Tamper Evident Labels Market

Tamper Evident Labels Market Size, Share & Trends Analysis Report by Material Type (PET-Based Tamper Evident Labels and Paper-Based Tamper Evident Labels), by Technology (Radio Frequency Identification, Near-Field Communication Tag, and Sensing Labels), and by End-use Industry (Pharmaceuticals, Automotive, Food and Beverage, Transport and Logistics, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Tamper-evident labels market is anticipated to grow at a considerable CAGR of 6.1% during the forecast period. The major factor driving the growth of the market includes the rising concern toward product safety coupled with the implementation of stringent regulations to avoid tampering with goods. Product tampering and theft are ongoing issues for brand owners in numerous industries which are increasing the concern for brand protection. Product counterfeit is increasing at a distressing rate where sub-standard products are being sold at premium prices this is making it highly important to incorporate product labeling as part of brand defense systems. Tamper evident labels are expected to keep a check on such products to ensure the right quality products reach the end consumers. When compared to other labels such as standard semi-gloss paper and film-based labels, tamper-evident labels enable companies to offer more advanced solutions which guarantee product integrity. Hence, tamper evident labels are a fundamental solution to providing additional security and authentication to products beyond packaging. Increasing emphasis on product labelling to ensure product safety and security is encouraging manufacturers to launch a tamper-evident label that offers a high level of security to the product. For instance, in December 2021, Dunmore launched tamper-evident label films designed to prevent tampering and provide an extra layer of brand protection. Dunmore’s line of security label films consists of 4 unique security designs including universal designs and a multi-language option. The security label films are 2 mils white polyester (PET) based products with proprietary release technology and a print receptive surface. The tamper evident feature is hidden until the label is peeled away from the surface.

Segmental Outlook

The global tamper-evident labels market is segmented based on the material type, technology, and end-use industry. Based on the material type, the market is sub-segmented into PET-based tamper evident labels and paper-based tamper evident labels. Based on the technology, the market is categorized into radio frequency identification, near-field communication tag, and sensing labels. Further, based on the end-use industry, the market is sub-segmented into pharmaceuticals, automotive, food and beverage, transport and logistics, and others. Among the end-use industry segment, the pharmaceuticals sub-segment is expected to cater to a prominent market share over the forecast period. However, the food and beverage segment is anticipated to grow at the fastest rate over the forecast period.

The food and beverage sub-segment is anticipated to grow at the fastest rate over the forecast period. Tamper evident packaging for food and beverages is constantly rising in popularity owing to the rising demand for no-contact takeout and delivery services along with the growing concern for food safety. It is largely being used in the food and beverage industry to guarantee the freshness and quality of packaged food. Moreover, using a tamper evident label on food containers aids in building consumer confidence in the quality of food while avoiding food contamination during transportation. With the rise of food delivery apps, food delivered from restaurants to customers has more touch points than ever before which increases the risk of contamination, in turn, increases food safety concerns. A tamper-evident label ensures that food remains fresh and tamper-free in the hands of third-party deliverers. According to Business of Apps, the top food delivery companies in the US including DoorDash, Grubhub, Uber Eats, and Postmates brought in approximately $5.5 billion combined revenue from April to September 2020 which is more than twice as much as their combined $2.5 billion in revenue during the same period in 2019.

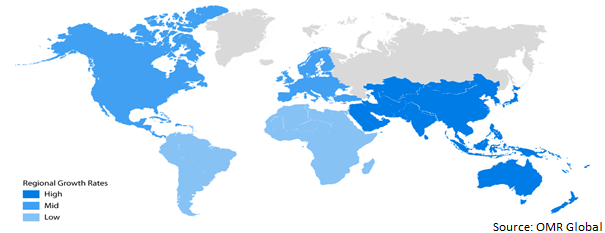

Regional Outlooks

The global tamper evident labels market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American regional market is expected to cater to prominent growth over the forecast period. However, the European region is projected to experience considerable growth in the tamper-evident labels market.

Global Tamper Evident Labels Market Growth, by Region 2022-2028

North America is Expected to Hold a Prominent Share in the Global Tamper Evident Labels Market

North America is expected to hold a prominent share in the global tamper-evident labels market. The increasing consumer awareness regarding safe packaging and product labeling coupled with the increase in government regulations to overcome thefts and ensure consumer safety are providing several growth opportunities for the market. For instance, in 2020, the state of California passed the Fair Food Delivery Act, which, in part, requires that “all bags or containers in which ready-to-eat foods are being transported or delivered from a food facility to a customer through a third-party food delivery platform to be closed by the food facility with a tamper-evident method prior to the food deliverer taking possession of the food”.

Market Players Outlook

The major companies serving the global tamper-evident labels market include 3M, Avery Dennison Corp., DUNMORE, Luminer Converting Group Inc., Schreiner Group GmbH & Co. KG, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in 2022, NXP Semiconductors released a new family of Near-Field Communication (NFC) integrated circuits (ICs) featuring tamper-detection and condition-monitoring functionality on a single chip. The NTAG 22x DNA family of NFC tags are designed for use in consumer brands, as well as with healthcare and smart-home products.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global tamper-evident labels market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segmentation

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendation

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Development

3.3. Avery Dennison Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Development

3.4. DUNMORE

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Development

3.5. Luminer Converting Group Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Development

3.6. Schreiner Group GmbH & Co. KG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Development

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Tamper-Evident Labels Market by Material Type

4.1.1. PET-Based Tamper-Evident Labels

4.1.2. Paper-Based Tamper-Evident Labels

4.2. Global Tamper-Evident Labels Market by Technology

4.2.1. Radio Frequency Identification

4.2.2. Near-Field Communication Tag

4.2.3. Sensing Labels

4.3. Global Tamper-Evident Labels Market by End-Use Industry

4.3.1. Pharmaceuticals

4.3.2. Automotive

4.3.3. Food and Beverage

4.3.4. Transport and Logistics

4.3.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Adampak

6.2. advast suisse AG

6.3. Arjobex SAS (Polyart)

6.4. Brady Company India Pvt. Ltd.

6.5. Cenveo, Inc. (MaverickLabel.Com, Inc.)

6.6. ELTRONIS UK LTD

6.7. HERMA GmbH

6.8. Körber Pharma GmbH

6.9. Mactac

6.10. Peter Lynn Ltd.

6.11. Resource Label Group

6.12. Royston Labels Ltd.

6.13. Stickythings Ltd.

6.14. Tailored Label Products, Inc.

6.15. TECHNICODE, INC.

6.16. tesa Tapes (India) Pvt. Ltd.

6.17. VPF-Veredelungsgesellschaft für Papiere

6.18. WRAPOLOGY (INT) LTD.

1. GLOBAL TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2021-2028 ($ MILLION)

2. GLOBAL PET-BASED TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL PAPER-BASED TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

5. GLOBAL RADIO FREQUENCY IDENTIFICATION IN TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL NEAR-FIELD COMMUNICATION TAG IN TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL SENSING LABELS IN TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2021-2028 ($ MILLION)

9. GLOBAL TAMPER-EVIDENT LABELS FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL TAMPER-EVIDENT LABELS FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL TAMPER-EVIDENT LABELS FOR FOOD AND BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL TAMPER-EVIDENT LABELS FOR TRANSPORT AND LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL TAMPER-EVIDENT LABELS FOR OTHER END-USE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. NORTH AMERICAN TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2021-2028 ($ MILLION)

17. NORTH AMERICAN TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

18. NORTH AMERICAN TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2021-2028 ($ MILLION)

19. EUROPEAN TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. EUROPEAN TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2021-2028 ($ MILLION)

21. EUROPEAN TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

22. EUROPEAN TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2021-2028 ($ MILLION)

27. REST OF THE WORLD TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. REST OF THE WORLD TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

30. REST OF THE WORLD TAMPER-EVIDENT LABELS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2021-2028 ($ MILLION)