Synthetic Diamond Market

Global Synthetic Diamond Market Size, Share & Trends Analysis Report By (Polished, and Rough) By Manufacturing Process (High-Pressure High-Temperature (HPHT), and Chemical Vapour Deposition (CVD)) By Application (Construction & Mining, Electronics, Jewellery, Healthcare, and Others (Oil and Gas)) Forecast 2021-2027 Update Available - Forecast 2025-2031

The global market for a synthetic diamond is projected to have a CAGR of around 6.4% during the forecast period. Synthetic diamonds (laboratory-grown diamonds) are otherwise called cultured or cultivated diamonds. A synthetic diamond is produced by an artificial process, and offers significant environmental advantages over mined diamonds, and requires a fraction of the resources of mining operations. These are the substitutes for natural diamonds. Synthetic Diamonds comprise various colors grown by the manufacturing method known as high-pressure high temperature (HPHT), and chemical vapor deposition (CVD). They have similar composition, crystal structure, and other properties as natural diamonds. The global synthetic diamond market is growing at a rapid speed due to various factors such as the increasing demand for the diamond as its application has increased in the field of healthcare, construction & mining, electronics, and jewellery. It is a substitute for a natural diamond with a lower price that contributes to the growth of the market. The availability of synthetic diamonds at an affordable price rising disposable income and technological advancement are the other drivers of the market

However, the factors such as lack of awareness and recession in emerging economies further projected to hinder the market growth. The dearth of marketing and branding of synthetic diamonds is another restraining factor that hampers the market growth. The growth of industrialization in the emerging economies, increasing investment in manufacturing, and product development are the major factors that create future opportunities for the market.

Segmental Outlook

The global synthetic diamond market is segmented based on type, manufacturing process, and application. As per type, the market is further subdivided as polish and rough. The rough segment is projected to grow at a significant rate during the forecast period. These are the uncut and unpolished diamonds used in a wide area of application include oil and gas, mining, precision machining, construction. The demand for this in such type of application fuels the growth of this segment. Based on the manufacturing process, the market is classified into high-pressure high temperature and chemical vapour deposition. On the basis of applications, the market is segregated as construction and mining, electronics, jewellery, healthcare, and others such as oil and gas.

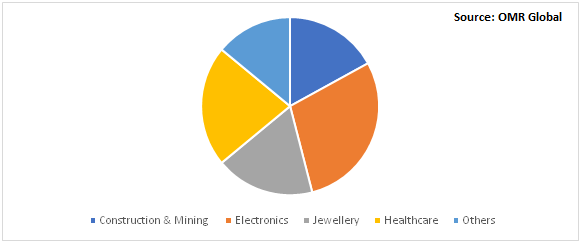

Global Synthetic Diamond Market Share by Application, 2020(%)

The electronic application segment holds the Major Market Share in Synthetic Diamond Market

Among, application, the electronics segment held the major share in 2020, and it is projected to grow at a considerable CAGR during the forecast period. The factor attributed to the growth of the segment includes the increasing demand for consumer electronics such as smartphones, refrigerators, washing machines, and HVAC. The chemical and physical properties of synthetic diamond, such as exceptional thermal conductivity, high resistance to thermal shock, high electrical carrier mobility, electric insulation have made it widely useful for application in electronic devices. High thermal conductivity serves as an effective heat dissipater and makes it widely useful in the production of semiconductors, which are further used in electronic devices, such as laptops, computers, and mobiles. The increasing demand for electronics, primarily the increasing sales of semiconductors, is likely to boost the demand for synthetic diamonds during the forecast period.

Regional Outlook

Geographically, the global Synthetic diamond market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, Russia, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). North America is projected to have a considerable market share during the forecast period. The factors driving the growth of the synthetic diamond market in the region include better infrastructural facilities, development of new technology and manufacturing sector, and strong research and development activities. In North America, the US is the major producer of synthetic diamonds.

Global Synthetic Diamond Market Growth, by Region 2021-2027

Asia-Pacific projected to have significant growth in the Synthetic Diamond Market

Geographically, Asia-Pacific is the fastest-growing region in the synthetic diamond market during the forecast period. The market growth is mainly driven due to growing industrialization, manufacturing investment, and increasing awareness among people regarding fashion. The growth of the synthetic diamond manufacturing units in emerging economies such as China, India, and South Korea is another major factor that drives the market growth. Apart from this, the growing industrialization and manufacturing activities by major market players are likely to fuel the growth of the market in near future.

Market Players Outlook

The key players in the synthetic diamond market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market are Applied Diamond Inc, Element Six UK Ltd., Hebei Plasma Diamond Technology Co., Ltd., Morgan Advanced Materials plc, New Diamond Technology LLC., Pure Grown Diamonds, Sumitomo Electric Industries, Ltd., among Others. To sustain a strong position in the market, these market players adopt different marketing strategies such as mergers and acquisitions, R&D, product launches, and geographical expansions and others. For instance, in June 2020, Element Six UK Ltd had launched DNV-B1, a commercially available, general-purpose CVD quantum grade diamond. DNV-B1 is used in researching nitrogen-vacancy (NV) ensembles for quantum demonstrations, masers, detection of RF radiation, gyroscopes, sensing, and further projects. The material is designed for emerging diamond applications that require ensembles of NV centres, guaranteeing a minimum level of performance. It also supports overcoming the barrier to the adoption of diamonds in R&D for quantum application.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global synthetic diamond market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Synthetic Diamond Market, By Type

5.1.1. Polished

5.1.2. Rough

5.2. Global Synthetic Diamond Market, By Manufacturing Process

5.2.1. High-Pressure High-Temperature (HPHT)

5.2.2. Chemical Vapour Deposition (CVD)

5.3. Global Synthetic Diamond Market, By Application

5.3.1. Construction & Mining

5.3.2. Electronics

5.3.3. Jewellery

5.3.4. Healthcare

5.3.5. Others (Oil and Gas)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Russia

6.2.7. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korean

6.3.5. ASEAN

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East Africa

7. Company Profiles

7.1. Applied Diamond Inc.

7.2. Crystallume Corp.

7.3. Element Six UK Ltd.

7.4. Forevermark Ltd.

7.5. Heart in Diamond

7.6. Hebei Plasma Diamond Technology Co., Ltd.

7.7. Henan Huanghe Whirlwind Co.,Ltd.

7.8. Hyperion Materials & Technologies, Inc.

7.9. ILJIN Co., Ltd.

7.10. Morgan Advanced Materials plc

7.11. New Diamond Technology LLC.

7.12. Pure Grown Diamonds

7.13. Sandvik AB

7.14. SWAROVSKI Group

7.15. Sumitomo Electric Industries, Ltd.

7.16. Tomei Diamond Co.,Ltd.

7.17. Washington Diamonds

7.18. Zhengzhou Sino-Crystal Diamond Co., Ltd.

1. GLOBAL SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027($ MILLION)

2. GLOBAL POLISHED SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

3. GLOBAL ROUGH SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

4. GLOBAL SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY MANUFACTURING PROCESS, 2020-2027($ MILLION)

5. GLOBAL SYNTHETIC DIAMOND IN HIGH PRESSURE HIGH TEMPERATURE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

6. GLOBAL SYNTHETIC DIAMOND IN CHEMICAL VAPOUR DEPOSITION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

7. GLOBAL SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027($ MILLION)

8. GLOBAL SYNTHETIC DIAMOND IN CONSTRUCTION & MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

9. GLOBAL SYNTHETIC DIAMOND IN ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

10. GLOBAL SYNTHETIC DIAMOND IN JEWELLERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

11. GLOBAL SYNTHETIC DIAMOND IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

12. GLOBAL SYNTHETIC DIAMOND IN OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

13. GLOBAL SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027($ MILLION)

14. NORTH AMERICAN SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027($ MILLION)

15. NORTH AMERICAN SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027($ MILLION)

16. NORTH AMERICAN SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY BY MANUFACTURING PROCESS 2020-2027($ MILLION)

17. NORTH AMERICAN SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY BY APPLICATION 2020-2027($ MILLION)

18. EUROPEAN SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027($ MILLION)

19. EUROPEAN SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027($ MILLION)

20. EUROPEAN SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY MANUFACTURING PROCESS, 2020-2027($ MILLION)

21. EUROPEAN SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027($ MILLION)

22. ASIA-PACIFIC SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027($ MILLION)

23. ASIA-PACIFIC SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027($ MILLION)

24. ASIA-PACIFIC SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY MANUFACTURING PROCESS 2020-2027($ MILLION)

25. ASIA-PACIFIC SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027($ MILLION)

26. REST OF THE WORLD SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027($ MILLION)

27. REST OF THE WORLD SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY MANUFACTURING PROCESS 2020-2027($ MILLION)

28. REST OF THE WORLD SYNTHETIC DIAMOND MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027($ MILLION)

1. GLOBAL SYNTHETIC DIAMOND MARKET SHARE BY TYPE, 2020 VS 2027 (%)

2. GLOBAL SYNTHETIC DIAMOND MARKET SHARE BY MANUFACTURING PROCESS 2020 VS 2027 (%)

3. GLOBAL SYNTHETIC DIAMOND MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

4. GLOBAL SYNTHETIC DIAMOND MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

5. GLOBAL POLISHED SYNTHETIC DIAMOND MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL ROUGH SYNTHETIC DIAMOND MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL SYNTHETIC DIAMOND IN HIGH PRESSURE HIGH TEMPERATURE MARKET SHARE BY TYPE, 2020-2027 ($ MILLION)

8. GLOBAL SYNTHETIC DIAMOND IN CHEMICAL VAPOUR DEPOSITION MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL SYNTHETIC DIAMOND IN ELECTRONICS MARKET SHARE BY TYPE, 2020-2027 ($ MILLION)

10. GLOBAL SYNTHETIC DIAMOND IN CONSTRUCTION & MINING MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL SYNTHETIC DIAMOND IN JEWELLERY MARKET SHARE BY TYPE, 2020-2027 ($ MILLION)

12. GLOBAL SYNTHETIC DIAMOND IN HEALTHCARE MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL SYNTHETIC DIAMOND IN OTHERS MARKET SHARE BY TYPE, 2020-2027 ($ MILLION)

14. US SYNTHETIC DIAMOND MARKET SIZE, 2020-2027 ($ MILLION)

15. CANADA SYNTHETIC DIAMOND MARKET SIZE, 2020-2027 ($ MILLION)

16. UK SYNTHETIC DIAMOND MARKET SIZE, 2020-2027 ($ MILLION)

17. FRANCE SYNTHETIC DIAMOND MARKET SIZE, 2020-2027 ($ MILLION)

18. GERMANY SYNTHETIC DIAMOND MARKET SIZE, 2020-2027 ($ MILLION)

19. ITALY SYNTHETIC DIAMOND MARKET SIZE, 2020-2027 ($ MILLION)

20. SPAIN SYNTHETIC DIAMOND MARKET SIZE, 2020-2027 ($ MILLION)

21. REST OF EUROPE SYNTHETIC DIAMOND MARKET SIZE, 2020-2027($ MILLION)

22. INDIA SYNTHETIC DIAMOND MARKET SIZE, 2020-2027($ MILLION)

23. CHINA SYNTHETIC DIAMOND MARKET SIZE, 2020-2027($ MILLION)

24. JAPAN SYNTHETIC DIAMOND MARKET SIZE, 2020-2027($ MILLION)

25. SOUTH KOREA SYNTHETIC DIAMOND MARKET SIZE, 2020-2027($ MILLION)

26. ASEAN SYNTHETIC DIAMOND MARKET SIZE, 2020-2027($ MILLION)

27. REST OF ASIA-PACIFIC SYNTHETIC DIAMOND MARKET SIZE, 2020-2027($ MILLION)

28. REST OF THE WORLD SYNTHETIC DIAMOND MARKET SIZE, 2021-2027($ MILLION