Tourism Vehicle Rental Market

Tourism Vehicle Rental Market Size, Share & Trends Analysis Report by Vehicle Type (Economy, and Luxury/Premium), by Booking Mode (Online and Offline), and by End-User (Self Driven, and Rental Agencies) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Tourism vehicle rental market is anticipated to grow at a significant CAGR of 8.1% during the forecast period. One of the key factors fueling the market growth includes the growing tourism industry across the globe. As per the World Bank’s 2019 data, international tourism, number of arrivals reached 2.4 billion which was 1.69 billion in 2009. Such high numbers of traveling have boosted the demand for the tourism vehicle rental market which is reflected in the active participation in the market. For instance, in December 2021, an India-based car rental startup, Zoom car, revealed its plan to expand its operations in Vietnam. For which, the Zoom car has added that the foray into Vietnam is in line with the company's target for democratizing car access across the globe’s most populated and highly growing developing markets.

Segmental Outlook

The global tourism vehicle rental market is segmented based on vehicle type, booking mode, and end-user. Based on the vehicle type, the market is segmented into economy and luxury/premium. Based on the booking mode, the market is sub-segmented into online, and offline. Based on the end-user, the market is sub-segmented into self-driven, and rental agencies. The above-mentioned segments can be customized as per the requirements. Among the booking mode, the online segment is anticipated to grow at the fastest rate in the market due to rising awareness and concern about the containment of the virus, while, among the vehicle type, the luxury vehicles segment is anticipated to grow at the fastest rate during the forecast period owing to increased travel budgets of tourists across the globe.

Among the booking mode, the online segment is anticipated to grow at the fastest CAGR in the market during the forecast period, due to the rising awareness and concern about the containment of the virus have mainly led to a growing number of vehicles rental options online. Moreover, the tourism vehicle rental market also offers the option of raised mobility without the anxiety of compensating the costs related to vehicle ownership. These services are provided through websites and other online platforms contributing to the growth of the market. Rising penetration of the internet and smartphone among consumers is projected to shift consumers’ inclination toward online booking mode. The growth is contributed to consumers’ inclination for having detailed access to the offerings of amenities, accommodation, and other benefits. For instance, as per the 2021 annual report of SIXT SE, by the end of 2021, around 73%, which was 72% at the end of 2020, of reservations in the area of mobility were made via the company's online and mobile channels.

Regional Outlooks

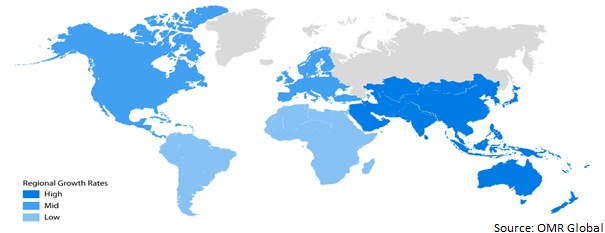

The global tourism vehicle rental market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America region is anticipated to grow significantly in the market, while, Asia-Pacific is anticipated to grow at the fastest rate during the forecast period.

Global Tourism Vehicle Rental Market Growth, by Region 2022-2028

The North America Region Anticipated to Grow Significantly in the Global Tourism Vehicle Rental Market

North America region is anticipated to grow significantly in the market during the forecast period owing to the presence of the US which is a leader in the tourism vehicle rental market since major car-renting market players have their fleets in almost all the major cities of the country. The scope of the fleet for any company depends on the number of tourists favoring renting a vehicle locally and the capacity of foreign passengers staying in the city. Canada has a huge foreign and domestic tourism industry. Being the second-largest country across the globe, Canada's implausible geographical diversity and the presence of nearly 20 global heritage sites are substantial tourist attractions across the country. Much of the country's tourism is positioned in regions such as Toronto, Vancouver/Whistler, Niagara Falls, Montreal, Vancouver Island, Calgary/Canadian Rockies, British Columbia's Okanagan Valley, and the national capital region Ottawa. Hence, these regions are some prominent hotspots for tourism vehicle renting.

Market Players Outlook

The major companies serving the global tourism vehicle rental market include Avis Budget Group, Inc., Enterprise Holdings, Inc., Europcar International S.A.S.U., SIXT SE, The Hertz Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2022, the Middle East’s mobility company, ekar, introduced its operations in Thailand opening in Bangkok, and with a plan for expanding into other countries. ekar introduced its service of proprietary car subscription which provides cars from one to nine-month terms for a single monthly subscription cost without any long-term commitments and down payments through the ekar app.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global tourism vehicle rental market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Avis Budget Group, Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Enterprise Holdings, Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Europcar International S.A.S.U.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. SIXT SE

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. The Hertz Corp.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Tourism Vehicle Rental Market by Vehicle Type

4.1.1. Economy

4.1.2. Luxury/Premium

4.2. Global Tourism Vehicle Rental Market by Booking Mode

4.2.1. Online

4.2.2. Offline

4.3. Global Tourism Vehicle Rental Market by End-User

4.3.1. Self Driven

4.3.2. Rental Agencies

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Auto Europe Deutschland GmbH

6.2. CarTrawler (easyCar)

6.3. Carzonrent (India) Private Limited

6.4. Kemwel

6.5. Seera Group Holding Co.

6.6. ZoomCar, Inc.

1. GLOBAL TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

2. GLOBAL TOURISM ECONOMY VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL TOURISM LUXURY/PREMIUM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY BOOKING MODE, 2021-2028 ($ MILLION)

5. GLOBAL ONLINE TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL OFFLINE TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

8. GLOBAL TOURISM VEHICLE RENTAL FOR SELF DRIVEN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL TOURISM VEHICLE RENTAL FOR RENTAL AGENCIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

13. NORTH AMERICAN TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY BOOKING MODE, 2021-2028 ($ MILLION)

14. NORTH AMERICAN TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

15. EUROPEAN TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. EUROPEAN TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

17. EUROPEAN TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY BOOKING MODE, 2021-2028 ($ MILLION)

18. EUROPEAN TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY BOOKING MODE, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

23. REST OF THE WORLD TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. REST OF THE WORLD TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY BOOKING MODE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD TOURISM VEHICLE RENTAL MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL TOURISM VEHICLE RENTAL MARKET SHARE BY VEHICLE TYPE, 2021 VS 2028 (%)

2. GLOBAL TOURISM ECONOMY VEHICLE RENTAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL TOURISM LUXURY/PREMIUM VEHICLE RENTAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL TOURISM VEHICLE RENTAL MARKET SHARE BY BOOKING MODE, 2021 VS 2028 (%)

5. GLOBAL ONLINE TOURISM VEHICLE RENTAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL OFFLINE TOURISM VEHICLE RENTAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL TOURISM VEHICLE RENTAL MARKET SHARE BY END-USER, 2021 VS 2028 (%)

8. GLOBAL TOURISM VEHICLE RENTAL FOR SELF-DRIVEN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL TOURISM VEHICLE RENTAL FOR RENTAL AGENCIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL TOURISM VEHICLE RENTAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. US TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

13. UK TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

18. REST OF EUROPE TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

22. SOUTH KOREA TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF ASIA-PACIFIC TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD TOURISM VEHICLE RENTAL MARKET SIZE, 2021-2028 ($ MILLION)