Superdisintegrants Market

Superdisintegrants Market Size, Share & Trends Analysis Report by Product Type (Synthetic Superdisintegrants and Natural Superdisintegrants), by Formulation (Capsules and Tablets), and by Therapeutic Area (Infectious Diseases, Cardiovascular Diseases, Hematological Diseases, Neurological Diseases, Oncology, and Others) and Forecast, 2019-2025 Update Available - Forecast 2025-2035

Excipients are integral non-therapeutic material used in the manufacturing, designing and development of a drug from active molecules. With the help of excipients, consistency, dose accuracy, and better patient compliance can be easily achieved. Superdisintegrants are the excipients used in the pharmaceutical industries for tablet-based drug delivery. It is used as a viscosity-enhancing agent in drug-loaded films, having superior performance, and possesses high drug content uniformity. Superdisintegrants are added to solid dosage forms such as capsules or tablets that aids them to disintegrate when submerged in liquid. Owing to this benefit, these are greatly used in the manufacturing of disintegrating oral formulations, which further increases the demand for superdisintegrants in the market. Thus, the use of superdisintegrants acts as a superior alternative to the conventional viscosity enhancing agents and it is comparatively more economical.

Segmental Outlook

The global superdisintegrants market is segmented on the basis of product type, formulation, and therapeutic area. Based on the product type, the market is sectioned as synthetic superdisintegrants and natural superdisintegrants. Based on the formulation, the market is bifurcated into tablets and capsules. On the basis of the therapeutic area, the market is segmented into infectious diseases, CVD, hematological diseases, neurological diseases, oncology, and others.

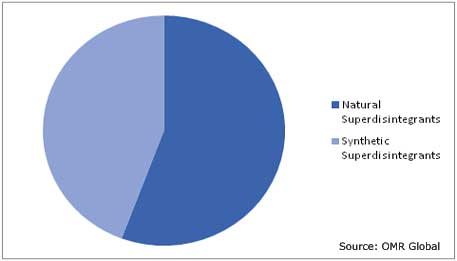

Natural Superdisintegrants segment to register significant growth

Based on the product type, the natural superdisintegrants segment shows lucrative growth during the forecast period. Natural superdisintegrants such as ispaghulla, gellan gum, fenugreek seed mucilage, and gum karaya, among others have many benefits over synthetic superdisintegrants, such as biodegradability, chemical inertness, and non-toxicity. Moreover, it can be modified in several ways in order to obtain tailor-made materials for drug delivery systems that aims to enhance safety by the formulation of a convenient dosage.

Global Superdisintegrants Market by Product Type, 2018 (%)

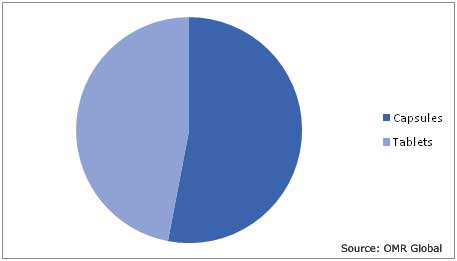

Tablets formulation is expected to witness considerable growth

By formulation, the tablet segment is anticipated to register significant growth in the market in the near future. This is accredited to the extensive use of fast disintegrating tablets and orally disintegrating tablets in the healthcare sector. Moreover, tablets are more preferred over capsules due to its several benefits, such as ease of swallowing, better pregastric absorption, increased drug bioavailability, ease of administration, and improved shelf life, among others.

Global Superdisintegrants Market by Formulation, 2018 (%)

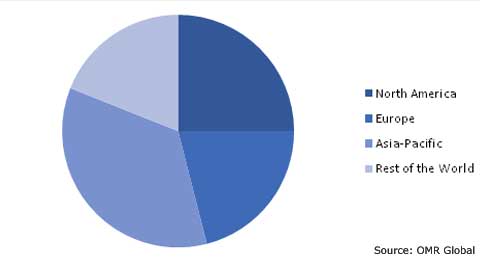

Regional Outlook

Based on the geographical viewpoint, the global superdisintegrants market is sectioned into North America, Europe, Asia-Pacific, and Rest of the World. North America holds a significant share in the global superdisintegrants market, as it has a presence of key manufacturers of the market, such as Ashland Inc. Additionally, increased demand for generic drugs, developments, and innovations in the manufacturing of superdisintegrants are the factors impacting the market. Asia-Pacific is expected to show considerable growth in the global superdisintegrants market. This is attributed to the factors such as increasing outsourcing of excipients which includes superdisintegrants; adoption of new drug delivery system technologies, and manufacturing of novel superdisintegrants.

Global Superdisintegrants Market by Region, 2018 (%)

Market Players Outlook

The prominent players functioning in the global superdisintegrants market are BASF SE, Asahi Kasei Corp., Ashland Inc., DFE Pharma, FMC Corp., JRS Pharma LP, Evonik Industries AG, and Roquette Freres S.A., among others. The market players are working towards the development of novel formulations by adopting certain strategies, such as product launch, mergers and acquisition, and geographical expansion, in order to excel their position in the global market.

Recent Developments

In March 2017, BASF SE started the ‘Innovation Campus Asia-Pacific’ in India, in order to enhance the company’s global reach and increase its global and regional research activities. The company’s investment in this activity is approximately $61 million, which marks as the largest R&D investment in South Asia.

In May 2017, Roquette completely takes over the Itacel, the excipient division of Blanver in Brazil. This acquisition will help in the expansion of the company’s pharmaceutical excipient business in the Americas, owing to the large presence of Itacel in the region.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global superdisintegrants market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. DFE Pharma

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Asahi Kasei Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Ashland Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Roquette Freres S.A.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Superdisintegrants Market by Product Type

5.1.1. Synthetic Superdisintegrants

5.1.2. Natural Superdisintegrants

5.2. Global Superdisintegrants Market by Formulation

5.2.1. Capsules

5.2.2. Tablets

5.3. Global Superdisintegrants Market by Therapeutic Area

5.3.1. Infectious Diseases

5.3.2. CVD

5.3.3. Hematological Diseases

5.3.4. Neurological Diseases

5.3.5. Oncology

5.3.6. Others (Inflammatory Diseases)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Asahi Kasei Corp.

7.2. Ashland Inc.

7.3. BASF SE

7.4. Corel Pharma Chem

7.5. DFE Pharma

7.6. Evonik Industries AG

7.7. FMC Corp.

7.8. JRS Pharma LP

7.9. Kerry Group

7.10. Merck KGaA

7.11. Roquette Freres S.A.

7.12. Sigachi Industries Pvt. Ltd.

1. GLOBAL SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL SYNTHETIC SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL NATURAL SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2018-2025 ($ MILLION)

5. GLOBAL CAPSULES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL TABLETS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2018-2025 ($ MILLION)

8. GLOBAL INFECTIOUS DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL CVD MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL HEMATOLOGICAL DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL NEUROLOGICAL DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL ONCOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

17. NORTH AMERICAN SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2018-2025 ($ MILLION)

18. NORTH AMERICAN SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2018-2025 ($ MILLION)

19. EUROPEAN SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. EUROPEAN SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

21. EUROPEAN SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2018-2025 ($ MILLION)

22. EUROPEAN SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2018-2025 ($ MILLION)

27. REST OF THE WORLD SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

28. REST OF THE WORLD SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2018-2025 ($ MILLION)

29. REST OF THE WORLD SUPERDISINTEGRANTS MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2018-2025 ($ MILLION)

1. GLOBAL SUPERDISINTEGRANTS MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL SUPERDISINTEGRANTS MARKET SHARE BY FORMULATION, 2018 VS 2025 (%)

3. GLOBAL SUPERDISINTEGRANTS MARKET SHARE BY THERAPEUTIC AREA, 2018 VS 2025 (%)

4. GLOBAL SUPERDISINTEGRANTS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD SUPERDISINTEGRANTS MARKET SIZE, 2018-2025 ($ MILLION)