Synthetic Rubber Market

Synthetic Rubber Market Size, Share & Trends Analysis Report by Type (Styrene Butadiene Rubber (BR), Polybutadiene (BR), Ethylene Propylene (EPDM), Nitrile Butadiene Rubber (NBR), Isoprene Rubber (IR), Chloroprene Rubber (Cr), Butyl Rubber (IIR), and Others), and by End-User (Tires, Industrial application, Electronics, Footwear, Household, and Others) Forecast Period (2024-2031)

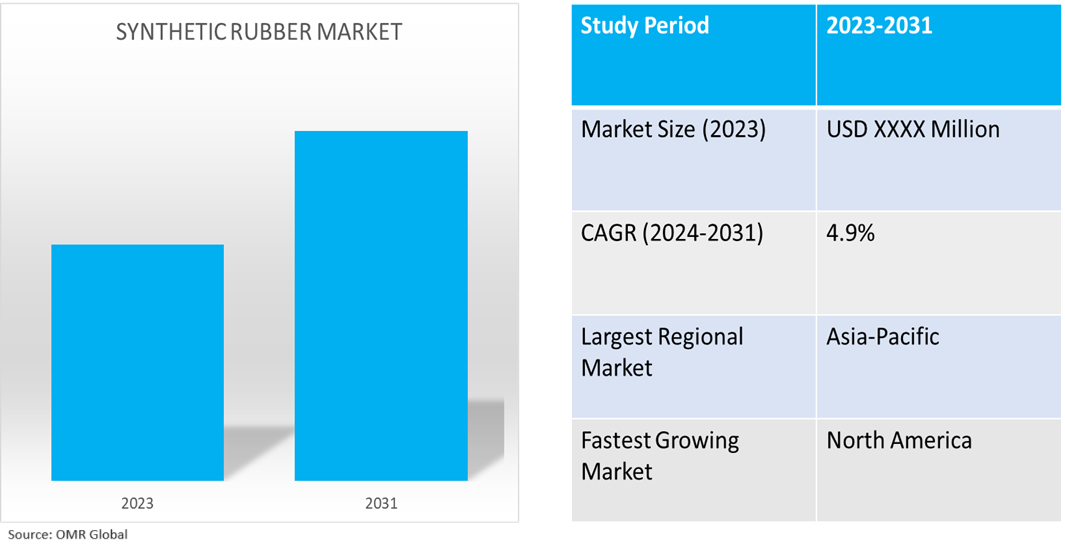

Synthetic rubber market is anticipated to grow at a CAGR of 4.9% during the forecast period (2024-2031). The global synthetic rubber market is influenced by factors such as the growing automotive industry, technological advancements, environmental trends, industrial applications, regional market dynamics, raw material supply, and supply chain management, enabling consumers to take the opportunity of growth possibilities, manage risks, and anticipate trends.

Market Dynamics

Automotive Industry Growth

The demand for synthetic rubber in the tire industry and automotive components such as gaskets, hoses, and belts has been significantly increased by rising auto production. According to the ACEA (Association des Constructeurs Européens d’Automobiles), in 2023, global car production reached a record high of 76 million units, with significant growth rates observed in various regions. The European Union solidified its position as the second-largest global car producer, with production reaching 12.1 million units, while China remains the dominant player in the market, producing over 25.3 million cars. The United States and Japan also experienced notable growth, producing 7.6 million and 7.7 million cars respectively.

The Growth of the Footwear Industry

The global footwear industry is experiencing growth, driven by increased production and exports, particularly from the US to destinations such as Vietnam and Canada, and a growing demand for durable and high-performance materials. According to the U.S. International Trade Commission, in 2021, the US total exports increased by $11 million to $1.1 billion, with domestic exports increasing by 2.2% to $816 million. Re-exports decreased by 1.9% to $332 million. The growth was attributed to rising footwear production and higher global demand. Vietnam and Canada were the largest export destinations, with China, Indonesia, and Mexico being the next-largest destinations

Market Segmentation

- Based on product, the market is segmented into styrene butadiene rubber (SBR), polybutadiene (BR), ethylene propylene (EPDM), nitrile butadiene rubber (NBR), isoprene rubber (IR), chloroprene rubber (CR), butyl rubber (IIR), and others (chloroprene rubber, acrylonitrile butadiene styrene, fluoroelastomers).

- Based on the end-user, the market is segmented into tires, industrial applications, electronics, footwear, household, and others(construction).

Tires Sub-segment to Hold a Considerable Market Share

Growing vehicle sales and urbanization are two factors driving up tire demand in emerging nations. The need for tires for commercial and passenger vehicles has been boosted by infrastructure initiatives, such as the expansion of the road network. According to the ACEA (Association des Constructeurs Européens d’Automobiles), in May 2023, the global production of motor vehicles saw a 5.7% growth from 2021 to 2022, with a total of 85.4 million vehicles manufactured globally during the latter year.

Chloroprene Rubber (CR) Sub-segment to Hold a Considerable Market Share

The growth of chloroprene Rubber in the synthetic rubber market is attributed to advancements in CR composites, enhancing its applications in automotive seals, hoses, adhesives, and industrial products. For instance, in April 2024, Tosoh Corp. introduced a new chloroprene rubber composite series, utilizing cellulose nanofibers as a reinforcement material, in collaboration with Japan's largest power transmission and conveyor belt manufacturer, Bando Chemical Industries.

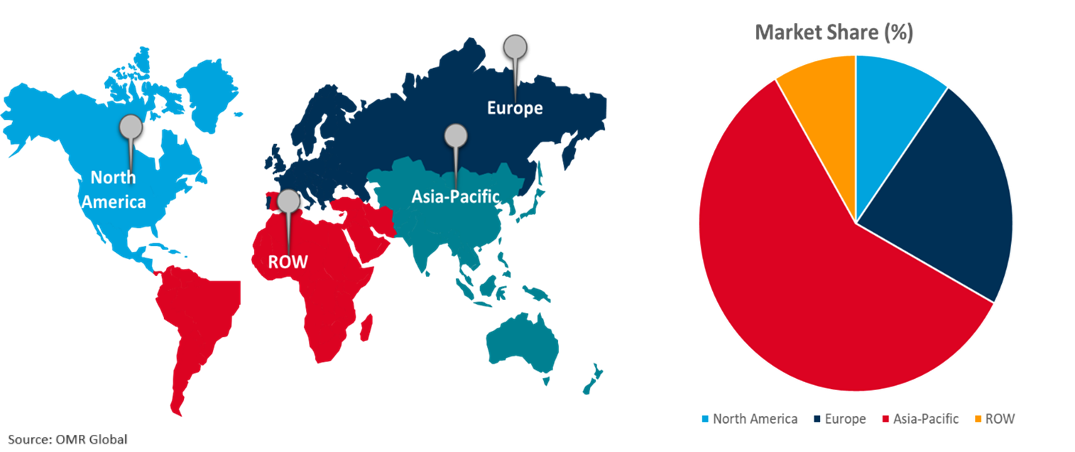

Regional Outlook

The synthetic rubber market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Rising Preference for Sustainable Materials In North America Region

Growing customer demand for sustainable materials can influence the market for synthetic rubber, particularly in eco-friendly and sustainable products, while natural rubber production grows. For instance, in May 2023, University of Arizona researchers collaborated with Bridgestone Americas to create a sustainable, arid Southwest-grown natural rubber. The $70 million project, led by Kim Ogden, aims to transition growers from traditional hay, cotton, and wheat to guayule, a hardy perennial shrub.

Synthetic Rubber Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

According to the International Organization of Motor Vehicle Manufacturers, in May 2022, car production and sales in China increased by 59.7% and 57.6% month-over-month, respectively, while year-over-year declines were 5.7% and 12.6%. From January to May, they reached 9.618 million and 9.555 million respectively. The auto industry has shown significant recovery post-pandemic, with increased production capacity and improvements in supplier supply, logistics, transportation, and personnel flow.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the synthetic rubber market include ARLANXEO, China Petrochemical Corp. (Sinopec), Kumho Petrochemical, PetroChina Co. Ltd., and Exxon Mobil Corp. among others. Market expansion and applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2024, Zhongzhe Group, a Chinese materials supplier, signed an agreement with the Beilun district local government to establish a €380 million synthetic rubber manufacturing plant in the eastern Chinese port of Ningbo. The 200 kilotonne per annum facility will produce styrene solution butadiene rubber (SSBR) and low-cis butadiene rubber (LCBR) for high-performance green tires for new energy vehicles.

The Report Covers-

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global synthetic rubber market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ARLANXEO

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. China Petrochemical Corp. (Sinopec)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Kumho Petrochemical

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. PetroChina Co. Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Exxon Mobil Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Synthetic Rubber Market by Product

4.1.1. Styrene Butadiene Rubber (BR)

4.1.2. Polybutadiene (BR)

4.1.3. Ethylene Propylene (EPDM)

4.1.4. Nitrile Butadiene Rubber (NBR)

4.1.5. Isoprene Rubber (IR)

4.1.6. Chloroprene Rubber (Cr)

4.1.7. Butyl Rubber (IIR)

4.1.8. Others (Chloroprene Rubber, Acrylonitrile Butadiene Styrene, Fluoroelastomers)

4.2. Global Synthetic Rubber Market by End-User

4.2.1. Tires

4.2.2. Industrial application

4.2.3. Electronics

4.2.4. Footwear

4.2.5. Household

4.2.6. Others (Construction)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Asahi Kasei Corp.

6.2. Denka Company Ltd.

6.3. Dynasol Group

6.4. Eni S.p.A.

6.5. Indian Synthetic Rubber Pvt. Ltd.

6.6. JSR Corp.

6.7. Kuraray Co., Ltd.

6.8. LANXESS AG

6.9. LCY Chemical Corp.

6.10. LG Chem Ltd.

6.11. Lion Elastomers

6.12. Michelin Group

6.13. Reliance Industries Ltd.

6.14. SIBUR Holding PJSC

6.15. Sumitomo Chemical Co., Ltd.

6.16. Synthos S.A.

6.17. Thai Rubber Latex Group Public Co. Ltd.

6.18. The Goodyear Tire & Rubber Co.

6.19. UBE Corp.

6.20. Zeon Corp.

1. Global Synthetic Rubber Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Styrene-Butadiene Synthetic Rubber Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Polybutadiene Synthetic Rubber Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Nitrile Butadiene Synthetic Rubber Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Butyl Synthetic Rubber Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Other Product Synthetic Rubber Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Synthetic Rubber Market Research And Analysis By End-User, 2023-2031 ($ Million)

8. Global Synthetic Rubber For Tires Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Synthetic Rubber For Industrial Application Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Synthetic Rubber For Electronics Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Synthetic Rubber For Footwear Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Synthetic Rubber For Household Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Synthetic Rubber For Other End-User Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Synthetic Rubber Market Research And Analysis By Region, 2023-2031 ($ Million)

15. North American Synthetic Rubber Market Research And Analysis By Country, 2023-2031 ($ Million)

16. North American Synthetic Rubber Market Research And Analysis By Type, 2023-2031 ($ Million)

17. North American Synthetic Rubber Market Research And Analysis By End-User, 2023-2031 ($ Million)

18. European Synthetic Rubber Market Research And Analysis By Country, 2023-2031 ($ Million)

19. European Synthetic Rubber Market Research And Analysis By Type, 2023-2031 ($ Million)

20. European Synthetic Rubber Market Research And Analysis By End-User, 2023-2031 ($ Million)

21. Asia-Pacific Synthetic Rubber Market Research And Analysis By Country, 2023-2031 ($ Million)

22. Asia-Pacific Synthetic Rubber Market Research And Analysis By Type, 2023-2031 ($ Million)

23. Asia-Pacific Synthetic Rubber Market Research And Analysis By End-User, 2023-2031 ($ Million)

24. Rest Of The World Synthetic Rubber Market Research And Analysis By Region, 2023-2031 ($ Million)

25. Rest Of The World Synthetic Rubber Market Research And Analysis By Type, 2023-2031 ($ Million)

26. Rest Of The World Synthetic Rubber Market Research And Analysis By End-User, 2023-2031 ($ Million)