Global Surface Disinfectant Market Size

Global Surface Disinfectant Market Size, Share & Trends Analysis Report by Type (Oxidizing and Non-Oxidizing), by Formulation(Liquid, Spray, and Wipes), and by End-User (Hospital anddiagnostic Center, Pharmaceutical Companies, Laboratory and Research Institutes, Homecare, and Others)and Forecast 2019-2025 Update Available - Forecast 2025-2031

The global surface disinfectant market is estimated to have a significant CAGR of 8%, during the forecast period.The major factors contributing to the market growth include growing awareness towards sanitation, and safety in hospitals and laboratories. Moreover, an increasing surgical procedure in healthcare institutions is propelling the demand for surface disinfectants across the globe. According to the American Society of Plastic Surgeons (ASAPS), surgical procedures accounted for 60% of the total expenditures of healthcare and nonsurgical procedures accounted for 40% of the total expenditures. There were 17.5 million surgical and minimally invasive cosmetic procedures performed in the US in 2017 that were 17.8 million in 2016, according to the ASAPS.

Growing prevalence of chronic disease coupled with strict sanitation regulations in healthcare sector is contributing to the surface disinfectant market growth. The increasing government initiatives towards awareness of health and safety is encouraging the demand for surface disinfectant in the healthcare industry. Increasing incidence of wound infection due to poor hygiene, sanitation,and others are contributing to the growth of the market. The surface disinfectantis used to reduce wound infection. According to the American College of Cardiology (ACC), the incidence of wound infection ranges from 2 to 17.5% after trauma and from 1 to 1.5% after minor dermatological surgical procedures. Infections are inconvenient and painful and lead to failure or delay in wound healing and poor cosmetic outcomes.

Segmental Outlook

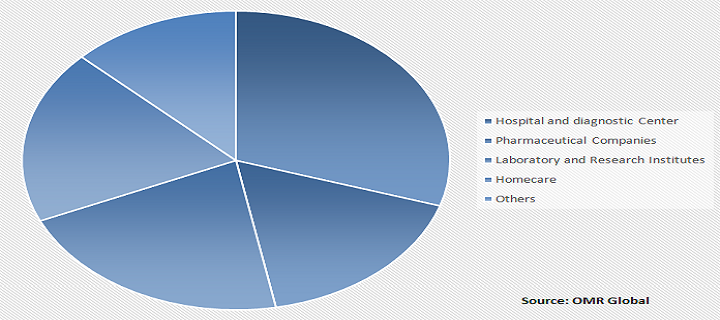

The global surface disinfectantmarket isclassifiedon the basis of type, formulation, and end-user. Based on type, the market is segmented into oxidizing and non-oxidizing. On the basis of formulation, the market is categorized into liquid, spray, and wipes. The wipe segment is projected to grow significantly due to the increasing application of alcohol-based wipes for equipment surface disinfectant. The market is further segmented on the basis of its end-users, including hospital and diagnostic center, pharmaceutical companies, laboratory and research institutes, homecare, and others.

Global Surface Disinfectant Market Share by End-User, 2018(%)

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. 3M Co.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. DuPont de Nemours, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Ecolab Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Henkel AG & Co. KGaA

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. The Procter & Gamble Co.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. GlobalSurface Disinfectant Market byType

5.1.1. Oxidizing

5.1.2. Non-Oxidizing

5.2. Global Surface Disinfectant Market by Formulation

5.2.1. Liquid

5.2.2. Spray

5.2.3. Wipes

5.3. Global Surface Disinfectant Market by End-User

5.3.1. Hospital and Diagnostic Center

5.3.2. Pharmaceutical Companies

5.3.3. Laboratory and Research Institutes

5.3.4. Homecare

5.3.5. Others (Food & Beverages Industry and Restaurants)

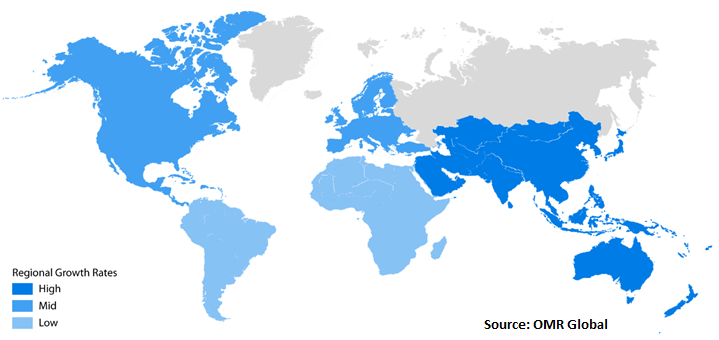

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. ABC Compounding Co., Inc.

7.3. Cantel Medical Corp.

7.4. Carroll Co.

7.5. DuPont de Nemours, Inc.

7.6. Ecolab Inc.

7.7. Henkel AG & Co. KGaA

7.8. Kimberly-Clark Worldwide, Inc.

7.9. Metrex Research, LLC, a company of KAVO KERR GROUP

7.10. Pal International Ltd.

7.11. PURE Bioscience, Inc.

7.12. PURELL, a company of GOJO Industries, Inc.

7.13. Reckitt Benckiser Group PLC

7.14. S. C. Johnson & Son, Inc.

7.15. STERIS Corp.

7.16. The Claire Manufacturing Co.

7.17. The Clorox Co.

7.18. The Procter & Gamble Co.

7.19. UPS Hygienes Pvt. Ltd.

7.20. Whiteley Corp.Pty. Ltd.

- GLOBAL SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- GLOBAL OXIDIZING SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL NON-OXIDIZING SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2018-2025 ($ MILLION)

- GLOBAL LIQUID SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL SPRAY SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL WIPES SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- GLOBAL SURFACE DISINFECTANT IN HOSPITAL AND DIAGNOSTIC CENTER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL SURFACE DISINFECTANT IN PHARMACEUTICAL COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL SURFACE DISINFECTANT IN LABORATORY AND RESEARCH INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL SURFACE DISINFECTANT IN HOME CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL SURFACE DISINFECTANT IN OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

- NORTH AMERICAN SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- NORTH AMERICAN SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- NORTH AMERICAN SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2018-2025 ($ MILLION)

- NORTH AMERICAN SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- EUROPEAN SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- EUROPEAN SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- EUROPEAN SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2018-2025 ($ MILLION)

- EUROPEAN SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- ASIA-PACIFIC SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- ASIA-PACIFIC SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- ASIA-PACIFIC SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2018-2025 ($ MILLION)

- ASIA-PACIFIC SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- REST OF THE WORLD SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- REST OF THE WORLD SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY FORMULATION, 2018-2025 ($ MILLION)

- REST OF THE WORLD SURFACE DISINFECTANT MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- GLOBAL SURFACE DISINFECTANT MARKET SHARE BY TYPE, 2018 VS 2025 (%)

- GLOBAL SURFACE DISINFECTANT MARKET SHARE BY FORMULATION, 2018 VS 2025 (%)

- GLOBAL SURFACE DISINFECTANT MARKET SHARE BY END-USER, 2018 VS 2025 (%)

- GLOBAL SURFACE DISINFECTANT MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

- US SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)

- CANADA SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)

- UK SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)

- FRANCE SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)

- GERMANY SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)

- ITALY SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)

- SPAIN SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)

- ROE SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)

- INDIA SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)

- CHINA SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)

- JAPAN SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF ASIA-PACIFIC SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF THE WORLD SURFACE DISINFECTANT MARKET SIZE, 2018-2025 ($ MILLION)