Superabsorbent Polymer (SAP) Market

Superabsorbent Polymer (SAP) Market Size, Share & Trends Analysis Report by Type (Sodium Polyacrylate, Polyacrylamide Copolymer, Polyacrylate Copolymers, Ethylene Maleic Anhydride Copolymers, Polysaccharides, and Others), and by Application (Pharmaceuticals, Personal Care, Baby Care, Agriculture, Packaging, Construction, and Others) Forecast Period (2023-2029) Update Available - Forecast 2025-2031

Superabsorbent polymer (SAP) market is anticipated to grow at a significant CAGR of 5.9% during the forecast period. The major factor that drives the market growth includes, the increasing application of superabsorbent polymer in baby care products such as diapers and sanitary napkins, as it absorbs a large amount of aqueous, water, and menstrual fluid. In 2020, the National Diaper Bank Network distributed more than 100 million diapers to 220 diaper banks, a 67% spike from 2019. Additionally, the regulatory bodies are introduced various innovative solutions in the superabsorbent polymer which further drives the market growth. For instance, in July 2021, the University of Michigan, in collaboration with Procter & Gamble (P&G), unveiled an energy-efficient way to repurpose a common polymer into another useful material. The bodies developed superabsorbent polymer (SAP), made with crosslinked poly(acrylic acid), or PAA,++ it absorbs 10,000% of its weight in water. This development in polymer processing reduced single-use product waste and a reduction of reliance on petroleum for polymer materials.

Segmental Outlook

The global superabsorbent polymer (SAP) market is segmented based on the type and application. Based on type, the market is subdivided into sodium polyacrylate, polyacrylamide copolymers, polyacrylate copolymers, ethylene maleic anhydride copolymers, polysaccharides, and others. Based on application, the market is categorized into pharmaceuticals, personal care, baby care, agriculture, packaging, construction, and others. Based on application, the personal care segment is projected to witness strong growth owing to the rising need for superabsorbent polymers among personal care products. A superabsorbent polymer provides excellent liquid absorption and retention capacity of up to 1,000 times its weight in fluid, superior thickening capacity with fast aqueous absorption, improved swelling, and superabsorbent capacity when in contact with water and liquids. Hence, owing to numerous features offered by superabsorbent polymers drive the personal care segment.

Based on type, the polyacrylate copolymers segment is anticipated to grow at a significant rate. Polyacrylate copolymers are widely used among numerous end-user industries, such as paints and coatings, films, organic glass, and adhesives. In addition, the increasing application of polyacrylate copolymers in the field of medicine, especially in dentistry to manufacture artificial jaws, is another factor that propels the segment growth.

Regional Outlooks

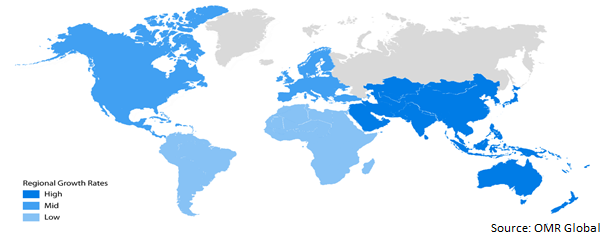

The global superabsorbent polymer (SAP) market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. The North American region is anticipated to register significant market growth. The regional growth is attributed due to increased demand from manufacturers of baby diapers owing to its high water absorption and retention capacity.

Global Superabsorbent Polymer (SAP) Market Growth, by Region 2023-2029

The European Region Dominates the Global Superabsorbent Polymer (SAP) Market

The European region is anticipated to grow at a significant rate in the global superabsorbent polymer market. The growth is mainly attributed owing to the increased application of superabsorbent polymers among pharmaceuticals, baby care, and agriculture end-user industries. Moreover, the presence of major market players which include, BASF, Evonik Industries, and others that provide a numerous range of superabsorbent polymers is further driving the market growth. For instance, in March 2021, BASF announced its expanded innovation capabilities for its superabsorbent polymer business by building a state-of-the-art Superabsorbents Excellence Center at its Verbund site in Antwerp, Belgium. The superabsorbent polymer offered by BASF is used for baby care, adult, and feminine hygiene.

Market Players Outlook

The major companies serving the global superabsorbent polymer (SAP) market include BASF SE, Evonik Industries, LG Chem, Chase Corp., Nippon Shokubai Co., Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, geographical expansions, partnerships, product launches, and collaborations, to stay competitive in the market. For instance, in November 2021, Nippon Shokubai Co., Ltd., LiveDo Corporation., and Total Care System Co., Ltd. jointly developed a variety of technologies to promote the spread of systems that recycle disposable diapers. The three companies have recently developed a new technology for recycling superabsorbent polymers (SAPs) in used diapers. With this technology, the company increases the recovery rate of paper pulp by processing SAPs, reduces energy consumption during the recycling process, and protects the water quality of rivers and other bodies of water.

The Report Covers

- Market value data analysis of 2023 and forecast to 2029.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global superabsorbent polymer (SAP) market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

1.1. Key Company Analysis

3.1. BASF SE

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Sumitomo Seika Chemicals Co. Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Evonik Industries AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. LG Chem, Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Nippon Shokubai Co., Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Superabsorbent Polymer (SAP) Market by Type

4.1.1. Sodium Polyacrylate

4.1.2. Polyacrylamide Copolymer

4.1.3. Polyacrylate Copolymers

4.1.4. Ethylene Maleic Anhydride Copolymers

4.1.5. Polysaccharides

4.1.6. Others

4.2. Global Superabsorbent Polymer (SAP) Market by Application

4.2.1. Pharmaceuticals

4.2.2. Personal Care

4.2.3. Baby Care

4.2.4. Agriculture

4.2.5. Packaging

4.2.6. Construction

4.2.7. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Formosa Plastics Corp.

6.2. Hosokawa Micron B.V.

6.3. Kao Corp.

6.4. M2 Polymer Technologies Inc

6.5. Sanyo Chemical Industries Ltd.

6.6. Shenghong Holding Group

6.7. Xitao Polymer Co., Ltd

6.8. Yixing Danson

1. GLOBAL SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2029 ($ MILLION)

2. GLOBAL SODIUM POLYACRYLATE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

3. GLOBAL POLYACRYLAMIDE COPOLYMER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

4. GLOBAL POLYACRYLATE COPOLYMERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

5. GLOBAL ETHYLENE MALEIC ANHYDRIDE COPOLYMERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

6. GLOBAL POLYSACCHARIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

7. GLOBAL OTHERS SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

8. GLOBAL SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

9. GLOBAL SUPERABSORBENT POLYMER (SAP) FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

10. GLOBAL SUPERABSORBENT POLYMER (SAP) FOR PERSONAL CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

11. GLOBAL SUPERABSORBENT POLYMER (SAP) FOR BABY CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

12. GLOBAL SUPERABSORBENT POLYMER (SAP) FOR AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

13. GLOBAL SUPERABSORBENT POLYMER (SAP) FOR PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

14. GLOBAL SUPERABSORBENT POLYMER (SAP) FOR CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

15. GLOBAL SUPERABSORBENT POLYMER (SAP) FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

16. NORTH AMERICAN SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

17. NORTH AMERICAN SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2029 ($ MILLION)

18. NORTH AMERICAN SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

19. EUROPEAN SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

20. EUROPEAN SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2029 ($ MILLION)

21. EUROPEAN SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

22. ASIA-PACIFIC SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

23. ASIA-PACIFIC SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2029 ($ MILLION)

24. ASIA-PACIFIC SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

25. REST OF THE WORLD SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

26. REST OF THE WORLD SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2029 ($ MILLION)

27. REST OF THE WORLD SUPERABSORBENT POLYMER (SAP) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

1. GLOBAL SUPERABSORBENT POLYMER (SAP) MARKET SHARE BY TYPE, 2021 VS 2029 (%)

2. GLOBAL SODIUM POLYACRYLATE MARKET SHARE BY REGION, 2021 VS 2029 (%)

3. GLOBAL POLYACRYLAMIDE COPOLYMER MARKET SHARE BY REGION, 2021 VS 2029 (%)

4. GLOBAL POLYACRYLATE COPOLYMERS MARKET SHARE BY REGION, 2021 VS 2029 (%)

5. GLOBAL ETHYLENE MALEIC ANHYDRIDE COPOLYMERS MARKET SHARE BY REGION, 2021 VS 2029 (%)

6. GLOBAL POLYSACCHARIDES MARKET SHARE BY REGION, 2021 VS 2029 (%)

7. GLOBAL OTHERS MARKET SHARE BY REGION, 2021 VS 2029 (%)

8. GLOBAL SUPERABSORBENT POLYMER (SAP) MARKET SHARE BY APPLICATION, 2021 VS 2029 (%)

9. GLOBALSUPERABSORBENT POLYMER (SAP) FOR PHARMACEUTICALS MARKET SHARE BY REGION, 2021 VS 2029 (%)

10. GLOBALSUPERABSORBENT POLYMER (SAP) FOR PERSONAL CARE MARKET SHARE BY REGION, 2021 VS 2029 (%)

11. GLOBAL SUPERABSORBENT POLYMER (SAP) FOR BABY CARE MARKET SHARE BY REGION, 2021 VS 2029 (%)

12. GLOBAL SUPERABSORBENT POLYMER (SAP) FOR AGRICULTURE MARKET SHARE BY REGION, 2021 VS 2029 (%)

13. GLOBAL SUPERABSORBENT POLYMER (SAP) FOR PACKAGING MARKET SHARE BY REGION, 2021 VS 2029 (%)

14. GLOBALSUPERABSORBENT POLYMER (SAP) FOR CONSTRUCTION MARKET SHARE BY REGION, 2021 VS 2029 (%)

15. GLOBAL SUPERABSORBENT POLYMER (SAP) FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2029 (%)

16. GLOBAL SUPERABSORBENT POLYMER (SAP) MARKET SHARE BY REGION, 2021 VS 2029 (%)

17. US SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

18. CANADA SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

19. UK SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

20. FRANCE SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

21. GERMANY SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

22. ITALY SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

23. SPAIN SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

24. REST OF EUROPE SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

25. INDIA SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

26. CHINA SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

27. JAPAN SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

28. SOUTH KOREA SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

29. REST OF ASIA-PACIFIC SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)

30. REST OF THE WORLD SUPERABSORBENT POLYMER (SAP) MARKET SIZE, 2021-2029 ($ MILLION)