Telehandler Market

Telehandler Market Size, Share & Trends Analysis Report by Type (Electric and Engine powered), by Product (Compact telehandler and Large telehandler), and by Application (Agriculture, Construction and mining, Industrial, and Rental) Forecast Period (2024-2031)

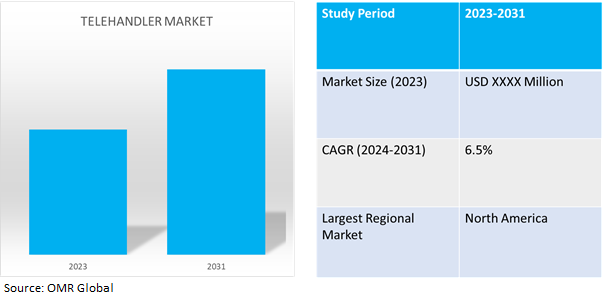

Telehandler market is anticipated to grow at a CAGR of 6.5% during the forecast period (2024-2031). A telehandler, also known as a telescopic handler, is a flexible lifting machine that can be easily converted into a crane for lifting and moving heavy industrial pipes, buckets, crates, container goods, and construction materials. It offers various advantages such as high load capacity, flexibility, and suitability for on- and off-road applications.

Market Dynamics

Growing transformation in the agricultural sector

Biofuels The agricultural sector is currently undergoing a profound transformation driven by rapid technological advancements and growing demand for heightened productivity, resulting in the adoption of innovative practices and precision farming techniques. Farmers globally are utilizing telehandlers to streamline tasks like loading and unloading, material handling, and stacking, thereby reducing labor requirements and time. These machines also offer cost savings by automating processes like crop management and storage, allowing farmers to allocate resources more efficiently and achieve higher productivity levels.

Growing construction and infrastructural Investments

Globally, the market has experienced remarkable growth, primarily propelled by the booming construction industry, especially in emerging economies. The phenomenon of urbanization has led to a surge in construction projects, including the construction of residential complexes, commercial buildings, and infrastructure development. As cities grow and populations rise, the demand for modern structures increases. Infrastructural development projects require versatile equipment for efficient task management and adaptability in challenging terrains. Telehandlers are needed for safe material handling, improved productivity, and flexibility.

Market Segmentation

Our in-depth analysis of the global telehandler market includes the following segments by type, product, and application:

- Based on type, the market is sub-segmented into electric and engine-powered.

- Based on product, the market is bifurcated into compact and large telehandler.

- Based on application, the market is augmented into agriculture, construction and mining, industrial, and rental.

Electric Telehandler is Projected to Emerge as the Largest Segment

Based on the type, the global telehandler market is sub-segmented into electric and engine-powered. Among these, the electric telehandler sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include the increasing environmental concerns and stricter emission regulations. Electric telehandlers offer reduced noise pollution, lower costs, and zero emissions, making them ideal for indoor and environmentally sensitive areas, with battery technology advancements extending their operating time.

Construction and Mining Sub-segment to Hold a Considerable Market Share

The growing emphasis on infrastructure development, particularly in emerging economies, has propelled the need for versatile and efficient machinery capable of lifting heavy loads and maneuvering in tight spaces. Telehandlers, which provide improved operator visibility, stability, and lifting capacities, have become more popular as a result of the growing emphasis on safety and productivity on construction sites. Technological innovations in telehandler design, like increased fuel economy, sophisticated control systems, and telematics integration, provide better performance and operational advantages that propel their global acceptance in building projects.

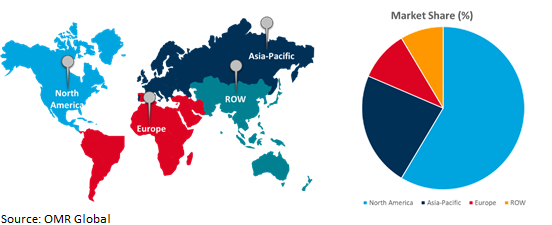

Regional Outlook

The global telehandler market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific countries to invest in the telehandler market

- Germany is held the highest market share owing to growing investments in construction projects, such as residential and commercial buildings, highways, bridges, and airports.

- The growing agriculture sector in India is fuelling the need for telehandlers for various applications, including the loading and unloading of crops and farm equipment.

Global Telehandler Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of rising demand for construction and infrastructure development projects which has increased the requirement for adaptable and efficient material-handling equipment. The United States and Canada are witnessing significant construction activities, including residential, commercial, and infrastructure projects. The need for modernizing infrastructure, coupled with the emphasis on sustainable practices, has driven the adoption of telehandlers in the region. Additionally, telehandler adoption is fueled by the growing trend of mechanization and automation in a variety of industries, such as manufacturing, logistics, and agriculture, because of their ease of handling a wide range of duties.

Furthermore, the total performance and productivity of telehandlers are enhanced by technical developments including enhanced fuel efficiency, sophisticated control systems, and telematics integration, which draw in clients searching for cutting-edge solutions. For instance, in February 2024, Manitou Group expanded its range of telehandlers dedicated to the North American market with the launch of a new compact model, the Manitou MTA 519, also available under the Gehl brand as Gehl TH5-19. The MTA 519, equipped with a universal skid-steer quick-attach system and hydrostatic transmission, offers a compact, high-performance machine with a maximum load capacity of 5,500 pounds and a working height of 19 feet.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global telehandler market include CNH Industrial N.V., Haulotte Group, Komatsu Ltd., Caterpillar, Volvo Group, JLG Industries Inc., and Oshkosh Corporation, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2021, JLG Industries, Inc., a leading global manufacturer of mobile elevating work platforms and telehandlers, introduced a new generation of rotary telehandlers in partnership with Dieci. The new JLG rotating telehandler line offers premium performance and initially consists of three models, the JLG R1370, R1385, and R11100 with max lift heights from 67.3- to 97.1-ft and max lift capacities of 11,000- to 13,200-lb. The line provides operators with optimal comfort, increased functionality, and premium performance, redefining productivity while reducing congestion on the job site.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global telehandler market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. CNH Industrial N.V.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. JLG Industries Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Komatsu Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Caterpillar, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Telehandler Market by Type

4.1.1. Electric

4.1.2. Engine powered

4.2. Global Telehandler Market by Product

4.2.1. Compact telehandler

4.2.2. Large telehandler

4.3. Global Telehandler Market by Application

4.3.1. Agriculture

4.3.2. Construction and Mining

4.3.3. Industrial

4.3.4. Rental

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Doosan Group

1.1. Haulotte Group

6.2. Hunan Sinoboom Intelligent Equipment Co, Ltd

1.2. J.C. Bamford Excavators Limited

1.3. JLG Industries Inc.

1.4. L&T Application Services Limited

1.5. Manitou BF

1.6. Oshkosh Corporation

1.7. Skyjack Inc.

1.8. Snorkel AI, Inc.

1.9. SOCAGE S.r.l.

1.10. Tadano Ltd.

1.11. Terex Corporation

1.12. Volvo Group

1.13. Wacker Neuson SE

1. GLOBAL TELEHANDLER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ELECTRIC TELEHANDLER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ENGINE-POWERED TELEHANDLER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL TELEHANDLER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

5. GLOBAL COMPACT TELEHANDLER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL LARGE TELEHANDLER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL TELEHANDLER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL TELEHANDLER FOR AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL TELEHANDLER FOR CONSTRUCTION AND MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL TELEHANDLER FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL TELEHANDLER FOR RENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL TELEHANDLER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN TELEHANDLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN TELEHANDLER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN TELEHANDLER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

16. NORTH AMERICAN TELEHANDLER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. EUROPEAN TELEHANDLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN TELEHANDLER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN TELEHANDLER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. EUROPEAN TELEHANDLER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC TELEHANDLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC TELEHANDLER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC TELEHANDLER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC TELEHANDLER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD TELEHANDLER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD TELEHANDLER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD TELEHANDLER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

28. REST OF THE WORLD TELEHANDLER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL TELEHANDLER MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL ELECTRIC TELEHANDLER MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ENGINE POWERED TELEHANDLER MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL TELEHANDLER MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

5. GLOBAL COMPACT TELEHANDLER MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL LARGE TELEHANDLER MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL TELEHANDLER MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL TELEHANDLER FOR AGRICULTURE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL TELEHANDLER FOR CONSTRUCTION AND MINING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL TELEHANDLER FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL TELEHANDLER FOR RENTAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL TELEHANDLER MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

15. UK TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA TELEHANDLER MARKET SIZE, 2023-2031 ($ MILLION)