels. Moreover, the region's robust food processing and manufacturing sector further stimulates demand for sugar as an essential ingredient in various food products. Furthermore, technological advancements and innovations in sugar production, along with efficient distribution networks, facilitate market growth in North America. For instance, in August 2023, "Just Date," a venture established by Dr. Sylvie Charles specializing in organic sugar production, unveiled plans for a nationwide expansion in collaboration with Sprouts Farmers Market Stores. This strategic initiative is designed to bolster the company's footprint in the United States and meet the growing demand within the market.

Global Sugar Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share due to the significant population size and rapid urbanization driving substantial demand for sugar and sugar-containing products. Rising disposable incomes across many Asian countries empower consumers to afford a wider range of food and beverage options, including those with added sugars, and traditional culinary practices in many Asian cultures heavily incorporate sugar, further bolstering demand. Additionally, the presence of major sugar-producing countries such as India, Thailand, and China contributes to the region's dominance in sugar production and trade. For instance, in August 2023, Mumbai-headquartered UPL Sustainable Agriculture Solutions (UPL SAS) and Hyderabad-based NSL Sugars entered a Memorandum of Understanding (MoU) to advance sustainable practices in sugarcane production. UPL SAS is focused on expanding its market presence, while NSL aims to leverage the advantages of sustainable cultivation methods. The collaboration aims to achieve a 15.0% enhancement in sugarcane yield per acre, equivalent to an increase of 5 metric tonnes.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global sugar market include Cosan, Associated British Foods plc, Wilmar International Ltd., Dalmia Bharat Sugar and Industries Limited, and Rajshree Sugars & Chemicals Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2021, Dalmia Bharat Sugar, a prominent sugar manufacturer headquartered in India, disclosed its strategic move to venture into the direct-to-consumer market. The company unveiled its latest packaged sugar product, branded as Dalmia Utsav, marking its entry into this segment.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global sugar market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Associated British Foods Plc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cosan S.A.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Wilmar International Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Sugar Market by Product Type

4.1.1. White Sugar

4.1.2. Brown Sugar

4.1.3. Liquid Sugar

4.2. Global Sugar Market by Form

4.2.1. Granulated Sugar

4.2.2. Powdered Sugar

4.2.3. Syrup Sugar

4.3. Global Sugar Market by Source

4.3.1. Sugarcane

4.3.2. Sugar Beet

4.4. Global Sugar Market by End-Use

4.4.1. Food & Beverages

4.4.2. Pharmaceuticals

4.4.3. Personal Care

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Al Khaleej Sugar

6.2. American Crystal Sugar Company

6.3. Bajaj Hindusthan Sugar Ltd.

6.4. Bannari Amman Group

6.5. Cargill, Inc.

6.6. Dalmia Bharat Sugar and Industries Limited

6.7. Dhampur Bio Organics Ltd.

6.8. Dhanraj Sugars Pvt. Ltd.

6.9. Imperial Sugar Company

6.10. Lantic Inc.

6.11. Louis Dreyfus Holding B.V.

6.12. Michigan Sugar Company

6.13. Mitr Phol Group

6.14. Nile Sugar

6.15. Nordzucker AG

6.16. Raizen

6.17. Rajshree Sugars & Chemicals Ltd. (RSCL)

6.18. Shree Renuka Sugars Ltd.

6.19. Südzucker AG

6.20. Tereos

6.21. Thai Roong Ruang Sugar Group

6.22. Thai Sugar Group Co., Ltd.

1. GLOBAL SUGAR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL WHITE SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BROWN SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL LIQUID SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SUGAR MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

6. GLOBAL GRANULATED SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL POWDERED SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL SYRUP SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SUGAR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

10. GLOBAL SUGARCANE SOURCED SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SUGAR BEET SOURCED SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SUGAR MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

13. GLOBAL SUGAR IN FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL SUGAR IN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL SUGAR IN PERSONAL CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN SUGAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN SUGAR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN SUGAR MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

20. NORTH AMERICAN SUGAR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

21. NORTH AMERICAN SUGAR MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

22. EUROPEAN SUGAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN SUGAR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

24. EUROPEAN SUGAR MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

25. EUROPEAN SUGAR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

26. EUROPEAN SUGAR MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC SUGAR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC SUGAR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC SUGAR MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC SUGAR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC SUGAR MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD SUGAR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD SUGAR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD SUGAR MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

35. REST OF THE WORLD SUGAR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

36. REST OF THE WORLD SUGAR MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

1. GLOBAL SUGAR MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL WHITE SUGAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL BROWN SUGAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL LIQUID SUGAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL SUGAR MARKET SHARE BY FORM, 2023 VS 2031 (%)

6. GLOBAL GRANULATED SUGAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL POWDERED SUGAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL LIQUID SUGAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL SUGAR MARKET SHARE BY SOURCE, 2023 VS 2031 (%)

10. GLOBAL SUGARCANE SOURCED SUGAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SUGAR BEET SOURCED SUGAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL SUGAR MARKET SHARE BY END-USE, 2023 VS 2031 (%)

13. GLOBAL SUGAR IN FOOD & BEVERAGES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL SUGAR IN PHARMACEUTICALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL SUGAR IN PERSONAL CARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL SUGAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. US SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

19. UK SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA SUGAR MARKET SIZE, 2023-2031 ($ MILLION)

31. MIDDLE EAST AND AFRICA SUGAR MARKET SIZE, 2023-2031 ($ MILLION)