Tobacco Market

Global Tobacco Market Size, Share & Trends Analysis Report, by Product Type (Cigarettes, Cigars and Cigarillos, Dissolvable Products, E-Cigarettes, Smokeless Tobacco Products, and Others) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global tobacco market is growing at a CAGR of 2% over the forecast period. The growth of the global tobacco industry is driven by some of the most powerful transnational commercial companies across the globe. These companies include China National Tobacco Corp. (CNTC), British American Tobacco, Imperial Brands PLC, Japan Tobacco International (JTI), and Philip Morris International, Inc. However, the industry faces various challenges that include rising health awareness, stringent government policies, and increasing popularity and availability of substitutes.

The companies associated with tobacco product manufacturing are looking for innovative ways to sell their products on a global scale in order to expand the company’s revenue. According to the World Health Organization (WHO) in 2019, around 80% of 1.1 billion global smokers live in low- and middle-income countries which are attracting many tobacco manufacturing companies to market their products in such economies. Moreover, it is estimated that if current tobacco consumption trends continue, it would cause around 1 billion mortalities during the 21st century.

Stringent Regulations

The tobacco industry is considered as the most-regulated and most-taxed of all the industries across the globe. Tobacco manufacturers are required to comply with the broad range of stringent regulations that vary significantly across the globe. Key target areas on which regulations are mainly focused include the introduction of plain packaging, product-specific regulation, graphic health warnings on packs, tougher restrictions on smoking in enclosed public places and bans on shops displaying tobacco products at the point of sale. In recent years, the tobacco industry has witnessed the adoption of regulations aimed at menthol flavorings as well as environmental concerns that are resulted from the litter associated with tobacco consumption.

Segmental Outlook

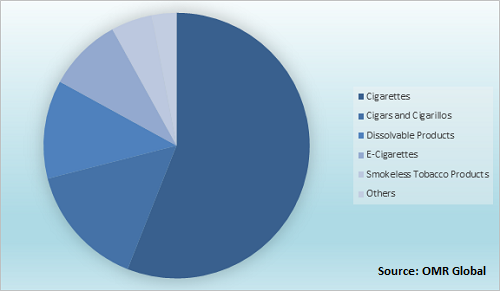

The global tobacco market is segmented on the basis of product type and region. On the basis of product type, the market is segmented into cigarettes, cigars and cigarillos, dissolvable products, e-cigarettes, smokeless tobacco products, and others. Cigarette type tobacco segment held the largest market share in the global tobacco market in 2018 and is further expected to continue the same trend over the forecast period. The growth of the segment is attributed to the wide preference of cigarettes over other tobacco products by the consumers.

Global Tobacco Market Share by Product Type, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global tobacco market. Based on the availability of data, information related to products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. China National Tobacco Corp. (CNTC)

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. British American Tobacco PLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Imperial Brands PLC

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Japan Tobacco International SA

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Philip Morris International Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Tobacco Market by Product Type

5.1.1. Cigarettes

5.1.2. Cigars and Cigarillos

5.1.3. Dissolvable Products

5.1.4. E-Cigarettes

5.1.5. Smokeless Tobacco Products

5.1.6. Others (Waterpipes)

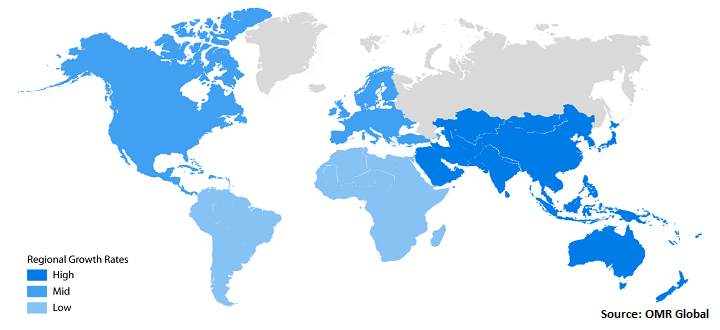

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. India

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Altria Group, Inc.

7.2. British American Tobacco PLC

7.3. Bulgartabac Holding Group AD

7.4. China National Tobacco Corp. (CNTC)

7.5. FDS d.o.o. Sarajevo

7.6. Imperial Brands PLC

7.7. ITC Ltd.

7.8. Japan Tobacco International SA

7.9. Japan Tobacco, Inc.

7.10. KT&G Corp.

7.11. Philip Morris International, Inc.

7.12. PT Gudang Garam Tbk.

7.13. Reynolds American, Inc.

7.14. Scandinavian Tobacco Group A/S

7.15. Vector Group Ltd.

1. GLOBAL TOBACCO MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL CIGARETTES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL CIGARS AND CIGARILLOS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL DISSOLVABLE TOBACCO PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL E-CIGARRETTES TOBACCO MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL SMOKELESS TOBACCO PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL OTHERS TOBACCO TYPES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL TOBACCO MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN TOBACCO MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN TOBACCO MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

11. EUROPEAN TOBACCO MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. EUROPEAN TOBACCO MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

13. ASIA-PACIFIC TOBACCO MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. ASIA-PACIFIC TOBACCO MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

15. REST OF THE WORLD TOBACCO MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

1. GLOBAL TOBACCO MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL TOBACCO MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

3. US TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)

4. CANADA TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)

5. UK TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)

6. FRANCE TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)

7. GERMANY TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)

8. ITALY TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)

9. SPAIN TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)

10. ROE TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)

11. CHINA TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)

12. JAPAN TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)

14. REST OF ASIA-PACIFIC TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF THE WORLD TOBACCO MARKET SIZE, 2018-2025 ($ MILLION)