Telecom Outsourcing Market

Global Telecom Outsourcing Market Size, Share & Trends Analysis Report by Type (Billing Operations, Call Center Outsourcing, Finance & Accounting, Infrastructure Maintenance, Customer Service, and Others), by Enterprise Size (Large Enterprises and Small & Medium Enterprises), and by Services (Managed & Professional Services) for the Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global Telecom Outsourcing market is anticipated to grow at a significant CAGR of 3.1 % during the forecast period. The telecom outsourcing market is growing and the presence of Internet service providers(ISP), companies with social media services, and app-making firms are pushing telecom companies to shift on new business models and creative offerings to boost customer experience and services, which is expected to drive the growth of the market. Moreover, telecom companies look for operational planning to assist their advantage in the basic value chain or traditional networks while minimizing the cost low or keeping it low. iSON states that by providing end-to-end business process management (BPM) services, it allows telecom companies to develop and grow their value chain while dealing with the upcoming challenges. The company’s solutions deliver the best business value through the accurate blend of technology, analytics, domain, and process expertise that allows its clients to attain cost efficiencies and run sustainable growth strategies smoothly.

Impact of COVID-19 Pandemic on Global Telecom Outsourcing Market

As the impact of the COVID-19 pandemic is felt globally. The opportunity emerges for the global telecom outsourcing industry to innovative solutions and plans future strategies, which had positively driven the market growth. Many countries announced different degrees of lockdown, and the mobility of people to go to work has become difficult. The outsourcing industry responded quickly by implementing business continuity plan (BCP) frameworks, enabling remote working facilities with the right security measures, and providing appropriate tools to employees to allow them to work from home. The learnings from these experiences will change the future outsourcing scenario.

Segmental Outlook

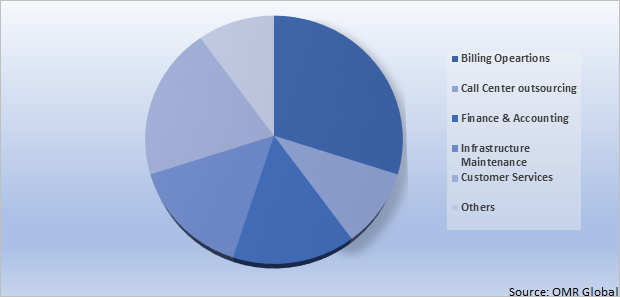

The global Telecom Outsourcing market is segmented based on the type, enterprise size, and service. Based on the type, the market is segmented into billing operations, call center, finance & accounting, infrastructure maintenance, customer services, and others. Based on the enterprise size, the market is sub-segmented into large enterprises and small & medium enterprises. Based on the service, the market is bifurcated into managed services and professional services. among the enterprise segment, the small & medium size enterprise is expected to drive the growth of the market and is expected to do in the coming years. Outsourcing from third parties allows these SMEs to reduce labor expenses and focus more resources on product development to attract customers and build a strong position in the market, which is driving the growth of the market.

Global Telecom Outsourcing Market Share by Type, 2021 (%)

The Billing Operations Segment Holds the Considerable Share in the Global Telecom Outsourcing Market.

Among type segments, the billing operations segment is expected to hold a considerable share in the market over the forecast. The gaining popularity of cloud-based billing operations is expected to drive the growth of the market. For instance, in October 2021, IBM introduced next-generation billing as a service with SAP on the IBM cloud for telecommunications. IBM and SAP to help telcos modernize their billing systems with an offering designed to achieve up to 40% cost savings. This can help to achieve cost savings and free up resources to drive innovation for customers. As the telecom industry is shifting to the cloud, IBM and SAP are supporting CSPs by delivering access to SAP Billing and Revenue Innovation Management as a service on IBM Cloud for Telecommunications.

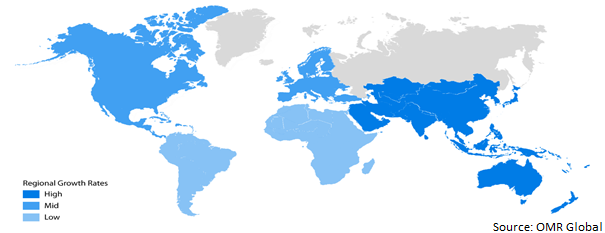

Regional Outlooks

The global Telecom Outsourcing market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Asia Pacific region is expected to hold a considerable share in the market over the forecast, due to significant digital investments by vendors and the government is supporting the growth of the market.

Global Telecom Outsourcing Market Growth, by Region 2022-2028

The North America Region is Projected to Hold the Prominent Share in the Global Telecom Outsourcing Market.

Among all, the North America region is projected to hold a prominent share in the telecom outsourcing market over the forecast. The increasing requirement for frequent assistance and maintenance for business operations across the region is propelling the growth of the market. moreover, the increasing adoption of cloud and digital services to provide different solutions to the telecom industry is another factor contributing to the growth of the market.

Market Players Outlook

The major companies serving the global Telecom Outsourcing market include Cisco Systems, Inc., Fujitsu Ltd., Huawei Technologies Co., Ltd, Nokia Corp., Ciena Corp., IBM Corp., Juniper Networks, Inc., Motorola Solutions, Inc. NEC Corp., Tata Consultancy Services Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in February 2021, Telecom Argentina launched new Cisco, Qwilt, and Digital Alpha CDN solution to improve the streaming experience for its customers in Argentina. The new CDN will help Telecom Argentina’s network support increasing data volume and improve the streaming experience across its entire network. Open Caching will also help to drive new services revenue, enabling Telecom Argentina to become an active part of the content delivery value chain.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global telecom outsourcing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Telecom Outsourcing Market

• Recovery Scenario of Global Telecom Outsourcing Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Cisco Systems, Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Fujitsu Ltd

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Huawei Technologies Co., Ltd

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Nokia Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Ericsson AB

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Telecom Outsourcing Market by Type

4.1.1. Billing Operations

4.1.2. Call center Outsourcing

4.1.3. Finance & Accounting

4.1.4. Infrastructure Maintenance

4.1.5. Customer Service

4.1.6. Others (HR, KPO, Procurement)

4.2. Global Telecom Outsourcing Market by Enterprise Size

4.2.1. Large Enterprises

4.2.2. Small & Medium Enterprises

4.3. Global Telecom Outsourcing Market by Service

4.3.1. Managed Services

4.3.2. Professional Services

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Accenture PLC

6.2. Ciena Corp

6.3. Hewlett Packard Enterprise Co.

6.4. IBM Corp.

6.5. Infosys Ltd.

6.6. Juniper Networks, Inc.

6.7. Motorola Solutions, Inc.

6.8. NEC Corp

6.9. Tata Consultancy Services Limited

6.10. Tellabs, Inc.

6.11. UTStarcom Holdings Corp.

6.12. ZTE Corp.

1. GLOBAL TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL TELECOM OUTSOURCING FOR BILLING OPERATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL TELECOM OUTSOURCING FOR CALL CENTER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL TELECOM OUTSOURCING FOR FINANCE & ACCOUNTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL TELECOM OUTSOURCING FOR INFRASTRUCTURE MAINTENANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL TELECOM OUTSOURCING FOR CUSTOMER SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL TELECOM OUTSOURCING FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2028 ($ MILLION)

9. GLOBAL TELECOM OUTSOURCING FOR LARGE ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL TELECOM OUTSOURCING FOR SMALL & MEDIUM ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2028 ($ MILLION)

12. GLOBAL TELECOM OUTSOURCING BY MANAGED SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL TELECOM OUTSOURCING BY PROFESSIONAL SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

17. NORTH AMERICAN TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2028 ($ MILLION)

18. NORTH AMERICAN TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2028 ($ MILLION)

19. EUROPEAN TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. EUROPEAN TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

21. EUROPEAN TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2028 ($ MILLION)

22. EUROPEAN TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. REST OF THE WORLD TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD TELECOM OUTSOURCING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL TELECOM OUTSOURCING MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL TELECOM OUTSOURCING MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL TELECOM OUTSOURCING MARKET, 2021-2028 (%)

4. GLOBAL TELECOM OUTSOURCING MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL TELECOM OUTSOURCING FOR BILLING OPERATIONS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL TELECOM OUTSOURCING FOR CALL CENTER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL TELECOM OUTSOURCING FOR FINANCE & ACCOUNTING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL TELECOM OUTSOURCING FOR INFRASTRUCTURE MAINTENANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL TELECOM OUTSOURCING FOR CUSTOMER REVIEWS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL TELECOM OUTSOURCING FOR OTHER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL TELECOM OUTSOURCING MARKET SHARE BY ENTERPRISE SIZE, 2021 VS 2028 (%)

12. GLOBAL TELECOM OUTSOURCING FOR LARGE ENTERPRISES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL TELECOM OUTSOURCING FOR SMALL & MEDIUM ENTERPRISES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL TELECOM OUTSOURCING MARKET SHARE BY SERVICE, 2021 VS 2028 (%)

15. GLOBAL TELECOM OUTSOURCING BY MANAGED SERVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL TELECOM OUTSOURCING BY PROFESSIONAL SERVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL TELECOM OUTSOURCING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. US TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

19. CANADA TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

20. UK TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

21. FRANCE TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

22. GERMANY TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

23. ITALY TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

24. SPAIN TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF EUROPE TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

26. INDIA TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

27. CHINA TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

28. JAPAN TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

29. SOUTH KOREA TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF ASIA-PACIFIC TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)

31. REST OF THE WORLD TELECOM OUTSOURCING MARKET SIZE, 2021-2028 ($ MILLION)