Thermal Imaging Market

Global Thermal Imaging Market Size, Share & Trends Analysis Report by Product Type (Handheld/Portable Camera, Fixed/Mounted Cores Fixed/Mounted Cores, and Scopes & Vision Goggles), by Technology (Cooled Infrared Detectors and Uncooled Infrared Detectors), by Vertical (Industrial, Commercial, Residential, Government & Defense, and Healthcare & Life Sciences), Forecast 2019-2025 Update Available - Forecast 2025-2035

The global thermal imaging market is anticipated to grow at a CAGR 7.2% during the forecast period. The market is driven by growing the growing investments by companies, governments, and capital ventures to develop innovative thermal imaging solutions. For instance, in April 2019, DroneBase raises capital and partners with FLIR Systems to train pilots on thermal imaging technology. FLIR Systems’ investment in DroneBase helps expand the adoption of FLIR thermal imaging technology. Such investment by major market players to develop innovative solutions is significantly contributing to the market growth. In addition, rising demand for thermal imaging solutions in security and surveillance in government & defense is boosting the growth of the thermal imaging market during the forecast period.

Growing urbanization is anticipated to impose a growing demand for advanced security solutions. Increasing investments in infrastructural systems with surging demand for professional surveillance is propelling the growth of the thermal imaging market during the forecast period. Moreover, the growing demand for thermal cameras in various sectors such asthe military and automotive sector is significantly driving the thermal imaging market during the forecast period. The increasing popularity of unmanned aerial vehicles (UAV) equipped with highly advanced video cameras in the military that is being witnessed as the technology that enables the aircraft to fly in the darkness and enables in detecting the target by smoke and clouds. Furthermore, a decrease in the average selling price of these cameras and the assimilation of camera modules along with smartphones that are significantly driving the market growth during the forecast period.

Segmental Outlook

The global thermal imaging market is segmented on the basis of product type, technology, and vertical. Based on the product type, the market is segmented into a handheld/portable camera, fixed/mounted cores fixed/mounted cores, and scopes & vision goggles. Based on technology, the market is segmented into cooled infrared detectors and uncooled infrared detectors. Cooled thermal imagers are heavy and costly owing to their significant application in the cryogenic cooling units as they offer sensitivity and highly suitable for low contrast large range imaging applications. The cooled thermal cameras offered improved image quality and benefits in the area of airports, nuclear power plants, high-security buildings, pipelines, and airports. The integration of cooled thermal cameras into CCTV cameras provides improved surveillance for the critical infrastructure.

Industrial to Hold a Significant Market Share by Verticals

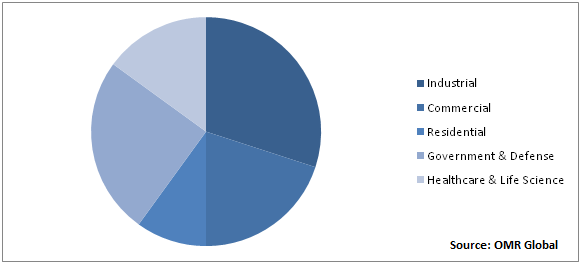

Based on vertical, the market is segmented into industrial, commercial, residential, government& defense, and healthcare & life science. The industrial segment is expected to hold a significant share in the thermal imaging market during the forecast period. In the automotive industry, the thermal imaging devices are utilized by engineers to validate the efficiency of HVAC systems in automobiles, to enhance the designs of airbag systems, quantify thermal impacts on tier wear and perform quality checks on bonds and welds. High-end automakers that include Porsche, Audi and BMW have been fitting their cars with thermal imaging sensors.

Global Thermal Imaging Market Share by Application, 2018 (%)

Regional Outlook

The global thermal imaging market is further segmented based on geography including North America, Europe, Asia-Pacific and Rest of the World.North America is expected to hold a significant market share during the forecast period attributed to the increasing demand for smartphones devices and the growing adoption of thermal imaging in home automation and commercial and presence of manufactures of thermal imaging products that include Fortive, IR cameras, and FLIR systems. The continuous evolution and application of new technologies to enormous volumes that were considered non-commercial and with these series of investments, the different applications such as industrial, transportation, surveillance and security in North America are expected to grow the thermal imaging market during the forecast period.

The market in Europe is expected to grow at a significant growth rate attributed to the adoption of imaging techniques across residential applications and a decline in the price of smart home devices and an increasing trend of home automation, which reduces the cost of residential imaging solutions. Whereas, the market in the Asia-Pacific region is expected to be the fastest-growing in the global thermal imaging market during the forecast period owing to the availability of cost-effective labor and rising defense budget.

Market Players Outlook

The key players of the thermal imaging market include FLIR Systems Inc., L3Harris Technologies, Inc, United Technologies Corp., Leonardo DRS, Inc,Axis Communications AB, BAE Systems, Inc., Fluke Corp. (A Danaher Corp. Company), Infrared Imaging Services, LLC, and Testo SE & Co. KGaA. Various device manufacturers are using innovative thermal imaging solutions provided by these companies. For instance, in September 2018, Caterpillar has collaborated with Bullitt Group, which has been synonymous with construction equipment and machinery that enhanced its smartphone product line with the product launch of Cat S61 with enhanced FLIR thermal imaging capability, built-in laser-assisted distance measuring, and an indoor air quality sensor.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global thermal imaging market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. FLIR Systems, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. L3Harris Technologies, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. United Technologies Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Leonardo DRS, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Axis Communications AB

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Thermal Imaging Market by Technology

5.1.1. Cooled Infrared Detectors

5.1.2. Uncooled Infrared Detectors

5.2. Global Thermal Imaging Market by Product Type

5.2.1. Handheld/Portable Camera

5.2.2. Fixed/Mounted Cores Fixed/Mounted Cores

5.2.3. Scopes & Vision Goggles

5.3. Global Thermal Imaging Market by Vertical

5.3.1. Industrial

5.3.2. Commercial

5.3.3. Residential

5.3.4. Government& Defense

5.3.5. Healthcare &Life Sciences

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Axis Communications AB

7.2. BAE Systems, Inc.

7.3. FLIR Systems, Inc.

7.4. Fluke Corp. (A Danaher Corp. Company)

7.5. Infrared Imaging Services, LLC.

7.6. L3Harris Technologies, Inc.

7.7. Leonardo DRS, Inc.

7.8. Lynred

7.9. SATIR Europe (Ireland) Co. Ltd.

7.10. Seek Thermal, Inc.

7.11. Testo SE & Co. KGaA

7.12. Thermoteknix Systems, Ltd.

7.13. Tonbo Imaging India Pvt. Ltd.

7.14. United Technologies Corp.

7.15. XenicsN.V.

1. GLOBAL THERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL HANDHELD/PORTABLE CAMERA MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL FIXED/MOUNTED CORES FIXED/MOUNTED CORES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL SCOPES & VISION GOGGLES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL THERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

6. GLOBAL INDUSTRIALMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL COMMERCIALMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL AEROSPACE &DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL HEALTHCARE & LIFE SCIENCE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL THERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

12. GLOBAL COOLED MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL UNCOOLED MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. NORTH AMERICA THERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN THERMAL IMAGINGMARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

16. NORTH AMERICAN THERMAL IMAGINGMARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

17. NORTH AMERICAN THERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

18. EUROPEANTHERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. EUROPEANTHERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

20. EUROPEANTHERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

21. EUROPEANTHERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC THERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC THERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC THERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC THERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

26. REST OF THE WORLD THERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

27. REST OF THE WORLD THERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

28. REST OF THE WORLD THERMAL IMAGING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

1. GLOBAL THERMAL IMAGING MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL THERMAL IMAGING MARKET SHARE BY VERTICAL, 2018 VS 2025 (%)

3. GLOBAL THERMAL IMAGING MARKET SHARE BY TECHNOLOGY, 2018 VS 2025 (%)

4. GLOBAL THERMAL IMAGING MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. THE US THERMAL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA THERMAL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

7. UK THERMAL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE THERMAL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY THERMAL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY THERMAL IMAGINGMARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN THERMAL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE THERMAL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA THERMAL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA THERMAL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN THERMAL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC THERMAL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD THERMAL IMAGING MARKET SIZE, 2018-2025 ($ MILLION)