Surface Measuring Instrument Market

Surface Measuring Instrument Market Size, Share & Trends Analysis Report by Surface Type (2D, and 3D), by Component (Devices, Software, and Services), by Technique (Contact, and Non-Contact), and by End-User (Automobile, Aerospace, and Defense, Optics and Metal Bearing, Medical and Pharmaceuticals, Semiconductor, Energy & Power, and Others) Forecast Period (2025-2035)

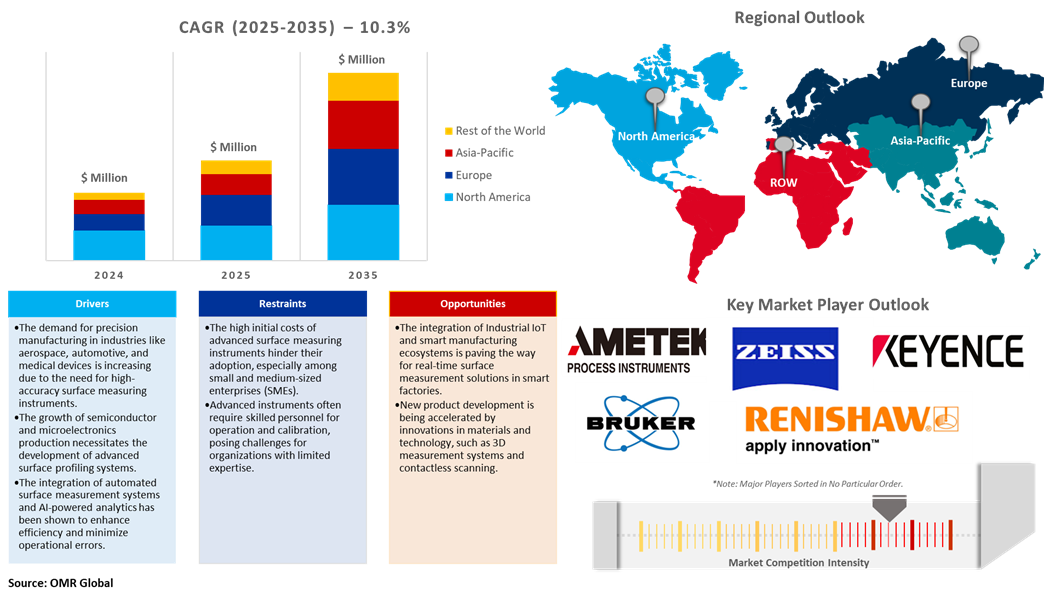

Surface measuring instrument market size was $1.4 billion in 2024 and is projected to reach $4.0 billion in 2035, witnessing a CAGR of 10.3% during the forecast period (2025-2035). Increased demand for precision-engineered products in the aerospace and automotive industries, high regulatory standards for medical devices and electronics, industrial automation, and surface metrology advancement drive the surface metrology market. Increased growth in the manufacturing and electronics industries, customization, modular designs, rapid industrialization in emerging economies, and research into nanotechnology applications are driving the adoption of the market.

Market Dynamics

Growth of the Semiconductor and Electronics Industries

The enormous growing demand for accuracy and reliability needed in surface measurement technologies in companies dealing with semiconductors and electronics is contributing to market growth. For instance, in July 2024, Mitutoyo America Corp. launched the SM1008S, the first non-contact line-laser sensor from the Mitutoyo Surface Measure product line. The new sensor allows in-line and near-line surface measurements. The measurement tools consist of height, width, volume, and defect detection by onboard software. It comes with an IP67 protection grade. Its target industries are electrical, electronics, and semiconductors among others.

Rising Demand for High-Precision Instruments

Manufacturers across industries such as semiconductors and electronics are adopting measurement instrumentation allowing for detailed analysis of the material and subsequently fulfilling the quality expectations, thereby providing deeper insight into surface properties, with increasing demands for consistent outcomes. For instance, in July 2024, DataPhysics Instruments introduced the Portable Contact Angle Goniometer PCA 200. The small, self-contained measuring device is an accurate means of determining contact angles and surface energy using two test liquids- water and diiodomethane. It has several advantages over dyne pens, such as objectivity, quantitativeness, reproducibility, and more information from subdividing surface energy into polar and dispersive components.

Market Segmentation

- Based on the surface type, the market is segmented into 2D and 3D.

- Based on the component, the market is segmented into devices (probes, cameras, imaging equipment, and others), software, and services.

- Based on the technique, the market is segmented into contact, and non-contact.

- Based on the end user, the market is segmented into automobile, aerospace and defense, optics and metal bearing, medical and pharmaceuticals, semiconductor, energy & power, and others (forensic, gem and jewelry, and research verticals).

The Devices Segment Is Projected to Hold the Largest Market Share

The demand for portable, user-friendly surface-measuring devices is growing owing to field measurements requiring efficiency and precision in production sites. For instance, in July 2024, Mahr launched its compact mobile tactile surface measuring the MarSurf M 510. The device is light and agile and is available in three measuring lengths. It measures waviness and large roughness values over a measuring length of up to 75 mm. The device is suitable for technical surfaces of workpieces and can be easily installed and set up. Over 1,000 measuring programs allow for wide-ranging applications.

Non-Contact Segment to Hold a Considerable Market Share

The demand for accurate, non-invasive surface analysis, especially for fragile materials such as thin films and coatings, has led to the adoption of non-contact measurement instruments. For instance, in July 2024, Opt-scope NEX was launched as the latest model of Opt-scope, a non-contact 3D surface roughness and contour measuring instrument. It can measure fine surface roughness and geometry at nano- and sub-nanometer levels with high accuracy using white-light interferometry and focus-variation microscopy. The new model adopts a NEX platform and offers expandability and usability, gaining from the SURFCOM NEX contact surface roughness measuring instrument.

Regional Outlook

The global surface measuring instrument market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Germany, France, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Requirements for Precision in Semiconductor Manufacturing In the North American Region

Semiconductor manufacturing requires exact surface measurements of wafers, substrates, and components to support strict surface roughness and flatness standards, contributing to the growth of the segment. According to the Semiconductor Industry Association, in September 2024, the US sales in the semiconductor industry stood at $527 billion with nearly 1 trillion units sold globally, reflecting more than 100 chips per person. World Semiconductor Trade Statistics anticipate sales to rise above $600 billion in 2024. Since the announcement of the CHIPS initiative in Congress, more than 90 new manufacturing projects have been announced within the US, totaling almost $450 billion in investments in 28 states.

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the aerospace and automotive sectors requiring sophisticated measurements for engine components, aircraft wings, and turbine blades owing to the high demand for precision. For instance, in October 2024, Hexagon Manufacturing Intelligence launched ENSPEC, its first made-in-India metrology product. The multi-dimensional coordinate measuring machine uses advanced technology and is designed for Indian manufacturers. ENSPEC is manufactured, assembled, and shipped locally from Hexagon's Noida facility. It provides ultraprecise measurements in aerospace, automotive, and manufacturing segments. It supports a top speed of 450 mm/s and 1100 mm/s².

Market Players Outlook

The major companies serving the surface measuring instrument market include AMETEK.Inc., Bruker Corp., KEYENCE CORP., ZEISS Group, Renishaw plc, and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In June 2024, Advantest Corp. unveiled the WEL2100 nanoSCOUTER particle measuring instrument. The product features a nanopore sensor device to measure precisely particles such as lipid nanoparticles, viruses, and exosomes. The APT-Pore proprietary device gives precise particle size distribution.

- In July 2024, Mahr Group acquired OptoSurf GmbH, a developer of optical surface measuring devices, expanding its portfolio in optical surface metrology for various applications.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global surface measuring instrument market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Surface Measuring Instrument Market Sales Analysis – Surface Type | Component | Technique | End-User ($ Million)

• Surface Measuring Instrument Market Sales Performance of Top Countries

1.1. Research Methods and Tools

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Surface Measuring Instrument Industry Trends

2.2.2. Market Recommendations

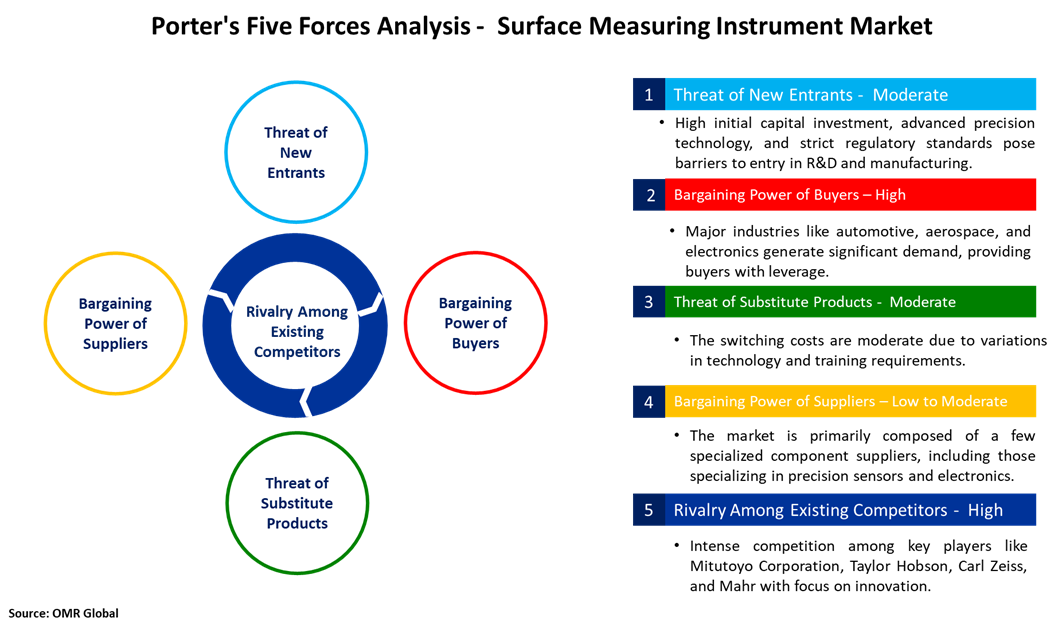

2.3. Porter's Five Forces Analysis for the Surface Measuring Instrument Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Surface Measuring Instrument Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Surface Measuring Instrument Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Surface Measuring Instrument Market Revenue and Share by Manufacturers

• Surface Measuring Instrument Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. AMETEK.Inc

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Bruker Corp.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. KEYENCE CORP.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Hexagon AB

4.2.4.1. Overview

4.2.4.2. Financial Analysis

4.2.4.3. SWOT Analysis

4.2.4.4. Recent Developments

4.2.5. ZEISS Group

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Surface Measuring Instrument Market by Surface Type ($ Million)

5.1. 2D

5.2. 3D

6. Global Surface Measuring Instrument Market by Component ($ Million)

6.1. Devices (Probes, Camera, Imaging Equipment, and Other)

6.2. Software and Services

7. Global Surface Measuring Instrument Market by Technique ($ Million)

7.1. Contact

7.2. Non- Contact

8. Global Surface Measuring Instrument Market by End-User ($ Million)

8.1. Automobile

8.2. Aerospace and Defense

8.3. Optics and Metal Bearing

8.4. Medical and Pharmaceuticals

8.5. Semiconductor

8.6. Energy & Power

8.7. Others (Forensic, Gem and Jewelry, and Research Verticals)

9. Regional Analysis

9.1. North American Surface Measuring Instrument Market Sales Analysis – Surface Type| Component | Technique| End-User | Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Surface Measuring Instrument Market Sales Analysis – Surface Type| Component | Technique| End-User | Country ($ Million)

• Macroeconomic Factors for European

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Surface Measuring Instrument Market Sales Analysis – Surface Type| Component | Technique| End-User | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

9.3.7. Rest of Asia-Pacific

10. Rest of the World Surface Measuring Instrument Market Sales Analysis – Surface Type| Component | Technique| End-User | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

10.1.1. Latin America

10.1.2. Middle East and Africa

11. Company Profiles

11.1. Ace Instruments

11.1.1. Quick Facts

11.1.2. Company Overview

11.1.3. Product Portfolio

11.1.4. Business Strategies

11.2. Advantest Corp.

11.2.1. Quick Facts

11.2.2. Company Overview

11.2.3. Product Portfolio

11.2.4. Business Strategies

11.3. Alicona Imaging GmbH

11.3.1. Quick Facts

11.3.2. Company Overview

11.3.3. Product Portfolio

11.3.4. Business Strategies

11.4. AMETEK.Inc

11.4.1. Quick Facts

11.4.2. Company Overview

11.4.3. Product Portfolio

11.4.4. Business Strategies

11.5. Breitmeier Messtechnik GmbH

11.5.1. Quick Facts

11.5.2. Company Overview

11.5.3. Product Portfolio

11.5.4. Business Strategies

11.6. Bruker Corp.

11.6.1. Quick Facts

11.6.2. Company Overview

11.6.3. Product Portfolio

11.6.4. Business Strategies

11.7. DataPhysics Instruments GmbH

11.7.1. Quick Facts

11.7.2. Company Overview

11.7.3. Product Portfolio

11.7.4. Business Strategies

11.8. Evident Corp.

11.8.1. Quick Facts

11.8.2. Company Overview

11.8.3. Product Portfolio

11.8.4. Business Strategies

11.9. FARO Technologies, Inc.

11.9.1. Quick Facts

11.9.2. Company Overview

11.9.3. Product Portfolio

11.9.4. Business Strategies

11.10. Helmut Fischer GmbH

11.10.1. Quick Facts

11.10.2. Company Overview

11.10.3. Product Portfolio

11.10.4. Business Strategies

11.11. Hexagon AB

11.11.1. Quick Facts

11.11.2. Company Overview

11.11.3. Product Portfolio

11.11.4. Business Strategies

11.12. JENOPTIK AG

11.12.1. Quick Facts

11.12.2. Company Overview

11.12.3. Product Portfolio

11.12.4. Business Strategies

11.13. KEYENCE CORP.

11.13.1. Quick Facts

11.13.2. Company Overview

11.13.3. Product Portfolio

11.13.4. Business Strategies

11.14. KLA Corp.

11.14.1. Quick Facts

11.14.2. Company Overview

11.14.3. Product Portfolio

11.14.4. Business Strategies

11.15. Kosaka Laboratory Ltd.

11.15.1. Quick Facts

11.15.2. Company Overview

11.15.3. Product Portfolio

11.15.4. Business Strategies

11.16. Mahr GmbH

11.16.1. Quick Facts

11.16.2. Company Overview

11.16.3. Product Portfolio

11.16.4. Business Strategies

11.17. Mitutoyo Corp.

11.17.1. Quick Facts

11.17.2. Company Overview

11.17.3. Product Portfolio

11.17.4. Business Strategies

11.18. OptiPro Systems, Inc.

11.18.1. Quick Facts

11.18.2. Company Overview

11.18.3. Product Portfolio

11.18.4. Business Strategies

11.19. Polytec GmbH

11.19.1. Quick Facts

11.19.2. Company Overview

11.19.3. Product Portfolio

11.19.4. Business Strategies

11.20. Renishaw plc

11.20.1. Quick Facts

11.20.2. Company Overview

11.20.3. Product Portfolio

11.20.4. Business Strategies

11.21. SCANTECH Group

11.21.1. Quick Facts

11.21.2. Company Overview

11.21.3. Product Portfolio

11.21.4. Business Strategies

11.22. Tokyo Seimitsu Co., Ltd.

11.22.1. Quick Facts

11.22.2. Company Overview

11.22.3. Product Portfolio

11.22.4. Business Strategies

11.23. TRIOPTICS GmbH

11.23.1. Quick Facts

11.23.2. Company Overview

11.23.3. Product Portfolio

11.23.4. Business Strategies

11.24. ZEISS Group

11.24.1. Quick Facts

11.24.2. Company Overview

11.24.3. Product Portfolio

11.24.4. Business Strategies

11.25. Zygo Corp.

11.25.1. Quick Facts

11.25.2. Company Overview

11.25.3. Product Portfolio

11.25.4. Business Strategies

1. Global Surface Measuring Instrument Market Research And Analysis By Surface Type, 2024-2035 ($ Million)

2. Global 2D Surface Measuring Instrument Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global 3D Surface Measuring Instrument Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Surface Measuring Instrument Market Research And Analysis By Technique, 2024-2035 ($ Million)

5. Global Contact Surface Measuring Instrument Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Non-Contact Surface Measuring Instrument Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Surface Measuring Instrument Market Research And Analysis By Component, 2024-2035 ($ Million)

8. Global Surface Measuring Devices Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Surface Measuring Software And Services Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Surface Measuring Instrument Market Research And Analysis By End-User, 2024-2035 ($ Million)

11. Global Surface Measuring Instrument For Automobile Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Surface Measuring Instrument For Aerospace and Defense Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Surface Measuring Instrument For Optics and Metal Bearing Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Surface Measuring Instrument For Medical and Pharmaceuticals Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Surface Measuring Instrument For Semiconductor Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Surface Measuring Instrument For Energy & Power Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Surface Measuring Instrument For Other End-User Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Surface Measuring Instrument Market Research And Analysis By Region, 2024-2035 ($ Million)

19. North American Surface Measuring Instrument Market Research And Analysis By Country, 2024-2035 ($ Million)

20. North American Surface Measuring Instrument Market Research And Analysis By Surface Type, 2024-2035 ($ Million)

21. North American Surface Measuring Instrument Market Research And Analysis By Technique, 2024-2035 ($ Million)

22. North American Surface Measuring Instrument Market Research And Analysis By Component, 2024-2035 ($ Million)

23. North American Surface Measuring Instrument Market Research And Analysis By End-User, 2024-2035 ($ Million)

24. European Surface Measuring Instrument Market Research And Analysis By Country, 2024-2035 ($ Million)

25. European Surface Measuring Instrument Market Research And Analysis By Surface Type, 2024-2035 ($ Million)

26. European Surface Measuring Instrument Market Research And Analysis By Technique, 2024-2035 ($ Million)

27. European Surface Measuring Instrument Market Research And Analysis By Component, 2024-2035 ($ Million)

28. European Surface Measuring Instrument Market Research And Analysis By End-User, 2024-2035 ($ Million)

29. Asia-Pacific Surface Measuring Instrument Market Research And Analysis By Country, 2024-2035 ($ Million)

30. Asia-Pacific Surface Measuring Instrument Market Research And Analysis By Surface Type, 2024-2035 ($ Million)

31. Asia-Pacific Surface Measuring Instrument Market Research And Analysis By Technique, 2024-2035 ($ Million)

32. Asia-Pacific Surface Measuring Instrument Market Research And Analysis By Component, 2024-2035 ($ Million)

33. Asia-Pacific Surface Measuring Instrument Market Research And Analysis By End-User, 2024-2035 ($ Million)

34. Rest Of The World Surface Measuring Instrument Market Research And Analysis By Region, 2024-2035 ($ Million)

35. Rest Of The World Surface Measuring Instrument Market Research And Analysis By Surface Type, 2024-2035 ($ Million)

36. Rest Of The World Surface Measuring Instrument Market Research And Analysis By Technique, 2024-2035 ($ Million)

37. Rest Of The World Surface Measuring Instrument Market Research And Analysis By Component, 2024-2035 ($ Million)

38. Rest Of The World Surface Measuring Instrument Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Surface Measuring Instrument Market Share By Surface Type, 2024 Vs 2035 (%)

2. Global 2D Surface Measuring Instrument Market Share By Region, 2024 Vs 2035 (%)

3. Global 3D Surface Measuring Instrument Market Share By Region, 2024 Vs 2035 (%)

4. Global Surface Measuring Instrument Market Share By Technique, 2024 Vs 2035 (%)

5. Global Contact Surface Measuring Instrument Market Share By Region, 2024 Vs 2035 (%)

6. Global Non-Contact Surface Measuring Instrument Market Share By Region, 2024 Vs 2035 (%)

7. Global Surface Measuring Instrument Market Share By Component, 2024 Vs 2035 (%)

8. Global Surface Measuring Devices Market Share By Region, 2024 Vs 2035 (%)

9. Global Surface Measuring Software And Services Market Share By Region, 2024 Vs 2035 (%)

10. Global Surface Measuring Instrument Other Component Market Share By Region, 2024 Vs 2035 (%)

11. Global Surface Measuring Instrument Market Share By End-User, 2024 Vs 2035 (%)

12. Global Surface Measuring Instrument For Automobile Market Share By Region, 2024 Vs 2035 (%)

13. Global Surface Measuring Instrument For Aerospace and Defense Market Share By Region, 2024 Vs 2035 (%)

14. Global Surface Measuring Instrument For Optics and Metal Bearing Market Share By Region, 2024 Vs 2035 (%)

15. Global Surface Measuring Instrument For Medical and Pharmaceuticals Market Share By Region, 2024 Vs 2035 (%)

16. Global Surface Measuring Instrument For Semiconductor Market Share By Region, 2024 Vs 2035 (%)

17. Global Surface Measuring Instrument For Energy & Power Market Share By Region, 2024 Vs 2035 (%)

18. Global Surface Measuring Instrument For Other End-User Market Share By Region, 2024 Vs 2035 (%)

19. Global Surface Measuring Instrument Market Share By Region, 2024 Vs 2035 (%)

20. US Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

21. Canada Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

22. UK Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

23. France Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

24. Germany Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

25. Italy Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

26. Spain Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

27. Russia Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

28. Rest Of Europe Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

29. India Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

30. China Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

31. Japan Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

32. South Korea Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

33. Rest of Asia-Pacific Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

34. ASEAN Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

35. Australia and New Zealand Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

36. Latin America Surface Measuring Instrument Market Size, 2024-2035 ($ Million)

37. Middle East And Africa Surface Measuring Instrument Market Size, 2024-2035 ($ Million)