Surgical Imaging Market

Global Surgical Imaging Market Size, Share & Trends Analysis Report, By Imaging Technology (Computed Tomography, Ultrasound, Magnetic Resonance Imaging, C-Arm, and Others), By Application (Orthopaedic and Trauma surgery, Neurosurgery, Gastrointestinal Surgery, Cardiovascular Surgery, Gynaecologic Surgery, Ophthalmic Surgery, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global surgical imaging market is estimated to grow at a CAGR of nearly 6.0% during the forecast period. Rising demand for minimally invasive surgical procedures and increasing prevalence of chronic diseases are primarily contributing to the growth of the market. Minimally invasive surgeries have a great significance in improved patient’s outcomes, reduced recovery time and hospital stay. The procedures employ tiny incisions compared to conventional open surgery that enables to reduce blood loss and post-operative recovery times. Traditional open surgery has a long recovery period and needs several days of hospitalization. Some minimally invasive procedures can be carried out as an outpatient procedure, such as spinal stenosis or disc herniations. In these procedures, the patients are usually discharged home under two to three hours after the procedure.

As shorter incisions are involved that leads to faster healing and recovery from the condition and ultimately reduced hospital stay. Owing to the safety and effectiveness, minimally invasive procedures have been gaining significance across CVD, orthopaedic, ophthalmic surgeries, and more. Monitoring and visualization equipment comprise X-Ray equipment, MRI scanners, CT scanners and ultrasound have a significant role in performing minimally invasive surgery. These medical imaging technologies are used at every stage during patient management process, including screening, diagnosis, procedure and follow up. It usually guides surgeons during performing the minimally invasive procedure for brain, heart and other body organs.

Image-guided minimally invasive technologies offer more efficient and less painful treatment to the patients rather than conventional open surgery. Therefore, the demand for image-guided equipment is rising in minimally invasive procedures. Additionally, partnerships between companies have been witnessed to deliver innovative imaging solutions. For instance, in March 2018, Philips declared collaboration agreement with Hologic to provide integrated solutions to the care professional, such as innovative informatics and services for diagnostic imaging modalities, screening, and treatment of women across the globe. This collaboration will combine the Hologic advanced mammography technology and the major portfolio of Philips ultrasound, X-ray systems, MRI, and CT. The emerging focus on innovations in image-guided systems will support clinicians to navigate through anatomical structures more accurately, which will provide more successful outcomes.

Market Segmentation

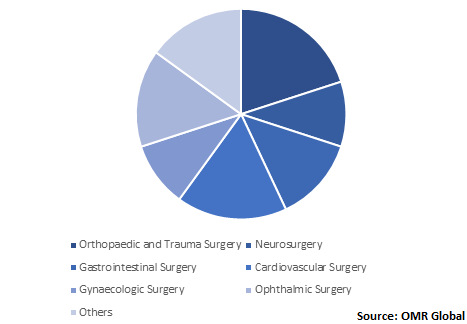

The global surgical imaging market is classified into imaging technology and application. Based on imaging technology, the market is classified into computed tomography, ultrasound, magnetic resonance imaging, c-arm, and others. Based on application, the market is classified into orthopaedic and trauma surgery, neurosurgery, gastrointestinal surgery, cardiovascular surgery, gynaecologic surgery, ophthalmic surgery, and others.

Orthopaedic and trauma surgery is anticipated to witness potential share in the market

In 2019, orthopaedic and trauma surgery is expected to witness a significant share in the market owing to the rising geriatric population base and increasing demand for arthroscopy procedures. Arthroscopy is used as a minimally invasive orthopaedic surgical procedure that employs miniature instruments and small incisions. It is a frequently used method for the treatment of sports injuries, including meniscal injuries, ligament tears and shoulder injuries. Moreover, it is used to treat injuries associated with knee, shoulder, wrist, ankle and elbow with safety among people of all age groups.

This, in turn, has increased the demand for imaging systems to perform surgery with more safety and efficacy. C-arm is one of the commonly used equipment in operating rooms and is being significantly used by orthopaedic surgeons. It offers two-dimensional images which enable surgeons to monitor the patient’s anatomy and locate the fracture fragments and implants and instruments during the procedure. Philips Healthcare offers BV Vectra mobile C-arm system for high-quality images which is designed for orthopaedic surgical procedures, such as spine, trauma and pain management.

Global Surgical Imaging Market Share by Application, 2019 (%)

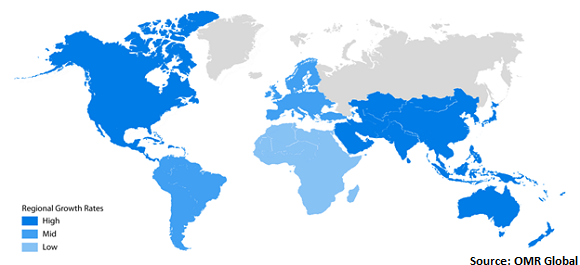

Regional Outlook

Geographically, in 2019, North America held the largest share in the market owing to the significant demand for minimally invasive procedures and rising incidences of sports injuries and spinal cord injuries in the region. As per the data published by the National Spinal Cord Injury Statistical Center, as of 2019, in the US, the new incidences of spinal cord injury (SCI) reported each year is 17,730 or 54 cases per one million people. As of 2019, the estimated number of individuals suffering from spinal cord injury in the US is nearly 291,000. Nearly 78% of new incidences were reported among males. The trend in spine surgery has been significantly moved towards minimally invasive surgery as it comprises surgical treatment of the spine by tiny incisions along with less disruption of the surrounding muscle tissue. This, in turn, is leading the demand for surgical imaging technologies in the region.

Global Surgical Imaging Market Growth, by Region 2020-2026

Market Players Outlook

Some crucial players operating in the market include General Electric Co., Siemens AG, Koninklijke Philips NV, Siemens AG, and Hologic, Inc. The market players are constantly focusing on gaining major market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance, in July 2019, Philips introduced Azurion with FlexArm in India for the establishment of a new standard in the image-guided procedures. Through its seamless and intuitive approach, Azurion FlexArm will increase patient care and save time while offering opportunities for novel image-guided procedures in India. This, in turn, will enable to accelerate the company’s market share.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global surgical imaging market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. General Electric Co.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Siemens AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Koninklijke Philips NV

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Siemens AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Hologic, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Surgical Imaging Market by Imaging Technology

5.1.1. Computed Tomography (CT)

5.1.2. Ultrasound

5.1.3. Magnetic Resonance Imaging (MRI)

5.1.4. C-Arm

5.1.4.1. Fixed C-Arm

5.1.4.2. Mobile C-Arm

5.1.5. Others

5.2. Global Surgical Imaging Market by Application

5.2.1. Orthopaedic and Trauma Surgery

5.2.2. Neurosurgery

5.2.3. Gastrointestinal Surgery

5.2.4. Cardiovascular Surgery

5.2.5. Gynaecologic Surgery

5.2.6. Ophthalmic Surgery

5.2.7. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 7D Surgical

7.2. Allengers Medical Systems Ltd.

7.3. Canon Medical Systems Corp.

7.4. Eurocolumbus srl

7.5. General Electric Co.

7.6. Genoray Co Ltd.

7.7. Hitachi, Ltd.

7.8. Hologic, Inc.

7.9. Intuitive Surgical, Inc.

7.10. Koninklijke Philips NV

7.11. Medtronic plc

7.12. Olympus Corp.

7.13. OrthoScan, Inc.

7.14. Shimadzu Corp.

7.15. Siemens AG

7.16. Stryker Corp.

7.17. Whale Imaging, Inc.

7.18. Xoran Technologies LLC

7.19. Ziehm Imaging GmbH

1. GLOBAL SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY IMAGING TECHNOLOGY, 2019-2026 ($ MILLION)

2. GLOBAL COMPUTED TOMOGRAPHY (CT) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL ULTRASOUND MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL MAGNETIC RESONANCE IMAGING (MRI) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL C-ARM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER SURGICAL IMAGING TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

8. GLOBAL SURGICAL IMAGING IN ORTHOPAEDIC AND TRAUMA SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL SURGICAL IMAGING IN NEUROSURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL SURGICAL IMAGING IN GASTROINTESTINAL SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL SURGICAL IMAGING IN CARDIOVASCULAR SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL SURGICAL IMAGING IN GYNAECOLOGICAL SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL SURGICAL IMAGING IN OPHTHALMIC SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL SURGICAL IMAGING IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY IMAGING TECHNOLOGY, 2019-2026 ($ MILLION)

18. NORTH AMERICAN SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

19. EUROPEAN SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. EUROPEAN SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY IMAGING TECHNOLOGY, 2019-2026 ($ MILLION)

21. EUROPEAN SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY IMAGING TECHNOLOGY, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

25. REST OF THE WORLD SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY IMAGING TECHNOLOGY, 2019-2026 ($ MILLION)

26. REST OF THE WORLD SURGICAL IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL SURGICAL IMAGING MARKET SHARE BY IMAGING TECHNOLOGY, 2019 VS 2026 (%)

2. GLOBAL SURGICAL IMAGING MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL SURGICAL IMAGING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)

6. UK SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD SURGICAL IMAGING MARKET SIZE, 2019-2026 ($ MILLION)