Traction Transformer Market

Traction Transformer Market Size, Share & Trends Analysis Report by Rolling Stock (Locomotives (Diesel and Hybrid), High-Speed Trains, and Electric Multiple Units (EMUs) and Battery Electric Multiple Units (BEMUs)), and by Overhead Line Voltage (AC and DC) Forecast Period (2025-2035)

Industry Overview

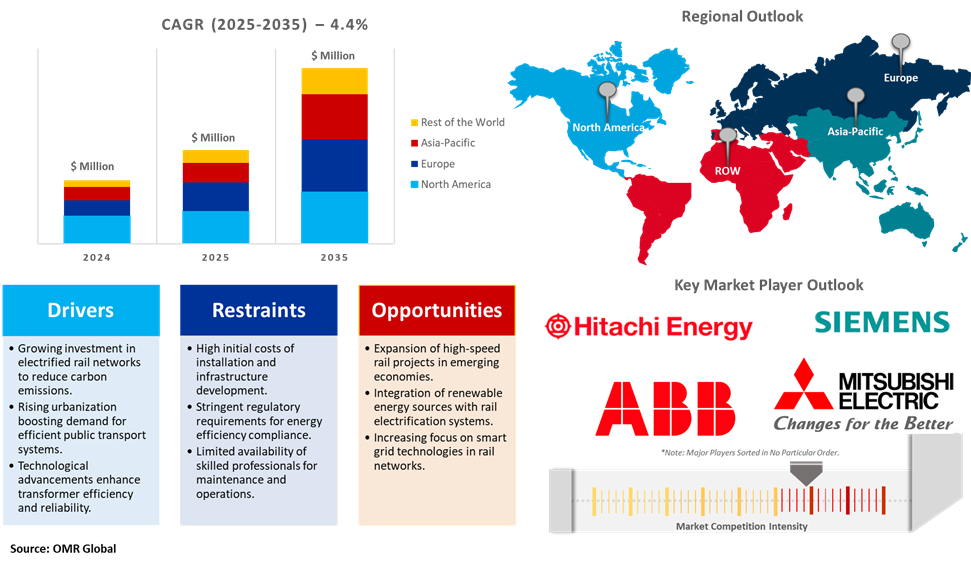

Traction transformer market was valued at $815 million in 2024 and is projected to grow at a CAGR of 4.4% to reach $1.3 billion by 2035. The expansion of high-speed rail networks and the increasing integration of power transmission and distribution networks in both urban and rural areas, along with the growing need for traction transformers, are the main factors propelling the market's expansion. According to the International Energy Agency (IEA), in July 2023, India is investing in a road-to-rail shift and is rapidly moving towards its target of 100.0% rail track electrification by 2024, with the share of electrified tracks increasing from 45.0% in 2015 to 80.0% in 2022.

Market Dynamics

Growing Expansion of High-Speed Rail Projects Globally

With the increasing number of high-speed rail projects being constructed globally, governments and the business sector are investing in train infrastructure to improve connectivity and dependability. The use of innovative innovations such as lightweight and environmentally friendly transformers is growing. Furthermore, increasing supportive policies and environmental issues promote the adoption of energy-efficient systems. This results in an increasing traction transformer market. For instance, in January 2024, India's National High-Speed Rail Corp. Ltd. awarded an order to Sojitz Corp. and Larsen & Toubro Limited, a prominent general contractor and complete engineering firm in India, for electrification system works including 508 km of the Mumbai-Ahmedabad High-Speed Rail project.

Increasing Demand for Cooling Systems Enhances Transformer Adoption

The small reduction in energy consumption is driven by the increasing demand for efficient cooling systems, advancements in transformer technology for train electrification, and the growing integration of innovative cooling solutions. Traction transformer cooling systems play a critical role in ensuring reliability and efficiency, especially under severe operating conditions. The demand for dependable and efficient transformers is rising with the global expansion of railway networks and the adoption of modern cooling technologies. These effective cooling systems help maintain consistent, optimal temperature levels and extend the operational lifespan of transformers.

Market Segmentation

- Based on the rolling stock, the market is segmented into locomotives, high-speed trains, Electric Multiple Units (EMUs), and Battery Electric Multiple Units (BEMUs).

- Based on the overhead line voltage, the market is segmented into alternating current (AC) and direct current (DC).

Locomotives to Lead the Market with the Largest Share

The primary factors supporting the growth are being driven by the increasing government and private investment in railway projects and the growing enhancement in transformer technology with modern rail systems. Furthermore, increasing urbanization and an effective transit system drive the growth of traction transformers. Traction transformers of all applicable grades and voltage levels are developed and manufactured by market players for rolling stock applications. Maximum dependability, cost-effectiveness, and safety are prioritized, along with making sure the transformers precisely match the needs of the client. Siemens AG provides AC and DC transformers for electric locomotive applications under the Tractronic brand. Siemens Energy develops and manufactures Tractronic traction transformers for train manufacturers and rail operators around the globe. These transformers handle the highest ratings in the smallest amount of space, satisfy local content requirements for global applications, and ensure the highest level of flexibility and dependability.

Overhead Line Voltage: A Key Segment in Market Growth

The factors supporting segment growth include the demand for overhead line voltage in railway networks with increasing adoption of overhead electrification for sustainable transportation solutions and growing investment of private and government in rail infrastructure driving the growth of the market. Overhead line voltage converts energy for electric trains, improves power supply and lowers dependency on conventional fuels. Hitachi Energy Ltd. provides traction transformers by the reduction of the network's high-voltage to low-voltage for use by the converters, they serve to move electricity from the catenary to the motor. As they are frequently a non-redundant traction component, they must be small, light, and of the highest caliber.

Regional Outlook

The global traction transformers market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Investment in Railways Infrastructure Project in Europe

The rising rapidly owing to the increasing demand for dependable power distribution systems brought on by industrialization and urbanization. Programs from the government that promote energy efficiency and grid upgrades drive the growth of the European traction transformer market. To integrate renewable energy sources into the system efficiently, advanced transformers are required. Initiatives to expand railway infrastructure continue to support the region's demand for traction transformers. According to the European Commission (EC), in June 2023, the European Union invested €6.2 billion ($6.71 billion) in efficient, safe, and sustainable transportation infrastructure. In the trans-European transport (TEN-T) network, more than 80.0% of the funds will go toward initiatives that create a more intelligent, greener, and efficient network of inland waterways, railways, and maritime routes.

- Regarding main lines, 60% of the European rail network is already electrified and 80% of traffic is running on these lines. In Germany, 74% of all train kilometers are already covered electrically.

- In January 2023, ABB and Škoda Group announced a partnership for railway electrification. The collaboration begins with ABB supplying its innovative Traction Battery Pro Series, which is compact and lightweight, and engineered to optimize vehicle performance while significantly reducing maintenance and downtime. The battery packs will be equipped on Škoda’s new fleet of battery-electric multiple units (BEMUs) ordered by ?eské dráhy, the Czech national railway operator.

Asia-Pacific Region Dominates the Market with Major Share

Asia-Pacific holds a significant share owing to the presence of traction transformers offering companies such as Toshiba Corp., Mitsubishi Electric Corp., CG Power and Industrial Solutions Ltd., Bharat Heavy Electricals Ltd. (BHEL), Hyosung Heavy Industries, and Hyundai Electric & Energy Systems and others. The rapid industrialization and urbanization of countries such as China, India, and Southeast Asia have increased the need for reliable energy distribution. According to the India Brand Equity Foundation (IBEF), in April 2024, Foreign direct investment (FDI) inflows into railway-related components totaled $1.40 billion between April and March of 2024. To meet its ambitious goal of allocating $1.4 trillion between 2019 and 2023, the government has committed to investing $750 billion in railway infrastructure by 2030.

Market Players Outlook

The major companies operating in the global traction transformers market include ABB Ltd., Hitachi Energy Ltd., Mitsubishi Electric Corp., Siemens AG, and Toshiba Corp. among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

- Hitachi Energy supplies traction transformers for all applications: high-speed, commuter, and regional trains, locomotives, tram-trains, and AC metros. It offers different designs in terms of size, weight, and power ratings. An estimated global installed base of 30,000 units worldwide with a global footprint with 4 manufacturing centers.

- Siemens Energy designs and manufactures Tractronic traction transformers for rail operators and train manufacturers worldwide, that increase train efficiency and performance. Their more than 20 manufacturing sites worldwide adhere to European quality and sustainability standards – regardless of the manufacturing location.

Recent Developments

- In May 2024, Bharat Heavy Electricals (BHEL) and HIMA Middle East FZE, Dubai formed a strategic partnership for BHEL's railway signaling division. The BHEL provides propulsion systems, traction motors, traction alternators, traction transformers, locomotives, and electrics for EMU/MEMU.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global traction transformers market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Traction Transformers Market Sales Analysis – Rolling Stock |Overhead Line Voltage ($ Million)

• Traction Transformers Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Traction Transformers Industry Trends

2.2.2. Market Recommendations

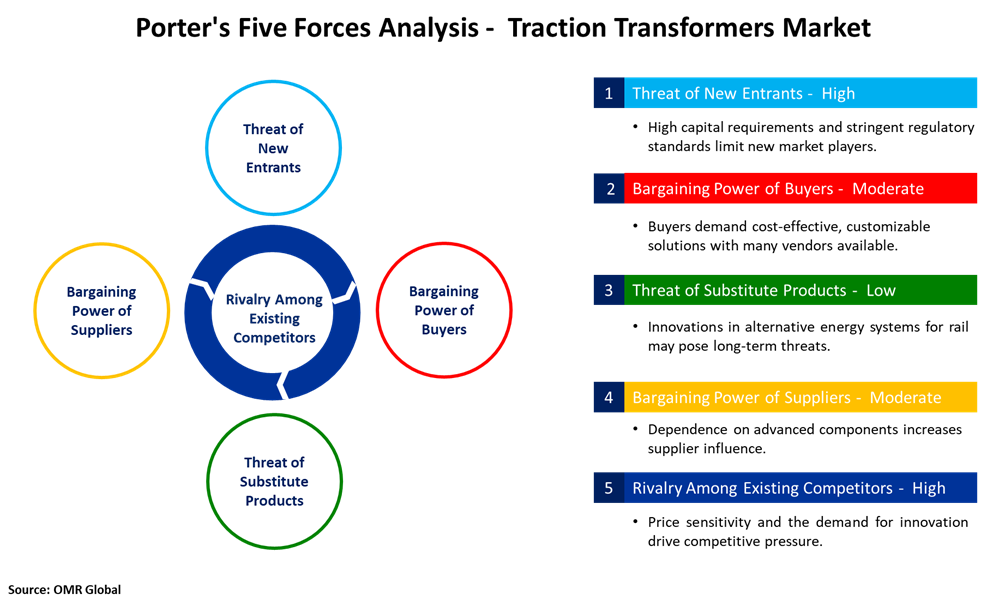

2.3. Porter's Five Forces Analysis for the Traction Transformers Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Traction Transformers Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Traction Transformers Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Traction Transformers Market Revenue and Share by Manufacturers

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Hitachi Energy, Ltd.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Siemens AG

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Mitsubishi Electric Corp.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. ABB, Ltd.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Traction Transformers Market Sales Analysis by Rolling Stock ($ Million)

5.1. Locomotives (Diesel and Hybrid)

5.2. High-Speed Trains

5.3. Electric Multiple Unit (EMUs) and Battery Electric Multiple Units (BEMUs)

6. Global Traction Transformers Market Sales Analysis by Overhead Line Voltage ($ Million)

6.1. Alternative Current (AC)

6.2. Direct Current (AC)

7. Regional Analysis

7.1. North American Traction Transformers Market Sales Analysis – Rolling Stock | Overhead Line Voltage | Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Traction Transformers Market Sales Analysis – Rolling Stock | Overhead Line Voltage | Country ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Traction Transformers Market Sales Analysis – Rolling Stock | Overhead Line Voltage | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Traction Transformers Market Sales Analysis – Rolling Stock | Overhead Line Voltage | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. ABB Ltd.

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Sécheron SA

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. Alstom SA

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Baoding Baoling Transformer Co., Ltd

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Brush Group

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. CEEG Transformer CO., Ltd.

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. CG Power and Industrial Solutions Ltd.

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. ENPAY Industrial Marketing and Investment Inc.

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. General Electric Co.

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Hind Rectifiers Ltd.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. Hitachi Energy Ltd.

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Iran Transfo Co.

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. Jesco Product Pvt. Ltd.

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Maschinenfabrik Reinhausen GmbH

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. Mitsubishi Electric Corp.

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. R&S International Holding AG

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. Siemens AG

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. SkipperSeil

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Stesalit Ltd.

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. Toshiba Corp.

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

8.21. Weidmann Electrical Technology AG

8.21.1. Quick Facts

8.21.2. Company Overview

8.21.3. Product Portfolio

8.21.4. Business Strategies

8.22. Zhuzhou CSR Electric Motor Co., Ltd.

8.22.1. Quick Facts

8.22.2. Company Overview

8.22.3. Product Portfolio

8.22.4. Business Strategies

1. Global Traction Transformers Market Research And Analysis By Rolling Stock, 2024-2035 ($ Million)

2. Global Traction Transformers For Locomotives Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Traction Transformers For High-Speed Trains Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Traction Transformers For EMUS And BEMUS Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Traction Transformers Market Research And Analysis By Overhead Line Voltage, 2024-2035 ($ Million)

6. Global Alternative Current (AC) Traction Transformers Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Direct Current (DC) Traction Transformers Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Traction Transformers Market Research And Analysis By Region, 2024-2035 ($ Million)

9. North American Traction Transformers Market Research And Analysis By Country, 2024-2035 ($ Million)

10. North American Traction Transformers Market Research And Analysis By Rolling Stock, 2024-2035 ($ Million)

11. North American Traction Transformers Market Research And Analysis By Overhead Line Voltage, 2024-2035 ($ Million)

12. European Traction Transformers Market Research And Analysis By Country, 2024-2035 ($ Million)

13. European Traction Transformers Market Research And Analysis By Rolling Stock, 2024-2035 ($ Million)

14. European Traction Transformers Market Research And Analysis By Overhead Line Voltage, 2024-2035 ($ Million)

15. Asia-Pacific Traction Transformers Market Research And Analysis By Country, 2024-2035 ($ Million)

16. Asia-Pacific Traction Transformers Market Research And Analysis By Rolling Stock, 2024-2035 ($ Million)

17. Asia-Pacific Traction Transformers Market Research And Analysis By Overhead Line Voltage, 2024-2035 ($ Million)

18. Rest Of The World Traction Transformers Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Rest Of The World Traction Transformers Market Research And Analysis By Rolling Stock, 2024-2035 ($ Million)

20. Rest Of The World Traction Transformers Market Research And Analysis By Overhead Line Voltage, 2024-2035 ($ Million)

1. Global Traction Transformers Market Research And Analysis By Rolling Stock, 2024 Vs 2035 (%)

2. Global Traction Transformers For Locomotives Market Share By Region, 2024 Vs 2035 (%)

3. Global Traction Transformers For High-Speed Trains Market Share By Region, 2024 Vs 2035 (%)

4. Global Traction Transformers For EMUS And BEMUS Market Share By Region, 2024 Vs 2035 (%)

5. Global Traction Transformers Market Research And Analysis By Overhead Line Voltage, 2024 Vs 2035 (%)

6. Global Alternative Current (AC) Traction Transformers Market Share By Region, 2024 Vs 2035 (%)

7. Global Direct Current (DC) Traction Transformers Market Share By Region, 2024 Vs 2035 (%)

8. Global Traction Transformers Market Share By Region, 2024 Vs 2035 (%)

9. US Traction Transformers Market Size, 2024-2035 ($ Million)

10. Canada Traction Transformers Market Size, 2024-2035 ($ Million)

11. UK Traction Transformers Market Size, 2024-2035 ($ Million)

12. France Traction Transformers Market Size, 2024-2035 ($ Million)

13. Germany Traction Transformers Market Size, 2024-2035 ($ Million)

14. Italy Traction Transformers Market Size, 2024-2035 ($ Million)

15. Spain Traction Transformers Market Size, 2024-2035 ($ Million)

16. Russia Traction Transformers Market Size, 2024-2035 ($ Million)

17. Rest Of Europe Traction Transformers Market Size, 2024-2035 ($ Million)

18. India Traction Transformers Market Size, 2024-2035 ($ Million)

19. China Traction Transformers Market Size, 2024-2035 ($ Million)

20. Japan Traction Transformers Market Size, 2024-2035 ($ Million)

21. South Korea Traction Transformers Market Size, 2024-2035 ($ Million)

22. ASEAN Traction Transformers Market Size, 2024-2035 ($ Million)

23. Australia and New Zealand Traction Transformers Market Size, 2024-2035 ($ Million)

24. Rest Of Asia-Pacific Traction Transformers Market Size, 2024-2035 ($ Million)

25. Latin America Traction Transformers Market Size, 2024-2035 ($ Million)

26. Middle East And Africa Traction Transformers Market Size, 2024-2035 ($ Million)