Temperature Controlled Packaging Solutions (TCPS) Market

Global Temperature Controlled Packaging Solutions (TCPS) Market Size, Share & Trends Analysis Report By Type (Active, and Passive) By Product (Insulated Container, and Insulated Shippers) By End-User (Food & Beverages, Healthcare, and Others) Forecast, 2021-2027 Update Available - Forecast 2025-2035

The global TCPS market is anticipated to grow at a CAGR of around 11.2% during the forecast period (2021-2027). The TCPS market is majorly driven by the increased demand for pharmaceuticals drugs due to the COVID-19 pandemic. TCPS plays an important role in the transportation of pharmaceutical drugs, as these drugs are more susceptible to heat, humidity, and other external environmental condition, and are required to be stored at a lower temperature during shipment. Both active and passive TCPS are used for the shipment of drugs. The demand for TCPS was highly increased during the pandemic for the distribution of COVID-19 vaccines across the globe. Various TCPS companies were shipping vaccines across the globe during the pandemic period, which has accelerated the market growth. For an instance, 138.3 million COVID-19 doses have been shipped through COVAX, a shipment company, to 136 countries. The market is also driven due to the increased number of partnership collaborations among pharmaceutical and TCPS procedures for the shipment of vaccines and other products globally during the pandemic. For instance, during the pandemic, Pfizer collaborated with Softbox Systems Ltd to develop reusable Ultra-Low Temperature (ULT) shippers to store the COVID-19 vaccine for a long time.

Moreover, the increasing demand for perishable goods and frozen foods in emerging economies across the globe due to increased population and busy lifestyle that has created the demand for ready-to-eat foods, are also the major factors creating the demand for TCPSs from the food & beverages industry to maintain the freshness of the products during transportation. Stringent government regulations associated with the usage of specific types of pharmaceutical products for the production of temperature-controlled packaging solutions are the major factor expected to limit the growth of the TCPS market during the forecast period.

COVID-19 Impact on Global TCPS Market Growth

The global market was positively impacted by the outbreak of the COVID-19 Pandemic. Due to the increasing number of positive cases, the supply of doses among hospitals across the globe was increased, due to which demand TCPS has been surged. According to WHO, in February 2021, COVAX shipped 600 000 doses of the AstraZeneca / Oxford vaccine, from the Serum Institute of India (SII) from Pune, India to Accra, Ghana. Further, the outbreak of COVID-19 across the globe has led to an increase in the R&D of vaccines for the treatment of COVID-19 and thereby increasing the growth of the TCPSs globally. In addition, the distribution range has been expanded at a rapid pace worldwide, to transfer the target products from different climatic zones. Most of the local, as well as international players, are increasing their global connections and focusing on shipping their products regularly to the end-users. Further, upraised demand for cold chain packaging systems is expected to fuel industry growth shortly.

Segmental Outlook

The global TCPS market is segmented based on type, product, and end-user. Based on type, the TCPS market is bifurcated into active, and passive. The passive segment is expected to grow at a faster CAGR during the forecast period. The active TCPS is highly used for the transportation of products in bulk. In addition, they have active temperature control, maintains a specific temperature range with the minimum deviation that makes them perfect for the shipment of large volumes payload with substantial transit time. Besides, the temperature accuracy provided by the active system is highest compared to the passive system. All these factors drive the segment growth. Based on the product, the market is again bifurcated into, insulated containers, and insulated shippers. The insulated containers are projected to hold the largest revenue share in the market due to the increasing demand for perishable goods. Whereas, based on end-user, it is segregated into food & beverage, healthcare, and others.

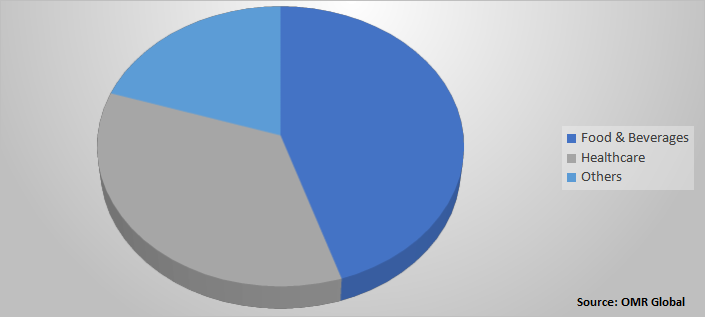

Global TCPS Market Share by End-User, 2020 (%)

The Food & Beverages Emerged as the Largest Segment in the Global TCPS Market

Among end-users of the TCPS, the food & beverages segment held the largest share in the market in 2020 and is anticipated to grow with significant CAGR during the forecast period. The segment growth is attributed to the increasing demand for fresh and frozen foods across the world. The TCPS packaging maintains the condition and nutritive value of the food & beverages in extreme conditions for later consumption, this is the reason, there use in the food & beverages industry is high.

Regional Outlook

Geographically, the global TCPS market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Asia-Pacific is projected to be the fastest-growing region in the market during the forecast period. The rapidly growing demand for frozen products and well-established infrastructure in large urban populations in China is the major factor driving the regional growth. The rapid growth in the middle class offers huge opportunities. Cities such as Beijing and Shanghai experienced an increase in the demand for utilization of cold chain warehouses and transportation systems.

Global TCPS Market Growth, By Region 2021-2027

North America Projected to be on Dominant Position in Global TCPS Market

Geographically, North America dominated the market in 2020 by accounting largest share in the market. The regional growth is majorly driven by the presence of pharma and biopharma industries, and TCPS manufacturing companies such as Pelican BioThermal LLC (US), Sonoco Products Company (US), Cold Chain Technologies, Inc. (US), among others. Moreover, the development in healthcare infrastructure, rising disposable income, increasing R&D activities, and increasing demand for food and beverages among the population are the factors that have accelerated the growth of the TCPS market. Besides, the demand for transportation drugs, vaccines, and clinical trials in North America during the pandemic period has triggered the demand for TCPSs during the forecast period.

Market Players Outlook

The key players in the TCPS market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include ACH Foam Technologies, LLC, AmerisourceBergen Corp., Cold Chain Technologies, Inc, Deutsche Post AG (DHL), GEBHARDT Logistic Solutions GmbH, Pelican BioThermal LLC, Sofrigram SA Ltd., Sonoco Products Co, Tempack and Cropak, among others. These market players are adopting several market strategies including product launch and approvals, merger and acquisition, partnership collaboration, business, and capacity expansion, and others. For instance, in April 2021, Pelican BioThermal has announced a new module on its School of Cool online learning platform, with an introduction to reusable and single-use shippers, including parcel and bulk shippers.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global TCPS market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global TCPS Industry

• Recovery Scenario of Global TCPS Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Porter’s Analysis

2.2.3. Recommendations

2.2.4. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global TCPS Market, By Type

5.1.1. Active

5.1.2. Passive

5.2. Global TCPS Market, By Product

5.2.1. Insulated Containers

5.2.2. Insulated Shippers

5.3. Global TCPS Market, By End-User

5.3.1. Food & Beverage

5.3.2. Healthcare

5.3.3. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East & Africa

7. Company Profiles

7.1. ACH Foam Technologies, LLC

7.2. AmerisourceBergen Corp.

7.3. APEX Packaging Corp.

7.4. Cold Chain Technologies, Inc.

7.5. Cryopak Industries Inc.

7.6. Deutsche Post AG (DHL)

7.7. DGP Intelsius GMBH

7.8. DHL International GmbH

7.9. Envirotainer AB

7.10. GEBHARDT Logistic Solutions GmbH

7.11. Inmark Temperature Controlled Packaging

7.12. Pelican BioThermal LLC

7.13. Sofrigram SA Ltd.

7.14. Softbox Systems Ltd.

7.15. Sonoco Products Co.

7.16. Snyder Industries Inc.

7.17. Tempack and Cropak.

7.18. Testo SE & Co.

7.19. United Parcel Service, Inc.

1. GLOBAL TCPS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL ACTIVE TCPS,MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL PASSIVE TCPS,MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL TCPS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

5. GLOBAL INSULATED TCPS CONTAINERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL INSULATED TCPS SHIPPERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL TCPS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

8. GLOBAL TCPS IN FOOD & BEVERAGES,MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL TCPS IN HEALTHCARE,MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL TCPS FOR OTHER END-USERS,MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. NORTH AMERICAN TCPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN TCPS MARKET RESEARCH AND ANALYSIS BY TYPE,2020-2027 ($ MILLION)

13. NORTH AMERICAN TCPS MARKET RESEARCH AND ANALYSIS BYPRODUCT, 2020-2027 ($ MILLION)

14. NORTH AMERICAN TCPS MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

15. EUROPEAN TCPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. EUROPEAN TCPS MARKET RESEARCH AND ANALYSIS BY TYPE,2020-2027 ($ MILLION)

17. EUROPEAN TCPS MARKET RESEARCH AND ANALYSIS BYPRODUCT, 2020-2027 ($ MILLION)

18. EUROPEAN TCPS MARKET RESEARCH AND ANALYSIS BY END-USER,2020-2027 ($ MILLION

19. ASIA-PACIFIC TCPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC TCPS MARKET RESEARCH AND ANALYSIS BY TYPE,2020-2027 ($ MILLION)

21. ASIA-PACIFIC TCPS MARKET RESEARCH AND ANALYSIS BYPRODUCT, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC TCPS MARKET RESEARCH AND ANALYSIS BY END-USER,2020-2027 ($ MILLION)

23. REST OF THE WORLD TCPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. REST OF THE WORLD TCPS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

25. REST OF THE WORLD TCPS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

26. REST OF THE WORLD TCPS MARKET RESEARCH AND ANALYSIS BY END-USER,2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL TCPS MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL TCPS MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF GLOBAL TCPS MARKET, 2020-2027 (%)

4. GLOBAL TCPS MARKET SHARE BY TYPE,2020 VS 2027 (%)

5. GLOBAL TCPS MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

6. GLOBAL TCPS MARKET SHARE BY END-USER,2020 VS 2027 (%)

7. GLOBAL TCPS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL ACTIVE TCPS, MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL PASSIVE TCPS, MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL INSULATED TCPS CONTAINERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL INSULATED TCPS SHIPPERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL TCPS IN FOOD & BEVERAGES, MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL TCPS IN HEALTHCARE, MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL TCPS FOR OTHER END-USERS, MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. US TCPS MARKET SIZE, 2020-2027 ($ MILLION)

16. CANADA TCPS MARKET SIZE, 2020-2027 ($ MILLION)

17. UK TCPS MARKET SIZE, 2020-2027 ($ MILLION)

18. FRANCE TCPS MARKET SIZE, 2020-2027 ($ MILLION)

19. GERMANY TCPS MARKET SIZE, 2020-2027 ($ MILLION)

20. ITALY TCPS MARKET SIZE, 2020-2027 ($ MILLION)

21. SPAIN TCPS MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF EUROPE TCPS MARKET SIZE, 2020-2027 ($ MILLION)

23. INDIA TCPS MARKET SIZE, 2020-2027 ($ MILLION)

24. CHINA TCPS MARKET SIZE, 2020-2027 ($ MILLION)

25. JAPAN TCPS MARKET SIZE, 2020-2027 ($ MILLION)

26. SOUTH KOREA TCPS MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF ASIA-PACIFIC TCPS MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF THE WORLD TCPS MARKET SIZE, 2021-2027($ MILLION