System Integrator Market

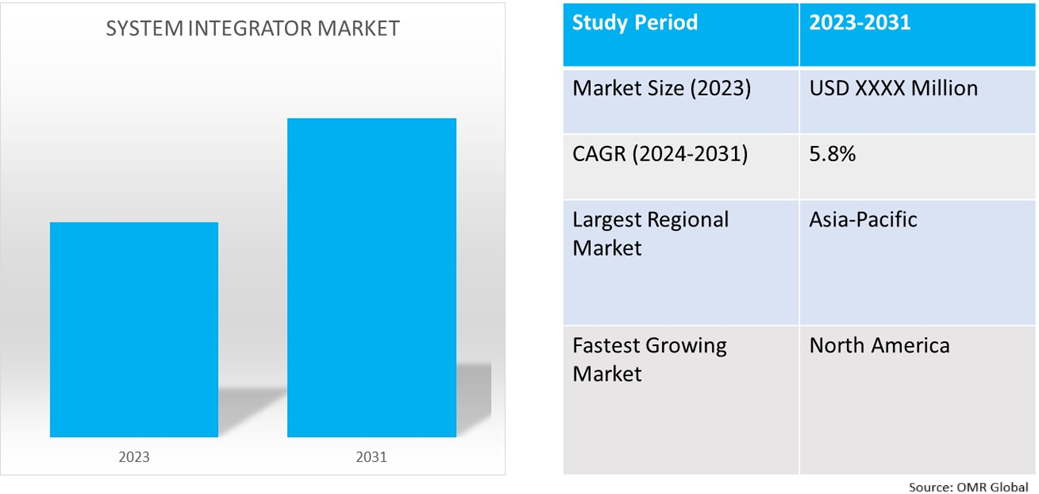

System Integrator Market Size, Share & Trends Analysis Report by Service Type (Consulting Service, Hardware Integration Service, and Software Integration Service), by Technology (Human-Machine Interface (HMI), Supervisory Control & Data Acquisition (SCADA), Manufacturing Execution System (MES), Functional Safety Systems, Machine Vision, Plant Asset Management, and Others), and by End-User (Oil & Gas, Automotive, Aerospace & Defense, Healthcare, Chemical & Petrochemical, Energy & Power, and Others) Forecast Period (2024-2031)

System integrator market is anticipated to grow at a significant CAGR of 5.8% during the forecast period (2024-2031). The market growth is attributed to pivotal factors such as is increasing demand for automation across industries such as manufacturing, oil and gas, automotive, and healthcare as businesses are seeking integrated systems to enhance operational efficiency, reduce human error, and improve productivity. Technological advancements, particularly in IoT, AI, and cloud computing, are also important drivers. This growth is further accelerated by advancements in Industry 4.0 technologies, led by a few countries and firms.

According to the 2022 report by United Nations Economic and Social Council, China and the US dominate in publications, patents, and investments, holding major shares in digital platforms, data centers, and AI start-up funding. They are also leading in the adoption of 5G networks and AI research. Western Europe, alongside China and the US, is heavily investing in IoT, contributing to about three-quarters of global IoT spending. These technological advancements and investments are pivotal in expanding the system integrator market. These technologies offer more sophisticated and efficient integration solutions, enabling real-time data analysis, predictive maintenance, and improved decision-making capabilities.

Market Dynamics

Technological advancements, particularly in IoT, AI, and cloud computing

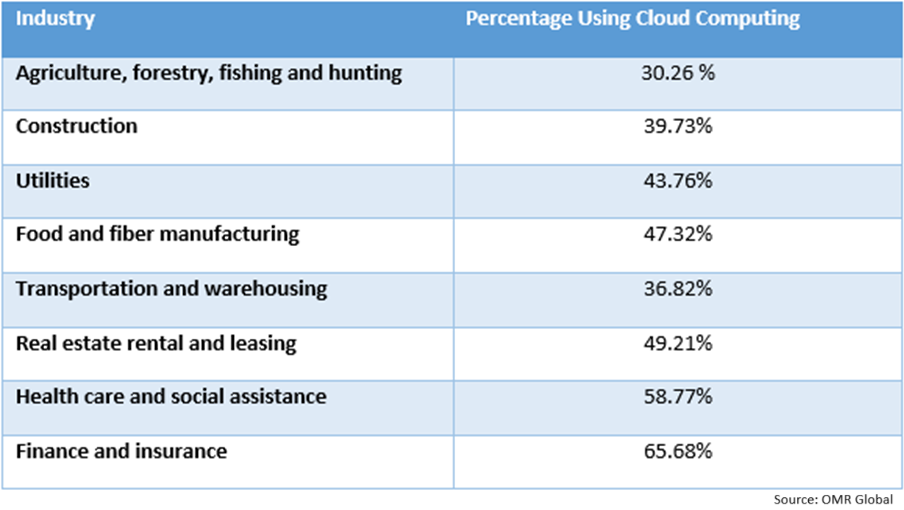

The system integrator market is growing owing technological advancements, particularly in IoT, AI, and cloud computing. The increasing adoption of cloud computing across industries such as oil & gas, power, and water management, the need for system integrator has risen. As organizations in these sectors transition to cloud-based solutions, they require expert assistance to seamlessly integrate new technologies with existing systems. System integrators play a crucial role in ensuring that these complex infrastructures operate securely, enabling companies to leverage the scalability, flexibility, and cost-effectiveness of cloud computing. In the power sector, system integrators facilitate the integration of renewable energy sources into traditional grids, promoting sustainability and energy efficiency. Similarly, in water management, they enable the implementation of smart technologies that improve resource management and compliance with regulatory standards. As these industries continue to embrace digital transformation, the system integrator market is expected to expand, driven by the need for specialized knowledge and support in navigating the complexities of cloud integration.

Cloud Computing by Industry

Source: National Center for Science and Engineering Statistics and Census Bureau, 2018

Rising Private Investments

Rising private investments in system integration solutions for the enhancement of Information Technology (IT) infrastructure are driving the system integration market growth. As businesses increasingly recognize the importance of robust and scalable IT systems to support their operations, they are turning to system integrators for specialized expertise and tailored solutions. For instance, in April 2024, E Tech Group announced a strategic investment with Graham Partners. The partnership aims to accelerate E Tech Group's growth, enhancing its commitment to innovation and advanced automation services. The investment will fund the development of tools and technologies, solidifying E Tech's position in the industry.

Market Segmentation

- Based on the service type, the market is segmented into consulting services, hardware integration services, and software integration services.

- Based on the technology, the market is segmented into human-machine interface (HMI), supervisory control & data acquisition (SCADA), manufacturing execution system (MES), functional safety systems, machine vision, plant asset management, and others.

- Based on the end-user, the market is segmented into oil & gas, automotive, aerospace & defense, healthcare, chemical & petrochemical, energy & power, and others.

The Hardware Integration Service Segment is projected to hold the Largest Market Share

As industries increasingly adopt automation and advanced technologies, the demand for seamless operations becomes critical, hardware integration services enable diverse components to work together efficiently, enhancing overall operational effectiveness. Hardware integration brings together diverse hardware components such as servers, storage devices, sensors, and control systems into a cohesive and functional system. With the increasing number of devices across various industries, the demand for system integrators with expertise in hardware integration has risen significantly. This encompasses the integration of numerous devices, industrial machinery, computing hardware, and other essential physical components that form the backbone of today’s technological ecosystems.

Energy & Power to Hold a Considerable Market Share

Energy and power industries undergo significant transformations driven by the transition to renewable energy sources and the need for enhanced grid management, the demand for advanced integration solutions, and government initiatives. Systems integration research in the US Department of Energy Solar Energy Technologies Office (SETO) supports technologies and solutions that enable solar grid integration while ensuring the reliability, resilience, and security of the electric power system. These research, development, and demonstration activities address the key technical challenges in power system planning and operations, solar forecasting and variability management, control optimization, system protection and stabilities, energy storage integration, power electronics, real-time situational awareness, and cybersecurity.

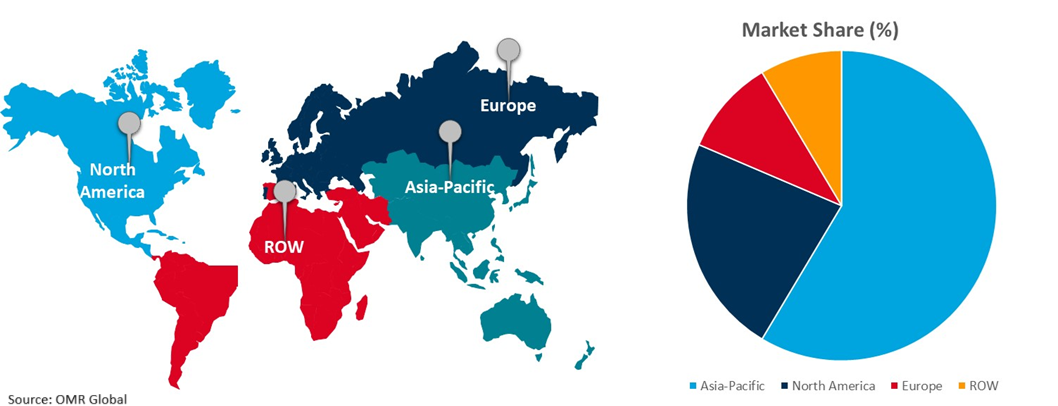

Regional Outlook

The global system integrator market is further segmented based on region including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for system integrators in North America

The growing demand for system integrators in North America is driven by several factors as well-established economies, empowering them to strongly invest in R&D activities, contributing to the development of new technologies, growing government support, and adoption of advanced technologies. These integrators play a crucial role in designing, implementing, and maintaining automated systems that enhance operational efficiency and productivity in industries. One of the key application segments is manufacturing, where system integrators deploy solutions for process automation, quality control, and production line optimization. They integrate technologies such as PLCs (Programmable Logic Controllers), SCADA (Supervisory Control and Data Acquisition), and robotics to streamline operations and ensure consistent output quality.

Global System Integrators Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to rapid industrialization in countries like China and India, which boosts the demand for automation and integrated systems. Digital transformation has become a top priority in the country, progressing at an impressive pace as more companies adopt formal strategies to support their initiatives. As businesses strive for greater efficiency, flexibility, and competitiveness, they are turning to system integrators to help streamline processes, optimize workflows, and facilitate the adoption of innovative solutions. The rise of Industry 4.0, characterized by the integration of IoT, AI, and automation, further amplifies this demand, as companies seek expertise to connect disparate systems and leverage data for informed decision-making. Additionally, sectors such as energy, electronics, manufacturing, and healthcare are undergoing significant transformations, requiring sophisticated integration services to manage complex infrastructures and ensure interoperability among various hardware and software components. According to the State Council Information Office of the People's Republic of China, fixed-asset investment in China's electronic information manufacturing industry rose 9.3% year on year in 2023 amid the sector's recovery, official data showed.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the system integrator market include ATS Automation Tooling Systems Inc., John Wood Group PL, ABB Ltd, Tesco Controls, Inc., and Siemens AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In August 2024, Yokogawa Electric Corporation announced that it has developed a system integration kit and software package, the OpreX Open Automation SI Kit, and the OpreX OPC UA Management Package for the implementation of Open Process Automation (OPA) systems.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global system integrator market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Key Player Strategies

3.3. ATS Automation Tooling Systems Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. John Wood Group PLC

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. ABB Ltd

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Tesco Controls, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Siemens AG

3.7.1. Overview

3.7.2. Financial Analysis

3.7.3. SWOT Analysis

3.7.4. Recent Developments

4. Market Segmentation

4.1. Global System Integrator Market by Service Type

4.1.1. Consulting Service

4.1.2. Hardware Integration Service

4.1.3. Software Integration Service

4.2. Global System Integrator Market by Technology

4.2.1. Human-Machine Interface (HMI)

4.2.2. Supervisory Control & Data Acquisition (SCADA)

4.2.3. Manufacturing Execution System (MES) Functional Safety Systems

4.2.4. Machine Vision

4.2.5. Plant Asset Management

4.2.6. Others

4.3. Global System Integrator Market by End-User

4.3.1. Oil & Gas

4.3.2. Automotive

4.3.3. Aerospace & Defense

4.3.4. Healthcare

4.3.5. Chemical & Petrochemical

4.3.6. Energy & Power

4.3.7. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1 ABB Ltd.

6.2 ATS Automation Tooling Systems Inc.

6.3 Avanceon

6.4 Barry-Wehmiller Group, Inc.

6.5 Burrow Global, LLC.

6.6 Deloitte

6.7 Dynamysk Automation Ltd.

6.8 E Tech Group

6.9 Fori Automation Inc.

6.10 John Wood Group PLC

6.11 JR Automation

6.12 MANGAN INC

6.13 Matrix Technologies, Inc.

6.14 MAVERICK Technologies, LLC.

6.15 Optimation Technology LLC

6.16 Prime Control

6.17 Rockwell Automation Inc.

6.18 Tesco Controls, Inc.

6.19 Wunderlich-Malec Engineering, Inc.

6.20 Yokogawa Corporation of America

1. Global System Integrator Market Research And Analysis By Service Type, 2023-2031 ($ Million)

2. Global Consulting System Integrator Service Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Hardware System Integration Service Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Software System Integration Service Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global System Integrator Market Research And Analysis By Technology, 2023-2031 ($ Million)

6. Global HMI Based System Integrator Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global SCADA Based System Integrator Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global MES Based System Integrator Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Functional Safety Based System Integrator Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Machine Vision-Based System Integrator Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Plant Asset Management Based System Integrator Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Others Based System Integrator Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global System Integrator Market Research And Analysis By End-User, 2023-2031 ($ Million)

14. Global System Integrator For Oil & Gas Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global System Integrator For Automotive Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global System Integrator For Aerospace & Defense Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global System Integrator For Healthcare Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Global System Integrator For Energy & Power Market Research And Analysis By Region, 2023-2031 ($ Million)

19. Global System Integrator For Chemical & Petrochemical Market Research And Analysis By Region, 2023-2031 ($ Million)

20. Global System Integrator For Others Market Research And Analysis By Region, 2023-2031 ($ Million)

21. Global System Integrator Market Research And Analysis By Geography, 2023-2031 ($ Million)

22. North American System Integrator Market Research And Analysis By Country, 2023-2031 ($ Million)

23. North American System Integrator Market Research And Analysis By Service Type, 2023-2031 ($ Million)

24. North American System Integrator Market Research And Analysis By Technology, 2023-2031 ($ Million)

25. North American System Integrator Market Research And Analysis By End-User, 2023-2031 ($ Million)

26. European System Integrator Market Research And Analysis By Country, 2023-2031 ($ Million)

27. European System Integrator Market Research And Analysis By Service Type, 2023-2031 ($ Million)

28. European System Integrator Market Research And Analysis By Technology, 2023-2031 ($ Million)

29. European System Integrator Market Research And Analysis By End-User, 2023-2031 ($ Million)

30. Asia-Pacific System Integrator Market Research And Analysis By Country, 2023-2031 ($ Million)

31. Asia-Pacific System Integrator Market Research And Analysis By Service Type, 2023-2031 ($ Million)

32. Asia-Pacific System Integrator Market Research And Analysis By Technology, 2023-2031 ($ Million)

33. Asia-Pacific System Integrator Market Research And Analysis By End-User, 2023-2031 ($ Million)

34. Rest Of The World System Integrator Market Research And Analysis By Country, 2023-2031 ($ Million)

35. Rest Of The World System Integrator Market Research And Analysis By Service Type, 2023-2031 ($ Million)

36. Rest Of The World System Integrator Market Research And Analysis By Technology, 2023-2031 ($ Million)

37. Rest Of The World System Integrator Market Research And Analysis By End-User, 2023-2031 ($ Million)

38. Global System Integrator Market Share by Service Type, 2023 Vs 2031 (%)

39. Global Consulting System Integrator Service System Integrator Market Share by Geography, 2023 Vs 2031 (%)

40. Global Hardware System Integration Service Market Share by Geography, 2023 Vs 2031 (%)

41. Global Software System Integration Service Market Share by Geography, 2023 Vs 2031 (%)

42. Global System Integrator Market Share by Technology, 2023 Vs 2031 (%)

43. Global HMI Based System Integrator Market Share by Geography, 2023 Vs 2031 (%)

44. Global SCADA Based System Integrator Market Share by Geography, 2023 Vs 2031 (%)

45. Global MES Based System Integrator Market Share by Geography, 2023 Vs 2031 (%)

46. Global Functional Safety Based System Integrator Market Share by Geography, 2023 Vs 2031 (%)

47. Global Machine Vision-Based System Integrator Market Share by Geography, 2023 Vs 2031 (%)

48. Global Plant Asset Management Based System Integrator Market Share by Geography, 2023 Vs 2031 (%)

49. Global Others Based System Integrator Market Share by Geography, 2023 Vs 2031 (%)

50. Global System Integrator Market Share by End-User, 2023 Vs 2031 (%)

51. Global System Integrator for Oil & Gas Market Share by Geography, 2023 Vs 2031 (%)

52. Global System Integrator for Automotive Market Share by Geography, 2023 Vs 2031 (%)

53. Global System Integrator for Aerospace & Defense Market Share by Geography, 2023 Vs 2031 (%)

54. Global System Integrator for Healthcare Market Share by Geography, 2023 Vs 2031 (%)

55. Global System Integrator for Energy & Power Market Share by Geography, 2023 Vs 2031 (%)

56. Global System Integrator for Chemical & Petrochemical Market Share By Geography, 2023 Vs 2031 (%)

57. Global System Integrator for Others Market Share by Geography, 2023 Vs 2031 (%)

58. Global System Integrator Market Share by Geography, 2023 Vs 2031 (%)

59. US System Integrator Market Size, 2023-2031 ($ Million)

60. Canada System Integrator Market Size, 2023-2031 ($ Million)

61. UK System Integrator Market Size, 2023-2031 ($ Million)

62. France System Integrator Market Size, 2023-2031 ($ Million)

63. Germany System Integrator Market Size, 2023-2031 ($ Million)

64. Italy System Integrator Market Size, 2023-2031 ($ Million)

65. Spain System Integrator Market Size, 2023-2031 ($ Million)

66. Rest Of Europe System Integrator Market Size, 2023-2031 ($ Million)

67. India System Integrator Market Size, 2023-2031 ($ Million)

68. China System Integrator Market Size, 2023-2031 ($ Million)

69. Japan System Integrator Market Size, 2023-2031 ($ Million)

70. South Korea System Integrator Market Size, 2023-2031 ($ Million)

71. Rest Of Asia-Pacific System Integrator Market Size, 2023-2031 ($ Million)

72. Rest Of The World System Integrator Market Size, 2023-2031 ($ Million)