Sugar Substitutes Market

Global Sugar Substitutes Market Size, Share & Trends Analysis Report by Type (Aspartame, Acesulfame Potassium, Sucralose, Stevia and Others), and by Application (Food & Beverage, Pharmaceuticals, and Personal care & Cosmetics) Forecast Period (2021-2027) Update Available - Forecast 2025-2035

The global sugar substitutes market is anticipated to grow at a significant CAGR of 5.1% during the forecast period. The global sugar substitutes are observed to grow in recent years due to increase in health awareness among the people globally. Consumers are avoiding the use of sugar and adapting sugar free products. Beverages are high in demand among the consumers, thus companies are using substitutes of sugar in place of regular sugar. For instance, in April 2021 Manus Bio, Inc launched NutraSweet Natural, a plant-based sweetener with zero calories. NutraSweet Natural is made from stevia leaf. Further, rapidly rise incidences of obesity, diabetes, and metabolic syndrome have become major health issues owing to their association with imbalanced calorie intake, which will drive the growth of the market.

Impact of COVID-19 Pandemic on Global Sugar Substitutes Market

The effects COVID-19 has created the awareness among the people to eat healthy food. Nowadays people prefer less sugary and immunity booster products. Many consumers avoided the use of sugar in their daily food consumption as during the pandemic period people were staying at home there was minimal physical activity was involved due to which many people gained weight and faced Obesity. To reduce the weight gain people avoided and reduced the sugar consumption and switched to sugar free products. For instance, in 2020, Tate & Lyle launched sweetener vantage expert systems with an education programme. Sweetener vantage is a sweetener solution design tools, designed to create sugar-reduced food and drink.

Segmental Outlook

The global sugar substitutes market is segmented based on the type and application. Based on the type, the market is segmented into aspartame, acesulfame potassium, sucralose, stevia and others including saccharine, sugar alcohols. Based on the application, the market is sub-segmented into the Food & Beverage, Pharmaceuticals, and Personal care & Cosmetics.

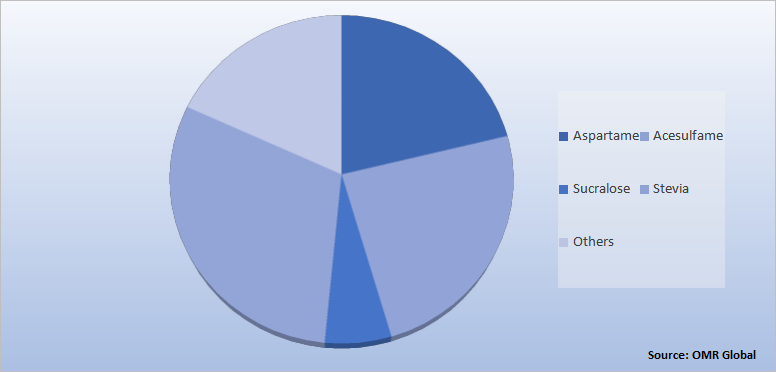

Global Sugar Substitutes Market Share by Type, 2020 (%)

The Stevia Segment Holds the Major Share in the Global Sugar Substitutes Market

Stevia is a natural sweetener extracted from Stevia rebaudiana plant leaves used in food items as a substitute of sugar. Stevia helps in lowering high blood pressure. Many companies are using stevia to add the sweetener taste in beverages as substitute of sugar. For instance, in 2018, PureCircle launched new food and beverage products which contains stevia leaf as a sweetener and in 2019 the company has also launched stevia leaf sweetener, Reb M in Singapore.

Regional Outlooks

The global sugar substitutes market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for region or country level as per the requirement.

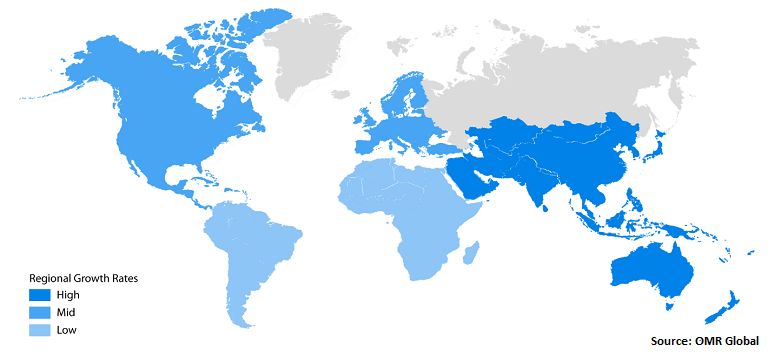

Global Sugar Substitutes Market Growth, by Region, 2021-2027

The North America Region Holds the Major Share in the Global Sugar Substitutes Market

The demand for replacement of sugar in food & beverages is high in North America due to changing lifestyle and eating habit of the consumers. This is expected that North America holds the major market share in sugar substitutes market. For instance, in July 2021, Coca-Cola launches Coca-Cola Zero Sugar. The ingredients used in production of zero sugar coke are Aspartame and acesulfame potassium. Additionally in March 2021, Pepsi has also changed its ingredients and launched diet pepsi with less sweet and fizzier.

Market Players Outlook

The major companies serving the global sugar substitutes market include Ajinomoto Co., Inc., Archer Daniels Midland Company, BENEO GmbH, Fooditive Group, Ingredion Incorporated, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in April 2021, Fooditive updates food waste into innovative natural sweetener by using sustain-apple solutions to reduce global sugar intake. In December 2021, B.T. Sweet, Ltd. launched Cambya, which is a plant-based, one-to-one drop for sugar replacement. Cambya is made from soluble fibers, monk fruit, and botanicals. In June 2017, the largest sugar substitute company of India, Zydus Wellness announced the launch of its new variant, Sugar Free Green which is made from Stevia leaves.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global sugar substitutes market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Sugar Substitutes Market

• Recovery Scenario of Global Sugar Substitutes Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Sugar Substitutes Market by Type

4.1.1. Aspartame

4.1.2. Acesulfame Potassium

4.1.3. Sucralose

4.1.4. Stevia

4.1.5. Others (Saccharine and Sugar Alcohols)

4.2. Global Sugar Substitutes Market by Application

4.2.1. Food & Beverage

4.2.2. Pharmaceuticals

4.2.3. Personal Care & Cosmetics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ajinomoto Co., Inc.

6.2. Archer Daniels Midland Co.

6.3. BENEO GmbH

6.4. Fooditive Group

6.5. Ingredion Inc.

6.6. JK Sucralose Inc.

6.7. Kyung-In Synthetic Corp.

6.8. Manus Bio Inc.

6.9. PureCircle

6.10. Roquette Frères

6.11. Tate & Lyle plc

6.12. Viachem

6.13. Zydus Wellness LTD.

1. GLOBAL SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL ASPARTAME MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL ACESULFAME MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL SUCRALOSE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL STEVIA MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

8. GLOBAL SUGAR SUBSTITUE IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL SUGAR SUBSTITUE IN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL SUGAR SUBSTITUE IN PERSONAL CARE & COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

14. NORTH AMERICAN SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

15. EUROPEAN SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. EUROPEAN SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

17. EUROPEAN SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

21. REST OF THE WORLD SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. REST OF THE WORLD SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

23. REST OF THE WORLD SUGAR SUBSTITUTES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL SUGAR SUBSTITUTES MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL SUGAR SUBSTITUTES MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL SUGAR SUBSTITUTES MARKET, 2021-2027 (%)

4. GLOBAL SUGAR SUBSTITUTES MARKET SHARE BY TYPE, 2020 VS 2027 (%)

5. GLOBAL ASPARTAME MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL ACESULFAME POTASSIUM MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL SUCRALOSE POTASSIUM MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL STEVIA POTASSIUM MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL OTHERS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL SUGAR SUBSTITUTES MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

11. GLOBAL SUGAR SUBSTITUES IN FOOD & BEVERAGE MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL SUGAR SUBSTITUES IN PHARMACEUTICALS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL SUGAR SUBSTITUES IN PERSONAL CARE & COSMETICS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL SUGAR SUBSTITUTES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. US SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

16. CANADA SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

17. UK SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

18. FRANCE SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

19. GERMANY SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

20. ITALY SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

21. SPAIN SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF EUROPE SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

23. INDIA SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

24. CHINA SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

25. JAPAN SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

26. SOUTH KOREA SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF ASIA-PACIFIC SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF THE WORLD SUGAR SUBSTITUTES MARKET SIZE, 2020-2027 ($ MILLION)