Telemetric Devices Market

Telemetric Devices Market Size, Share & Trends Analysis Report by Component (Hardware and Software), and by Application (Healthcare, Aerospace & Defense, Consumer Electronics, Logistics & Transportation, Energy & Power, Oil & Gas, and Others) Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Telemetric devices market is anticipated to grow at a considerable CAGR of 16.0% during the forecast period. The growing trend of connected devices across several industrial verticals is a key factor driving the growth of the global market. The increasing trend of health consciousness & technology miniaturization is taking the application of telemetric devices from hospital vital monitors to wearable devices which collect data such as ECG, oxygen and other vital signs. According to Cisco Systems, the number of connected wearable devices worldwide is expected to reach 1,105 million devices by 2022. This is further driving the growth of the global market.

The increasing innovation in technology is driving the market and miniaturizing the devices even further. Philips has developed a product named VitalSense, which is a telemetric physiological monitoring system that enables continuous monitoring of core body temperature, dermal temperature, and heart & respiration rate all of this without any wires or probes. The popularity of wearable health-tracking devices is further contributing to the market growth. However, the increasing data security concern will restrain the market growth.

Segmental Outlook

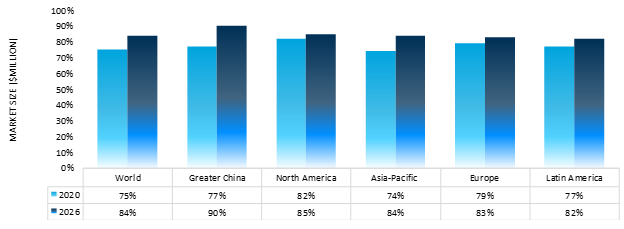

The global telemetric devices market is segmented based on component and application. Based on the component, the market is bifurcated into hardware and software. Based on application, the market is sub-segmented into healthcare, aerospace & defense, consumer electronics, logistics & transportation, energy & power, oil & gas, and other application. Among the applications, The growing demand for connected devices across the healthcare industry along with growing healthcare industry is a key factor contributing to the high share of this market segment. The rapidly growing penetration of smartphones, growing internet penetration, rising demand for remote patient monitoring, fueling the growth of telemetric devices in healthcare sector. According to the International Telecommunication Union (ITU) estimation, approximately 5.4 billion people or 67% of the world’s population are using the Internet in 2023. This represents an increase of 45% since 2018, with 1.7 billion people estimated to have come online during that period. According to the Mobile Economy 2022, there will be nearly 7.5 billion smartphone connections by 2025, accounting for over four in five mobile connections. Moreover, penetration of smartphones and growing internet penetration is accelerating the demand for telemetric devices in healthcare sector.

Smartphone Connection by Region, 2020 VS 2026* (%)

Source: The Mobile Economy 2022

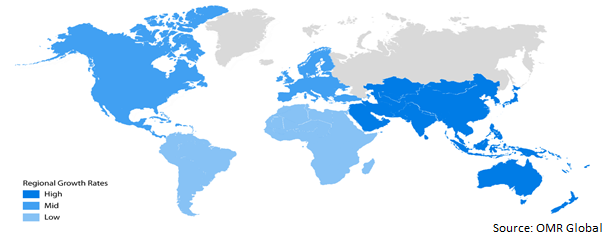

Regional Outlook

The global telemetric devices market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America).

Global Telemetric Devices Market Growth, by Region 2023-2030

North America is Anticipated to Hold a Considerable Share in the Global Telemetric Devices Market

The market is attributed to factors including the rising usage of telemedicine, mHealth, e-prescribing and other healthcare IT technologies as a response to COVID-19, as well as growing government requirements and support for IoT solutions in healthcare. Furthermore, the rising number of hospitals, advanced research organizations, universities, and growing innovation by medical device manufacturers are contributing the market growth. Moreover, several government initiatives and supportive programs are also boosting the adoption of telemetric devices in healthcare. For instance, in August 2023, the advanced research projects agency for health (ARPA-H), an agency within the US Department of Health and Human Services (HHS), launched the Digital Health Security (DIGIHEALS) project to protect the US healthcare system’s electronic infrastructure. Through a Broad Agency Announcement (BAA), the project appealed the proposals for proven technologies developed for national security and apply them to civilian health systems, clinical care facilities, and personal health devices.

Market Players Outlook

The major companies serving the global telemetric devices market include Siemens AG, GE Healthcare, Philips Healthcare, Schlumberger Ltd., and Schneider Electric among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in October 2023, The UK Space Agency (UKSA) and Japan Aerospace Exploration Agency (JAXA) are working together to develop an in-orbit telemetry relay service to be demonstrated on the H3 launch vehicle. The relay service, InRange, will be a new in-orbit telemetry relay service for space launch vehicles using Inmarsat-Viasat’s global L-band network. The InRange service will be designed to reduce the dependency of launch providers on traditional ground-based infrastructure by providing a global in-orbit telemetry solution.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global telemetric devices market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. GE Healthcare

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Philips Healthcare

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Schneider Electric

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Schlumberger Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Siemens AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Telemetric Devices Market by Components

4.1.1. Hardware

4.1.2. Software

4.2. Global Telemetric Devices Market by Application

4.2.1. Healthcare

4.2.2. Aerospace & Defense

4.2.3. Consumer Electronics

4.2.4. Logistics & Transportation

4.2.5. Energy & Power

4.2.6. Oil & Gas

4.2.7. Others (Hydrography)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Actsoft, Inc.

6.2. Agero Inc.

6.3. BSM Technologies Inc.

6.4. CalAmp Corp.

6.5. Daimler AG

6.6. Cisco Systems, Inc.

6.7. Geotab Inc.

6.8. Masternaut Ltd.

6.9. Mix Telematics Ltd.

6.10. HERE Global B.V.

6.11. Octo Group S.p.A

6.12. Omnitracs, LLC

6.13. OnStar Corp.

6.14. ORBCOMM Inc.

6.15. Tantalum Corp.

6.16. Telit IoT Platforms, LLC

6.17. Tomtom International BV

6.18. Trimble Inc.

6.19. WirelessCar AB

6.20. Verizon Wireless Inc.

6.21. Wex Inc.

1. GLOBAL TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

2. GLOBAL HARDWARE IN TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL SOFTWARE IN TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

5. GLOBALTELEMETRIC DEVICES FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL TELEMETRIC DEVICES FOR AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL TELEMETRIC DEVICES FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL TELEMETRIC DEVICES FOR LOGISTICS & TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL TELEMETRIC DEVICES FOR ENERGY & POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL TELEMETRIC DEVICES FOR OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL TELEMETRIC DEVICES FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. NORTH AMERICAN TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

14. NORTH AMERICAN TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

15. NORTH AMERICAN TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

16. EUROPEAN TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. EUROPEAN TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY COMPONENTS, 2022-2030 ($ MILLION)

18. EUROPEAN TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

20. ASIA-PACIFIC TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

21. ASIA-PACIFIC TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

22. REST OF THE WORLD TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

23. REST OF THE WORLD TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

24. REST OF THE WORLD TELEMETRIC DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL TELEMETRIC DEVICES MARKET SHARE BY COMPONENT, 2022 VS 2030 (%)

2. GLOBAL HARDWARE IN TELEMETRIC DEVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL SOFTWARE IN TELEMETRIC DEVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL TELEMETRIC DEVICES MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

5. GLOBAL TELEMETRIC DEVICES FOR HEALTHCARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL TELEMETRIC DEVICES FOR AEROSPACE & DEFENSE MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL TELEMETRIC DEVICES FOR CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL TELEMETRIC DEVICES FOR LOGISTICS & TRANSPORTATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL TELEMETRIC DEVICES FOR ENERGY & POWER MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL TELEMETRIC DEVICESFOR OIL & GAS MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL TELEMETRIC DEVICES FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL TELEMETRIC DEVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. US TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

14. CANADA TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

15. UK TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

16. FRANCE TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

17. GERMANY TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

18. ITALY TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

19. SPAIN TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

20. REST OF EUROPE TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

21. INDIA TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

22. CHINA TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

23. JAPAN TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

24. SOUTH KOREA TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF ASIA-PACIFIC TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF THE WORLD TELEMETRIC DEVICES MARKET SIZE, 2022-2030 ($ MILLION)