Switchgear Monitoring System Market

Switchgear Monitoring System Market Size, Share & Trends Analysis Report, by Type (Gas Insulated Switchgear (GIS) and Air Insulated Switchgear (AIS)), By End-User (Utilities, Industrial, Commercial, and Others), and Forecast, 2019-2025 Update Available - Forecast 2025-2035

Switchgear monitoring system market is expected to grow significantly at a CAGR of 6.9% during the forecast period. The growing industrial and commercial sector has led to the utilization of high electricity requirements which in turn would lead to unexpected temperature rise at a particular location. The rising concern for the better maintenance of electrification systems has enabled the demand for on-line monitoring and diagnostic system. The switchgear monitoring system is the component of an electrical power system which is used for electrical power distribution and to isolate electrical loads. With the advancement in technology, the demand for power quality is increasing. Switchgear monitoring system offers real-time and on-line temperature monitoring solutions which provide the collection of temperature and transmitting information.

The switchgear monitoring system consists of discharge sensors, instruments, and diagnostic software in order to measure the working of switchgear for scheduling the maintenance power cuts and take preventive measures to avoid failure of the switchgear system. The increasing demand for switchgear monitoring system from the manufacturing and service industry which rely heavily on the reliable power supply from electric utilities to enhance the working of the electrically powered devices is driving the switchgear monitoring system market. However, the increased cost of installation may hamper the market segment of the switchgear monitoring system. The inspection and maintenance provided by power distributors may restrain the market share of the switchgear monitoring system.

Segmental Outlook

The switchgear monitoring system market is segmented on the basis of type and end-user. Based on the type, the market is segmented into gas-insulated switchgear (GIS) and air-insulated switchgear (AIS). Based on end-user, the market is segmented into utilities, industrial, commercial, and others.

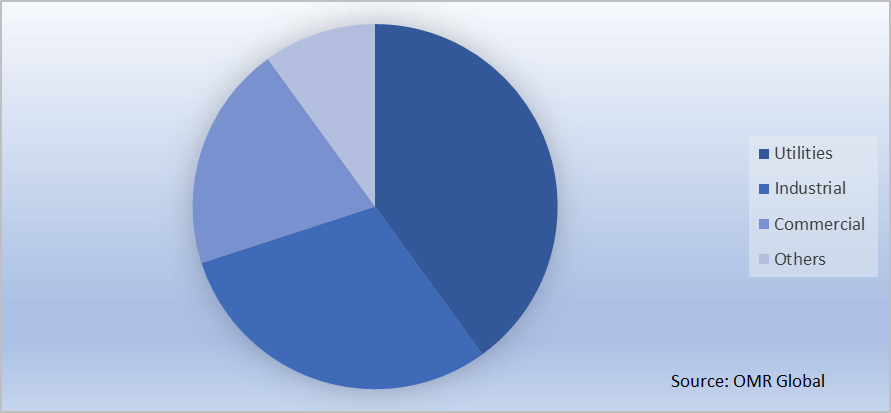

Switchgear Monitoring System Market Share by End-User, 2018(%)

The gas-insulated segment is estimated to have a significant market share in the switchgear monitoring system market

The gas-insulated segment is expected to register significant market share over the forecast period owing to the increasing demand from the industrial sector to provide high energy demands. The gas-insulated switchgear system consists of high voltage components such as circuit-breakers and disconnectors which can be operated in confined space. Increasing investment from investors as well as from manufacturers in the transmission and distribution infrastructure has led to the high demand for gas-insulated switchgear. The segment is driven by increasing innovation in technology as well as rapid improvement in the power distribution sector. The implementation of smart grid and smart metering technology tends to drive the market share of the gas-insulated switchgear segment.

The utility segment is projected to have significant growth in the switchgear monitoring system market

The utility segment is expected to register significant growth over the forecast period owing to the favorable government policies supporting reliable and uninterrupted power supply. The increasing adoption of smart and secure electric infrastructure along with digitalization across the power industry tends to drive the market share of switchgear monitoring system in the utility segment.

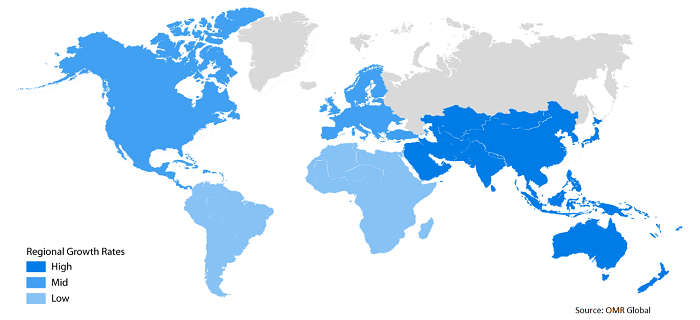

Regional Outlook

The global switchgear monitoring system industry further classified based on geography including North America, Europe, Asia-Pacific and Rest of the World (RoW). Asia-Pacific region is expected to register significant growth over the forecast period owing to the improvement in transmission and distribution network with switchgear surveillance systems to enable the safety and security of the power system.

Switchgear Monitoring System Market Growth, by Region 2019-2025

Market Players Outlook

The major players that contribute to the growth of the switchgear monitoring system market include Schneider Electric, Siemens AG, ABB Group, General Electric, Co., Emerson Electric, Co., and others. These market players are contributing to the market by adopting various market approaches including product launch & approvals, merger & acquisition, partnerships collaborations, and others for gaining a strong position in the market.

Recent Developments

- In June 2018, ABB Group has announced to upgrade one of Helsinki’s substation with the ABB ability technology to meet the increasing demand for power, improve power reliability and assist transmission system operator, through digitalization.

- In June 2017, RFMicron, Inc. (Axzon) announced the deployment of temperature monitoring system for the electric power distribution switchgear equipment used by utilities.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global switchgear monitoring system market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Schneider Electric SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Siemens AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. ABB Group

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. General Electric, Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Emerson Electric, Co.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Switchgear Monitoring System Market by Type

5.1.1. Gas-Insulated Solutions (GIS)

5.1.2. Air-Insulated Solutions (AIS)

5.2. Global Switchgear Monitoring System Market by End-User

5.2.1. Utilities

5.2.2. Industrial

5.2.3. Commercial

5.2.4. Others

6. REGIONAL ANALYSIS

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. COMPANY PROFILES

7.1. ABB Group

7.2. Axzon

7.3. Donwil Co.

7.4. Dynamic Ratings, Inc.

7.5. Eaton Corp.

7.6. EFACEC Power Solutions, SGPS, S.A.

7.7. Emerson Electric Co.

7.8. Fuji Electric Co. Ltd.

7.9. Futronic GmbH

7.10.General Electric, Co.

7.11. Koncar – Electrical Engineering Institute. Inc

7.12. Mitsubishi Electric Corp.

7.13. Pacific Ocean Electrical Switchgear Industries, LLC

7.14. Prism Power Group

7.15. Qualitrol Corp.

7.16. S&C Electric Co.

7.17. Schneider Electric SE

7.18. Siemens AG

7.19. Tiara Vibrasindo Pratama

7.20. Trafag AG

- GLOBAL SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- GLOBAL GIS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AIS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- GLOBAL UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

- NORTH AMERICAN SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- NORTH AMERICAN SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- NORTH AMERICAN SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- EUROPEAN SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- EUROPEAN SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- EUROPEAN SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- ASIA-PACIFIC SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- ASIA-PACIFIC SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- ASIA-PACIFIC SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- REST OF THE WORLD SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- REST OF THE WORLD SWITCHGEAR MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- GLOBAL SWITCHGEAR MONITORING SYSTEM MARKET SHARE BY TYPE, 2018 VS 2025 (%)

- GLOBAL SWITCHGEAR MONITORING SYSTEM MARKET SHARE BY END-USER, 2018 VS 2025 (%)

- GLOBAL SWITCHGEAR MONITORING SYSTEM MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

- US SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- CANADA SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- UK SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- FRANCE SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- GERMANY SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- ITALY SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- SPAIN SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF EUROPE SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- INDIA SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- CHINA SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- JAPAN SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF ASIA-PACIFIC SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF THE WORLD SWITCHGEAR MONITORING SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)