Telecom Towers Market

Telecom Towers Market Size, Share & Trends Analysis Report by Fuel Type (Renewable and Non-renewable), by Type of Tower (Lattice Tower, Guyed Tower, Monopole Towers and Stealth Towers), by Installation (Rooftop and Ground-based) and by Ownership (Operator-owned, Joint Venture, Private-owned and MNO Captive) Forecast Period (2024-2031)

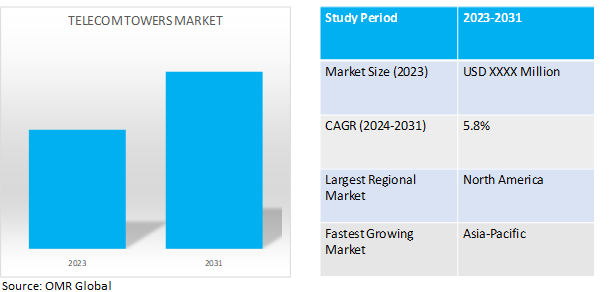

Telecom towers market is anticipated to grow at a considerable CAGR of 5.8% during the forecast period (2024-2031).The factors driving the telecom tower market growth includes investments in 5G connectivity and telecom infrastructure, as well as the extension of mobile networks into rural areas.

Market Dynamics

Growing focus on LTE technology

The growing focus on advanced Long-Term Evolution (LTE) technology in telecom towers has driven the growth of the global market. A number of factors, such as the increased accessibility of reasonably priced smartphones, the growing demand for high-speed internet access, the expansion of investments in smart city programs, and the growing demand for IoT devices, are contributing to this surge in demand for LTE-A network connectivity. As a result, network operators are making proactive investments in the LTE-A infrastructure deployment, which will increase the number of LTE and LTE-A base stations. Due to their connection to telecom towers, these stations are able to provide end users with vital radio access network services. The telecom tower market is expanding significantly due to the rising demand for LTE-A.

Growing demand for advanced network connectivity

The growing demand for advanced connectivity has increased the global telecom towers market. Telecom towers-sharing offers advantages including lower costs and quicker data deployment, which makes it one of the major growth drivers in the telecom sector. The telecom tower sector has become very well-known on its own, mostly in the network driven countries such as US and India.The market is being stimulated by the quick growth of internet services and e-commerce. Data consumption is a result of the broad use of e-commerce platforms and the rising demand for online services like gaming, cloud computing, and video streaming. In order to sustain the strong and dependable communication infrastructure needed to meet the needs of this digital ecosystem, telecom towers are essential.

Market Segmentation

Our in-depth analysis of the global telecom towers market includes the following segments by fuel type, type of tower, installation and ownership:

- Based on fuel type, the market is sub-segmented into renewable and non-renewable.

- Based on type of tower, the market is bifurcated into lattice tower, guyed tower, monopole towers and stealth towers.

- Based on installation, the market is augmented into rooftop and ground-based

- Based on ownership, the market is augmented into operator-owned, joint venture, private-owned and mno captive

Ground-based Installation is Projected to Emerge as the Largest Segment

Ground-based installations usually found in large-scale power plants, wind farms, or solar farms.These installations are typically located in rural or land-rich locations. For their scalability and possibility for increased energy generation capacity, ground-based systems have advantages. They are appropriate for large energy demand centers and utility-scale projects since they frequently rely on economies of scale. The large scale installation of ground-based telecom towers is a key factor contributing to the high share of this market segment.

Renewable Fuels to Exhibit Highest CAGR during the forecast Period

The growing adoption of renewable fuels to meet the target of reducing carbon footprints of the countries is a key factor driving the growth of this market segment. The growing advancements in the renewable fuel making technologies is further aiding to the growth of this market segment. Regional Outlook

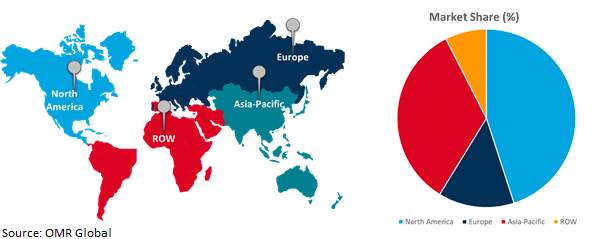

The global telecom towers market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific countries to invest in technologies and telecom business

- Emerging sectors, such as Internet data centers, cloud computing, and the Internet of Things, saw their revenues rise 22.3 percent year on year, driving the revenue of the telecom business up by 4.3 percentage points in countries such as India and China.

- Government has approved the auction of IMT/5G spectrum for deployment of 5G services to increase digital connectivityin the Asia Pacific countries.

Global Telecom Towers Market Growth by Region 2024-2031

North America Holds Major Market Share

The US market is fiercely competitive, with many major suppliers such as American Tower Corporation,fighting for supremacy. The nation's high demand for 5G telecommunications services is fueling many businesses to concentrate on growing to take advantage of this market growth. Numerous significant vendors working with the US government participate in alliances, rollouts, mergers, collaborations, and acquisitions.In order to address the nation’s growing interest in and demand for radio spectrum, NTIA, in consultation with the federal agencies, has developed a compendium of detailed reports describing federal spectrum uses from 225 MHz to 5 GHz.Canada has fastest telecommunications industry with mobile wireless services. It is expected that this increasing trajectory will continue when new applications such as the Internet of Things (IoT) and cutting-edge technology like the fifth-generation 5G network are implemented in Canada.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global telecom towers market include American Tower Corporation, Helios Towers Plc, Indus Towers Ltd., China Tower, SBA Communications Corp and AT&T Inc.,among others. The market players are increasingly focusing on business expansion and Type of Tower development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, Saudi Arabia's TAWAL raised $1.42 billion in Islamic financing for the acquisition of the tower infrastructure of United Group. This includes the United Groups mobile telecommunications infrastructureunitin Bulgaria, Croatia and Slovenia,parent Saudi Telecom Company (STC).

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global telecom towers market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. American Tower Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Helios Towers Plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Indus Towers Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Telecom Towers Market by Fuel Type

4.1.1. Renewable

4.1.2. Non-renewable

4.2. Global Telecom Towers Market by Type of Tower

4.2.1. Lattice Tower

4.2.2. Guyed Tower

4.2.3. Monopole Towers

4.2.4. Stealth Towers

4.3. Global Telecom Towers Market by Installation

4.3.1. Rooftop

4.3.2. Ground-based

4.4. Global Telecom Towers Market by Ownership

4.4.1. Operator-owned

4.4.2. Joint Venture

4.4.3. Private-owned

4.4.4. MNO Captive

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AT&T Inc.

6.2. Cellnex Telecom S.A.

6.3. China Tower

6.4. Crown Castle

6.5. Deutsche Funkturm GmbH

6.6. GTL Infrastructure Ltd.

6.7. IHS Holding Ltd.

6.8. Orange

6.9. SBA Communications Corp

6.10. Tawal Com SA

6.11. Telenor

6.12. Telesites SAB de CV

6.13. Telkom Indonesia

6.14. Telxius Telecom SA

6.15. T-Mobile

6.16. Zong (CMPak Ltd.)

1. GLOBAL TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2023-2031 ($ MILLION)

2. GLOBAL RENEWABLE FUEL BASED TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL NON-RENEWABLE BASED TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY TYPE OF TOWER, 2023-2031 ($ MILLION)

5. GLOBAL LATTICE TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL GUYED TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL MONOPOLE TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL STEALTH TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2023-2031 ($ MILLION)

10. GLOBAL ROOFTOP TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL GROUND-BASED TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY OWNERSHIP, 2023-2031 ($ MILLION)

13. GLOBAL OPERATOR-OWNED TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL JOINT VENTURE TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL PRIVATE-OWNED TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL MNO CAPTIVE TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY TYPE OF TOWER, 2023-2031 ($ MILLION)

20. NORTH AMERICAN TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY INSTALLATION,2023-2031 ($ MILLION)

21. NORTH AMERICAN TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY OWNERSHIP,2023-2031 ($ MILLION)

22. EUROPEAN TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2023-2031 ($ MILLION)

24. EUROPEAN TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY TYPE OF TOWER, 2023-2031 ($ MILLION)

25. EUROPEAN TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2023-2031 ($ MILLION)

26. EUROPEAN TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY OWNERSHIP, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFICTELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2023-2031 ($ MILLION)

29. ASIA-PACIFICTELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY TYPE OF TOWER, 2023-2031 ($ MILLION)

30. ASIA-PACIFICTELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2023-2031 ($ MILLION)

31. ASIA-PACIFICTELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY OWNERSHIP, 2023-2031 ($ MILLION)

32. REST OF THE WORLD TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY TYPE OF TOWER, 2023-2031 ($ MILLION)

35. REST OF THE WORLD TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2023-2031 ($ MILLION)

36. REST OF THE WORLD TELECOM TOWERS MARKET RESEARCH AND ANALYSIS BY OWNERSHIP, 2023-2031 ($ MILLION)

1. GLOBAL TELECOM TOWERS MARKET SHARE BY FUEL TYPE, 2023 VS 2031 (%)

2. GLOBAL RENEWABLE FUEL BASED TELECOM TOWERSMARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL NON-RENEWABLE FUEL BASED TELECOM TOWERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL TELECOM TOWERS MARKET SHAREBY TYPE OF TOWER, 2023 VS 2031 (%)

5. GLOBAL LATTICE TELECOM TOWERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBALGUYED TELECOM TOWERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL MONOPOLE TELECOM TOWERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBALSTEALTH TELECOM TOWERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL TELECOM TOWERS MARKET SHAREBY INSTALLATION, 2023 VS 2031 (%)

10. GLOBAL ROOFTOP TELECOM TOWERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL GROUND-BASED TELECOM TOWERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL TELECOM TOWERS MARKET SHARE BY OWNERSHIP, 2023 VS 2031 (%)

13. GLOBAL OPERATOR-OWNED TELECOM TOWERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL JOINT VENTURE TELECOM TOWERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL PRIVATE-OWNED TELECOM TOWERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL MNO CAPTIVE TELECOM TOWERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL TELECOM TOWERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

20. UK TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC TELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICATELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)

32. MIDDLE EAST AND AFRICATELECOM TOWERS MARKET SIZE, 2023-2031 ($ MILLION)