Synthetic Natural Gas Market

Synthetic Natural Gas Market Size, Share & Trends Analysis Report by Technology (Anaerobic Digestion & Fermentation, Power-To-Gas, and Thermal Gasification (Moving bed gasifier, Fluidized bed gasifier and Entrained Flow Gasifier)) by Source (Coal, Biomass and Renewable energy) and by Application (Transportation, Power Generation, Industrial and Grid injection) Forecast Period (2024-2031)

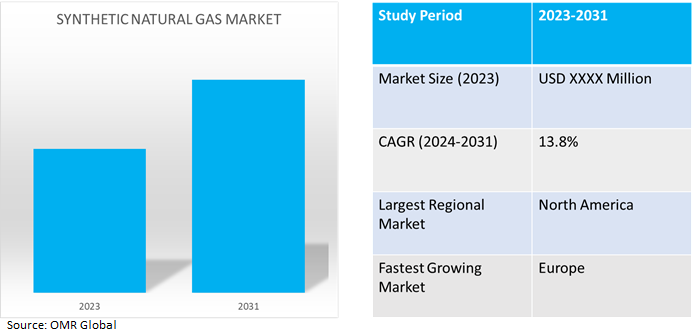

Synthetic natural gas (SNG) market is anticipated to grow at a significant CAGR of 13.8% during the forecast period (2024-2031). The market growth is attributed to the increasing Innovation in waste management and a rise in government efforts to spend heavily on the development of renewable energy sources to reduce carbon emissions and provide a steady supply globally. Natural gas equipment can continue to run by using gasification, which is a common on-site industrial process that produces electricity and SNG from a coal source.

Market Dynamics

Integration of Synthetic Natural Gas with Renewable Energy

An intriguing way to reduce the consumption of fossil fuels and the resulting greenhouse gas emissions is to replace natural gas with a renewable alternative. This move also makes sense from the perspective of supply security. The term "green natural gas" carriers made from biomass that include both biogas and synthetic natural gas (SNG). This is a renewable substitute for natural gas. All of the benefits of natural gas, including the trade and supply network, dense infrastructure, and natural gas applications, are available for this route.

Increasing Industrial and Transportation Applications

Synthetic natural gas as a transport fuel offers important benefits to consumers, the environment, and the economy. It provides a quick and cost-effective way to meet key objectives, including decarbonizingdecarbonizing road transport and improving air quality in cities. SNG can replace fossil fuels with a low-carbon or even carbon-free alternative, depending on the source of fuel. In all applications, it can be combined and utilized in place of natural gas. SNG that has been compressed or liquefied can be moved or kept in the gas infrastructure. Synthetic natural gas also offers important synergies with biomethane from waste and biomass or synthetic gas produced using wind and solar energy. When using renewable gas, quasi-carbon-neutral mobility is achieved without any impact on the infrastructure and vehicle technology.

Market Segmentation

Our in-depth analysis of the global synthetic natural gas market includes the following segments technology, source, and application.

- Based on the technology, the market is segmented into anaerobic digestion & fermentation, power-to-gas, and thermal gasification (moving bed gasifier, fluidized bed gasifier, entrained flow gasifier, and others (steam reforming).

- Based on the source, the market is segmented into coal, biomass, and renewable energy.

- Based on the application, the market is sub-segmented into transportation, power generation, industrial, and grid injection.

Thermal Gasification is Projected to Remain the Largest Segment

Thermal gasification segment is expected to hold the largest share of the market. Interest in thermal gasification for SNG generation is being driven by the demand for efficient waste management solutions, particularly for organic waste streams including agricultural residues and municipal solid trash. The problems of waste management and energy are addressed when waste is transformed into useful energy products. For instance, in August 2022, Storengy chose MAN Energy Solutions for a methanation reactor to produce synthetic gas (Syngas) at a French wastewater treatment plant. The treatment of sludge by anaerobic digestion produces a mixture of bio-methane and biogenic CO2.

Transportation Sub-segment to Hold a Considerable Market Share

The transportation segment is expected to hold a considerable share of the market. Growing consumer awareness of the environmental effects of traditional fossil fuels is driving increased demand for automobiles fueled by cleaner fuels, such as synthetic natural gas (SNG). Customers are actively looking for more environmentally friendly transportation options as they are increasingly more aware of their carbon footprint owing to easier access to information about air pollution and climate change.

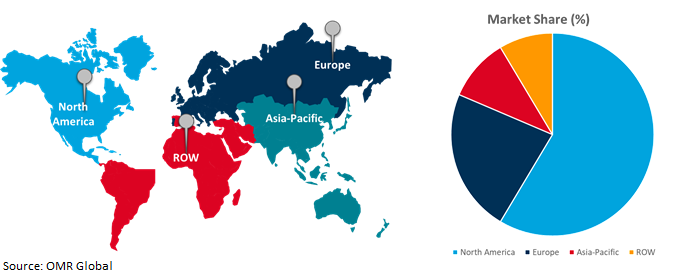

Regional Outlook

Global synthetic natural gas market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand of Synthetic Natural Gas in Europe

- The regional growth is attributed to the growing demand for synthetic natural gas in countries such as Germany, the UK, and France for industrial and commercial applications drives the growth of the synthetic natural gas market in Europe.

- For instance, in March 2022, the European Union imported an average of over 380.0 million cubic meters (mcm) per day of gas by pipeline from Russia, or around 140.0 billion cubic meters (bcm) for the year as a whole in 2021. As well as that, around 15 bcm was delivered in the form of liquefied natural gas (LNG). The total 155 bcm imported from Russia accounted for around 45.0% of the EU’s gas imports in 2021 and almost 40.0% of its total gas consumption.

Global Synthetic Natural Gas Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent synthetic natural gas companies and providers such as Ameresco, Chevron Corp., and Monarch Bio Energy LLC. in the region. The growth is mainly attributed to the increasing demand for synthetic natural gas in applications such as transportation, power generation, and industrial maintenance drives the growth of the market. According to the US Energy Information Administration, in 2022, Coalbed methane obtained from coal seams, or beds contributes to the US natural gas supply. In 2022, US coalbed methane production was about 2.0% of total US dry natural gas production. The largest single source of synthetic natural gas in the US is the Great Plains Synfuels Plant in Beulah, North Dakota, where coal is converted to pipeline-quality natural gas. Supplemental gaseous fuel production equaled about 0.2% of US natural gas production in 2022. For instance, in May 2023, TotalEnergies partnered with Tree Energy Solutions (TES) to study and develop a large-scale production unit in the US for e-natural gas (e-NG), a synthetic gas produced from renewable hydrogen and CO2. The project, which is expected to produce 100,000 to 200,000 metric tons of e-NG per year, will be equally owned by the partners and operated by TotalEnergies.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global synthetic natural gas market include AIR LIQUIDE, Air Products and Chemicals, Inc., IHI Corp., Mitsubishi Heavy Industries, Ltd., and Siemens AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2023, Naturgy and Greene are collaborating on a project to produce synthetic (syngas) biomethanation for injection into the distribution network or use in mobility. The innovative aspect of this project, unique in Spain, resides in the type of waste from which the bio-synthetic natural gas is obtained.

Recent Development

- In November 2022, Tokyo Gas Co., Ltd. (TG), Osaka Gas Co., Ltd. (OG), Toho Gas Co., Ltd. (THG), and Mitsubishi Corporation (MC) entered into an agreement and commenced to conduct a detailed joint feasibility study on a project to produce synthetic methane (e-methane) in Texas or Louisiana, liquefy it at the existing Cameron LNG facility, and transport it to Japan utilizing other existing infrastructure, including LNG ships and receiving terminals in Japan.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global synthetic natural gas market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AIR LIQUIDE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Air Products and Chemicals, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IHI Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Mitsubishi Heavy Industries, Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Siemens AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Synthetic Natural Gas Market by Technology

4.1.1. Solution

4.1.2. Anaerobic digestion & fermentation

4.1.3. Power-to-gas

4.1.4. Thermal gasification

4.1.4.1. Moving bed gasifier

4.1.4.2. Fluidized bed gasifier

4.1.4.3. Entrained flow gasifier

4.1.4.4. Others (Steam Reforming)

4.2. Global Synthetic Natural Gas Market by Source

4.2.1. Coal

4.2.2. Biomass

4.2.3. Renewable energy

4.3. Global Synthetic Natural Gas Market by Application

4.3.1. Transportation

4.3.2. Power generation

4.3.3. Industrial

4.3.4. Grid injection

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Algas-SDI

6.2. Basin Electric Power Cooperative

6.3. Chevron Corp. (Renewable Energy Group)

6.4. Chiyoda Corp.

6.5. Dakota Gasification Company

6.6. Enerkem Inc.

6.7. EnviTec Biogas AG

6.8. Exxon Mobil Corp.

6.9. KADATEC s.r.o.

6.10. Kohler Co. (Clarke Energy)

6.11. Linde GmbH

6.12. MAN Energy Solutions SE

6.13. Sasol Ltd.

6.14. Shell Group

6.15. Thyssenkrupp Uhde GmbH

6.16. Topsoe A/S

6.17. Velocys plc

1. GLOBAL SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY,2023-2031 ($ MILLION)

2. GLOBAL SYNTHETIC NATURAL GAS ANAEROBIC DIGESTION & FERMENTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SYNTHETIC NATURAL POWER-TO-GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SYNTHETIC NATURAL GAS THERMAL GASIFICATIONMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

6. GLOBAL COAL-BASED SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BIOMASS-BASED SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL RENEWABLE ENERGY-BASED SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

10. GLOBAL SYNTHETIC NATURAL GAS FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SYNTHETIC NATURAL GAS FOR POWER GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SYNTHETIC NATURAL GAS FOR INDUSTRIALMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SYNTHETIC NATURAL GAS FOR GRID INJECTIONMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY,2023-2031 ($ MILLION)

17. NORTH AMERICAN SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. EUROPEAN SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

21. EUROPEAN SYNTHETIC NATURAL GASMARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

22. EUROPEAN SYNTHETIC NATURAL GASMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

26. ASIA-PACIFICSYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. REST OF THE WORLD SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

29. REST OF THE WORLD SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023 VS 2031 (%)

2. GLOBAL SYNTHETIC NATURAL GAS ANAEROBIC DIGESTION & FERMENTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL SYNTHETIC NATURAL POWER-TO-GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL SYNTHETIC NATURAL GAS THERMAL GASIFICATIONMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023 VS 2031 (%)

6. GLOBAL COAL-BASED SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL BIOMASS-BASED SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL RENEWABLE ENERGY-BASED SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

10. GLOBAL SYNTHETIC NATURAL GAS FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL SYNTHETIC NATURAL GAS FOR POWER GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL SYNTHETIC NATURAL GAS FOR INDUSTRIALMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL SYNTHETIC NATURAL GAS FOR GRID INJECTIONMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. GLOBAL SYNTHETIC NATURAL GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

15. US SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

17. UK SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST & AFRICA SYNTHETIC NATURAL GAS MARKET SIZE, 2023-2031 ($ MILLION)