Thermometer Market

Global Thermometer Market Size, Share & Trends Analysis Report by Product (Mercury-Based, and Mercury-Free Thermometer), and by Application (Healthcare and Medical, Industrial, Food, and Research Laboratories) Forecast Period (2022-2028)

The global thermometer market is anticipated to grow at a substantial CAGR of 7.7% during the forecast period. The rise in the prevalence of infectious diseases and other medical conditions including malaria and dengue fever is the major factor impacting the growth of the global thermometer market. These medical conditions require accurate body temperature readings to measure treatment options. Owing to the well-developed healthcare system and the high prevalence of diseases that necessitate body temperature monitoring is likely to heighten demand for thermometers during the forecast period. According to the Centers for Disease Control and Prevention (CDC), about 2,000 cases of malaria are diagnosed in the US each year. Furthermore, according to the same source, nearly half the global population lives in areas at risk of malaria transmission in 87 countries and territories. Moreover, the requirement of specific temperature conditions in various industries for manufacturing, medical, laboratory, and imaging purposes is further escalating the demand for the global thermometer market.

Impact of COVID-19 Pandemic on Global Thermometer Market

The COVID-19 pandemic highly impacted the medical and medical devices industry with an increased demand for thermometers. Due to the high prevalence rate of the COVID-19 pandemic, the use of thermometers was growing since body temperature monitoring was standard for COVID infection screening. Moreover, due to strict lockdown and social distancing rules and regulations implemented by governments across the globe, manufacturers were inclining their efforts into manufacturing medical devices with non-contact capabilities. For instance, in 2020, DeltaTrak improved the availability of an FDA and CE-approved forehead infrared thermometer that provides instant readings without necessary contact making it an ideal COVID-19 risk prevention solution. Similarly, in 2020, EVERYCOM launched IR37 which is also a non-contact infrared thermometer with a display temperature range of 89.6 ? to 109.4 ? (32? to 43?).

Segmental Outlook

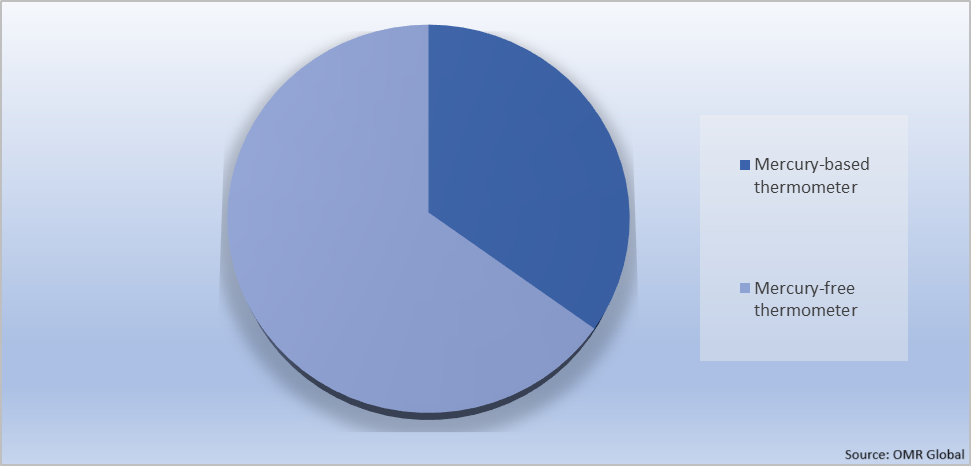

The global thermometer market is segmented based on the product, and application. Based on the product, the market is segmented into mercury-based and mercury-free thermometers. A mercury-free thermometer is further sub-segmented into an infrared radiation thermometer, digital thermometer, and others. Based on application, the market is sub-segmented into healthcare and medical, industrial, food, and research laboratories. Among the product segment, the mercury-free sub-segment is expected to cater to a prominent market share over the forecast period owing to the ban on traditional mercury-based thermometers across the globe.

Global Thermometer Market Share by Product, 2021 (%)

The Mercury-Free Thermometer Sub-Segment is anticipated to Hold a Prominent Share in the Global Thermometer Market

The mercury-free thermometers segment is anticipated to hold a prominent share in the market attributed to the ease of use and high adoption among consumers. Mercury-free thermometers such as infrared radiation thermometers and digital thermometers provide more accurate readings and are not associated with the environmental hazards of mercury which makes them more popular among users. Moreover, the Environmental Protection Agency (EPA) recommends using mercury-free thermometers and launched an effort to reduce the use of mercury-filled non-fever thermometers used in industrial settings where suitable alternatives exist. Owing to these aforementioned factors, companies are introducing non-intrusive and simple-to-use mercury-free thermometers into the market. For instance, in 2022, Baracoda Daily Healthtech launched the first battery-free, mercury-free, eco-friendly connected family thermometer: BCool. The product recharges with only a few shakes through Baracoda Daily Healthtech's patented BMotion sensor technology and delivers fast, accurate, non-invasive temperature readings.

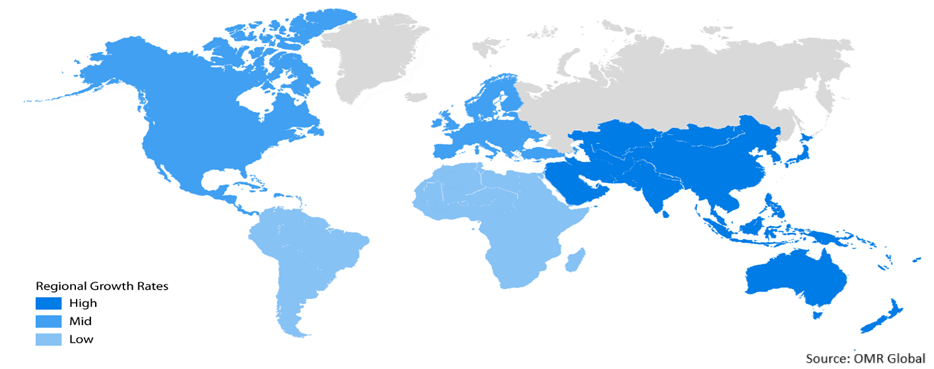

Regional Outlooks

The global thermometer market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American regional market is expected to cater to prominent growth over the forecast period. However, the Asia-Pacific region is expected to experience considerable growth in the thermometer market.

Global Thermometer Market Growth, by Region 2022-2028

The North American Region is Expected to Hold a Prominent Share in the Global Thermometer Market

The North American region is expected to hold a prominent share in the global thermometer market owing to growing awareness and healthcare spending in this region is likely to boost the market growth. Moreover, companies in US and Canada are making efforts to expand their product portfolio as a strategic response to COVID-19 which is further adding to the growth of the market. For instance, in 2020, Neptune Wellness Solutions Inc. launched Neptune Air, a non-contact infrared thermometer (NCIT) optimized for measuring a person's temperature while reducing cross-contamination risk and minimizing the risk of spreading disease. The company made efforts to make the product available for consumers, businesses, and government customers, and shipped it to a large North American distributor of first aid and safety products.

Market Players Outlook

The major companies serving the global Thermometer market include A&D Company Ltd., EASYWELL BIOMEDICALS, INC., Exergen Corp., Hill-Rom Holdings, Inc., Omron Healthcare Europe B.V.., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in 2021, Hicks a well-established healthcare brand in India launched Hicks DT-12 digital thermometer that comes with extraordinary features such as memory, beeper, and automatic shutoff facility. Equally suitable for both adults and children, the digital thermometer is waterproof, safe, fast, and accurate.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global thermometer market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Thermometer Market

• Recovery Scenario of Global Thermometer Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. A&D Company Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. EASYWELL BIOMEDICALS, INC.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Exergen Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Hill-Rom Holdings, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Omron Healthcare Europe B.V.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

3.8. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Thermometer Market by Product

4.1.1. Mercury-Based

4.1.2. Mercury-free Thermometer

4.1.2.1. Infrared Radiation Thermometer

4.1.2.2. Digital Thermometer

4.1.2.3. Others

4.2. Global Thermometer Market by Application

4.2.1. Healthcare and Medical

4.2.2. Industrial

4.2.3. Food

4.2.4. Research Laboratories

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. 3M Co.

6.2. Actherm Medical Corp.

6.3. American Diagnostic Corp.

6.4. Cardinal Health, Inc.

6.5. Citizen Systems Japan Co., Ltd.

6.6. Comark Instruments

6.7. DeltaTrak

6.8. Dr. Trust.

6.9. Electronic Temperature Instruments Ltd.

6.10. Endress+Hauser Group Services AG

6.11. Everycom Electronics

6.12. Geratherm Medical AG

6.13. Hicks Thermometers India Ltd.

6.14. Jiangsu Yuyue medical equipment & supply Co., Ltd.

6.15. Masimo

6.16. Medline International B.V.

6.17. Medtronic

6.18. Microlife AG Swiss Corp.

6.19. MICROTEMP ELECTRICS CO., LTD.

6.20. Neptune Wellness Solutions Inc.

6.21. Opto Circuits (India) Ltd.

6.22. RJ Brands, LLC

6.23. SFT Technologies India Pvt. Ltd.

6.24. Taiwan Manufacturing Company, INC. (RADIANT INNOVATION INC)

6.25. Terumo Group

1. GLOBAL THERMOMETER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL MERCURY-BASED THERMOMETER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL MERCURY-FREE THERMOMETER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL THERMOMETER MARKET RESEARCH AND ANALYSIS BY MERCURY-FREE THERMOMETER, 2021-2028 ($ MILLION)

5. GLOBAL INFRARED RADIATION THERMOMETER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL DIGITAL THERMOMETER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL OTHER MERCURY-FREE THERMOMETER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL THERMOMETER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

9. GLOBAL THERMOMETER FOR HEALTHCARE AND MEDICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBALTHERMOMETER FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBALTHERMOMETER FOR FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBALTHERMOMETER FOR RESEARCH LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL THERMOMETER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN THERMOMETER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN THERMOMETER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

16. NORTH AMERICAN THERMOMETER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

17. EUROPEAN THERMOMETER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. EUROPEAN THERMOMETER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

19. EUROPEAN THERMOMETER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC THERMOMETER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC THERMOMETER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC THERMOMETER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

23. REST OF THE WORLD THERMOMETER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. REST OF THE WORLD THERMOMETER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

25. REST OF THE WORLD THERMOMETER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL THERMOMETER MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL THERMOMETER MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL THERMOMETER MARKET, 2022-2028 (%)

4. GLOBAL THERMOMETER MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

5. GLOBAL MERCURY-BASED MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL MERCURY-FREE THERMOMETER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL THERMOMETER MARKET SHARE BY MERCURY-FREE THERMOMETER, 2021 VS 2028 (%)

8. GLOBAL INFRARED RADIATION THERMOMETER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL DIGITAL THERMOMETER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL OTHER MERCURY-FREE THERMOMETER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL THERMOMETER MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

12. GLOBAL THERMOMETER FOR HEALTHCARE AND MEDICAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL THERMOMETER FOR INDUSTRIAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL THERMOMETER FOR FOOD MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL THERMOMETER FOR RESEARCH LABORATORIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL THERMOMETER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. US THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

18. CANADA THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

19. UK THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

20. FRANCE THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

21. GERMANY THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

22. ITALY THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

23. SPAIN THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF EUROPE THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

25. INDIA THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

26. CHINA THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

27. JAPAN THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

28. SOUTH KOREA THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF ASIA-PACIFIC THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD THERMOMETER MARKET SIZE, 2021-2028 ($ MILLION)