Sulphonamides Market

Global Sulphonamides Market Size, Share & Trends Analysis Report, By Route of Administration (Oral and Topical), By Application (Urinary Tract Infection, Skin Infection, Eye Infection, Respiratory Tract Infection, Gastrointestinal Tract Infection, and Others) and Forecast, 2019-2025 Update Available - Forecast 2025-2035

The global sulphonamides market is estimated to grow at a CAGR of nearly 4.0% during the forecast period. Increasing prevalence of urinary tract infection and skin infection is the major factor contributing to the growth of the market. As per the World Health Organization (WHO), urinary tract infection (UTI) is the major cause of morbidity and healthcare spending among all age group individuals. An estimated 40%-50% of women witnessed having UTI at some point in their lives. Significant rise in the elderly population is one of the causes leading to an increased prevalence of UTIs. As per the United Nations (UN), by 2050, one in six people globally will be more than the age of 65 (16%), increased from one in 11 in 2019 (9%).

UTIs are considered as common concerns ins the ageing population. The condition ranges from relatively benign cystitis to potentially severe pyelonephritis. An aged person suffering from mental difficulties are observed for other UTI signs, including bloody urine, pressure in the lower pelvis, and pain or burning with urination. UTIs may occur either due to the pathogenicity of the organism, the susceptibility of the host or a combination of both factors. Antimicrobials, including Sulfonamides, nalidixic acid, and trimethoprim-sulfamethoxazole are commonly used for the treatment of UTIs.

These medications are useful to treat uncomplicated lower and acute UTIs in an outpatient environment. Sulphonamides have a wide range of antimicrobial activity against several microorganisms such as bacteria and some protozoa including plasmodia and toxoplasma. Currently, they are normally used in combination with other agents including pyrimethamine and trimethoprim to treat parasitic diseases. The main parasitic causes of UTIs include leishmaniasis, filariasis, schistosomiasis, and trichomoniasis. Therefore, it is expected that sulphonamides have significant applications in the treatment of UTIs, which in turn, is encouraging the market growth.

Market Segmentation

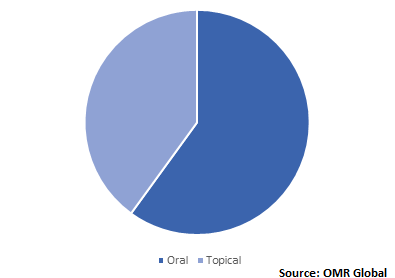

The global sulphonamides market is segmented based on the route of administration and application. Based on the route of administration, the market is classified into oral and topical. Based on application, the market is classified into urinary tract infection, skin infection, eye infection, respiratory tract infection, gastrointestinal tract infection, and others.

Oral sulphonamides finds its significant application in route of administration

Orally administered sulphonamides are available in the form of powder, tablets, and capsules. Oral sulphonamides have significant applications in UTIs and gastrointestinal tract infection. Sulphonamides which not absorbed can be orally administered for the treatment of specific localized infections in the gastrointestinal tract. Oral sulfonamides are excreted quickly and highly soluble in urine and therefore, it is often used for the treatment of urinary tract infections. Sulfamethoxazole is a type of oral sulfonamide antibiotic which is provided in combination with trimethoprim, for the treatment of several UTIs, respiratory infection, and gastrointestinal tract infections.

Global Sulphonamides Market Share by Route of Administration, 2018 (%)

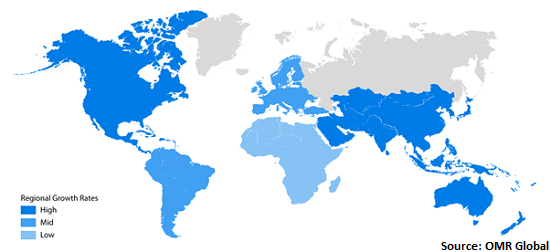

Regional Outlook

The global sulphonamides market is classified into North America, Europe, Asia-Pacific, and Rest of the World. North American sulphonamides market is estimated to hold the prominent share in the market owing to the significant prevalence of UTIs and gastrointestinal tract infections in the region. Nearly 7 million official visits and over 1 million hospitalizations reported due to UTI in the US each year. This contributes to the demand for sulphonamides in the country as an antimicrobial agent for the treatment of UTIs. In addition, increasing drug discovery coupled with the availability of grants to the research institutes and start-ups leads to the demand for sulphonamides as a significant number of US FDA approved drugs contains sulphonamide.

Global Sulphonamides Market Growth, by Region 2019-2025

Market Players Outlook

The major players operating in the market include GlaxoSmithKline plc, Bayer AG, Pfizer Inc., Allergan plc, and Mylan N.V. Introduced in 1935, Prontosil by Bayer AG was the first sulfa drug that successfully treated bacterial infections. The drug found to possess active properties that support to fight against human infections occurred due to the bacterial streptococci and is used for the treatment of certain forms of blood-poisoning and puerperal fever. It has also applications in the treatment of meningitis resulted due to the meningococcus and other infections. In addition, Pfizer offers SILVADENE (silver sulfadiazine) which works by stopping the bacterial growth that may infect the open wound and thereby enables to spread the risk of bacteria to the skin or blood where it may lead to a severe blood infection (Sepsis). This drug is indicated for the prevention and treatment of wound infections among patients with serious burns.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global sulphonamides market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. GlaxoSmithKline plc

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bayer AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Pfizer Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Allergan plc

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Mylan N.V.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Sulphonamides Market by Route of Administration

5.1.1. Oral

5.1.2. Topical

5.2. Global Sulphonamides Market by Application

5.2.1. Urinary Tract Infection

5.2.2. Skin Infection

5.2.3. Eye Infection

5.2.4. Respiratory Tract Infection

5.2.5. Gastrointestinal Tract Infection

5.2.6. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AA Pharma Inc.

7.2. Abbott Laboratories

7.3. Allergan plc

7.4. Bausch Health Companies Inc.

7.5. Bayer AG

7.6. Boehringer Ingelheim International GmbH

7.7. Cipla Ltd.

7.8. DK Pharmachem Pvt. Ltd.

7.9. F. Hoffmann-La Roche AG

7.10. GlaxoSmithKline plc

7.11. Lexine Technochem Pvt. Ltd.

7.12. Mylan N.V.

7.13. Pfizer Inc.

7.14. Prudence Pharma Chem

7.15. Teva Pharmaceutical Industries Ltd.

1. GLOBAL SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

2. GLOBAL ORAL SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL TOPICAL SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

5. GLOBAL SULPHONAMIDES IN URINARY TRACT INFECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL SULPHONAMIDES IN SKIN INFECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL SULPHONAMIDES IN EYE INFECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL SULPHONAMIDES IN RESPIRATORY TRACT INFECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL SULPHONAMIDES IN GASTROINTESTINAL TRACT INFECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL SULPHONAMIDES IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

14. NORTH AMERICAN SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

15. EUROPEAN SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

17. EUROPEAN SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

21. REST OF THE WORLD SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

22. REST OF THE WORLD SULPHONAMIDES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL SULPHONAMIDES MARKET SHARE BY ROUTE OF ADMINISTRATION, 2018 VS 2025 (%)

2. GLOBAL SULPHONAMIDES MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL SULPHONAMIDES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)

6. UK SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD SULPHONAMIDES MARKET SIZE, 2018-2025 ($ MILLION)