Temperature Sensor Market

Temperature Sensor Market Size, Share & Trends Analysis Report by Product Type (Contact Temperature Sensors, and Non-contact Temperature Sensors), by Connectivity (Wired, and Wireless), and by End-User (Chemicals, Oil & Gas, Consumer Electronics, Energy & Power, Healthcare, Automotive, Food & Beverages, and Aerospace & Defense) Forecast Period (2024-2031)

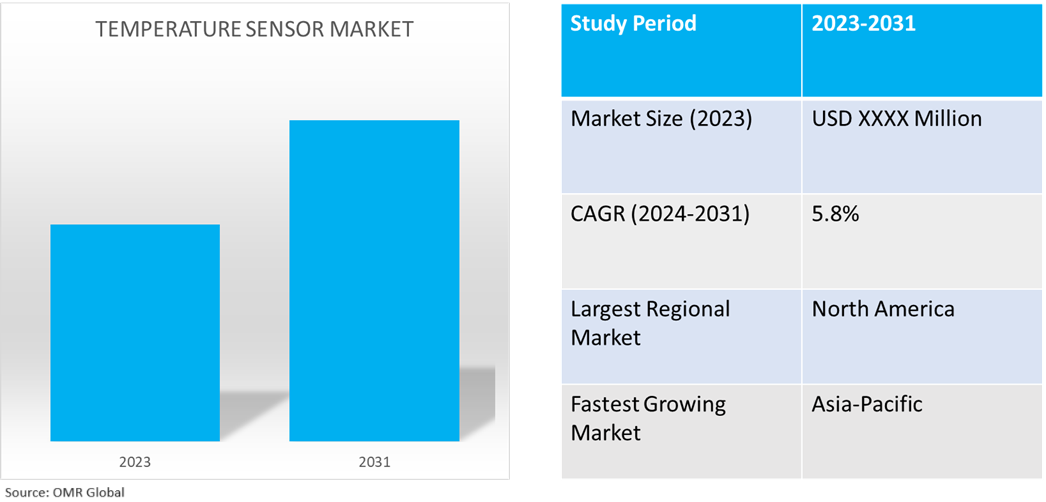

Temperature sensor market is anticipated to grow at a CAGR of 5.8% during the forecast period (2024-2031). The global temperature sensor market is driven by the rising demand for temperature sensors in end-user industries such as healthcare, oil & gas, and food & beverage among others. Further, technological advancements in temperature sensing, such as multi-parameter temperature sensing, IoT-enabled sensors, and integration in consumer electronics, have increased the application scope for the product.

Market Dynamics

Growing Application of Temperature Sensors across Industries

The rising need to monitor perishable goods such as food, beverages, and pharmaceuticals in manufacturing units has driven the demand for temperature sensors in the food industry. In the automobile industry, temperature sensors are used to transmit and notify heat levels for automotive systems. Temperature sensors are used to maintain optimum temperatures in commercial and residential buildings, maintain worker safety in oil mining sites, and monitor temperature for chemical reactions in the chemical industry among others, creating scope for the growth of the product. To meet the increasing demand for temperature sensors across industries key players are launching new sensors. For instance, in September 2023, E+E Elektronik introduced the HTS801, a powerful humidity and temperature sensor for industrial applications on the market. The HTS801 sensing probes include a premium, heatable sensing element for accurate measurements, ensuring long-term stability even in the most complex environments.

Increasing Adoption in Cold Chain Logistics

The temperature sensor market is expanding owing to the increasing use of cold chain logistics, particularly in pharmaceuticals and the food and beverage industry, to preserve food, crops, and medicine for longer periods while reducing the use of preservatives and processing during the transportation of goods. Additionally, the industry is bound by regulatory frameworks to maintain product quality, which is accomplished using cold chain products, such as sensor-integrated vaccine containers to get remote access to temperature data and manage temperature from remote locations to optimize cost, energy, and product quality. In September 2022, CubeWorks, a startup business accelerating the future of IoT with innovative smart sensing solutions, unveiled the next-generation visibility solution for cold chain logistics, CubiSens XT1. The XT1 is the first temperature tracker of its kind, allowing for product-level monitoring of biopharma goods to ensure temperature compliance and quality during their full lifecycle. Such product development for application in cold chain logistics is further driving the global market growth.

Segmental Outlook

- Based on product type, the market is segmented into contact temperature sensors (thermocouples, resistive temperature detectors, thermistors, temperature sensor ICs, and bimetallic temperature sensors), and non-contact temperature sensors (infrared temperature sensors, and fiber optic temperature sensors).

- Based on connectivity, the market is segmented into wired, and wireless.

- Based on end-user, the market is segmented into chemicals, oil & gas, consumer electronics, energy & power, healthcare, automotive, food & beverages, and aerospace & defense.

Wireless Temperature Sensor is the Most Prominent Temperature Sensor

The development of wireless temperature sensors has transformed the temperature sensor industry by expanding its application in high-risk industries such as oil and gas, defense, and chemical among others. The wireless connectivity allows end-users to monitor and collect temperature data without risk. Furthermore, the connectivity type has enabled temperature monitoring in logistics and remote locations, broadening the scope of temperature sensing via integration with IoT devices, containers, and smart devices, among other things, resulting in high demand for the connectivity type.

Oil & Gas Industry Dominates Based on End–User Industry

The oil & gas industry dominates the end-user industry owing to harsh working environments, safety requirements for workers, and increasing demand for temperature-sensing solutions in various applications. In November 2022, Downhole SolutionsTM, manufacturers of the OuraTM Intelligent Electric Valve and other high-performance downhole instrumentation devices, announced the first technical cooperation with distributed optical sensing experts, AP Sensing. The FBG BarcodeTM is the latest generation of distributed temperature sensing (DTS), specifically suited for tough environments like oil and gas applications. Such developments are further aiding the growth of this market segment.

Regional Outlook

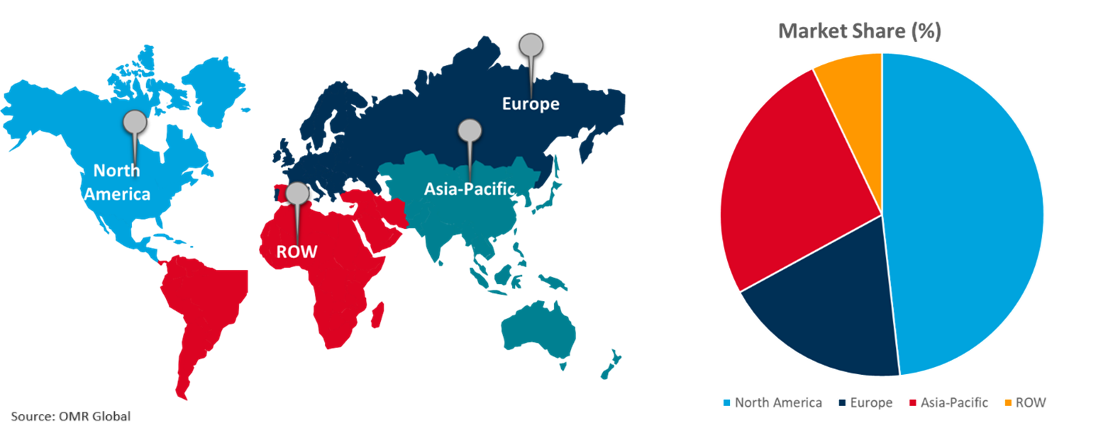

The global temperature sensor market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific is the Fastest Growing Temperature Sensor Market

- The regional growth is attributed to increasing manufacturing capacities and investment in integrating temperature sensing technology into industrial units requiring temperature monitoring and management solutions.

- Asia-Pacific is also one of the biggest exporters of pharmaceutical and food and beverage products globally, creating scope for investment in temperature sensing technology to strengthen cold chain storage and logistics. For instance, as per India Brand Equity Foundation, Indian manufacturing exports have registered the highest-ever annual exports of $447.4 billion, with 6.0% growth during 2022, surpassing the previous year's (2021) exports of $422.0 billion. Also, it is estimated to add more than $500.0 billion annually to the global economy by 2030.

Global Temperature Sensor Market Growth by Region 2024-2031

North America Holds Substantial Market in Temperature Sensor Market

North America is projected to dominate the temperature sensor market owing to increasing demand for temperature sensors from the healthcare and chemical sectors. The increasing investment in cold chain infrastructure, growing consumption of automotive and consumer electronics, and the presence of major sensor manufacturers such as ABB, Honeywell, and analog devices among others are also driving the regional market growth. For instance, in February 2022, the United States Agency for International Development (USAID) announced two new collaborations with private companies to invest in Cambodia's cold chain, agricultural storage capacity, and logistical infrastructure. These collaborations will boost the country's economic competitiveness and inclusiveness by closing supply chain gaps in the agricultural sector.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global temperature sensor market include ABB Group, Analog Devices, Inc., Honeywell International Inc., Robert Bosch GmbH., and STMicroelectronics N.V. among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in March 2023, TWTG and Thermo-Electra partnered to provide wireless temperature measurement solutions. The agreement will benefit both organizations by leveraging one another's strengths to create new business opportunities and improve client services. Customers will benefit from customized tooling and enhanced operational safety and efficiency, thanks to the greater accessibility of wireless temperature sensors.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global temperature sensor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABB Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Analog Devices, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Honeywell International Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Robert Bosch GmbH

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. STMicroelectronics N.V.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Temperature Sensor Market by Product Type

4.1.1. Contact Temperature Sensors

4.1.1.1. Thermocouples

4.1.1.2. Resistive Temperature Detectors

4.1.1.3. Thermistors

4.1.1.4. Temperature Sensor ICs

4.1.1.5. Bimetallic Temperature Sensors

4.1.2. Non-contact Temperature Sensors

4.1.2.1. Infrared Temperature Sensors

4.1.2.2. Fiber Optic Temperature Sensors

4.2. Global Temperature Sensor Market by Connectivity

4.2.1. Wired

4.2.2. Wireless

4.3. Global Temperature Sensor Market by End-User

4.3.1. Chemicals

4.3.2. Oil & Gas

4.3.3. Consumer Electronics

4.3.4. Energy & Power

4.3.5. Healthcare

4.3.6. Automotive

4.3.7. Food & Beverages

4.3.8. Aerospace & Defense

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Amphenol Corp.

6.2. DENSO Corp.

6.3. Emerson Electric Co.

6.4. Endress+Hauser AG

6.5. Infineon Technologies AG

6.6. Kongsberg Gruppen ASA

6.7. Microchip Technology Inc.

6.8. NXP Semiconductors N.V.

6.9. Okazaki Manufacturing Co.

6.10. OMRON Corp.

6.11. Renesas Electronics Corp.

6.12. Siemens AG

6.13. TDK Corp.

6.14. TE Connectivity Corp.

6.15. Texas Instruments Inc.

1. GLOBAL TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL CONTACT TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL NON-CONTACT TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2023-2031 ($ MILLION)

5. GLOBAL WIRED TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL WIRELESS TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

8. GLOBAL TEMPERATURE SENSOR FOR CHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL TEMPERATURE SENSOR FOR OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL TEMPERATURE SENSOR FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL TEMPERATURE SENSOR ANALYSIS FOR ENERGY & POWER MARKET RESEARCH AND BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL TEMPERATURE SENSOR FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL TEMPERATURE SENSOR FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL TEMPERATURE SENSOR ANALYSIS FOR FOOD & BEVERAGE MARKET RESEARCH AND BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL TEMPERATURE SENSOR FOR AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. EUROPEAN TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. EUROPEAN TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

22. EUROPEAN TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2023-2031 ($ MILLION)

23. EUROPEAN TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

28. REST OF THE WORLD TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2023-2031 ($ MILLION)

31. REST OF THE WORLD TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL TEMPERATURE SENSOR MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL CONTACT TEMPERATURE SENSOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL NON-CONTACT TEMPERATURE SENSOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL TEMPERATURE SENSOR MARKET SHARE BY CONNECTIVITY, 2023 VS 2031 (%)

5. GLOBAL WIRED TEMPERATURE SENSOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL WIRELESS TEMPERATURE SENSOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL TEMPERATURE SENSOR MARKET SHARE BY END-USER, 2023 VS 2031 (%)

8. GLOBAL TEMPERATURE SENSOR FOR CHEMICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL TEMPERATURE SENSOR FOR OIL & GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL TEMPERATURE SENSOR FOR CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL TEMPERATURE SENSOR FOR ENERGY & POWER MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL TEMPERATURE SENSOR FOR HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL TEMPERATURE SENSOR FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL TEMPERATURE SENSOR FOR FOOD & BEVERAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL TEMPERATURE SENSOR FOR AEROSPACE & DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL TEMPERATURE SENSOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. US TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

19. UK TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

31. MIDDLE EAST AND AFRICA TEMPERATURE SENSOR MARKET SIZE, 2023-2031 ($ MILLION)