Synthetic Biology Market

Synthetic Biology Market Size, Share & Trends Analysis Report by Deployment (Enabling Product, Core Product and Enabled Product), by Technology (Gene Synthesis & Sequencing, Genome Engineering, Bioinformatics and Others), and by Application (Medical Application, Industrial Application, Food &, Agriculture and Environmental Application) Forecast Period (2024-2031)

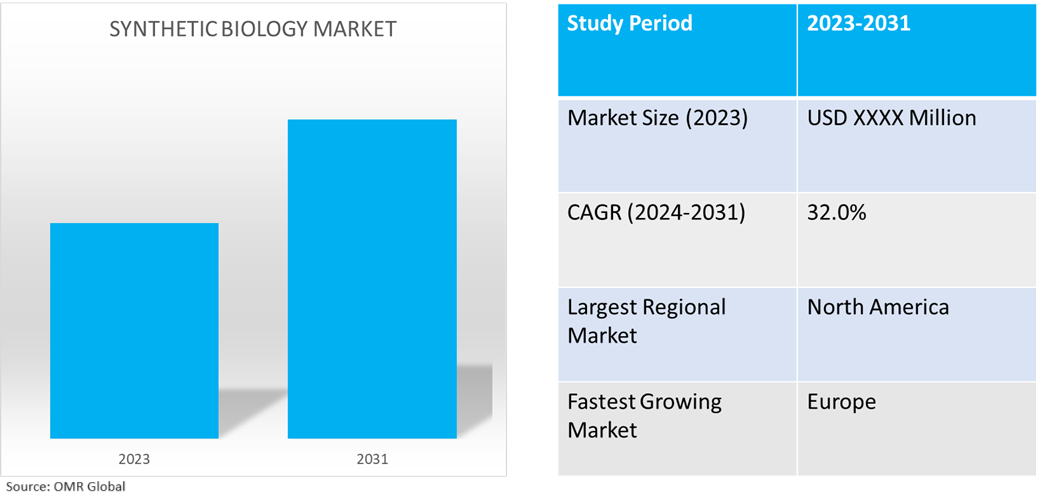

Synthetic biology market is anticipated to grow at a significant CAGR of 32.0% during the forecast period. Synthetic biology is an emerging field of science and has a broad range of applications in sectors, such as chemical environmental, agriculture, medical, energy, and nanotechnology and is increasingly being adopted in these fields. The increasing adoption of synthetic biology in various industries is expected to fuel the growth of the global synthetic biology industry. Furthermore, technological advancements in the life science sector have resulted in increased speed and reduced cost of DNA amalgamation. This enables researchers to design and integrate adjusted bacterial chromosomes that can be utilized as a part of the generation of cutting-edge biofuels, bio-items, sustainable chemicals, and others. The advancements in modern engineering have enabled scientists to build new sequences of DNA.

Market Dynamics

Increased Funding is Likely to Upsurge the Market Growth

Research in synthetic biomedicine has gained significant momentum due to several pressing factors, including diminishing antibiotic options, the rise in chronic and debilitating diseases such as HIV and cancer, and the urgent need for effective treatments globally. Addressing these challenges and improving the quality of life globally has become a driving force behind the surge in synthetic biology research.

Crucially, government agencies are increasingly investing in synthetic biology, providing substantial funding to support this growing field. For instance, in July 2022, SynbiCITE, the UK's National Center for the Industrial Translation of Synthetic Biology, secured a funding commitment of $5.7 million from SynBioVen, a venture capital investment firm based in the UK. This investment aims to bolster synthetic biology startups and small to medium-sized enterprises (SMEs), particularly in the healthcare and biotechnology sectors. These funds not only empower the Imperial-hosted center but also play a pivotal role in strengthening the emerging UK bioeconomy. Ultimately, this support helps unlock the vast societal benefits of synthetic biology research and its practical applications in biomedicine.

Biosafety, Biosecurity, and Ethical Concerns

One significant biosafety concern in synthetic biology revolves around the potential accidental or intentional release of synthetic organisms into the environment during research and various applications. When these synthetic microbes are released, they can mutate and interact with natural organisms, leading to unintended crossbreeding and bio errors. This poses a threat to the delicate balance of natural ecosystems.

To address these concerns, the European Union (EU) has funded multiple research initiatives focusing on understanding the environmental impact of genetically engineered microbes intentionally released for purposes such as plant growth or bioremediation. For instance, according to the European Commission (EC), the EU has established a legal framework to ensure that the development of modern biotechnology, and more specifically of GMOs, takes place in safe conditions. These efforts are crucial in ensuring the responsible development and deployment of synthetic biology applications, safeguarding both the environment and public health.

Biosecurity issues arise from the possible uses of the products of synthetic biology that include harmful acts such as bioterrorism. This concern has been more widely occurring in North America than in Europe. The US has already seen a successful biological attack. The biosecurity concern arises from obtaining materials necessary for baseline synthetic biology research outside of the more regulated environment of a university or research institute.

Segmental Outlook

- Based on product, the market is segmented into enabling product, core product and enabled product.

- Based on technology, the market is segmented into gene synthesis & sequencing, genome engineering, bioinformatics and others.

- Based on application, the market is segmented into medical application, industrial application, food & agriculture and environmental application.

Enabling Product Contribute Highest Share in Global Synthetic Biology Market

The enabling product segment has the highest market share in the global synthetic biology market owing to its essential role in supporting synthetic biology research and applications. This segment includes key tools and technologies such as DNA synthesis, gene sequencing, and genome editing tools, which are crucial for creating, manipulating, and analyzing genetic material. The new wave of DNA synthesis technology has been making significant advances in the field of synthetic biology. The use of new technologies has significantly reduced the time it takes to obtain a DNA sequence needed for an experiment, giving researchers more flexibility. For instance, in August 2023, Camena Bioscience, a synthetic biology company providing genes to the pharmaceutical and biotechnology industries, has closed a $10m Series A financing round led by Mercia, which will be used to scale operations and continue development of its DNA synthesis platform, gSynth. The demand for these technologies is driven by the increasing number of research initiatives and industrial applications that rely on efficient and cost-effective enabling products.

Gene Synthesis & Sequencing is Contributing Significantly to Overall Market Growth

Global synthetic biology market is driven by advancements in gene synthesis technologies, which facilitate the development and application of synthetic biology. Gene sequencing, used to detect the arrangement of nucleotide bases in DNA, is essential for providing information on naturally occurring organisms and constructing biological parts and devices. New microchip-based gene synthesis technologies are expanding the applications of synthetic biology in agriculture, pharmaceuticals, diagnostics, and biofuels by increasing throughput and reducing costs. For instance, in July 2022, Ribbon Biolabs, a synthetic biology company, announced that the US Patent and Trademark Office has issued U.S. Patent US 2020283756 A1, covering Ribbon Biolabs’ novel method for synthesizing a double-stranded polynucleotide, also known as DNA, using a diverse library of oligonucleotides. The patent is the first of the company's submitted patent applications to be approved, laying the groundwork for its IP portfolio encompassing its long DNA synthesis method. These advancements enhance synthetic biology through more efficient enzymatic error correction and genome assembly methods. Gene synthesis enables a wide range of applications, from genetic circuits and metabolic pathways to synthetic genomes. These technologies allow for the development, manipulation, and analysis of DNA, which are crucial for creating artificial living systems.

Regional Outlook

The global synthetic biology market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Synthetic Biology Market Growth by Region 2024-2031

Europe is Expected to Demonstrate a Significant Market Growth

Europe is expected to be a major market for synthetic biology during the forecast period, with key contributors being the UK, Germany, France, Italy, Spain, and other European countries. Companies such as eureKARE are driving market growth with innovative projects, such as their synthetic biology studio launched in Belgium in July 2022. This initiative aims to create a pan-European biotech studio network focused on biomedical and other applications. Additionally, various associations and universities, including Cambridge University, are actively involved in synthetic biology research and development, enhancing the region's research environment and fostering market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global synthetic biology market include BASF SE, Merck KGaA, Thermo Fisher Scientific, Inc., GenScript Biotech Corp. and Twist Bioscience Corp. To gain competitive advantage, major market players are increasingly focusing on investing in R&D, strategic partnerships. For instance, in November 2022, Bio Memory, a start-up focused on DNA data synthesis and storage, raised $5.2 million in seed funding to develop its technology. The funding round was led by eureKARE and the French Tech Seed Fund, with support from Paris Business Angels, Prunay Impact, and existing investors. The funds will be used to optimize Biomemory's technology and reduce its cost.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global synthetic biology market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current End-User Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BASF SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Genscript Biotech Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Twist Bioscience

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Thermo Fisher Scientific, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Synthetic Biology Market by Product

4.1.1. Enabling Product

4.1.1.1. DNA Synthesis

4.1.1.2. Oligonucleotide Synthesis

4.1.2. Core Product

4.1.2.1. Synthetic DNA

4.1.2.2. Synthetic Gene

4.1.2.3. Synthetic Cells

4.1.2.4. Chassis Organisms

4.1.3. Enabled Product

4.1.3.1. Pharmaceuticals and Diagnostics

4.1.3.2. Chemicals

4.1.3.3. Biofuels

4.1.3.4. Agriculture and Plants Science

4.2. Global Synthetic Biology Market by Technology

4.2.1. Gene Synthesis & Sequencing

4.2.2. Genome Engineering

4.2.3. Bioinformatics

4.2.4. Others

4.3. Global Synthetic Biology Market by Application

4.3.1. Medical Application

4.3.2. Industrial Application

4.3.3. Food & Agriculture

4.3.4. Environmental Application

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Agilent Technologies, Inc

6.2. Algenol

6.3. Amyris, Inc

6.4. Autolus Therapeutics Plc

6.5. Codexis, Inc.

6.6. Danaher Corp.

6.7. Dna Twopointo, Inc. (Atum)

6.8. Dupont De Nemours, Inc.

6.9. Editas Medicine, Inc.

6.10. Genewiz

6.11. Ginkgo Bioworks, Inc.

6.12. Inscripta, Inc.

6.13. Integrated DNA Technologies, Inc.

6.14. Intellia Therapeutics, Inc.

6.15. LGC Ltd.

6.16. Origene Technologies, Inc.

6.17. Precigen, Inc.

6.18. Promega Corp.

6.19. Synbio Technologies

6.20. Telesis Bio Inc.

6.21. Vedanta Bioscience, Inc.

6.22. Viridos, Inc.

1. Global Synthetic Biology Market Research and Analysis by Product, 2023-2031 ($ Million)

2. Global Enabling Synthetic Biology Product Market Research and Analysis by Region, 2023-2031 ($ Million)

3. Global Core Synthetic Biology Product Market Research and Analysis by Region, 2023-2031 ($ Million)

4. Global Enabled Synthetic Biology Product Market Research and Analysis by Region, 2023-2031 ($ Million)

5. Global Synthetic Biology Market Research And Analysis by Technology, 2023-2031 ($ Million)

6. Global Gene Synthesis & Sequencing Market Research and Analysis by Region, 2023-2031 ($ Million)

7. Global Synthetic Genome Engineering Market Research and Analysis by Region, 2023-2031 ($ Million)

8. Global Synthetic Biology Bioinformatics Market Research and Analysis by Region, 2023-2031 ($ Million)

9. Global Other Synthetic Biology Technology Market Research and Analysis by Region, 2023-2031 ($ Million)

10. Global Synthetic Biology Market Research and Analysis by Application, 2023-2031 ($ Million)

11. Global Synthetic Biology for Medical Application Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Synthetic Biology Analysis For Industrial Application Market Research And By Region, 2023-2031 ($ Million)

13. Global Synthetic Biology for Food & Agriculture Market Research and Analysis by Region, 2023-2031 ($ Million)

14. Global Synthetic Biology for Environmental Application Market Research and Analysis by Region, 2023-2031 ($ Million)

15. North American Synthetic Biology Market Research and Analysis by Country, 2023-2031 ($ Million)

16. North American Synthetic Biology Market Research and Analysis by Product, 2023-2031 ($ Million)

17. North American Synthetic Biology Market Research and Analysis by Technology, 2023-2031 ($ Million)

18. North American Synthetic Biology Market Research and Analysis by Application, 2023-2031 ($ Million)

19. European Synthetic Biology Market Research and Analysis by Country, 2023-2031 ($ Million)

20. European Synthetic Biology Market Research and Analysis by Product, 2023-2031 ($ Million)

21. European Synthetic Biology Market Research and Analysis by Technology, 2023-2031 ($ Million)

22. European Synthetic Biology Market Research and Analysis by Application, 2023-2031 ($ Million)

23. Asia-Pacific Synthetic Biology Market Research and Analysis by Country, 2023-2031 ($ Million)

24. Asia-Pacific Synthetic Biology Market Research and Analysis by Product, 2023-2031 ($ Million)

25. Asia-Pacific Synthetic Biology Market Research and Analysis by Technology, 2023-2031 ($ Million)

26. Asia-Pacific Synthetic Biology Market Research and Analysis by Application, 2023-2031 ($ Million)

27. Rest Of The World Synthetic Biology Market Research and Analysis by Region, 2023-2031 ($ Million)

28. Rest Of The World Synthetic Biology Market Research and Analysis by Product, 2023-2031 ($ Million)

29. Rest Of The World Synthetic Biology Market Research and Analysis by Technology, 2023-2031 ($ Million)

30. Rest Of The World Synthetic Biology Market Research and Analysis by Application, 2023-2031 ($ Million)

1. Global Synthetic Biology Market Share by Product, 2023 Vs 2031 (%)

2. Global Enabling Synthetic Biology Product Market Share by Region, 2023 Vs 2031 (%)

3. Global Core Synthetic Biology Product Market Share by Region, 2023 Vs 2031 (%)

4. Global Enabled Synthetic Biology Product Market Share by Region, 2023 Vs 2031 (%)

5. Global Synthetic Biology Market Share by Technology, 2023 Vs 2031 (%)

6. Global Gene Synthesis & Sequencing Market Share by Region, 2023 Vs 2031 (%)

7. Global Synthetic Genome Engineering Market Share by Region, 2023 Vs 2031 (%)

8. Global Synthetic Biology Bioinformatics Market Share by Region, 2023 Vs 2031 (%)

9. Global Other Synthetic Biology Technology Market Share by Region, 2023 Vs 2031 (%)

10. Global Synthetic Biology Market Share by Application, 2023 Vs 2031 (%)

11. Global Synthetic Biology for Medical Application Market Share by Region, 2023 Vs 2031 (%)

12. Global Synthetic Biology for Industrial Application Market Share by Region, 2023 Vs 2031 (%)

13. Global Synthetic Biology for Food & Agriculture Market Share by Region, 2023 Vs 2031 (%)

14. Global Synthetic Biology for Environmental Application Market Share by Region, 2023 Vs 2031 (%)

15. Global Synthetic Biology Market Share by Region, 2023 Vs 2031 (%)

16. US Synthetic Biology Market Size, 2023-2031 ($ Million)

17. Canada Synthetic Biology Market Size, 2023-2031 ($ Million)

18. UK Synthetic Biology Market Size, 2023-2031 ($ Million)

19. France Synthetic Biology Market Size, 2023-2031 ($ Million)

20. Germany Synthetic Biology Market Size, 2023-2031 ($ Million)

21. Italy Synthetic Biology Market Size, 2023-2031 ($ Million)

22. Spain Synthetic Biology Market Size, 2023-2031 ($ Million)

23. Rest Of Europe Synthetic Biology Market Size, 2023-2031 ($ Million)

24. India Synthetic Biology Market Size, 2023-2031 ($ Million)

25. China Synthetic Biology Market Size, 2023-2031 ($ Million)

26. Japan Synthetic Biology Market Size, 2023-2031 ($ Million)

27. South Korea Synthetic Biology Market Size, 2023-2031 ($ Million)

28. Rest Of Asia-Pacific Synthetic Biology Market Size, 2023-2031 ($ Million)

29. Latin America Synthetic Biology Market Size, 2023-2031 ($ Million)

30. Middle East And Africa Synthetic Biology Market Size, 2023-2031 ($ Million)