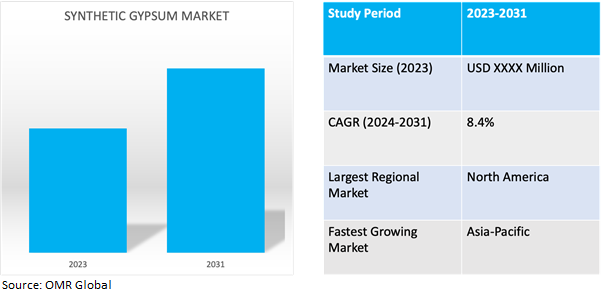

Synthetic Gypsum Market

Synthetic Gypsum Market Size, Share & Trends Analysis Report by Product Type (Flue Gas Desulfurization (FGD) Gypsum, Fluorogypsum, Phosphogypsum, Citrogypsum, and Titanogypsum) and by Application (Drywall, Cement and Soil Amendments) Forecast Period (2024-2031)

Synthetic gypsum market is anticipated to grow at a CAGR of 8.4% during the forecast period (2024-2031). Synthetic Gypsum is a by product of various industrial processes, particularly those involved in the treatment of flue gas emissions from power plants or the production of phosphoric acid. It's created through a process called flue-gas desulfurization (FGD) or scrubbing, where sulfur dioxide (SO2) emissions from power plants are captured and reacted with a calcium-based absorbent, typically limestone or lime, to produce calcium sulfite or calcium sulfate.

Market Dynamics

Driving the Demand for Synthetic Gypsum

Synthetic gypsum, derived from industrial processes like flue-gas desulfurization, presents an attractive solution. Its utilization in construction products such as drywall, plaster, and cement not only reduce the reliance on natural gypsum but also diverts industrial waste from landfills. Builders and developers are increasingly opting for sustainable materials to meet green building standards and consumer preferences for eco-friendly structures, thus driving the demand for synthetic gypsum. For instance, in March 2020, Knauf AG unveiled intentions to establish a second gypsum wallboard production line in Bukhara, situated within the Bukhara region. This initiative encompasses an investment of approximately $2.4 million towards the installation of an extra gypsum mixture line at its existing Bukharagips facility.

Advancements in Synthetic Gypsum Production

Technological advancements in synthetic gypsum production processes have significantly enhanced efficiency and quality. Improved FGD technologies enable more effective capture and conversion of sulfur dioxide emissions into gypsum. These advancements result in higher purity and consistency of synthetic gypsum, making it suitable for a wider range of applications. Additionally, innovations in manufacturing techniques and equipment have streamlined production and reduced costs, making synthetic gypsum more competitive with natural gypsum. These technological advancements drive market growth by increasing the availability and attractiveness of synthetic gypsum as a sustainable construction material.

Market Segmentation

Our in-depth analysis of the global synthetic gypsum market includes the following segments by product type and application:

- Based on product type, the market is sub-segmented into flue gas desulfurization gypsum, fluorogypsum, phosphogypsum, citrogypsum, and titanogypsum.

- Based on application, the market is sub-segmented into drywall, cement, and soil amendments.

Flue Gas Desulfurization (FGD) Gypsum is Projected to Emerge as the Largest Segment

Based on the product type, the FGD gypsum sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing adoption of FGD technologies by industries, particularly coal-fired power plants. As environmental regulations become more stringent worldwide, there is a growing imperative for industries to reduce sulfur dioxide (SO2) emissions. FGD systems offer an effective solution by capturing and treating these emissions, resulting in the production of synthetic gypsum as a byproduct.

Drywall Sub-segment to Hold a Considerable Market Share

The drywall sub-segment commands a significant market share in the global synthetic gypsum market due to its widespread use in construction and several key factors. Synthetic gypsum, derived from FGD processes, serves as a crucial raw material for drywall production, offering affordability, ease of installation, and fire-resistant properties. With steady growth in the construction industry, particularly in the residential and commercial sectors, the demand for drywall continues to rise. Additionally, environmental considerations drive the adoption of synthetic gypsum, contributing to sustainability efforts by reducing reliance on natural gypsum.

Regional Outlook

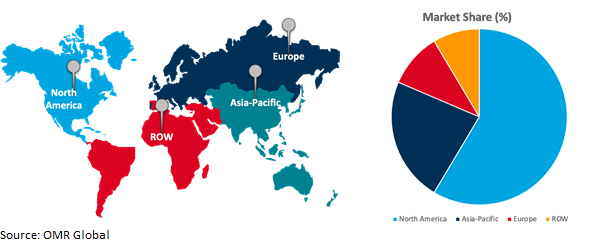

The global synthetic gypsum market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Major Market Share

North America holds a significant share due to its abundance of coal-fired power plants, which produce synthetic gypsum through FGD. The region's thriving construction industry also contributes to the demand for gypsum-based products, with synthetic gypsum offering a cost-effective and sustainable alternative.

Global Synthetic Gypsum Market Growth by Region 2024-2031

Driving Forces Behind the Rapid Growth of the Asia-Pacific Synthetic Gypsum Market

The Asia-Pacific region is witnessing rapid growth in the global synthetic gypsum market due to industrialization and urbanization driving demand for construction materials, including gypsum-based products like drywall and plaster. Stringent environmental regulations in countries like China and India are leading to increased adoption of FGD technologies, resulting in substantial production of synthetic gypsum. Technological advancements are making synthetic gypsum production more cost-effective and efficient, meeting the region's demand for sustainable construction materials. Additionally, government initiatives promoting sustainable development are further encouraging the use of synthetic gypsum. These factors collectively position the Asia-Pacific region as the fastest-growing market in the global synthetic gypsum market. For instance, the Indian government initiated the "Housing for All by 2022" program, to ensure accessible and affordable housing for every citizen within the country.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global synthetic gypsum market include Drax, LafargeHolcim, Saint-Gobain, PABCO Gypsum, USG Corp., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in October 2023, Etex disclosed a formal agreement to purchase BGC's gypsum and fiber cement operations. This acquisition encompasses BGC's manufacturing facilities for wallboard, plaster, compounds, and cornice, as well as the Perth gypsum wallboard plant situated in Western Australia. Through this strategic expansion, Etex aims to strengthen its current gypsum wallboard portfolio while strategically positioning itself to leverage the growing demand for fiber cement products.

In October 2023, Beneficial Reuse Management (BRM) disclosed its acquisition of USA Gypsum. This strategic move enables BRM to diversify its gypsum sources by integrating recycled drywall scrap into its operations. Additionally, the acquisition expands BRM's geographical footprint, complementing its existing activities in supplying gypsum pellets to agricultural and other sectors. This acquisition perfectly aligns with BRM's dedication to offering sustainable solutions for industrial byproduct management, thus reducing materials sent to landfills.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global synthetic gypsum market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Drax Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Holcim Group

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Saint-Gobain S.A.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Synthetic Gypsum Market by Product Type

4.1.1. Flue Gas Desulfurization (FGD) Gypsum

4.1.2. Fluorogypsum

4.1.3. Phosphogypsum

4.1.4. Citrogypsum

4.1.5. Titanogypsum

4.2. Global Synthetic Gypsum Market by Application

4.2.1. Drywall

4.2.2. Cement

4.2.3. Soil Amendments

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. 4 Georgia-Pacific Gypsum LLC

6.2. American Gypsum Company LLC

6.3. Boral Ltd.

6.4. Gujarat State Fertilizers & Chemicals Limited (GSFC)

6.5. GYPSOIL (Beneficial Reuse Management LLC)

6.6. Jeya Enterprises

6.7. Knauf Group

6.8. National Gypsum Company

6.9. PABCO Gypsum (a division of PABCO® Building Products, LLC)

6.10. USG Corp.

1. GLOBAL SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL FLUE GAS DESULFURIZATION (FGD) GYPSUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FLUOROGYPSUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL PHOSPHOGYPSUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL CITROGYPSUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL TITANOGYPSUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL SYNTHETIC GYPSUM FOR DRYWALL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SYNTHETIC GYPSUM FOR CEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL SYNTHETIC GYPSUM FOR SOIL AMENDMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. EUROPEAN SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

17. EUROPEAN SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD SYNTHETIC GYPSUM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL SYNTHETIC GYPSUM MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL FLUE GAS DESULFURIZATION (FGD) GYPSUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FLUOROGYPSUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL PHOSPHOGYPSUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL CITROGYPSUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL TITANOGYPSUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL SYNTHETIC GYPSUM MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL SYNTHETIC GYPSUM FOR DRYWALL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL SYNTHETIC GYPSUM FOR CEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL SYNTHETIC GYPSUM FOR SOIL AMENDMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SYNTHETIC GYPSUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

14. UK SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA SYNTHETIC GYPSUM MARKET SIZE, 2023-2031 ($ MILLION)