Sustainable Manufacturing Market

Sustainable Manufacturing Market Size, Share & Trends Analysis Report by Offering (Recycled Lithium-Ion Battery, Recycled Material, Recycled Plastic, Recycled Metal, Recycled Carbon Fiber, and Water Recycle and Reuse), by Application (Automotive, Energy, Electrical & Electronics, Packaging, Building & Construction, Marine, Aerospace, Power, Chemicals and Other), Forecast Period (2024-2031)

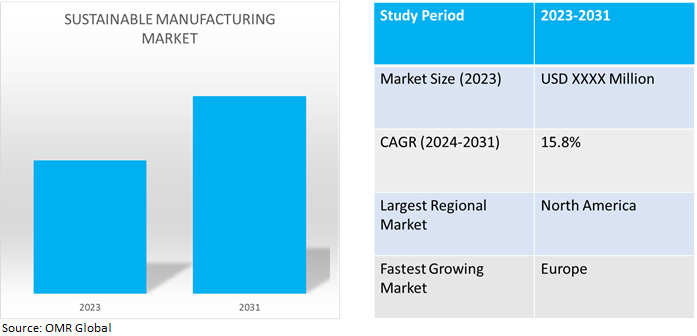

Sustainable manufacturing market is anticipated to grow at a significant CAGR of 15.8% during the forecast period (2024-2031). The market growth is attributed to the increasing adoption of waste reduction, energy efficiency, and recycling, manufacturers automate procedures, customize products, and boost production efficiency with the economical use of resources globally. According to the United Nations Industrial Development Organization, in December 2023, manufacturing accounted for most of this dynamism, with an increase of 3.2%, while the combined mining and utilities sector—the largest contributor to the economy in low-income countries contracted by 0.9%.

Market Dynamics

Growing Adoption of Recycling, Reusing, and Remanufacturing Products And Materials.

Recently, there has been an increasing interest in supply chain remanufacturing, reuse, and recycling (RRR & Supply chain). The complete industrial process combines rebuilding, reusing, mending, and using new parts. Remanufacturing is frequently used in the fields of printing, electrical and electronic, and medical equipment. An economic paradigm called the "circular economy" aims to reduce waste production and increase resource efficiency. Through techniques including recycling, reusing, remanufacturing, and refurbishing, it supports the notion of extending the life of materials and things. Designing products with circularity in mind is essential to facilitate material recovery, recycling, and disassembly. According to the World Economic Forum, in June 2022, globally about 400.0 million tons of plastic waste yearly. The total bottle recycling rate for 2020 was 27.2%.

Increasing Environmental Concerns Resulting in Demand for Sustainable Manufacturing

The growing demand for sustainable manufacturing techniques that reduce carbon emissions, waste output, and resource consumption as corporations, governments, and consumers become more conscious of the environmental effects of industrial activities. Global regulatory frameworks are becoming more stringent, making industries comply with more stringent standards and emissions targets, which is propelling the adoption of sustainable manufacturing practices. Companies are reevaluating their operations, investing in clean technologies, and putting plans in place to lessen their environmental footprint throughout the supply chain as a result of the increased awareness of environmental challenges.

Market Segmentation

Our in-depth analysis of the global sustainable manufacturing market includes the following segments, offerings, and applications.

- Based on the offering, the market is sub-segmented into recycled lithium-ion batteries, recycled material, recycled plastic, recycled metal, recycled carbon fiber, and water recycle and reuse.

- Based on the application, the market is sub-segmented into automotive, energy, electrical & electronics, packaging, building & construction, marine, aerospace, power, chemicals, and other applications (healthcare).

Recycled Plastic is Projected to Hold as the Largest Segment

Based on the offering, the global sustainable manufacturing market is sub-segmented into recycled lithium-ion batteries, recycled material, recycled plastic, recycled metal, recycled carbon fiber, and water recycling and reuse. Among these recycled plastics, the sub-segment is expected to hold the largest share of the market. The primary factors supporting the growth include increasing demand for plastic recycling globally. For instance in October 2022, according to PlasticsEurope, global plastics production reached 390.7 metric tons in 2021. Post-consumer recycled plastics and bio-based/bioattributed plastics respectively accounted for 8.3% and 1.5% of the global plastics production. By providing a sustainable substitute for virgin plastics and promoting the circular economy, recycled plastics are essential to the market for sustainable manufacturing. When plastic is diverted from landfills and the ocean, it helps conserve natural resources, and when compared to the manufacturing of virgin plastic, it lowers energy usage and carbon emissions.

Packaging Sub-segment to Hold a Considerable Market Share

Based on application, the global sustainable manufacturing market is sub-segmented into automotive, energy, electrical & electronics, packaging, building & construction, marine, aerospace, power, chemicals, and other applications (healthcare). Among these, the packaging sub-segment is expected to hold a considerable share of the market. Recycled plastics are growing increasingly in demand for packaging. Packaging materials are made from a variety of recycled plastics, including polyethylene terephthalate (PET), high-density polyethylene (HDPE), and polypropylene (PP). These substances are frequently found in containers, bottles, and other packaging materials. Using recycled plastic packaging, it helpshelps preserve natural resources by lowering the need for virgin plastics made from non-renewable fossil fuels. Recycled plastic packaging can be produced with less energy than new plastics made from raw materials, which can have a positive environmental impact and cut carbon emissions.

Regional Outlook

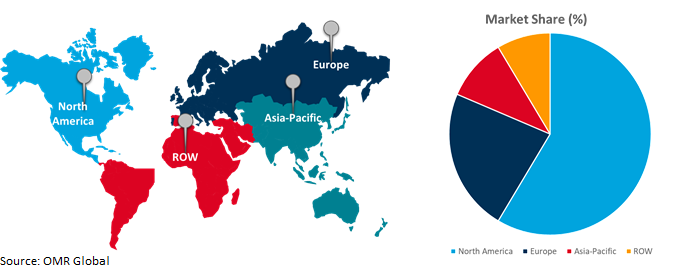

The global sustainable manufacturing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Demand for Sustainable Manufacturings in Europe

- The regional growth is attributed to the growing demand for sustainable manufacturing with the rising adoption of environment-friendly and sustainable practices in the industrial manufacturing sector. According to the European Environment Agency, in November 2023, the implementation of the European Green Deal (EGD) demands a huge amount of investments in sustainability transition, around £520.0 billion ($562.8 billion) per year from 2021-2030. Additional investments to boost the EU’s capacity to manufacture net-zero technologies amount to around £92.0 billion ($99.5 billion) from 2023 until 2030.

- In March 2024, GOV.UK announced £360.0 million ($389.7 million) investment to boost British manufacturing and R&D. Government joint investment of £200.0 million ($216.5 million) in zero-carbon aircraft technology to develop a more sustainable aviation sector and almost £73.0 million ($79.0 million) in automotive technology.

Global Sustainable Manufacturing Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent sustainable manufacturing companies such as Apple Inc., Johnson & Johnson Services, Inc., Nike, Inc., Tesla, Inc., and sustainable manufacturing providers in the region. The growth is mainly attributed to the increasing adoption of sustainable manufacturing in chemicals and refining, cement and concrete, iron and steel, aluminum and metals, food and beverage, glass and pulp and paper industries drive the market growth in the region. The government in the region investing in sustainable manufacturing to reduce industrial greenhouse gas emissions. For instance, in March 2024, The US Department of Energy (DOE) announced $6.0 billion for 33 projects across more than 20 states to decarbonize energy-intensive industries, reduce industrial greenhouse gas emissions, support good-paying union jobs, revitalize industrial communities, and strengthen the nation’s manufacturing competitiveness.

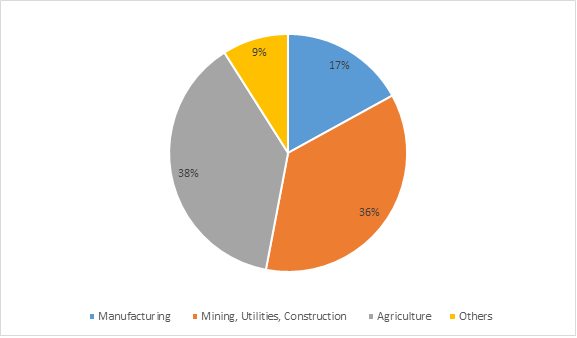

Environment Impact of the US Manufacturing and its Suppliers

Source: National Institute of Standards and Technology

According to the National Institute of Standards and Technology (NIST), in October 2020, Contributions to US environmental impacts from the manufacturing industry and its supply chains. The figure shows that, of the 76.6% of US emissions driven by manufacturing production, 17.0% is directly attributed to the manufacturing sector. The remainder is driven by supporting sectors including mining, utilities, construction, and agriculture. The US Energy Information Administration predicts the industrial sector including manufacturing processes will see an increase in emissions of 26.0% by 2050 while emissions of other high-producing sectors hold steady or decline.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global sustainable manufacturing market include Dassault Systèmes S.E., General Electric Company, Johnson & Johnson Services, Inc., Koninklijke Philips N.V., and Siemens AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in April 2023, Siemens AG and IBM Corp. collaborated to accelerate sustainable product development and operations. The two companies are developing a new systems engineering and asset management combined software solution to support traceability and sustainable product development linking domains including mechanical, electronics, electrical, and software engineering.

Recent Development

- In May 2023, Fujitsu and Microsoft announced a global partnership to enable “sustainability transformation”. The agreement involves investment by both companies to drive the expansion of Fujitsu’s multibillion-dollar Uvance business leverages the Microsoft Cloud and industry-leading technologies to digitally transform organizations around the globe by developing more sustainable practices and solutions.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global sustainable manufacturing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Dassault Systèmes S.E.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. General Electric Company

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Johnson & Johnson Services, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Koninklijke Philips N.V.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Siemens AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Sustainable Manufacturing Market by Offering

4.1.1. Recycled Lithium-Ion Battery

4.1.2. Recycled Material

4.1.3. Recycled Plastic

4.1.4. Recycled Metal

4.1.5. Recycled Carbon Fiber

4.1.6. Water Recycle and Reuse

4.2. Global Sustainable Manufacturing Market by Application

4.2.1. Automotive

4.2.2. Energy

4.2.3. Electrical & Electronics

4.2.4. Packaging

4.2.5. Building & Construction

4.2.6. Marine

4.2.7. Aerospace

4.2.8. Power

4.2.9. Chemicals

4.2.10. Other Applications (Healthcare)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. 3M

6.2. Alat

6.3. Apple Inc.

6.4. BASF SE

6.5. Fujitsu Ltd.

6.6. Hitachi Energy Ltd.

6.7. Interface, Inc.

6.8. Kyndryl Inc.

6.9. Nike, Inc.

6.10. Patagonia, Inc

6.11. Procter & Gamble

6.12. SAP SE

6.13. Schneider Electric

6.14. Sony Group Corp.

6.15. Tesla, Inc.

6.16. The Coca?Cola Company

6.17. Walmart Inc.

1. GLOBAL SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

2. GLOBAL SUSTAINABLE RECYCLED LITHIUM-ION BATTERY MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SUSTAINABLE RECYCLED MATERIAL MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SUSTAINABLE RECYCLED PLASTIC MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SUSTAINABLE RECYCLED METAL MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL SUSTAINABLE RECYCLED CARBON FIBER MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SUSTAINABLE WATER RECYCLE AND REUSE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL SUSTAINABLE MANUFACTURING FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL SUSTAINABLE MANUFACTURING FOR ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SUSTAINABLE MANUFACTURING FOR ELECTRICAL & ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SUSTAINABLE MANUFACTURING FOR PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SUSTAINABLE MANUFACTURING FOR BUILDING & CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL SUSTAINABLE MANUFACTURING FOR MARINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL SUSTAINABLE MANUFACTURING FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL SUSTAINABLE MANUFACTURING FOR POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL SUSTAINABLE MANUFACTURING FOR CHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL SUSTAINABLE MANUFACTURING FOR OTHERS APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

22. NORTH AMERICAN SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. EUROPEAN SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

25. EUROPEAN SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

31. REST OF THE WORLD SUSTAINABLE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL SUSTAINABLE MANUFACTURING MARKET SHARE BY OFFERING, 2023 VS 2031 (%)

2. GLOBAL SUSTAINABLE RECYCLED LITHIUM-ION BATTERY MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SUSTAINABLE RECYCLED MATERIAL MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SUSTAINABLE RECYCLED PLASTIC MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL SUSTAINABLE RECYCLED METAL MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL SUSTAINABLE RECYCLED CARBON FIBER MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL SUSTAINABLE WATER RECYCLE AND REUSE MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL SUSTAINABLE MANUFACTURING MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

9. GLOBAL SUSTAINABLE MANUFACTURING FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL SUSTAINABLE MANUFACTURING FOR ENERGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SUSTAINABLE MANUFACTURING FOR ELECTRICAL & ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL SUSTAINABLE MANUFACTURING FOR PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL SUSTAINABLE MANUFACTURING FOR BUILDING & CONSTRUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL SUSTAINABLE MANUFACTURING FOR MARINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL SUSTAINABLE MANUFACTURING FOR AEROSPACE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL SUSTAINABLE MANUFACTURING FOR POWER MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL SUSTAINABLE MANUFACTURING FOR CHEMICALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL SUSTAINABLE MANUFACTURING FOR OTHER APPLICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL SUSTAINABLE MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. US SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

21. CANADA SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

22. UK SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

23. FRANCE SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

24. GERMANY SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

25. ITALY SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

26. SPAIN SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF EUROPE SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

28. INDIA SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

29. CHINA SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

30. JAPAN SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

31. SOUTH KOREA SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

32. REST OF ASIA-PACIFIC SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

33. LATIN AMERICA SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

34. MIDDLE EAST AND AFRICA SUSTAINABLE MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)